Healthcare IT Market

Healthcare IT Market - Global Industry Assessment & Forecast

Segments Covered

By Product & Services Healthcare Provider Solutions, Healthcare Payer Solutions, HCIT Outsourcing Services

By Component Services, Software, Hardware

By End User Healthcare Providers, Healthcare Payers

By Region North America, Europe, Asia Pacific, Middle East & Africa, Latin America

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 482.35 Million | |

| USD 2166 Million | |

| 18.19% | |

| Europe | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The Global Healthcare IT Market is valued at USD 482.35 Million in 2023 and is projected to reach a value of USD 2166 Million by 2032 at a CAGR (Compound Annual Growth Rate) of 18.19% between 2024 and 2028.

Key highlights of Healthcare IT Market

- North America dominated the market in 2023, obtaining the largest revenue share of 38.2%.

- The Healthcare Provider Solution segment dominated the Healthcare IT market with the largest market share of 77.5% in 2023.

- The Software segment dominated the Healthcare IT market with the largest market share of 39.6% in 2023.

- The Healthcare Providers segment dominated the Healthcare IT market with the largest market share of 72.6% in 2023.

- Healthcare companies and clinicians are constantly pressured to boost operational effectiveness, lower medical errors, and improve patient care results.

- Technologies like telehealth and remote patient monitoring provide the healthcare IT business with a huge opportunity.

- The companies in the market are working to innovate products with more efficiency, low-cost, and easily adaptable which are further estimated to enhance the growth of the market.

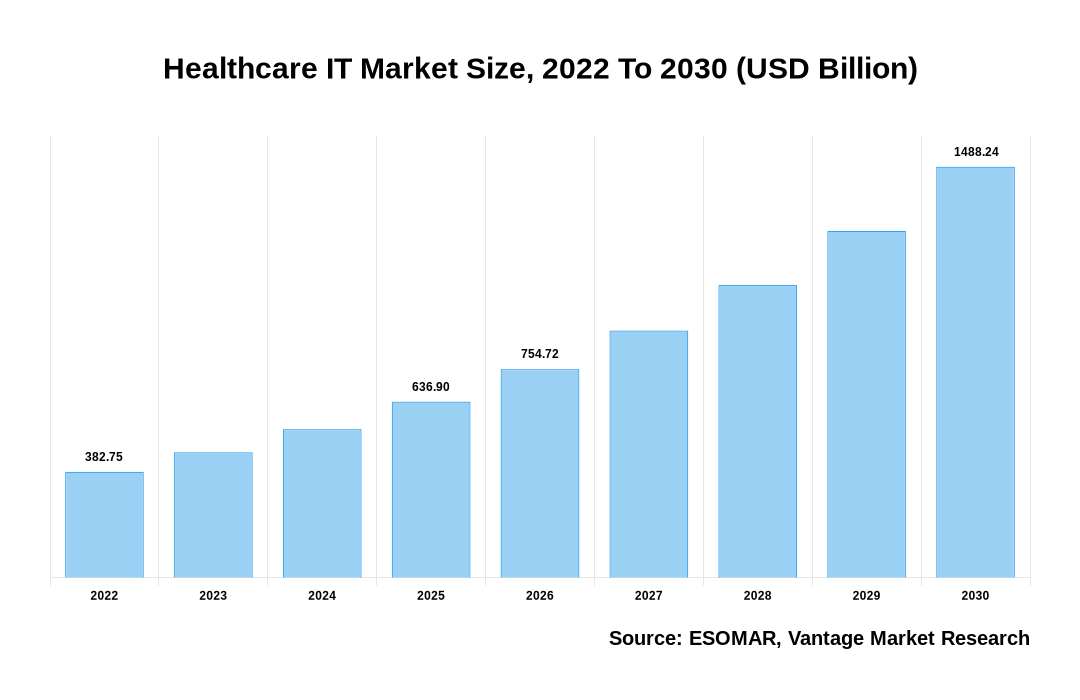

Healthcare IT Market Size, 2023 To 2032 (USD Million)

AI (GPT) is here !!! Ask questions about Healthcare IT Market

Healthcare IT Market: Regional Overview

North America Dominated Sales with a 38.2% share in 2023. In North America, people and communities use healthcare services to manage their healthcare requirements, promote health and wellness, and get medical care. Family doctors, pediatricians, internists, and nurse practitioners are examples of primary care professionals. Patients see primary care doctors for various reasons, including immunizations, yearly checkups, and minor health issues. People in North America, for instance, can make appointments with their family doctors for routine health checks, flu shots or to get help for conditions like colds or allergies. Healthcare specialists with specialized knowledge in particular medical specialties provide specialist care services. A person with suspected heart disease might be referred to a cardiologist for further assessment and therapy, whereas someone with joint pain might contact an orthopedic specialist. People in North America, for instance, might undergo routine screenings like mammograms, colonoscopies, or Pap smears to identify any health issues in the early stages and take the required preventive action.

U.S. Healthcare IT Market Overview

The Healthcare IT market in U.S., with a valuation of USD 134.91 Million in 2023, is projected to reach around USD 315.03 Million by 2028. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 23.62% from 2024 to 2028. The American healthcare system greatly benefits from the use of healthcare information technology. With the widespread adoption of electronic health records (EHRs), healthcare practitioners can now store and access patient data digitally, which enhances care coordination and patient safety. The US also stresses using Health Information Exchanges (HIEs) to enable seamless information sharing by facilitating the secure flow of patient data between various healthcare entities. In addition, billing and reimbursement procedures are supported by systems enabling claims administration, coding, and revenue cycle management in the healthcare industry.

The global Healthcare IT market can be categorized as Product & Service, Component, End User, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product & Services

By Component

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Healthcare IT Market: Product & Service Overview

In 2023, the Healthcare Provider solution segment dominated the market, with the largest share accounting for 77.5% of the overall market. The Healthcare IT market, segmented by the Product & Service, includes Healthcare provider solution, healthcare payer solution, and HCIT outsourcing solution. Healthcare provider solutions include various hardware and software tools that aid healthcare companies in providing high-quality care, maintaining patient information, streamlining administrative procedures, and enhancing financial performance. These technologies improve administrative work, decision-making, and clinical workflows, resulting in better patient outcomes and more effective healthcare delivery. Medical history, diagnoses, treatments, prescriptions, and laboratory results are just a few of the patient data that may be collected, stored, and accessed by healthcare professionals using Healthcare Provider systems.

Healthcare IT Market: Component Overview

In 2023, the Software segment dominated the market, with the largest share accounting for 39.6% of the overall market. The Healthcare IT market, segmented by the Component, includes Services, Software, and Hardware. Software in healthcare IT refers to the platforms, applications, and programs created to support various healthcare-related operations and functions. The management of patient data, streamlined processes, facilitation of clinical decision-making, and enhancement of total healthcare delivery are all made possible by healthcare software. Healthcare providers can access and update patient information electronically with electronic health record (EHR) systems, which are sophisticated software platforms that consolidate patient medical records. EHRs improve patient outcomes, increase care coordination, and lower medical errors. Telehealth software allows patients to consult with medical professionals via video calls, messaging, or remote monitoring. These technologies enable telemedicine visits, remote patient monitoring, and virtual consultations, providing access to healthcare from anywhere.

Healthcare IT Market: End User Overview

In 2023, the Healthcare Providers segment dominated the market, with the largest share accounting for 72.6% of the overall market. The Healthcare IT market, segmented by the End User, includes Healthcare providers, Healthcare payers. Hospitals and medical facilities are the main sources of healthcare and provide various services, including inpatient and outpatient care, emergency services, surgeries, and specialty treatments. These companies significantly rely on healthcare IT solutions to improve clinical decision-making, manage patient data, and optimize operations. Physician practices, which include primary care facilities, specialized facilities, and private doctor offices, are crucial components of the healthcare system. They concentrate on providing outpatient medical care and preventive services. Thanks to healthcare IT technologies, these clinics can manage patient information, expedite administrative processes, and enhance communication. For instance, hospitals may use clinical decision support systems to help with diagnosis and treatment, electronic health record (EHR) systems to compile patient data, and telehealth platforms to provide remote consultations.

Key Trends

- In 2023, the healthcare provider solutions category dominates the market and is projected to witness significant growth in the coming years.

- In 2023, the software had a major share. Moreover, services category to witness the fastest growth over the forecast period.

- In 2023, North America category had a major share in the market.

Premium Insights

The global Healthcare IT market is projected to witness a substantial growth. This is majorly due to the increase in demand for technogically advanced products. As COVID-19 waves hit the countries worldwide, the demand for healthcare is expected to witness susbtantial growth in the long run. The major companies are continously investing heavily to enhance the production which is projected to enhance the global market growth over the coming years. The steady growth in the demand of heathcare industry and increased investments by major companies for the adoption of advanced technologies are presumed to be favorable for market growth. The companies in the Healthcare IT market are working to innovate products with more efficiency, low-cost, and easily adaptable which are further estimated to enhance the growth of the market.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Increasing demand for efficient healthcare delivery

Healthcare companies and clinicians are constantly pressured to boost operational effectiveness, lower medical errors, and improve patient care results. The broad adoption of numerous healthcare IT solutions designed to address these issues results from this need. The adoption of electronic health records (EHRs) is one of the major areas where healthcare IT has had a significant impact. EHRs convert paper-based records into digital formats, giving healthcare providers easy and safe access to patient data. EHRs allow detailed records of a patient's medical history, prescriptions, allergies, and test results to be centralized and shared among various healthcare locations. For instance, the American Recovery and Reinvestment Act of 2009's Health Information Technology for Economic and Clinical Health (HITECH) Act incentivized healthcare organizations to use EHRs. Telemedicine is another area where healthcare IT has changed how healthcare is delivered. Using technology, telemedicine makes it possible to diagnose, treat, and monitor patients at a distance. It enables patients to communicate with medical staff via video conferencing or other digital means, eliminating the need for in-person consultations, especially for routine or follow-up care. Reducing patient travel time and expenses, facilitating prompt interventions, and enhancing access to healthcare in underserved or rural areas have all been made possible via telemedicine. As healthcare providers attempted to maintain continuity of treatment while reducing in-person interactions during the COVID-19 epidemic, telemedicine saw a notable increase in popularity. Various telemedicine platforms allow patients to get medicines, consultations, and even remote monitoring. These innovations increase productivity, decrease human error rates, and give healthcare personnel more time to devote to patient care.

Regulatory requirements

Regulations have a significant impact on how quickly healthcare IT solutions are adopted. Globally, governments have put in place several laws and policies to enhance patient privacy, data security, interoperability, and healthcare quality. The need for healthcare IT solutions is fueled by the requirement to comply with these standards, which frequently mandate the usage of IT systems and technology. The Health Insurance Portability and Accountability Act (HIPAA) in the United States is a well-known illustration of a regulatory requirement that impacts the healthcare IT business. For instance, the 21st Century Cures Act, which includes provisions to encourage interoperability, facilitate the exchange of health information, and give patients access to their data, was created in the United States by the Office of the National Coordinator for Health Information Technology (ONC). These laws encourage using interoperable healthcare IT systems, including platforms for exchanging health information and application programming interfaces (APIs). The effect of regulatory regulations on the healthcare IT sector is illustrated by real-world instances. The ACA's meaningful use incentives significantly increased the adoption of electronic health records, which enhanced data sharing and care coordination. Healthcare organizations were prompted to invest in technology that secures patient data and enhances privacy due to the GDPR's implementation in Europe. The adoption of interoperable healthcare IT solutions is facilitated by interoperable government efforts, such as the 21st Century Cures Act in the United States, which aims to eliminate data silos and enable the seamless sharing of health information.

Competitive Landscape

The global market is a competitive and fragmented market due to the high presence of players in the market. Only a few companies account for a major market share, and hence, the degree of competition among the suppliers is high as the players in the market are active at global, regional, and country level. Also, the increasing rivalry between the players to obtain the majority of the market share for global has played a major role in intensifying the level of competition. The Major players are Cerner, Optum, Cognizant, Philips, Dell Technologies, Epic Systems, GE Healthcare, IBM, Oracle Corporation, Allscripts, eClinical Works, Infor, Conduent, Tata Consultancy Services, Conifer Health, Nuance Communication Inc., Wipro Limited, 3M.

FAQ

Frequently Asked Question

What is the global demand for Healthcare IT in terms of revenue?

-

The global Healthcare IT valued at USD 482.35 Million in 2023 and is expected to reach USD 2166 Million in 2032 growing at a CAGR of 18.19%.

Which are the prominent players in the market?

-

The prominent players in the market are Cerner, Optum, Cognizant, Philips, Dell Technologies, Epic Systems, GE Healthcare, IBM, Oracle Corporation, Allscripts, eClinical Works, Infor, Conduent, Tata Consultancy Services, Conifer Health, Nuance Communication Inc., Wipro Limited, 3M. .

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 18.19% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Healthcare IT include

- Increasing demand for efficient healthcare delivery

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Healthcare IT in 2023.

Vantage Market

Research | 17-Feb-2022

Vantage Market

Research | 17-Feb-2022