Healthcare Data Interoperability Market

Healthcare Data Interoperability Market - Global Industry Assessment & Forecast

Segments Covered

By Level Foundational, Structural, Semantic

By Deployment Cloud-based, On-premise

By Component Type Software Solutions, Services

By Model Centralized, Hybrid, Decentralized

By End-User Healthcare Providers, Healthcare Payers, Pharmacies

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 3.2 Billion | |

| USD 7.7 Billion | |

| 13.4% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The global Healthcare Data Interoperability Market is valued at USD 3.2 Billion in 2022 and is projected to reach a value of USD 7.7 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 13.4% between 2023 and 2030.

Premium Insights

The Healthcare Data Interoperability market is experiencing advancements as hospitals work towards improving their ability to share and exchange data seamlessly. According to the Office of the National Coordinator for Health Information Technology, 88% of hospitals in the United States were actively using electronic means to communicate and receive patient health information as of 2022. This included either querying electronic databases or electronically receiving the summary of care records. Since 2017, there has been a 40% increase in hospitals integrating patient health information into EHRs, with roughly 75% of hospitals doing so in 2021. Such trends exhibit development in interoperable exchange. The rate at which hospitals say that healthcare providers have access to and use electronic patient health information at the point of care between 2017-2021 has improved.

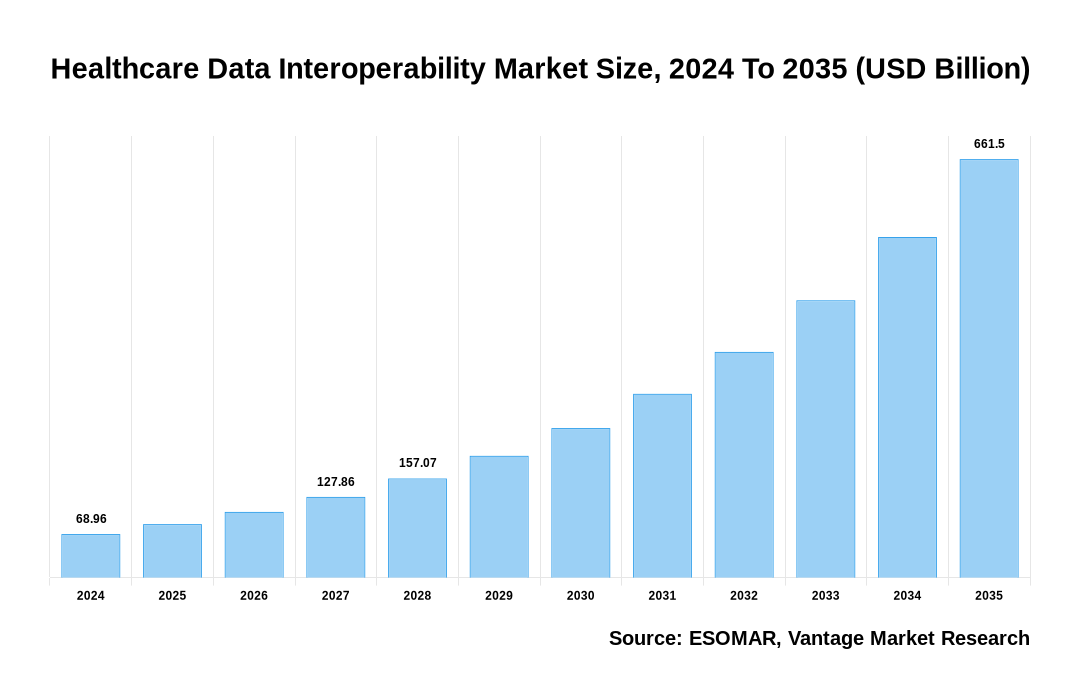

Healthcare Data Interoperability Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Healthcare Data Interoperability Market

- Increasing focus on patient-centric interoperability is fueling the market. Healthcare providers recognize the importance of patient engagement and empowerment, leading to a shift towards patient-centric interoperability. This involves ensuring that patients can easily access their health data and share it with their healthcare providers as needed. Initiatives like the MyHealthEData by the U.S. government aim to empower patients by promoting interoperability and data access.

- In 2022, North America generated over 40.30% of the market share because of the rise in adopting electronic health records (EHR), government initiatives, and the need for improved patient care coordination and management.

- During the forecast period, the Asia Pacific is projected to observe growth due to the increasing adoption of healthcare IT systems and digitization of medical records.

- The on-premise segment contributed to the major market growth, surpassing 62.5% of the share in 2022. This is due to the need for increased data security and privacy in the healthcare industry.

- Because of the rise in the adoption of electronic health records (EHRs), increasing emphasis on patient-centric care, and the need to improve healthcare outcomes while reducing costs, the software solutions segment in the Healthcare Data Interoperability market is observing significant growth.

- The healthcare providers experienced the most significant market growth due to technological advancements, regulatory requirements, and the growing need for effective healthcare delivery and coordination.

Economic Insights

Policies, incentives, and collaborations accelerate interoperability, but these components still need to be scattered, which may create further inequities in the public health data system. Through the Centers for Medicare & Medicaid Services (CMS) Meaningful Use program and, lately, the Merit-based Incentive Payment System, the federal government has recently used incentive programs to promote interoperability and gather a standardized set of data. Payments to providers are based on data collection and information exchange criteria under these incentive programs. In order to promote the exchange of electronic health information (EHI) and give patients access to their medical records, CMS finalized a rule in 2020.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Increased adoption of electronic health records: The EHR market has grown significantly, with healthcare organizations increasingly transitioning from paper-based medical records to electronic systems. This has created a need for interoperability to ensure the seamless exchange of patient data between different EHR systems.

- Emergence of application programming interfaces (APIs) in healthcare: APIs enable the integration of applications and systems, allowing seamless data exchange between different platforms. In healthcare, APIs are being used to facilitate interoperability between EHR systems, telemedicine platforms, and other healthcare applications. For instance, Epic and Cerner, two industry leaders in electronic health records, collaborated on a project to foster interoperability under the guidance of the Department of Health and Human Services Office of the National Coordinator for Health IT.

- Advancements in FHIR (Fast Healthcare Interoperability Resources): Fast Healthcare Interoperability Resources is the standard for exchanging healthcare information electronically. It enables healthcare systems to share data using modern web technologies easily and has gained traction due to its simplicity and flexibility. Many healthcare organizations are adopting FHIR to achieve interoperability. For example, the National Institutes of Health (NIH) has launched the FHIR Genomics project to explore using FHIR in genomics research.

Market Segmentation

The global Healthcare Data Interoperability market can be categorized into Level, Deployment, Component Type, Model, End-User, Region. The Healthcare Data Interoperability market can be categorized into Foundational, Structural, Semantic based on Level. The Healthcare Data Interoperability market can be categorized into Cloud-based, On-premise based on Deployment. The Healthcare Data Interoperability market can be categorized into Software Solutions, Services based on Component Type. The Healthcare Data Interoperability market can be categorized into Centralized, Hybrid, Decentralized based on Model. The Healthcare Data Interoperability market can be categorized into Healthcare Providers, Healthcare Payers, Pharmacies based on End-User. The Healthcare Data Interoperability market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Level

The Foundational Level Dominates the Market

The Foundational Level contributed to significant market growth in 2022. The segment plays a crucial role in facilitating the exchange of patient data, clinical information, and administrative records across healthcare organizations, such as hospitals, clinics, and laboratories. It ensures that information can be accessed and shared securely, accurately, and in a standardized format, regardless of the source system or technology platform. Key components of the foundational segment include data standards like HL7, FHIR, and DICOM, as well as interoperability frameworks such as IHE, Direct Messaging, and Health Information Exchange (HIE). These foundational elements form the backbone of interoperability, enabling healthcare providers to enhance care coordination, improve patient outcomes, and streamline administrative processes.

Based on Deployment

On-premise Segment Topped the Market

The On-premise segment accounted for the most significant market growth in 2022, with 62.5% of revenue. This segment involves using software and hardware installed and managed locally by healthcare organizations rather than hosted and operated by a third-party cloud service provider. The on-premise segment provides several advantages to healthcare organizations. It offers higher control and security as the data remains within the organization's premises, reducing the risk of data breaches and unauthorized access. Additionally, on-premise solutions can be tailored to specific requirements and integrated seamlessly with existing systems. This segment also enables healthcare organizations to comply with regulatory requirements and maintain data sovereignty.

Based on Component Type

The Software Solutions Segment Dominates the Market

The Software Solutions segment in the Healthcare Data Interoperability market is experiencing significant growth and is expected to continue expanding in the coming years. These software solutions play a crucial part in Healthcare Data Interoperability by facilitating the seamless sharing of patient data among healthcare providers, payers, and other stakeholders. They enable healthcare organizations to overcome the challenges of disparate data sources, incompatible formats, and varying communication protocols. Moreover, the demand for software solutions in Healthcare Data Interoperability is driven by factors such as the augmented adoption of electronic health records (EHRs), growing emphasis on patient-centric care, and the need to improve healthcare outcomes while reducing costs. These solutions offer a range of functionalities, including data mapping and transformation, messaging standards, data validation, and data exchange protocols.

Based on Model

The Centralized model Dominates the Market

The Centralized model accounted for the largest market growth. In the centralized model, healthcare organizations can benefit from improved coordination and collaboration as they share a common data infrastructure. This enables better care coordination and patient management, as providers can easily access and share patient records, test results, and treatment plans. Moreover, the centralized model ensures data consistency and integrity, as all updates and modifications are made in the central database, eliminating the risk of data discrepancies between different systems or locations.

Based on End-User

The Healthcare Providers Segment Dominates the Market

The Healthcare Providers segment will likely hold the highest market share in the healthcare interoperability solutions market. These providers include hospitals, clinics, physicians, and other healthcare professionals who are vital in delivering patient care. The healthcare providers category in the Healthcare Data Interoperability market is rapidly growing, driven by technological advancements, regulatory requirements, and the increasing need for effective healthcare delivery and coordination. These providers embrace interoperability solutions to enhance care coordination, improve patient safety, and streamline clinical workflows.

Based on Region

North America Led the Market

In 2022, North America led the global market with 40.30% revenue share. This market is driven by the growth in adopting electronic health records (EHR), the need for improved patient care coordination and management, and the push towards value-based care. Healthcare Data Interoperability is essential for healthcare organizations to improve clinical workflows, enhance patient outcomes, and reduce healthcare costs. In recent years, a significant focus has been on enhancing Healthcare Data Interoperability in North America. The Office of the National Coordinator for Health Information Technology (ONC) has led efforts to establish standards, guidelines, and policies to promote interoperability, including implementing the 21st Century Cures Act and the Trusted Exchange Framework and Common Agreement (TEFCA). The North America Healthcare Data Interoperability Market is projected to expand significantly in the coming years, driven by government initiatives, the increasing demand for integrated care delivery models, and the growing adoption of digital health technologies.

Competitive Landscape

The Healthcare Data Interoperability market is highly competitive, with several major players aiming to provide solutions for seamless data exchange and integration across healthcare systems and stakeholders. As interoperability becomes increasingly crucial in the healthcare industry, more companies, established players, and emerging startups enter the market with innovative solutions to cater to data exchange and integration challenges.

The players in the global Healthcare Data Interoperability market include Epic Systems Corporation, Koninklijke Philips N.V., Infor, Jitterbit, NextGen Healthcare Inc., Orion Health, InterSystems Corporation, Cerner Corporation, ViSolve Inc., Allscripts Healthcare, LLC, McKesson Corporation, Athenahealth, IBM Corporation, Wipro among others.

Recent Market Developments

- In May 2023, the first group of health systems to sign up for the nationwide interoperability framework was announced by Epic. The Trusted Exchange platform and the Common Agreement (TEFCA), a platform for sharing health information across the United States, are receiving commitments from health systems nationwide. The 21st Century Cures Act, a bipartisan congressional effort to enhance interoperability nationwide, authorized the public-private cooperation known as TEFCA.

- In April 2023, at the HIMSS annual conference, InterSystems, a creative data technology provider committed to assisting clients in resolving their most pressing scalability, interoperability, and speed issues, will highlight Department of Veterans Affairs (VA) programs that provide quality care to veterans across the nation. Through the streamlined sharing of health information, InterSystems, Cognosante, and VetsEZ are working together to enhance veterans' healthcare experiences. Their technologies give doctors a complete picture of a patient's medical history and give veterans access to vital care.

- In March 2022, at the HIMSS22 Global Health Conference & Exhibition, Philips—a leader in health technology, announced its most recent developments in analytics and interoperability solutions. To address various workflow needs across the imaging enterprise, Philips HealthSuite Interoperability is a fully integrated cloud-enabled health IT platform.

Segmentation of the Global Healthcare Data Interoperability Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Level

By Deployment

By Component Type

By Model

By End-User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Healthcare Data Interoperability in terms of revenue?

-

The global Healthcare Data Interoperability valued at USD 3.2 Billion in 2022 and is expected to reach USD 7.7 Billion in 2030 growing at a CAGR of 13.4%.

Which are the prominent players in the market?

-

The prominent players in the market are Epic Systems Corporation, Koninklijke Philips N.V., Infor, Jitterbit, NextGen Healthcare Inc., Orion Health, InterSystems Corporation, Cerner Corporation, ViSolve Inc., Allscripts Healthcare, LLC, McKesson Corporation, Athenahealth, IBM Corporation, Wipro.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 13.4% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Healthcare Data Interoperability include

- Adoption of Cloud technology related to healthcare services

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Healthcare Data Interoperability in 2022.