Health Insurance Market

Health Insurance Market - Global Industry Assessment & Forecast

Segments Covered

By Provider Public, Private

By Coverage Type Life Insurance, Term Insurance

By Health Insurance Plans Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) , Exclusive Provider Organization (EPO), Point of Service (POS) , High Deductible Health Plan (HDHP) plans

By Level of Coverage Bronze, Silver, Gold, Platinum

By Demographics Minors, Adults, Seniors

By End- Use Individuals, Corporates, Adults

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 2.09 Trillion | |

| USD 2.93 Trillion | |

| 4.30% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

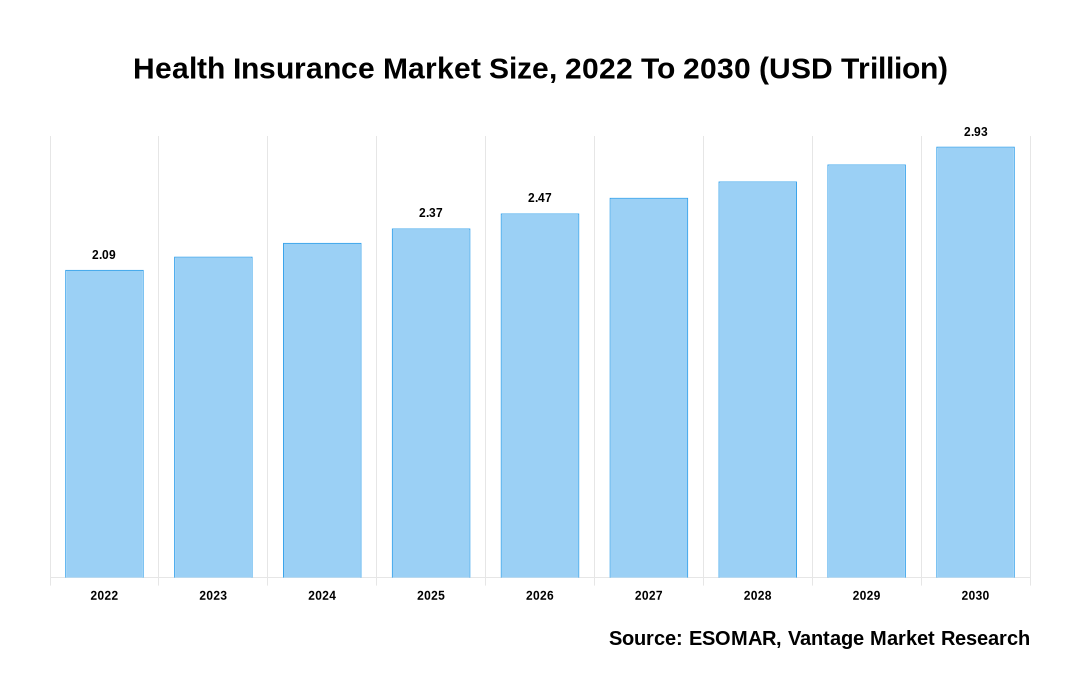

Market Synopsis: Global Health Insurance Market is valued at USD 2.09 Trillion in the year 2022 and is projected to reach a value of USD 2.93 Trillion by the year 2030. The Global Market is expected to grow at a Compound Annual Growth Rate (CAGR) of 4.30% over the forecast period.

Health Insurance is a form of insurance that covers medical costs. It can be purchased through private companies, government agencies, or other organizations. There are two types of Health Insurance plans: individual and group. An individual plan offers coverage for one person only. A group plan offers coverage to several people who pay monthly premiums based on their age and income.

Health Insurance Market Size, 2022 To 2030 (USD Trillion)

AI (GPT) is here !!! Ask questions about Health Insurance Market

The Health Insurance Market has been witnessing significant growth over the past few years owing to the increasing demand for health care services. According to the World Health Organization (WHO), the global healthcare expenditure was US$ 8.5 trillion in 2019, which accounted for 9.8% of GDP. In addition, the number of people suffering from chronic diseases is rising at a rapid pace. These factors are driving the need for Health Insurance coverage to provide financial protection against medical costs. Moreover, the aging population is also contributing to the growth of this market. As per WHO, the number of older adults aged 60+ is projected to increase from 12% in 2015 to 22% in 2050.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The rapid rise in the cost of medical services is driving the demand for Health Insurance. According to the World Bank, the average annual expenditure per capita on health care in India was US$ 73 in 2018. Moreover, the government’s decision to provide free treatment under the Ayushman Bharat scheme is likely to increase the demand for Health Insurance further. Furthermore, the introduction of the National Health Protection Scheme (NHPS) in 2017 is expected to benefit the Health Insurance segment.

However, the lack of awareness about the benefits of Health Insurance is restraining the growth of the market. Moreover, the high premiums charged by some private insurers are deterring customers from availing of their services.

Market Segmentation: The Global Health Insurance Market is segmented by provider, coverage, Health Insurance plans, level of coverage, demographics, end-use, and region. By provider, the market is bifurcated into public and private. By coverage type, the Global Health Insurance Market is segmented as life insurance and term insurance. Based on Health Insurance plans, the market is segmented into Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), Point of Service (POS), and High Deductible Health Plan (HDHP) plans. By level of coverage, the Global Health Insurance Market is segmented as bronze, silver, gold, and platinum. By demographics, the target market is segmented as minors, adults, and seniors. Based on end-use, the market is segmented into individuals, corporates, and adults.

The public segment is expected to dominate the Health Insurance Market over the forecast period:

The public segment accounts for the largest revenue share and dominates the Health Insurance Market in the next coming years. The state or federal government is the primary insurance company and direct provider of health care services. The federal government has played an important role in healthcare since the establishment of Medicare and Medicaid in 1965. Besides, public healthcare insurance is more affordable as compared to private one, as it generally requires no co-pays or deductibles and also has lower administrative costs.

Life insurance holds the largest market share in terms of revenue during the forecast period:

During the forecast period, life insurance is expected to lead the market in terms of revenue and market share. This is due to the benefits of life insurance, like permanent coverage and a guaranteed death payment. Working professionals can also benefit from life insurance plans because they can save money on taxes. Furthermore, life insurance gives financial assistance during emergency cases, and such reasons may drive the growth of the Health Insurance Market during the projected period.

The PPO segment grow at the highest CAGR during the forecast period:

The Preferred Provider Organization (PPO) segment dominated the healthcare insurance market and earned the most revenue. PPOs make it easier for their patients to have well-managed healthcare plans, and they provide more versatility in their schemes. Patients can choose from a list of pre-approved healthcare professionals, doctors, and hospitals. Furthermore, they provide access to the most prominent health plans as well as a vast network of healthcare providers, allowing the insured to choose from a variety of hospitals and doctors. Furthermore, there is minimal to no documentation necessary, resulting in a preference for recommended service organizations, increasing acceptance rates and driving the market growth.

The silver level of coverage accounts for the largest revenue share in the market:

Silver health plans account for the majority of the healthcare insurance market. Silver plans are the most prominent in the federal and state stock markets, with 70 percent of stock buyers opting for them. They're mainly for those who have one or two minor health issues and need to take medicine. During the forecast period, the gold plans segment is expected to increase at the fastest rate. This could be related to the growing incidence of chronic conditions, which necessitate frequent medical visits and pricey medications that are unaffordable out of budget.

The senior segment dominates the Health Insurance Market over the forecast period:

Because of the growing geriatric population, senior individuals account for a substantial market share. People between the ages of 65 and 80 are the most susceptible to medical emergencies, which is why Health Insurance is so important for providing the required financial support. However, due to increased healthcare awareness among this demographic, the adult segment is projected to expand at a faster rate during the forecast period. The high prevalence of unhealthy lifestyles in the adult population, such as obesity, diabetes, heart disease, and others, has elevated future health risks. As a result, the adult population is more susceptible to chronic diseases, which may necessitate long-term medical care. Adults are acquiring medical insurance policies to offset rising healthcare costs and avoid economic difficulties in the future, and these considerations will raise market growth.

The North America region dominated the Health Insurance Market during the forecast period:

North America holds 36.5% of market share in the Global Health Insurance Market this can be attributed to increased spending on healthcare infrastructure and favorable government regulations in the region. In addition, the US government’s expansion of the Medicaid program under the Affordable Care Act (ACA) is likely to drive the demand for Health Insurance in the country. Moreover, the increasing adoption of telemedicine services and the rise in the geriatric population are further expected to propel the growth of the market in the region. Asia Pacific is expected to witness the highest CAGR during the forecast period owing to increasing disposable income, improving healthcare infrastructure, and increasing geriatric population.

Competitive Landscape:

Some of the major key players in the Health Insurance Market are United Healthcare, Aetna, Anthem Inc., Aviva, Allianz, Centene, Cigna, CVS Health Corporation, Humana, Kaiser Foundation, Bupa and others.

Segmentation of Global Health Insurance Market:

Parameter

Details

Segments Covered

By Provider

By Coverage Type

By Health Insurance Plans

By Level of Coverage

By Demographics

By End- Use

By Region

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

FAQ

Frequently Asked Question

What is the global demand for Health Insurance in terms of revenue?

-

The global Health Insurance valued at USD 2.09 Trillion in 2022 and is expected to reach USD 2.93 Trillion in 2030 growing at a CAGR of 4.30%.

Which are the prominent players in the market?

-

The prominent players in the market are United Healthcare, Aetna, Anthem Inc., Aviva, Allianz, Centene, Cigna, CVS Health Corporation, Humana, Kaiser Foundation, Bupa.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.30% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Health Insurance include

- Increasing cost of healthcare

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Health Insurance in 2022.

Vantage Market

Research | 11-Apr-2022

Vantage Market

Research | 11-Apr-2022