Genotyping Assay Market

Genotyping Assay Market - Global Industry Assessment & Forecast

Segments Covered

By Product & Service Reagents & Kits, Bioinformatics, Genotyping Services, Instruments

By Technology PCR, Microarrays, Sequencing, Capillary Electrophoresis, MALDI-TOF, Others

By End-Use Pharmacogenomics, Personalized Medicine and Diagnostics, Animal Genetics, Agricultural Biotechnology, Research and Diagnostic Laboratories, Academic Institutes

By Region North America, Europe, Latin America, Asia Pacific, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 14.36 Billion | |

| USD 60.52 Billion | |

| 19.70% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

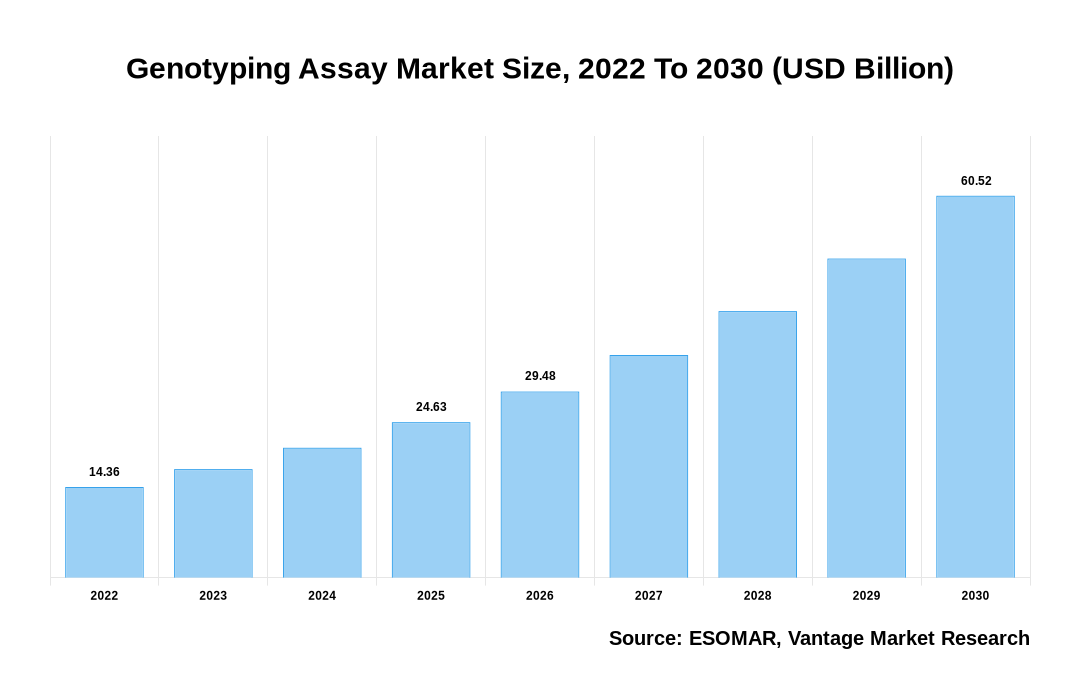

Global Genotyping Assay market is valued at USD 14.36 Billion in 2022 and is projected to attain a value of USD 60.52 Billion by 2030 at a CAGR of 19.70% during the forecast period, 2022–2028. Technological developments and reduced DNA sequencing expenses are projected to be the primary factors driving the Genotyping Assay market. In the next years, the rising frequency of genetic illnesses and increased awareness of personalised medicine, as well as the expanding importance of genotyping in drug discovery and the growing demand for bioinformatics solutions in data analysis, are projected to drive market expansion.

Genotyping Assay Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Genotyping Assay Market

Pharmacogenomics, diagnostic research, customised medicine, and forensics are all possible applications for genotyping platforms. This technique is also suitable for a variety of veterinary applications, food safety and quality, and environmental testing in distant places and industrial settings. Human diagnostics and pharmacogenomics now have substantial marker potential since these segments require large-scale genotyping analysis due to the need for better treatment choices and the high prevalence of disease. NGS is being adapted for this purpose, with businesses like QIAGEN and Freenome (US) collaborating to create NGS-based assays for precision medicine.

Technological Advancements and Decreasing Prices of DNA Sequencing

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Miniaturization, automation, and lower total costs have all been enabled by technological improvements, as well as operational flexibility and the introduction of multi-parameter testing. All of this has aided in expanding the uses and convenience of DNA sequencing, allowing clinicians to concentrate on higher-level decisions such as selecting and prioritising therapeutic targets through various genotyping studies. This has enhanced the use of PCR, sequencing, capillary electrophoresis, and microarrays in domains including drug development and clinical research. Furthermore, technology developments in DNA sequencing, such as next-generation sequencing (NGS), have enabled speedy, accurate sequencing, allowing for great productivity. This has also decreased the cost of DNA sequencing, lowering the entire cost of genomic and genotyping projects by USD 2,500 in a year.

High Cost of Equipment Used in Genotyping Assay

The instruments needed to conduct genotyping tests are quite expensive, and their installation necessitates a significant capital expenditure. Genotyping Assay instruments have a lot of advanced features and functions, hence they're expensive. Pharmaceutical businesses and research labs demand a large number of these systems, necessitating large expenditures in many, high-cost genotyping devices. The entire cost of ownership of these instruments rises as a result of maintenance costs and various other indirect charges, such as sample and labour costs. As a result, advanced research facilities such as NGS technology cannot be installed or expanded in academic and research institutes in developing countries across Asia, the Middle East, and Africa.

Market Segmentation:

Global Genotyping Assay market is segmented on the basis of product and services, into Instruments, Reagents And Kits, Bioinformatics, and Genotyping Services. On the basis of Technology, into Microarrays, Capillary Electrophoresis, Sequencing, Polymerase Chain Reaction (PCR), Matrix-Assisted Laser Desorption/Ionization-Time of Flight (Maldi-Tof) Mass Spectrometry and Others Technologies. On the basis of end user, into Pharmacogenomics, Diagnostics And Personalized Medicine, Animal Genetics, Agricultural Biotechnology, diagnostic and research laboratories, academic institutes and other. Based on region, the Genotyping Assay market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

North America to Continue Dominating the Genotyping Assay Market

During the projected period, North America is expected to dominate the worldwide Genotyping Assay market, followed by Europe. Increased adoption of technologically advanced Genotyping Assay products, high healthcare expenditures, advanced healthcare infrastructure, highly developed healthcare systems in the US and Canada, a large number of Genotyping Assay-based R&D projects, and the presence of a large number of leading Genotyping Assay manufacturers in the region, as well as increased demand for genotyping products from pharmaceutical companies and rising government investments, by government bodies, are responsible for the large share of the North American Genotyping Assay market.

USD 4.6 Million

Key Players:

Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Bioline, Qiagen, Danaher, F. Hoffmann-La Roche Ltd., General Electric, Sequenom, Fluidigm, Biogeniq Inc., Envigo, Helix, LGC Biosearch Technologies, among others.

The Genotyping Assay market is segmented as follows:

Parameter

Details

Segments Covered

By Product & Service

By Technology

By End-Use

By Region

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

The report scope can be tabulated as below:

Vantage Market

Research | 27-Jan-2022

Vantage Market

Research | 27-Jan-2022

FAQ

Frequently Asked Question

What is the global demand for Genotyping Assay in terms of revenue?

-

The global Genotyping Assay valued at USD 14.36 Billion in 2022 and is expected to reach USD 60.52 Billion in 2030 growing at a CAGR of 19.70%.

Which are the prominent players in the market?

-

The prominent players in the market are Illumina, Inc., Thermo Fisher Scientific Inc., Agilent Technologies, Bioline, Qiagen, Danaher, F. Hoffmann-La Roche Ltd., General Electric, Sequenom, Fluidigm, Biogeniq Inc., Envigo, Helix, LGC Biosearch Technologies.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 19.70% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Genotyping Assay include

- Technological Advancements and Decreasing Prices of DNA Sequencing

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Genotyping Assay in 2022.