Gas Water Heater Market

Gas Water Heater Market - Global Industry Assessment & Forecast

Segments Covered

By Fuel Type Natural Gas, LPG

By Product Type Instant, Storage

By Application Residential, Commercial, Industrial

By Installation Type Outdoor, Indoor

By Region North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 7.85 Billion | |

| USD 12.2 Billion | |

| 5% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

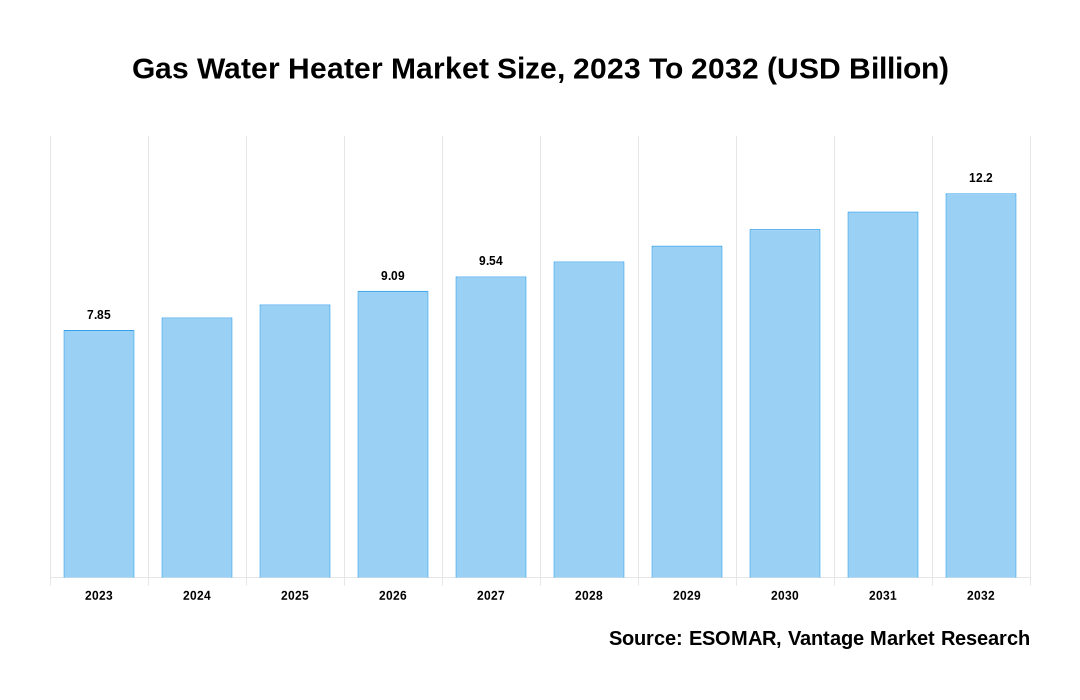

The global Gas Water Heater Market is valued at USD 7.85 Billion in 2023 and is projected to reach a value of USD 12.2 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 5% between 2024 and 2032.

Key Highlights of Gas Water Heater Market

- Asia Pacific predominantly led the Gas Water Heater market in 2023, with 38.5% of the total market share

- North America is projected to witness significant growth during the forecast period

- In 2023, the LPG segment accounted for the largest market share

- In 2023, the Instant segment took the lead in the market, contributing a 54.5% substantial revenue share

- The Commercial segment revealed the most significant market revenue in 2023 with 76.1% of revenue share

- While Gas Water Heater is typically powered by natural gas, there is a growing interest in alternative energy sources like biogas and renewable gas. This shift is part of a broader trend toward sustainability and reduced reliance on fossil fuels

Gas Water Heater Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Gas Water Heater Market

Gas Water Heater Market: Regional Overview

The Asia Pacific Gas Water Heater market exhibited significant dominance in 2023, with 38.5% of the revenue share. This is because of the rapid urbanization, industrialization, and rising disposable incomes across the region. Increased demand for efficient and environmentally friendly water heating solutions and government initiatives promoting energy efficiency of appliances are other key drivers. Further growth is expected to be driven by developments in technology, e.g. smart controls and energy efficiency designs. In addition, the leading countries such as China, India, and Japan are significant contributors to market expansion.

The global Gas Water Heater market can be categorized as Fuel Type, Product Type, Application, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Fuel Type

By Product Type

By Application

By Installation Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Gas Water Heater Market: Fuel Type Overview

Extensive growth was observed in the Global Gas Water Heater market within the LPG category in 2023. The Fuel Type segment is divided into Natural Gas and LPG. The Liquefied Petroleum Gas (LPG) segment in the global Gas Water Heater market experiences largest growth due to its versatility, energy efficiency, and eco-friendliness. LPG powered water heaters are valued for their portability, making them popular in regions without access to natural gas pipelines. The growth in demand for renewable energy sources and the need to reduce carbon emissions will benefit this segment. As consumers look for alternatives to traditional electrical water heaters, LPG offers an assured and cost effective solution.

Gas Water Heater Market: Product Type Overview

In 2023, considerable growth was seen in the Instant segment, commanding a market share of 54.5%. Based on the Product Type, the Gas Water Heater market is separated into Instant and Storage. The instant segment in the global Gas Water Heater market is gaining traction, driven by the increasing demand for on-demand hot water mainly across the residential sector. Unlike traditional storage-based systems, instant Gas Water Heater heat water only when needed, providing energy savings and reducing water wastage. This segment appeals to consumers seeking efficiency, space-saving designs, and fast access to hot water, mainly in areas with limited space. The rapid urbanization and growth of compact living spaces further boost the adoption of instant Gas Water Heater. They are ideal for households with smaller hot water requirements and businesses that prioritize energy efficient solutions.

Gas Water Heater Market: Application Overview

There was a major growth in the Commercial segment in 2023, i.e., 76.1% of revenue share. Based on the Application, the Gas Water Heater market is segmented into Residential, Commercial, and Industrial. The commercial segment in the Gas Water Heater market is driven by the increased hospitality, healthcare, and industrial sectors. In order to meet their operational needs, enterprises and institutions require reliable, high-capacity water heating systems. Key factors driving the commercial segment's growth include the need for large-scale water heating in hotels, hospitals, laundries, and manufacturing facilities. Additionally, the increasing focus on sustainability and energy efficiency encourages businesses to invest in efficient gas-based systems, ensuring a stable segmental growth.

Key Trends

- Demand for energy efficient Gas Water Heater is increasing due to increased awareness of energy conservation and the environmental impact. Products with lower carbon emissions and more efficient insulation are being developed by a number of manufacturers to meet the stringent energy efficiency standards.

- Integration of smart technologies with Gas Water Heater is fuelling market growth. This includes the ability for users to control and watch their water heaters via a mobile phone or another device, and features such as remotely monitoring, programmable controls etc.

- Tankless or on-demand Gas Water Heater are gaining popularity due to their energy-saving benefits and smaller footprint. These heaters are more efficient and suitable for smaller spaces because they offer instant hot water without the need for a storage tank.

- More environmentally friendly Gas Water Heater are becoming popular due to stringent energy efficiency and emission regulations. Consumers are also being encouraged to upgrade their water heaters by government incentives and rebates for energy efficient appliances.

- Demand for Gas Water Heater is fueled by rapidly growing urbanization and economic development in emerging markets, especially Asia Pacific and Latin America. Market growth is being driven by the increased construction of housing and commercial buildings in these regions.

Premium Insights

The Global Gas Water Heater Market is influenced by evolving energy efficiency standards, consumer sustainability trends, and regulatory frameworks such as those set by the Federal Energy Management Program (FEMP) and ENERGY STAR. FEMP's acquisition guidance encompasses a range of commercial Gas Water Heater, including storage units with input rates exceeding 75,000 British thermal units (Btu) per hour but under 4,000 Btu/hr per gallon of stored water, and gas-fired instantaneous-type units with input rates over 200,000 Btu/hr but not less than 4,000 Btu/hr per gallon of stored water. In addition, ENERGY STAR specifications cover heat pump water heaters with electric power inputs over 12 kilowatts (kW), driving manufacturers to innovate towards energy-efficient solutions. Manufacturers that align with these regulatory and consumer demands are poised to expand their market presence, catering to both the commercial and residential segments.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

In January 2024, A.O. Smith, a top provider of water heating and treatment solutions, introduced the Emerge™ X Air Source Heat Pump Water Heater (HPWH), a new addition to its line of high-efficiency commercial products. The Emerge X HPWH boosts energy efficiency and also simplifies installation and usage, providing significant cost savings and reliable hot water for commercial settings with high demand. This innovative product uses patented technology to maximize heat transfer and reduce emissions, and ensure it is eco-friendly and economical. Installation is streamlined for contractors, as no special tools are needed, and the control box can be installed separately from the heat pump and tanks for greater flexibility.

Bradford White Water Heaters unveils Bradford White Connect™, a new external adapter that brings app-based monitoring capabilities to the AeroTherm® heat pump water heater (HPWH) series. With Bradford White Connect™, users can control their HPWHs, adjust settings, and receive alerts directly from a user-friendly mobile app available on both Google Play and Apple's App Store. Contractors can leverage Bradford White Connect™ to oversee in-service AeroTherm units, assess performance, and set up alerts for any water heater malfunctions. In addition, the adapter’s CTA-2045 port meets grid-enabled demand response standards, allowing integration with utility programs.

Competitive Landscape

A mix of established and new players, each competing for market shares through innovation and differentiation, dominates the global Gas Water Heater market. Leading companies such as A.O. Smith, Rheem, Bosch, and Rinnai focus on technological advancements, energy efficiency, and diverse product portfolios to maintain their competitive edge. Niche markets, offering specialized products or unique features, are often targeted by new players and smaller companies. Factors such as consumer demand for ecofriendly products, changes in legislation and energy costs influence market dynamics. As companies seek to increase their global reach and product lines, strategic partnerships, mergers and acquisitions are also common.

Recent Market Developments

- In March 2024, Bradford White Corporation, a top manufacturer of water heaters, boilers, and storage tanks, presents its latest products from the Bradford White Water Heaters and Laars® Heating Systems brands at the Canadian Mechanical and Plumbing Exposition (CMPX) in Toronto from March 22-24. The company, known for its innovation in water heating, is set to display its advanced solutions at the event.

- In January 2024, A.O. Smith, a leading provider of water heating and water treatment products, has introduced its Adapt™ Premium Condensing Gas Tankless Water Heaters featuring the innovative X3® Scale Prevention Technology. This new product comes with advanced features like an integrated recirculation pump and a patented heat exchanger, providing greater installation flexibility and exceptional efficiency.

- In December 2023, Rheem, a top international producer of water heating and HVACR products, is expanding its Maximus™ line of ultra-efficient Gas Water Heater with two new additions. The latest models include the 75-gallon Maximus™ Heavy Duty (HD) equipped with LeakSense™ and the Maximus™ Plus, which is available in 40- and 50-gallon sizes.

- In July 2023, Rheem® is unveiling the next generation of its RTGH Series Super High Efficiency Condensing and RTG Series High Efficiency Non-Condensing tankless Gas Water Heater. This updated product range comes with improved performance features and a more compact, contemporary design.

- In March 2023, Bradford White Water Heaters, a leading U.S. manufacturer of water heaters, boilers, and storage tanks, revealed that its Infiniti® GS and GR tankless water heaters, along with certain eF Series® Ultra High Efficiency commercial tank Gas Water Heater, have received certification from the Green Restaurant Association (GRA). This certification endorses these products for use in GRA-certified restaurants, a key milestone in the Green Restaurant movement.

FAQ

Frequently Asked Question

What is the global demand for Gas Water Heater in terms of revenue?

-

The global Gas Water Heater valued at USD 7.85 Billion in 2023 and is expected to reach USD 12.2 Billion in 2032 growing at a CAGR of 5%.

Which are the prominent players in the market?

-

The prominent players in the market are Bradford White Corporation, Ariston Holding N.V., A.O. Smith Corporation, Bosch Thermotechnik GmbH, Rheem Manufacturing Company, Haier Inc., Lennox International Inc., Noritz America Corporation, Rinnai Corporation, BDR Thermea Group B.V..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Gas Water Heater include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Gas Water Heater in 2023.