Furniture Market

Furniture Market - Global Industry Assessment & Forecast

Segments Covered

By Raw Material Wood, Metal, Plastic, Other Raw Materials

By Category Indoor, Outdoor

By End-User Residential, Office, Hotel, Other End-Users

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 521.5 Billion | |

| USD 800.3 Billion | |

| 5.5% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

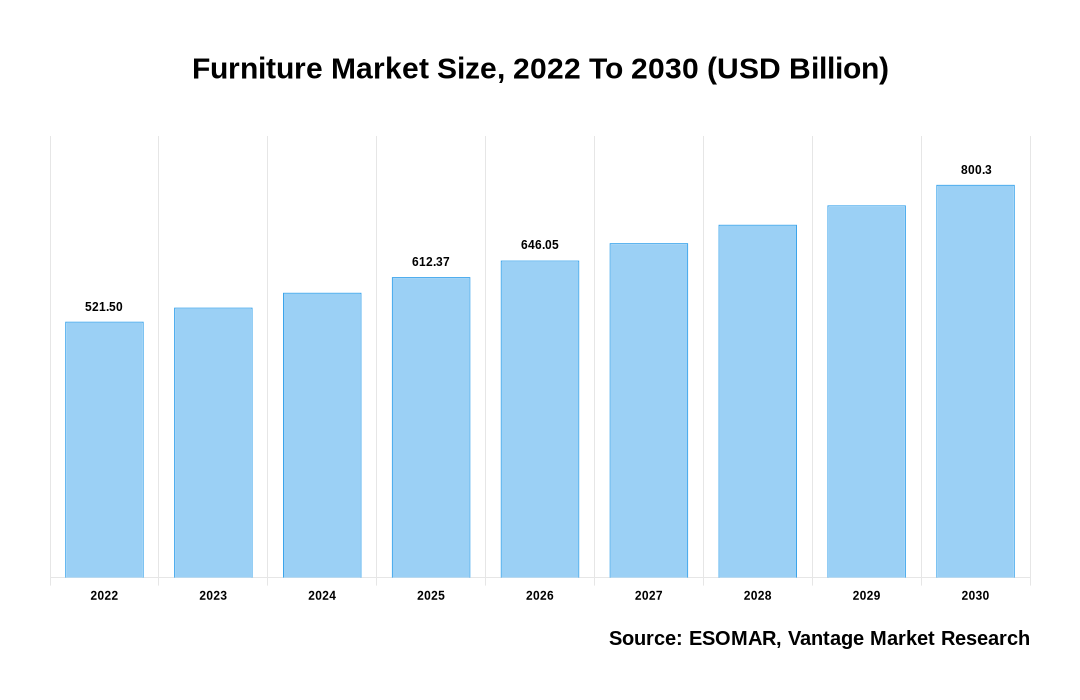

The global Furniture Market is valued at USD 521.5 Billion in 2022 and is projected to reach a value of USD 800.3 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 5.5% between 2023 and 2030.

Premium Insights

The Furniture industry is expanding rapidly due to a number of variables coming together. The American Furniture Manufacturers Association (AFMA) reports that sales increased by 7% in the most recent fiscal year, indicating a consistent rise in demand in the industry. As noted in a recent blog post by Furniture Today.com, this increase in sales can be linked to shifting consumer preferences toward more environmentally friendly and sustainable Furniture options. Additionally, the COVID-19 pandemic has led to a shift in lifestyle, which has increased demand for ergonomic and multipurpose Furniture pieces. This is due to the growing trend of remote working and the establishment of home offices. The market is also benefiting from the growth of e-commerce since online sales channels provide customers with more variety and convenience. The need for individualized Furniture solutions and the growing understanding of the value of interior design aesthetics have both fueled the Furniture market's overall growth, which is still expanding today.

Furniture Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Furniture Market

- The expanding urban population and a surge in home improvement projects, along with changing consumer preferences for stylish and functional furniture, are driving the global Furniture market during the projection period from 2023 to 2030.

- The wood segment will continue to assert its dominance by raw material and will capture the largest market share globally throughout the forecast period 2023 to 2030.

- In 2022, Asia Pacific exhibited its market prowess, achieving the highest revenue share of over 40.5%.

- The Asia Pacific region is poised for remarkable growth, displaying a noteworthy Compound Annual Growth Rate (CAGR) between 2023 and 2030.

Top Market Trends

- In the Furniture sector, sustainability is still very much in style, as buyers choose more environmentally friendly products and manufacturing processes. Growing environmental consciousness is the driving force behind this trend, which has many Furniture makers using responsibly sourced and recycled materials to cut down on their carbon footprint.

- Furniture that incorporates electronics is becoming more common. As people want more convenient and connected living environments, smart Furniture—which includes features like built-in charging outlets, wireless charging, and Internet of Things connectivity—is becoming more and more popular.

- Furniture design is still influenced by minimalism. Customers' preferences for minimalist and uncluttered living spaces are reflected in their inclination toward Furniture that is both streamlined and practical while optimizing space consumption.

- Customization is a major trend, as buyers seek out Furniture that meets their unique requirements and tastes. Nowadays, a lot of manufacturers provide customizable alternatives, letting clients select the types of materials, colors, and designs to create one-of-a-kind Furniture items that suit their preferences.

Report Coverage & Deliverables

Get Access Now

Economic Insights

Economic insights have had a major impact on the Furniture business, especially in the aftermath of the COVID-19 pandemic. Data from the National Association of Home Builders (NAHB) indicates that during the early stages of the market's existence, lockdowns and economic uncertainty caused customer spending on non-essential items—including Furniture—to fall. This had a short-term detrimental effect, causing supply chain disruptions and production slowdowns for several Furniture producers. However, according to CNBC, there was an increase in demand for home office Furniture as individuals stayed home more during lockdowns, which somewhat countered the overall decline. In addition, the market adjusted by increasing its e-commerce presence; Statista notes that this resulted in a surge in online Furniture sales. The Furniture market recovered as the economy grew stronger and consumer confidence increased, demonstrating its ability to adapt and persevere in the face of difficult financial circumstances.

Market Segmentation

The Global Furniture Market is categorized into the segments as mentioned below:

The global Furniture market can be categorized into Raw Material, Category, End-User, Region. The Furniture market can be categorized into Wood, Metal, Plastic, Other Raw Materials based on Raw Material. The Furniture market can be categorized into Indoor, Outdoor based on Category. The Furniture market can be categorized into Residential, Office, Hotel, Other End-Users based on End-User. The Furniture market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Raw Material

Wood-Based Products to Sell Majorly Owing to its Popularity & Longevity

During 2022, in the Furniture sector, wood continues to be the most popular material. First and foremost, wood is a popular material for creating sturdy, traditional Furniture because of its reputation for longevity and style. Its adaptability also enables a variety of finishes and styles, catering to a broad spectrum of consumer preferences and inclinations in interior design. Furthermore, wood has been valued by the sustainability movement because, when sourced sustainably, it is renewable, which is in line with consumers' growing environmental conscience. Last but not least, wood's capacity to arouse feelings of coziness and genuineness in living areas keeps it the material of choice for Furniture manufacturers, securing its dominance in the market.

Based on Category

Furniture Intended for Indoor Usage to Accommodate Larger Share Due to Increasing Need for Stylist Requirement

In 2022, in the market, indoor Furniture is the industry leader. Numerous causes can be blamed for this frequency. First of all, whether at home, in a workplace, or in another indoor space, most individuals spend a large amount of their lives indoors. Because of the necessity to outfit these spaces with pieces that are comfortable, practical, and aesthetically beautiful, there is a constant need for indoor Furniture. Second, Furniture lasts longer indoors in a climate-controlled environment than it does outdoors in the open air because it is not as exposed to the weather. Thirdly, as the interior design market develops continuously, there is a need for fresh, creative designs of indoor Furniture to stay up with shifting consumer tastes and trends. Overall, the market's predominant use of indoor Furniture is cemented by the interaction of lifestyle considerations, consumer demand, and innovative design.

Based on End User

Residential Furniture to Widen its Footprint Due to Increasing Space & Ongoing Requirement for Furniture

In 2022, residential Furniture is the industry leader. The main causes of this are the enormous number of residences and the ongoing requirement for Furniture to decorate homes. Furniture for the house comes in a variety of styles, including dining room sets, patio Furniture, and living room and bedroom sets. Furthermore, there is a constant need for new household Furniture designs due to the demand for personalization and the changing trends in home décor. Additionally, as more individuals spent time working and socializing from home due to the COVID-19 epidemic, the significance of having cozy and practical home surroundings increased, which in turn caused a spike in the sale of residential Furniture. The domestic Furniture market is the largest and most diverse area of the industry; the office and hotel sectors, while also important, cannot compare.

Based on Region

Asia Pacific Furniture Market to Witness Dominant Share Due to Larger Population and Increased Consumer Spending Power

The Furniture market in Asia Pacific had the largest share in 2022 and is presumed to expand quickly over the upcoming years. A growing middle class, urbanization, and economic growth in the area have raised disposable income and increased demand for high-quality Furniture. Asia Pacific is a significant global Furniture exporter due to its cost-effective production capabilities. Due to its manufacturing prowess, growing consumer affluence, and expanding economy, Asia Pacific has the greatest potential for growth in the Furniture market.

In the Furniture market, North America is the region with the significant sales. Numerous factors contribute to this supremacy. The large population and robust interior design and homeownership cultures in North America sustain a steady demand for Furniture. In addition, the area's well-established Furniture production, distribution, and retail infrastructure help it maintain its market-leading position. Particularly, the United States is a major Furniture producer and consumer, supporting North America's position as the industry leader.

Competitive Landscape

The Furniture market has a very broad competitive landscape, with both local and well-established multinational businesses. Prominent multinational corporations such as Ashley Furniture, Steelcase, and IKEA, with their vast product lines and global presence, control the market. Locally, a large number of smaller businesses provide specialty Furniture to target niche markets. Online retailers of Furniture have seen a rise in the influence of e-commerce behemoths like Wayfair and Amazon. As businesses compete for customers' attention and loyalty, ongoing innovation in design, materials, and sustainable practices further fuels the market's competitiveness.

The key players in the global Furniture market include - Harman Miller Inc. (U.S.), Steelcase Inc. (U.S.), HNI Corporation (U.S.), Ashley Furniture, Industries Inc. (U.S.), Duff & Phelps LLC. (U.S.), Global Furniture USA (U.S.), ZouYou (China), P & C ArteMobili SA (Brazil), Saudi Modern Factory Co. (Saudi Arabia), DEDON GmbH (Germany), Dare Studio (England) among others.

Recent Market Developments

- In July 2022, desks, monitor arms, and gaming chairs will be supplied by Harman Miller Inc. in collaboration with G2 Esports. Revenue from sales and gross profit will rise for the company as a result of the relationship.

- December 2022: Brosa, one of Australia's biggest online luxury Furniture sellers, was taken up by Kogan.com Limited. Through the backing of the Kogan Group, the agreement guarantees that the well-known Furniture brand endures and emerges stronger than before.

- December 2022: DeKalb Office Environments, Inc. will be acquired by Empire Office, Inc. Through the acquisition, the business will be able to expand locally in Atlanta and Birmingham.

Segmentation of the Global Furniture Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Raw Material

By Category

By End-User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Furniture in terms of revenue?

-

The global Furniture valued at USD 521.5 Billion in 2022 and is expected to reach USD 800.3 Billion in 2030 growing at a CAGR of 5.5%.

Which are the prominent players in the market?

-

The prominent players in the market are Harman Miller Inc. (U.S.), Steelcase Inc. (U.S.), HNI Corporation (U.S.), Ashley Furniture, Industries Inc. (U.S.), Duff & Phelps LLC. (U.S.), Global Furniture USA (U.S.), ZouYou (China), P & C ArteMobili SA (Brazil), Saudi Modern Factory Co. (Saudi Arabia), DEDON GmbH (Germany), Dare Studio (England).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.5% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Furniture include

- Regular Introduction of the Innovative & Luxurious Furniture Items to Drive Market Growth

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Furniture in 2022.

Vantage Market

Research | 30-Oct-2023

Vantage Market

Research | 30-Oct-2023