Fumed Silica Market

Fumed Silica Market - Global Industry Assessment & Forecast

Segments Covered

By Type Hydrophilic, Hydrophobic

By Application Silicone Rubber, Plastics and Composites (Unsaturated Polyester Resin), Food and Beverages, Paints and Coatings (Including Inks), Adhesives and Sealants, Pharmaceutical, Personal Care, Chemicals and Fertilizers, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 1.05 Billion | |

| USD 1.55 Billion | |

| 5.00% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

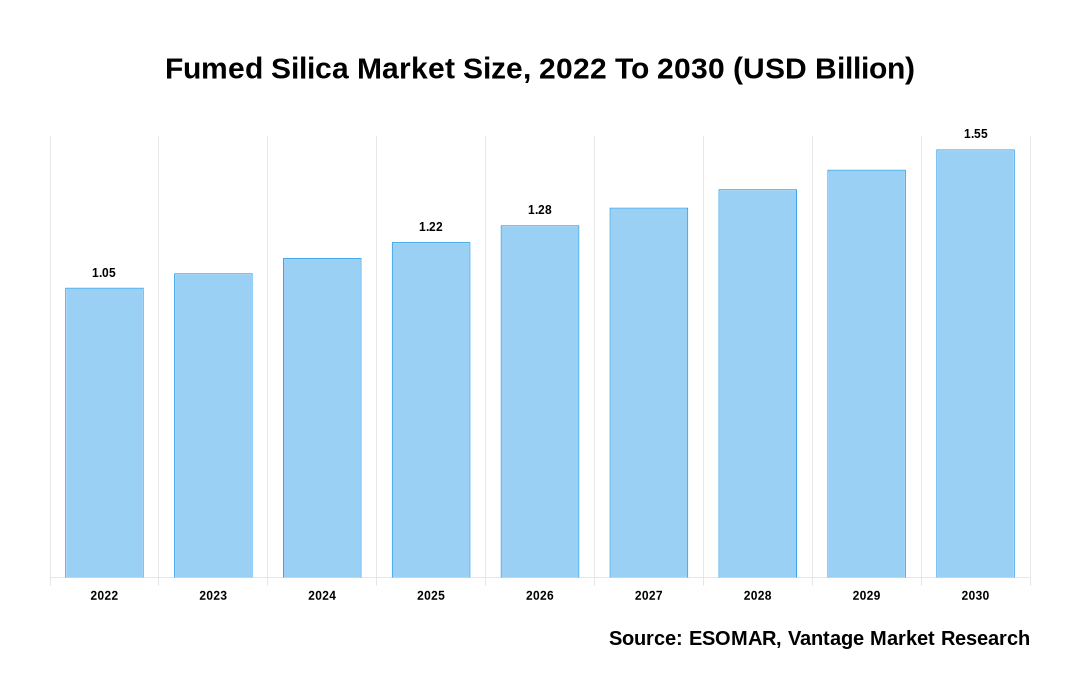

Global Fumed Silica market is valued at USD 1.05 Billion in 2022 and is estimated to reach a value of USD 1.55 Billion by 2030 at a CAGR of 5.00% during the forecast period. The market revenue and volume are predicted to reduce in 2021 as a result of the COVID-19 pandemic; however, the reduction is expected to soon recover and show a considerable increase thereafter. In terms of both production and consumption, China controls nearly half of the global Fumed Silica market. The global supply chain has been harmed by China's reliance since the coronavirus pandemic has disrupted shipping and production processes.

Furthermore, industrial closures and travel and trade restrictions put people at risk of becoming overly reliant on a single area for both vital and non-essential goods. The industry is also catching up to supply concerns by concentrating manufacturing activities in multiple geographic places to reduce the danger of relying on a single source.

The global Fumed Silica market has seen a lot of demand from the automotive, healthcare, paint & coatings, and construction industries, which means there are a lot of potentials for it to grow in the next years. It is expected to be used in the majority of end-user applications. The major players are now on the lookout for new applications in which their products can be used to fulfill the estimated worldwide Fumed Silica market size for the next few years.

Fumed Silica Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Fumed Silica Market

Market Segmentation:

The global Fumed Silica market is segmented on the basis of Type(Hydrophilic,Hydrophobic),Application(Silicone Rubber,Plastics and Composites (Unsaturated Polyester Resin),Food and Beverages,Paints and Coatings (Including Inks),Adhesives and Sealants,Pharmaceutical,Personal Care,Chemicals and Fertilizers,Others),Region(North America,Europe,Asia Pacific,Latin America,Middle East & Africa). Based on Type, the market is segmented as Hydrophilic And Hydrophobic. By Application, the market is segmented as Silicone Elastomers, Paints, Coatings & Inks, Adhesives & Sealants, UPR & Composites, Building & Construction, Electrical & Electronics, Automotive & Transportation, Personal Care & Beauty, Food & Beverages, Pharmaceuticals and Others.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The hydrophilic sector of the Fumed Silica market is expected to be the largest. Hydrolyzing volatile chlorosilanes in an oxyhydrogen flame produces hydrophilic Fumed Silica. It can be absorbed and distributed fully in water. At high temperatures, this silica possesses outstanding insulating characteristics. Non-polar resin systems can benefit from hydrophilic Fumed Silica. It's employed in silicone reinforcing and thickening, as well as in the thickening of non-polar solvents including xylene, mineral spirits, and styrene. It's best for compositions where shelf stability isn't a big concern. Because of its inexpensive cost, hydrophilic Fumed Silica is rapidly being used in a variety of applications. Even at high temperatures, it has good chemical purity and excellent insulating characteristics.

The largest section of the Fumed Silica market is expected to be silicone elastomers. Voltage line insulators, cooking, baking, and food storage items; undergarments, sportswear, and footwear; electronics; medical devices and implants; and household gaskets and O-rings are all examples of silicone elastomers in use. Silicone elastomers are also employed in the production of sealants. Because of their physiological inertness, they are ideal for usage in the healthcare business, particularly in blood transfusions, artificial heart valves, and other prosthetic devices. The United Kingdom, France, Germany, the United States, and Japan are the major producers of silicone elastomers.

Increasing Demand For Fumed Silica In The Pharmaceutical Industry Are Expected To Drive Growth Of The Fumed Silica Market

The creation of tablets and capsules in the pharmaceutical business is a big difficulty, but fumed silica helps to improve characteristics, making the process considerably easier. In tablet manufacturing, fumed silica is used as anticaking agents, adsorbents, disintegrants, and glidants to allow powder to flow easily when tablets are being processed. Biologically, these chemicals appear to be harmless. The FDA considers it to be generally safe.

Due to the medical industry in Europe, demand for Fumed Silica is predicted to expand at an unprecedented rate. Large investments are being made in the pharmaceutical business in Europe, and technological advancements are reinforcing the market's grip. The pharmaceutical business has experienced strong growth as a result of COVID-19's impact.

Increased Demand In Paints, Coatings And Sealants Industries Are Expected To Drive Growth Of The Fumed Silica Market

During the projected period, demand for Fumed Silica is expected to rise due to rising demand in the paints, coatings, and sealants industry. According to the World Painting and Coating Association, the global painting and coating industry will produce USD 150 billion in revenue in 2020, and demand for Fumed Silica will rise as the industry improves the properties of paints and coatings to suit customer demand. The thixotropic nature of fumed silica in sealants provides sag-specific features for successful practical application. It also gives sealants reinforcement and mechanical qualities. Because no other source can achieve these qualities, Fumed Silica has a competitive edge and dominates the sealant industry.

Stringent Government Regulations On The Usage Of Fumed Silica

Governments and organizations all over the world have enacted a slew of regulations and standards governing the use of fumed silica. The Food and Drug Administration (FDA), for example, has placed restrictions on the use of fumed silica in production. Manufacturers may use fumed silica as a food additive, but only in modest amounts that do not exceed 2% of the product's weight. A standard for fumed silica is enforced by the Occupational Safety and Health Administration (OSHA).

Asia Pacific Fumed Silica Market to Grow at the Fastest CAGR

In terms of value, APAC had the greatest market share of nearly 42.58% in 2021. One of the main drivers of industry expansion in this region is the expanding population and rapid urbanization. APAC is a profitable market for producers looking to acquire market share and enhance profitability because of the high domestic demand, simple availability of raw materials, and low-cost labor. The advantages of setting up production facilities, the low cost of manufacturing, and the opportunity to better serve local emerging markets are attracting manufacturers of fumed silica to this country.

Competitive Landscape:

Some of the major vendors in the Fumed Silica market is Dongyue Group, Kemitura Group, Cabot Corporation, OCI Company Ltd., Evonik Industries AG, Tokuyama Corporation, Orisl, China-Henan Huamei Chemical Co., Ltd., Wacker Chemie AG, Henan Xunyu Chemical Co., Ltd., Cabot Sanmar Limited, and Hubei Xingrui Silicon Materials Co., Ltd.

Fumed Silica is Segmented as Follows:

Parameter

Details

Segments Covered

By Type

By Application

By Region

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Vantage Market

Research | 21-Feb-2022

Vantage Market

Research | 21-Feb-2022

FAQ

Frequently Asked Question

What is the global demand for Fumed Silica in terms of revenue?

-

The global Fumed Silica valued at USD 1.05 Billion in 2022 and is expected to reach USD 1.55 Billion in 2030 growing at a CAGR of 5.00%.

Which are the prominent players in the market?

-

The prominent players in the market are Dongyue Group, Kemitura Group, Cabot Corporation, OCI Company Ltd., Evonik Industries AG, Tokuyama Corporation, Orisl, China-Henan Huamei Chemical Co., Ltd., Wacker Chemie AG, Henan Xunyu Chemical Co., Ltd., Cabot Sanmar Limited, and Hubei Xingrui Silicon Materials Co., Ltd..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.00% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Fumed Silica include

- Increasing demand for fumed silica in the pharmaceutical industry

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Fumed Silica in 2022.