Floating Production Systems Market

Floating Production Systems Market - Global Industry Assessment & Forecast

Segments Covered

By Type FPSO, Tension Leg Platform, SPAR, Barge

By Water Depth Shallow Water, Deep Water, Ultra Deep Water

By Build New, Converted

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 68.5 Billion | |

| USD 265.2 Billion | |

| 18.2% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

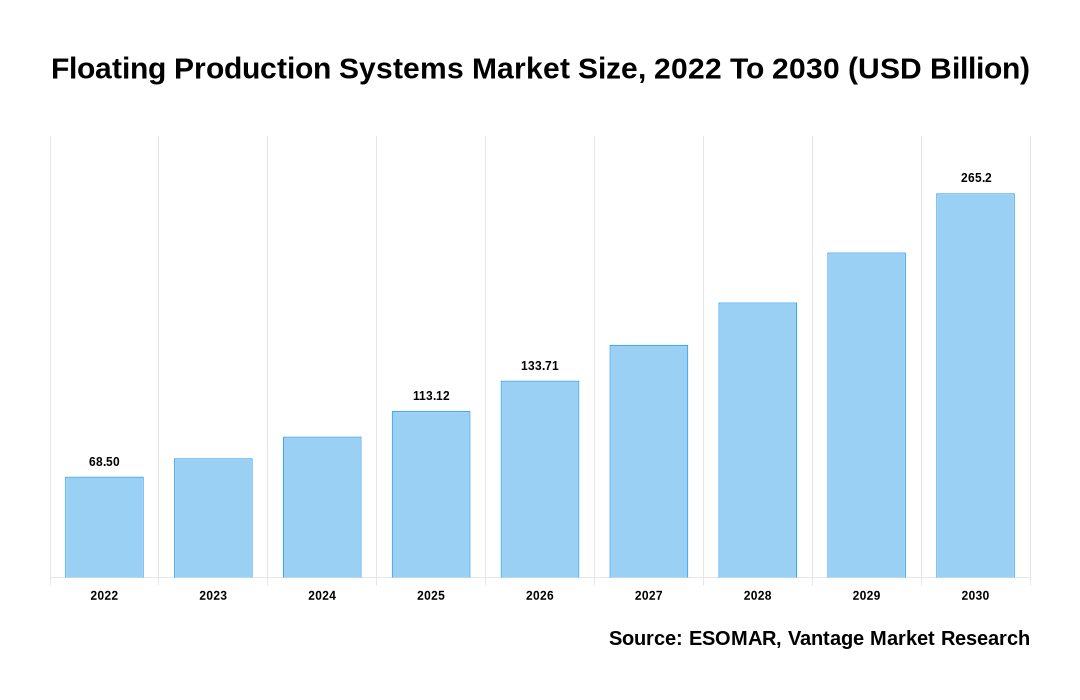

The global Floating Production Systems Market is valued at USD 68.5 Billion in 2022 and is projected to reach a value of USD 265.2 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 18.2% between 2023 and 2030.

Premium Insights

The escalating demand for offshore oil and gas production, resulting from the depletion of onshore and shallow water reserves, is a major factor driving the Floating Production Systems market. This depletion has led to a shift towards deepwater and ultra-deepwater exploration and production activities. In this challenging environment, floating production systems, particularly FPSOs, are essential for the development of oil and gas fields. These systems are highly versatile and adaptable, playing a crucial role in efficiently producing, processing, storing, and offloading hydrocarbons.

Floating Production Systems Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Floating Production Systems Market

- With global energy demands increasing and offshore technologies advancing to improve the efficiency and reliability of floating production systems, there is a growing need to access and exploit resources in deeper waters in order to ensure a sustainable energy supply.

- North America generated more than 43.5% of revenue share in 2022.

- The Asia Pacific region is expected to grow at the quickest rate from 2023 to 2030.

- The FPSO segment accounted for the largest market growth. It contributed over 50.2% of the total revenue share in 2022.

- Deep Water segment revealed the most significant market growth, contributing 40.5% share in 2022.

- The New build segment accounts for the largest revenue of 55.6% market share in 2022.

Economic Insights

The global energy dynamics have a significant influence on the economic landscape of the Floating Production Systems market. The market's growth is driven by the increasing global demand for offshore oil and gas production, as the world increasingly relies on energy. In order to maximize profits, companies within the industry are focusing on cost optimization strategies, which are prompted by fluctuations in oil prices. This has resulted in the adoption of innovative technologies and solutions to enhance operational efficiency. The economic viability of floating production systems is further emphasized by their ability to access deepwater and ultra-deepwater reserves, which contributes to continued exploration and production activities. Moreover, government policies that support offshore development and investment in offshore technologies also shape the economic trajectory of the market.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Increasing demand for energy: The global energy demand is expected to grow significantly in the coming years. This is driving the exploration and production of oil and gas in new and challenging environments, such as Deep Water and the Ultra Deep Water. Floating production systems are essential for the development of these fields.

- Rising investments in offshore technologies: Governments and oil and gas companies are investing heavily in offshore technologies to meet the growing energy demand and to exploit the vast oil and gas reserves in deep water. This is driving the demand for floating production systems.

- Growing demand for FPSOs: FPSOs (floating production, storage, and offloading vessels) are the most popular type of floating production system. They are expected to account for the largest share of the market during the forecast period. This is due to their versatility and ability to operate in a wide range of environments.

- Increasing focus on cost optimization: Oil and gas companies are focusing on cost optimization in the wake of the recent oil price slump. This is leading to the adoption of new technologies and innovative solutions in the floating production systems market.

- Growing demand for hybrid systems: Hybrid floating production systems are gaining popularity as they offer a number of advantages over traditional systems. For example, they are more efficient and environmentally friendly.

Market Segmentation

The Global Floating Production Systems Market is segregated into the segments as mentioned below:

The global Floating Production Systems market can be categorized into Type, Water Depth, Build, Region. The Floating Production Systems market can be categorized into FPSO, Tension Leg Platform, SPAR, Barge based on Type. The Floating Production Systems market can be categorized into Shallow Water, Deep Water, Ultra Deep Water based on Water Depth. The Floating Production Systems market can be categorized into New, Converted based on Build. The Floating Production Systems market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Type

FPSO Expected to Hold the Largest Share in Coming Times

FPSOs segment is the dominant segment among the Type, in the Floating Production Systems market due to their ability to function effectively in various environments and their adaptability. These versatile vessels are crucial in offshore oil and gas operations as they enable production, processing, storage, and offloading. An advantage of FPSOs is their mobility, allowing them to be easily moved to new fields when necessary. The growing demand for FPSOs is driven by the increased exploration and production activities in deep and Ultra Deep Water environments, greater investments in offshore technologies, and continuous advancements that enhance their efficiency and reliability.

Based on Water Depth

Deepwater will Dominate the Market during the Forecast Period

The Deepwater segment accounted for the largest market share driven by the increasing exploration and production activities in deep water and ultra-deep water environments. As reserves onshore and in shallow waters diminish, the importance of deepwater oil and gas fields is growing. The demand for these systems in deep water is on the rise due to factors such as growing energy needs, substantial investments in offshore technologies, continuous technological advancements that improve the efficiency and reliability of floating production systems, and favorable government policies.

Based on Build

The New Build will Account for the Largest Market Share

The New Build segment is expected to dominate the Floating Production Systems market because these systems have several advantages such as improved efficiency and reliability, the ability to customize designs for specific oil and gas fields, and a longer lifespan. The growth of the market is focused on cost optimization, leading to the adoption of new technologies and innovative solutions.

Based on Region

North America will lead the market

The Floating Production Systems market in the North American region is set to take the lead due to its abundance of reserves in deep water and Ultra Deep Water in the floating production systems market. The region's rise to the top is also fueled by favorable government policies, specifically in the United States, which has encouraged increased investments in offshore oil and gas development. This strong government support is a major reason for the growing demand for Floating Production Systems, establishing North America as the leader in this dynamic market.

Competitive Landscape

The Floating Production Systems market is highly competitive and characterized by intense competition as key industry players strive to establish themselves in this evolving sector. Major companies are actively participating in strategic initiatives such as mergers, acquisitions, and partnerships to strengthen their presence in the market and enhance their technological capabilities. The competition is driven by the desire to find innovative solutions that can address the challenges facing the industry and take advantage of emerging opportunities. Additionally, sustainability and environmental considerations play a significant role in shaping the competitive landscape, with companies exploring technologies that comply with strict regulatory standards.

The players in the global Floating Production Systems market include Hitachi Ltd. (Japan), Deere & Company (U.S.), Husqvarna Group (Sweden), Robert Bosch GmbH (Germany), MTD Products (U.S.), Textron Inc. (U.S.), Stiga S.P.A. (Italy), Andreas Stihl AG & Co. KG (Germany), Honda Motor Co. Ltd. (Japan), Xishi Stone Group (China), The Toro Company (U.S.) among others.

Recent Market Developments

- September 2022: The P-83 FPSO project, valued at USD 2.8 billion, has been awarded to Keppel Offshore & Marine by Petrobras through an engineering, procurement, and construction (EPC) tender. The delivery of the FPSO is expected to take place in the first half of 2027.

- November 2022: The construction of a floating production storage and offloading (FPSO) vessel for a project in Guyana has been announced by Exxon Mobil Corp., with plans to order it from SBM Offshore. Signing a Memorandum of Understanding (MoU), the two companies have agreed to collaborate on the construction of the FPSO.

Segmentation of the Global Floating Production Systems Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Water Depth

By Build

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Floating Production Systems in terms of revenue?

-

The global Floating Production Systems valued at USD 68.5 Billion in 2022 and is expected to reach USD 265.2 Billion in 2030 growing at a CAGR of 18.2%.

Which are the prominent players in the market?

-

The prominent players in the market are Hitachi Ltd. (Japan), Deere & Company (U.S.), Husqvarna Group (Sweden), Robert Bosch GmbH (Germany), MTD Products (U.S.), Textron Inc. (U.S.), Stiga S.P.A. (Italy), Andreas Stihl AG & Co. KG (Germany), Honda Motor Co. Ltd. (Japan), Xishi Stone Group (China), The Toro Company (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 18.2% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Floating Production Systems include

- Increasing demand for offshore oil and gas exploration and production

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Floating Production Systems in 2022.