Flavors & Fragrances Market

Flavors & Fragrances Market - Global Industry Assessment & Forecast

Segments Covered

By Ingredients Natural, Synthetic

By Application Food & Beverages, Homecare, Pharmaceuticals & Healthcare, Beauty & Personal Care, Fabric Care, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

By End-Use Flavors, Fragrances

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 26.1 Billion | |

| USD 36.83 Billion | |

| 4.4% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

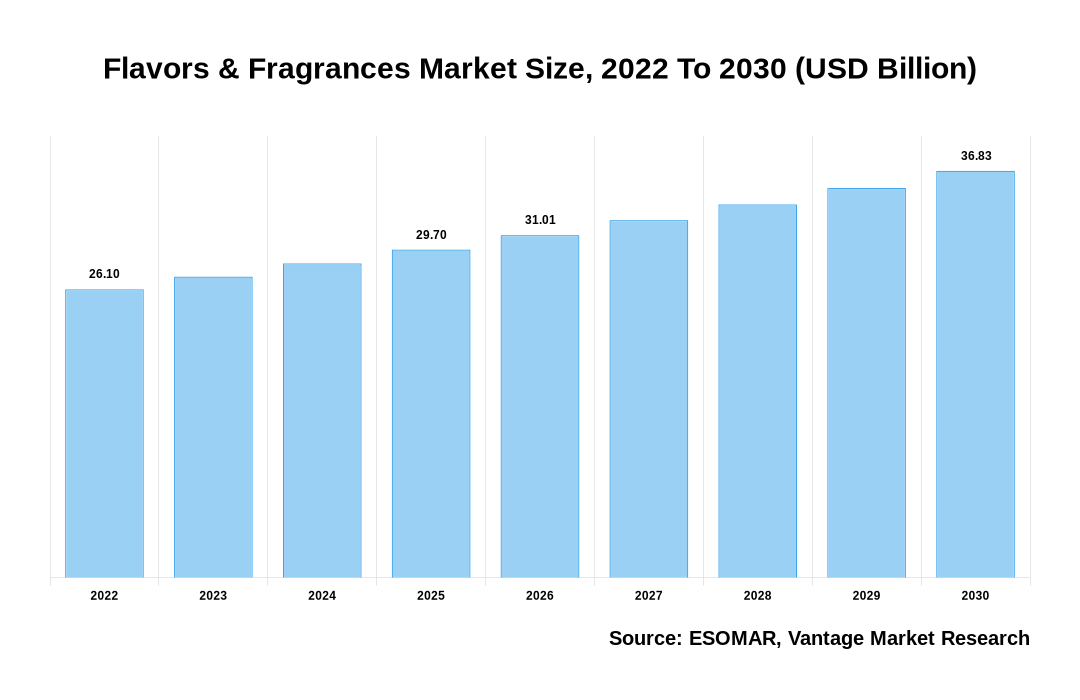

The Global Flavors & Fragrances Market was valued at USD 26.1 Billion in 2022 and is projected to reach a value of USD 36.83 Billion by 2030 at a CAGR of 4.4% over the forecast period.

Premium Insights

Drugs that taste and smell bitter are being flavored and scented by the healthcare and pharmaceutical industries. These variables are driving flavor and scent growth. They are used in tablets, emulsions, syrups, ODTs, elixirs, and others to improve customer perception, especially among young children and infants. Increasing raw material costs due to climate change caused by global warming is a major factor limiting revenue growth in the Flavors & Fragrances business. On March 17, 2022, Intercontinental Tastes & Perfumes Inc. announced it would significantly raise prices across the board for its Flavors & Fragrances. Pharmaceutical products like suspensions, antacids, and purgative tablets often have a flavor of peppermint. It's cooling or revitalizing effects are largely topical. Due to environmental concerns, customers choose organic and natural Flavors & Fragrances. Takasago International Company makes citrus oils and scents at the Citrus Centres in Florida with US citrus processor Largest River Citrus Producers.

Flavors & Fragrances Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Flavors & Fragrances Market

Key industry participants use the consumer transition from synthetic to natural smells and flavors to increase their markets and support sustainable development. New approaches are developed to increase product appeal and consumer acceptability. MANE, a French pioneer and global leader, uses extrusion. It's cheap and flexible. These factors should boost market sales throughout the forecast term. The global demand for packaged meals, personal-care products, and cosmetics is expected to propel the device's demand. According to a report by Euromonitor International, the global sales of personal care products will reach $277.5 billion in the coming years. Experts forecast that India will be the fastest-growing country in the global personal care products market. By 2030, this share is expected to rise to 10%.

Consumer demand for cosmetics and personal care products is expected to rise as China, and India's populations grow and their disposable incomes rise. The hectic lifestyles of established and emerging nations are expected to raise the demand for processed foods and beverages, increasing the global market for tastes. Due to resource scarcity and high processing costs, industry companies have developed cheaper synthetic alternatives to natural scents and tastes. These items have regular pricing, consistent supply, and low production costs. Multi-year contracts between dealers are now popular. Flavors and smells are not consumed directly but added to other products. They are also used in everyday chemicals, medicine, food, tobacco, feed, textiles, cosmetics, and leather. Though little, it affects product quality. Upstream of the taste and scent business include spices, animals, petrochemicals, coal chemicals, and oil. Chemicals, tobacco, food, beverage, feed, and other downstream industries dominate. The global demand for ready meals, convenience foods, and health-promoting foods drives this market's growth. Demand for vehicle and room fresheners, aromatherapy, and cosmetic and pharmaceutical developments are driving the industry. Recent reports have suggested that the ready meals market is expected to grow at a CAGR of 7.5% during the forecast period.

However, stringent regulations in some parts of the world are restraining the growth of this market. There are three types of restraints on the Flavors & Fragrances Market: production constraints (such as a lack of raw materials or insufficient production capacity), marketing constraints (such as product differentiation or pricing restrictions), and consumer preferences (such as health concerns or environmental awareness). Production constraints include lacking essential raw materials such as natural ingredients or essential oils. These constraints can be due to environmental issues such as water scarcity or climate change that reduce crop yields or because agricultural land has been converted to other uses. Cultural considerations can also restrict access to certain ingredients. For example, nutmeg is only available in Indonesia because it is part of traditional Hindu ceremonies there.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Compliance with applicable laws and regulations

Numerous regulatory agencies have established rules and regulations that the flavor and fragrance industry must follow. Regulations vary from country to country, but they all aim to keep consumers safe. Many countries' regulations also focus heavily on correctly labeling consumer goods and using flavorings and scents. These stringent regulations may increase prices and cause product faults, in addition to slowing or preventing the introduction of new items. Therefore, the expansion of the market could be improved by adding new regulations and changes to the existing ones.

Top Market Trends

- Increasing acceptance of artificial flavors among consumers: This trend is likely to be driven by growing awareness about health benefits associated with consuming flavorings in food, a rise in preference for healthy lifestyle choices among consumers, and an increase in advertising spending on flavorings.

- One of the major trends in this market is the increasing popularity of natural flavors. These flavors are made from organic ingredients and don’t contain any synthetic chemicals. They are also less expensive than traditional flavors and have a longer shelf life.

- Another trend that is attracting a lot of attention is the development of ethnic flavors. These flavors are designed to capture the regional preferences of different consumer groups. Some of the leading players in this segment include Danone, PepsiCo, and Mondelez International.

- Another trend that is gaining traction is the development of niche flavors. These flavors are designed specifically for specific consumer segments, such as wine lovers, tea enthusiasts, cheese aficionados, etc.

Market Segmentation

The global Flavors & Fragrances market is segmented based on Ingredients, End-Use, and Region. Based on the Ingredients, the market is classified into Natural and Synthetic. Furthermore, based on End-Use, the market is segmented into Flavors and Fragrances. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Ingredients

In 2022, the share of the natural segment was 32.8%, and the synthetic segment share was 67.2%. The natural segment is expected to grow at the highest rate during this period, owing to the increasing awareness about the benefits of natural ingredients. This segment is expected to account for most of the total market share. The synthetic segment is forecast to grow faster than the natural segment due to the increasing demand for fragrances with strong odor profiles.

Based on End-Use

The flavors segment is further divided into oral and nasal flavors. The food and beverage industry dominates the oral flavor segment. The nasal flavor segment is more fragmented but is expected to increase due to the increasing popularity of fragrances in personal care products. The fragrances segment is divided into toiletry and cosmetics. The male grooming category mainly occupies the toiletry segment.

Based on Region

North America will be the largest region with more than 36% market share. This is due to increasing industrialist demand for new and innovative flavors and fragrance products. Europe will be the second-largest region with a share of about 27%. This is due to growth in the luxury and specialist segments. Asia Pacific will be the third-largest region, with a share of about 16%. This is due to growing demand from emerging markets such as China and India. Latin America will be the fourth-largest region, with a share of about 9%. This is due to the low penetration of the market and high growth potential. The Middle East & Africa will be the fifth-largest region with a share of about 4%.

Competitive Landscape

The key players in the Global Flavors & Fragrances Market include- Sensient Technologies Corporation (U.S.), Mane SA (France), Takasago International Corporation (Japan), Manohar Botanical Extracts Pvt. Ltd. (India), Alpha Aromatics (U.S.), Ozone Naturals (India), Elevance Renewable Sciences Inc. (U.S.), Firmenich SA (Switzerland), Symrise AG (Germany), Vigon International Inc. (U.S.), BASF SE (Germany), Indo World (India), Akay Flavors & Aromatics Pvt. Ltd. (India), Ungerer & Company (U.S.), Synthite Industries Limited (India), Universal Oleoresins (India), Flavex Naturextrakte GmbH (Germany), Falcon Essential Oils (India), doTERRA International LLC (U.S.), Young Living Essential Oils (U.S.), Biolandes SAS (France), International Flavors & Fragrances Inc. (U.S.), Givaudan (Switzerland) and others.

Recent Developments

- One of the major players in this market is The Coca-Cola Company (NYSE: KO). The company has been developing new flavor formulations and expanding its distribution channels. It has also launched several initiatives, such as ShareAthlete, allowing athletes to share their favorite Coke flavors with others online, and Coca-Cola Freestyle Canisters, allowing consumers to customize their Coke drink. These initiatives will likely appeal to millennials and other consumers interested in exploring different flavors.

- Another key player in this market is PepsiCo Inc. (PEP). The company has been focusing on developing new flavor profiles and enhancing the taste experience of its products. For instance, it has developed Pepsi Max+, aimed at energizing consumers during mid-day hours, and Pepsi Viva+, designed to provide a more prominent lime flavor. This focus on enhancing the taste experience will likely appeal to millennials and young adults who value sensory experiences over traditional ingredients.

- The release of new scent technology, such as the development of virtual or “augmented” reality scents.

- Increasing consumer demand for environmentally friendly scents.

- The growth of online sales channels for scents and fragrances, such as Amazon and eBay.

Segmentation of the Global Flavors & Fragrances Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Ingredients

By Application

By Region

By End-Use

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 26-Jun-2023

Vantage Market

Research | 26-Jun-2023

FAQ

Frequently Asked Question

What is the global demand for Flavors & Fragrances in terms of revenue?

-

The global Flavors & Fragrances valued at USD 26.1 Billion in 2022 and is expected to reach USD 36.83 Billion in 2030 growing at a CAGR of 4.4%.

Which are the prominent players in the market?

-

The prominent players in the market are Sensient Technologies Corporation (U.S.), Mane SA (France), Takasago International Corporation (Japan), Manohar Botanical Extracts Pvt. Ltd. (India), Alpha Aromatics (U.S.), Ozone Naturals (India), Elevance Renewable Sciences Inc. (U.S.), Firmenich SA (Switzerland), Symrise AG (Germany), Vigon International Inc. (U.S.), BASF SE (Germany), Indo World (India), Akay Flavors & Aromatics Pvt. Ltd. (India), Ungerer & Company (U.S.), Synthite Industries Limited (India), Universal Oleoresins (India), Flavex Naturextrakte GmbH (Germany), Falcon Essential Oils (India), doTERRA International LLC (U.S.), Young Living Essential Oils (U.S.), Biolandes SAS (France), International Flavors & Fragrances Inc. (U.S.), Givaudan (Switzerland).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.4% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Flavors & Fragrances include

- Growing key end-use industries

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Flavors & Fragrances in 2022.