Eyewear Market

Eyewear Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Spectacles, Sunglasses, Contact lenses

By Material Type Metal, Plastic, Silicone

By End Use Male, Female, Unisex, Kids

By Sales Channel Online, Offline

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 151.2 Billion | |

| USD 231.2 Billion | |

| 4.83% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The global Eyewear Market is valued at USD 151.2 Billion in 2023 and is projected to reach a value of USD 231.2 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 4.83% between 2024 and 2032.

Key Highlights of Eyewear Market

- By Region, North America dominated the market in 2023, gaining the major market share above 27.5%

- The Asia Pacific market is expected to grow significantly from 2024 to 2032

- The US Eyewear market, with a valuation of USD 41.58 billion in 2023, is projected to increase to approximately 58.38 billion by 2032

- By Product Type, the Spectacles segment captures the highest market share of 67.3% in 2023

- On the basis of the Material Type, the Metal category accounted for about 43.1% of the market share in 2023

- Based on Sales Channel, the Offline category accounted for the market share of about 81.7% in 2023

- The Eyewear market has witnessed a surge in demand in recent years, driven by the growing reliance on digital devices like mobile phones and computers.

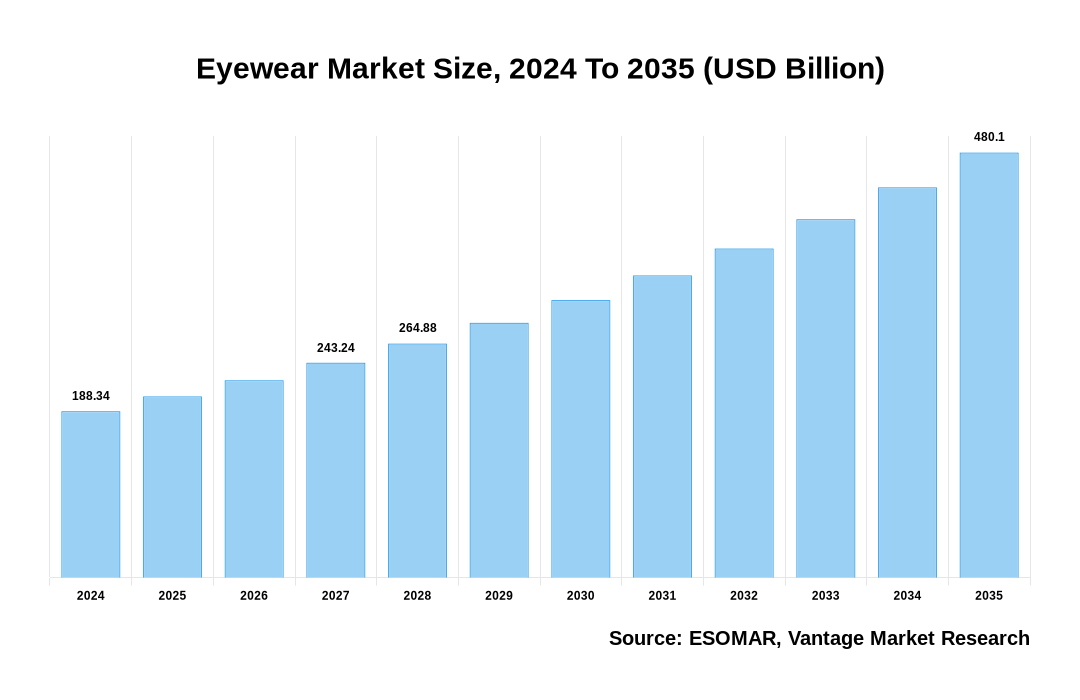

Eyewear Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Eyewear Market

Eyewear Market: Regional Overview

In 2023, the North America Eyewear market took the lead, capturing 27.5% of the revenue share. This growth was primarily fuelled by the region's robust e-commerce sector, which streamlined eye power consultations and spectacle selection, enhancing user experience. Guidelines from the American Academy of Ophthalmology facilitated telemedicine visits and appointments, further bolstering market expansion. Increased local production also contributed to growth opportunities. Notably, high consumer spending on health and wellness, including vision care, alongside technological advancements and fashion trends, drove market dynamics. Major Eyewear brands and retailers, supported by a well-established online retail infrastructure, played pivotal roles in promoting market growth.

U.S. Eyewear Market Overview

The Eyewear market in the U.S., with a valuation of USD 41.58 Billion in 2023, is projected to reach around USD 58.38 Billion by 2032. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 3.84 % from 2024 to 2032. The Eyewear industry in the US is a dynamic and fiercely competitive sector. In recent years, global players have expanded their presence in this market, while new contenders continuously enter to seize growth opportunities. As the largest importer of Eyewear globally, the United States saw a dip in market revenue due to the pandemic in 2020. However, as the pandemic's impact wanes, it's anticipated that the market will rebound to pre-pandemic levels by 2023. Notably, there's a rising trend among consumers towards performance-oriented sunglasses, driven by the growing popularity of outdoor activities like hiking, mountain biking, golfing, and more. With approximately 64 million Americans participating in outdoor pursuits in 2023, the demand for Eyewear tailored for such activities is on the rise. Additionally, around 6.8% of children under 18 in the US have diagnosed eye and vision conditions, indicating a significant potential market segment.

Eyewear Market: Product Overview

In 2023, the global Eyewear market saw significant growth, particularly in the Spectacles sector, which held a dominant 67.3% share. The Type segment is separated into Spectacles, Sunglasses and Contact lenses. This surge can be attributed to the heightened demand for products driven by the increasing prevalence of computer vision syndrome (CVS), stemming from heightened mobile phone and digital screen usage worldwide. The shift towards online learning and the adoption of smart Eyewear technology, particularly during the pandemic, further propelled CVS cases among children, boosting the uptake of anti-glare and anti-fatigue glasses. This trend correlates with the rising incidence of hypermetropia and myopia. Major players capitalizing on this trend, such as Amazon with its Echo Frames integrated with Alexa, further fuelled market expansion.

Eyewear Market: Material Type Overview

In 2023, the global Eyewear market experienced remarkable growth, with the Metal sector leading the way with a commanding 43.1% share. The Sourcing Type segment is categorized into Metal, Plastic and Silicone. Metal-framed Eyewear emerged as a key driver of this surge, owing to its sleek and sophisticated appeal that resonates with a broad consumer base. The durability and versatility of metal frames, particularly those crafted from premium materials like titanium or stainless steel, make them highly sought-after. Their ability to complement various face shapes and fashion styles further solidifies their popularity for both formal and casual settings. Moreover, the resilience of metal frames against wear and tear enhances their appeal, despite their susceptibility to breakage or discoloration compared to plastic or alloy counterparts.

Eyewear Market: Sales Channel Overview

In 2023, the global Eyewear market witnessed significant growth, with Offline segment dominating at a remarkable 81.7% share. The sales channel segment is categorized into Online and Offline. This growth can be attributed to increased awareness about regular eye checkups and the use of eyeglasses, driving sales in brick-and-mortar stores. Many companies are expanding their physical stores to stay competitive. For instance, in November 2023, the Cult Swedish brand partnered with BRDG Group to enter the Indian market, offering 11 signature silhouettes to cater to various preferences. Optical stores, provide specialized services like eye exams, consultations, and fittings. Independent brand showrooms offer exclusive collections, appealing to brand-conscious consumers, while retail stores offer convenience and variety, attracting shoppers who prefer trying on Eyewear in-person.

Key Trends

- Increased cases of visual impairments globally due to factors like aging population, lifestyle changes, and prolonged screen time, are driving market growth.

- Growing consumer interest in Eyewear as a fashion accessory, spurred by fashion trends and celebrity endorsements, is fueling market expansion.

- Innovations in Eyewear materials, designs, and functionalities, including smart glasses with AR capabilities and specialized lens coatings, are driving market growth.

- Efforts by health organizations, governments, and the expansion of healthcare infrastructure, along with the availability of vision care insurance policies, are enhancing market opportunities by making Eyewear more accessible to a broader consumer base.

Premium Insights

As a result of factors such as an ageing population, greater focus on health and higher inflation that encourages companies to adjust their prices in order to stimulate demand, the worldwide market for spectacles has demonstrated excellent performance. However, a significant threat to consumer behaviour is the uncertainty of prices and resources. The return of tourists from abroad led to an increase in demand for luxury glasses worldwide, with a particular impact on the sale of designer spectacles. In this period, sunglasses have shown the fastest growth in categories. The growing emphasis on sustainability in the sector, with businesses increasingly recognising their responsibility for the long-term environmental impact, is underlined by the surge in demand for sustainable Eyewear among Gen Z consumers. In addition, it is becoming increasingly important to ensure that all people are able to receive vision correction and the correct fitting of glasses regardless of physical, economic or geographical limitations. The pandemic has led to a major shift towards e.g. online sales of glasses, although growth is slowing as consumers value the knowledge gained from retail stores. An omnichannel strategy must be adopted by optical retailers to thrive, with seamless integration of online and offline experiences.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The Eyewear market has witnessed a surge in demand in recent years, driven by the growing reliance on digital devices like mobile phones and computers. In view of the increased emphasis on eye protection in the wake of the Pandemic, this includes not only prescriptions but also non-prescription Blue Light Glasses. Notably, the demand for Eyewear designed to block blue light, which can alleviate eye strain and improve sleep quality, has skyrocketed. In view of the increased emphasis on eye protection in the wake of the Pandemic, this includes not only prescriptions but also non-prescription Blue Light Glasses.

Moreover, the Eyewear market has expanded due to fashion trends incorporating Eyewear, featuring fashionable frames in vibrant colours and designs. Lightweight, unbreakable frames, as well as customizable options, have further fuelled market growth. Additionally, innovations such as fibre-coated and transparent frames have gained traction. The online Eyewear market has emerged as a significant contributor to this growth, offering virtual try-ons, doorstep delivery, and free check-ups, which appeal to consumers seeking convenience.

The global Eyewear market can be categorized as Product Type, Material Type, End Use, Sales Channel and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Material Type

By End Use

By Sales Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Competitive Landscape

Major players in the Eyewear industry are employing diverse strategies to bolster their market positions. They're heavily investing in research and development to introduce innovative materials and designs, enhancing Eyewear's comfort, durability, and functionality. Companies are also focusing on lightweight, impact-resistant materials and integrating digital technologies like augmented reality (AR) and smart lenses to drive market growth. Strategic mergers and acquisitions are prevalent among leading players, expanding their product portfolios and global presence. Additionally, effective use of social media and digital marketing helps them connect with a broader consumer base. These activities underscore the competitive nature of the industry, where partnerships and acquisitions are vital for sustaining profitability and market share amidst intense competition.

Recent Market Developments

- In January 2024, Taiwanese electronic brand Asus unveiled its AirVision M1 glasses at the Consumer Electronic Show 2024. The wearable display has a USB Type-C port for connection with a range of devices that support DisplayPort Alt mode over USB-C, such as laptops, smartphones, and gaming consoles.

- In January 2024, Pair Eyewear, the direct-to-consumer customizable Eyewear brand reimagining the Eyewear industry, announced a new partnership with National Vision, Inc., the second-largest optical retailer in America (by sales).

- In April 2024, British heritage luxury fashion brand Sunspel collaborated with independent Eyewear brands Cutler and Gross for spring/summer Eyewear.

- In October 2023, Lenskart made a splash in the Eyewear market with the introduction of Blue Billion Collective - a new curative product line. This innovative launch, aimed at celebrating the Cricket World Cup, offered a wide range of products in blue to support team India and was met with overwhelming success, further solidifying Lenskart's position as a leader in the industry.

- In September 2023, Meta, in collaboration with Essilor Luxottica, launched the Ray-Ban Meta smart glasses collection. These next-generation products were made available in stores in October 2023.

FAQ

Frequently Asked Question

What is the global demand for Eyewear in terms of revenue?

-

The global Eyewear valued at USD 151.2 Billion in 2023 and is expected to reach USD 231.2 Billion in 2032 growing at a CAGR of 4.83%.

Which are the prominent players in the market?

-

The prominent players in the market are Safilo Group S.p.A., Fielmann AG, EssilorLuxottica SA, Johnson & Johnson Services, Inc., The Cooper Companies, Inc., Carl Zeiss AG, Bausch & Lomb Inc., Chemilens (CHEMIGLAS Corp.), CIBA VISION, De Rigo Vision S.p.A, Fielmann AG.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.83% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Eyewear include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Eyewear in 2023.