Exempt Solvents Market

Exempt Solvents Market - Global Industry Assessment & Forecast

Segments Covered

By Type Methyl Chloroform, Methyl Chloride, Methyl Acetate, Acetone, Parachlorobenzotrifluoride, Others

By Application Chemical, Pharmaceutical, Oil and Gas, Automotive, Electronics, Coatings, Adhesives, Personal Care, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 2.1 Billion | |

| USD 5.7 Billion | |

| 13.20% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

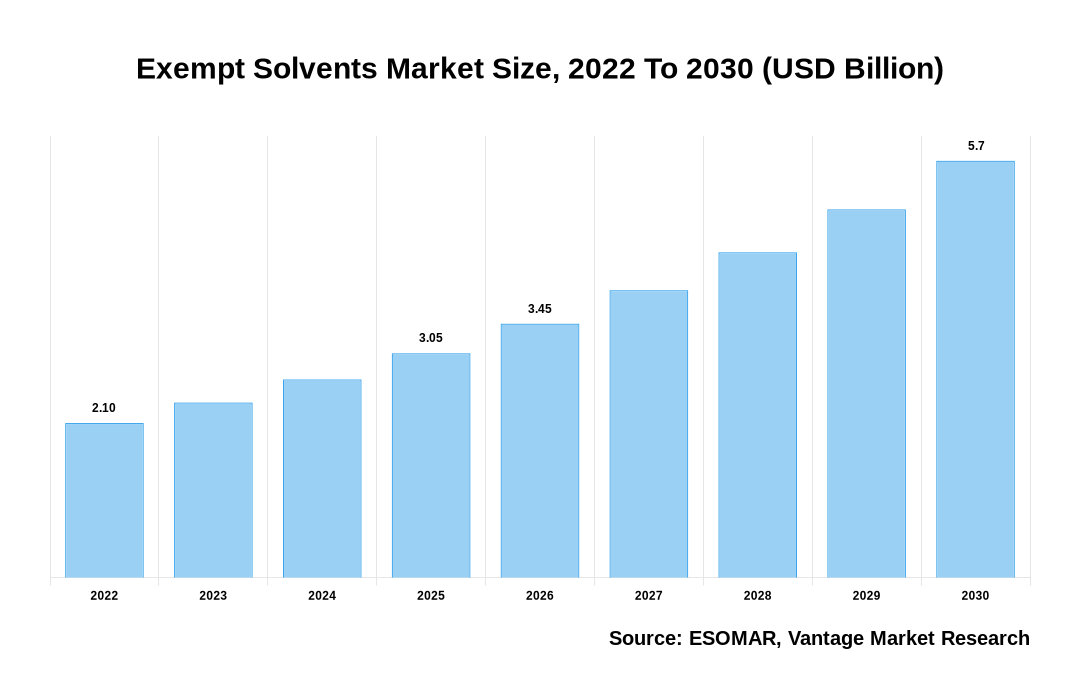

The global Exempt Solvents Market is valued at USD 2.1 Billion in 2022 and is projected to reach a value of USD 5.7 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 13.20% between 2023 and 2030.

Premium Insights

The Clean Air Act (CAA) regulation, issued by the United States Environmental Protection Agency (EPA), imposes air pollution standards on sources, including exempt solvent users. Facilities exceeding certain thresholds are required to obtain permits and install pollution control equipment. Compliance is monitored through emissions testing and reporting. In addition, Resource Conservation and Recovery Act (RCRA) framework addresses the safe handling, storage, disposal, and transportation of hazardous wastes, including those associated with exempt solvents. RCRA regulations establish rules for generators, transporters, and disposal facilities, emphasizing waste minimization, labeling, and proper documentation. Thus, the stringent rules imposed by various regulatory bodies are accelerating the growth of the exempt solvent market in recent years.

Exempt Solvents Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Exempt Solvents Market

Furthermore, the market is expected to surge in demand for bio-based and renewable solvents due to increased environmental concerns and the need to minimise greenhouse gas emissions, For instance, Dow introduced a new line of high-performance oxygenated solvents called Dowanol™ Pro Glycol Ethers. These solvents are designed to offer improved cleaning power, lower toxicity, and reduced environmental impact compared to traditional glycol ethers. Also, a commercial supply of bio-based nbutanol and acetone from its manufacturing facility has been initiated by Green Biologics Ltd, a United Kingdom industrial biotechnology and renewable specialty chemicals company. In addition to nButanol and acetone, Green Biologics offers a broad portfolio of 100% bio-based products that includes the highest purity 100 % bio-based isopropyl alcohol product as well as several specialty esters of nButanol ispropol and other bio-based alcohol.

Moreover, exempt solvents are considered to have low toxicity and low volatility, making them safer to use and less hazardous to the environment, which, in turn, is increasing the demand for exempt solvents. For instance, the annual need for solvents in the U.S. is about 12 billion pounds, valued at approximately $5 billion. Coatings, ink, and adhesive manufacturers have also come under increasing pressure to eliminate HAPs and VOCs from formulations. Some of the latest regulations to affect coatings manufacturers include the Architectural and Industrial-Maintenance (AIM) rule, Automotive Refinish rule, Wood Furniture CTG and NESHAP, and National Ambient Air Quality Standard (NAAQS). With this regard, many manufacturers are sifted towards adopting exempt solvents that are considered environmentally friendly.

Key Highlights

- North America created more than 42.9% of revenue share in 2022

- Asia Pacific is expected to witness the market's most considerable growth during the forecast period

- Based on Product Type, the Methyl Acetate segment dominated the market and contributed more than 28.1% of the total revenue share in 2022

- Based on Application, the Chemical segment revealed the most significant market growth and contributed more than 38.4% of the total revenue share in 2022

Economic Insights

Exempt solvents are generally more effective and efficient in their specific applications. They have better cleaning properties, lower viscosity, and higher solvency power, which can result in improved performance and productivity for industries. This increased efficiency can lead to higher output levels and improved economic productivity. One of the key economic benefits of the exempt solvent market is cost savings for industries that heavily rely on solvents. Exempt solvents are often cheaper than regulated solvents, which can significantly reduce business production costs. This cost advantage can enhance the competitiveness of industries and potentially lead to higher profit margins.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Shift towards Green and Bio-Based Solutions: As the world keeps struggling with the negative effects of climate change and natural resource depletion, the sector is progressively adopting sustainable practises. The exempt solvent industry, which deals with solvents exempted from certain regulatory restrictions due to lower toxicity levels and flammability, is no exception. In recent years, there has been a notable shift towards green and bio-based solutions within this industry, as companies aim to reduce their ecological footprint, improve product performance, and meet the demands of increasingly environmentally conscious consumers. For instance, acetone, a commonly used solvent in various industries, has long been associated with environmental and health hazards. Companies like Green Biologics have introduced bio-based acetone substitutes derived from sustainable feedstocks, such as corn or sugarcane. These substitutes perform similarly to traditional acetone while significantly reducing carbon emissions and environmental impact. Dryclean USA, a laundry service provider, uses a solvent called Solvair, which can be distilled and reused. This approach reduces the consumption of virgin solvents and minimizes the environmental impact of solvent disposal.

- Technological Advancements: Continuous research and development efforts have resulted in the development of innovative exempt solvents that offer improved performance and reduced environmental impact. Technological advancements have helped expand the range of applications for exempt solvents, further fueling market growth. The latest technological advances have created greener solvents that are biodegradable and have a lower impact on air and water quality. This has been achieved by utilizing renewable resources and reducing reliance on petroleum-based solvents. For instance, Merck, a leading science and technology company, launched CyreneTM, a sustainable dipolar aprotic solvent produced in two steps from renewable cellulose. Advancements in solvent extraction technology have further enhanced the efficiency and effectiveness of solvent-based processes. Solvent extraction is a technique for separating and purifying substances from mixtures using solvents. The technological advancements in this field have led to the development of more effective solvents, improved equipment, and enhanced operating conditions. For example, Supercritical fluid extractions are gaining popularity in recent years because they provide high-quality extracts with minimal residual solvent levels.

Market Segmentation

The global Exempt Solvents market can be categorized as

The global Exempt Solvents market can be categorized into Type, Application, Region. The Exempt Solvents market can be categorized into Methyl Chloroform, Methyl Chloride, Methyl Acetate, Acetone, Parachlorobenzotrifluoride, Others based on Type. The Exempt Solvents market can be categorized into Chemical, Pharmaceutical, Oil and Gas, Automotive, Electronics, Coatings, Adhesives, Personal Care, Others based on Application. The Exempt Solvents market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Product Type

Methyl Acetate Express Maximum Market Share owing to its Use as a Substitution for Hazardous Solvents

Methyl Acetate dominated the exempt solvent market in 2022. Methyl acetate is often used as a substitute for hazardous solvents like toluene, xylene, and acetone. These solvents are known to have adverse health effects and are subject to regulatory restrictions. Methyl acetate offers a safer alternative without compromising performance, making it a preferred choice for many applications. Methyl acetate is widely used across various industries, such as paints and coatings, adhesives, printing inks, cosmetics, and pharmaceuticals. Its excellent solvency properties and relatively low cost make it an attractive choice for these industries. As these industries expand, will also increase the demand for methyl acetate.

Based on Application

Chemical Segment to Mention Maximum Market Share Owing to Increasing Regulations and Restrictions on the Use of VOCs

In 2022, the chemical segment accounted for the most significant growth. Increasing regulations and restrictions on using VOCs have compelled industries to adopt environmentally friendly alternatives. Exempt solvents offer a solution by providing a viable substitute for traditional VOCs in various applications. This regulatory compliance requirement has driven the demand for exempt solvents in the chemical industry. In addition, growing awareness and concern about the environmental impact of chemicals have led to the rising demand for sustainable and eco-friendly solutions. Exempt solvents are considered environmentally preferred alternatives as they lower impact on air quality and contribute less to global warming potential.

Based on Region

North America to Dominate Global Sales Owing to Increasing Demand from Various Sectors

North America was the most significant revenue contributor in 2022, owing to increased demand for these solvents in numerous sectors. These solvents are widely used in manufacturing industries, such as automotive, aerospace, electronics, and pharmaceuticals. In the automotive sector, exempt solvents are used for cleaning and degreasing applications and producing adhesives, coatings, and sealants. Similarly, in the electronics industry, exempt solvents are commonly applied to clean circuit boards and electronic components.

During the forecast period, Asia Pacific is foreseen to be a rapidly developing region in the exempt solvent market. The increasing focus on research and development activities in the Asia Pacific region has also supported the growth of the exempt solvent industry. Various industry players are investing in R&D to develop new and innovative solvent formulations that are more efficient and comply with the stringent regulations and standards set by governments. This has resulted in the development of advanced solvent technologies that offer improved performance, lower emissions, and enhanced environmental sustainability.

Competitive Landscape

One of the roles of leading players in the growth of the exempt solvents market is compliance with regulatory standards. Various rules and standards relating to the health and safety aspects of VOC emissions and environmental sustainability shall apply to the exempt solvent industry. Key players in this industry must thoroughly understand these regulations and ensure that their solvents comply with all the requirements. This involves monitoring regulatory changes, conducting regular testing and analysis, and maintaining proper compliance documentation. Key players can gain confidence and trust from their customers by demonstrating that they comply with the regulatory standards, which will lead to a positive brand image.

The key players in the global Exempt Solvents market include - The Dow Chemical Company, Exxon Mobil Corporation, Royal Dutch Shell plc, BASF SE, Eastman Chemical Company, Celanese Corporation, Arkema Group, LyondellBasell, Industries N.V., Chevron Phillips Chemical Company LLC, Huntsman Corporation, INEOS Group Holdings S.A., Solvay S.A., Archer Daniels Midland Company, Ashland Global Holdings Inc., Oxea Corporation, and Mitsubishi Chemical Corporation among others.

Recent Market Developments

- July 2022: Dow signed a Memorandum of Understanding (MOU) with China's leading food and beverage group, Want- Want, to drive zero-solvent emissions and develop a circular economy for flexible packaging. This agreement aims to deepen value-chain partner collaborations with customized adhesives solutions to address the needs of the industry for more sustainable packaging choices.

- May 2022: Archer Daniels Midland Company announced that it would invest to especially develop starch production at its Marshall, Minnesota, in U.S. facility.

Segmentation of the Global Exempt Solvents Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Exempt Solvents in terms of revenue?

-

The global Exempt Solvents valued at USD 2.1 Billion in 2022 and is expected to reach USD 5.7 Billion in 2030 growing at a CAGR of 13.20%.

Which are the prominent players in the market?

-

The prominent players in the market are The Dow Chemical Company, Exxon Mobil Corporation, Royal Dutch Shell plc, BASF SE, Eastman Chemical Company, Celanese Corporation, Arkema Group, LyondellBasell, Industries N.V., Chevron Phillips Chemical Company LLC, Huntsman Corporation, INEOS Group Holdings S.A., Solvay S.A., Archer Daniels Midland Company, Ashland Global Holdings Inc., Oxea Corporation, and Mitsubishi Chemical Corporation.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 13.20% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Exempt Solvents include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Exempt Solvents in 2022.