Ethanol Market

Ethanol Market - Global Industry Assessment & Forecast

Segments Covered

By Source Sugar & Molasses Based, Grain Based, Second Generation

By Purity Denatured, Undenatured

By Application Industrial Solvents, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 93.78 Billion | |

| USD 130.33 Billion | |

| 4.20% | |

| 149.1 Billion liters | |

| 206.9 Billion liters | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

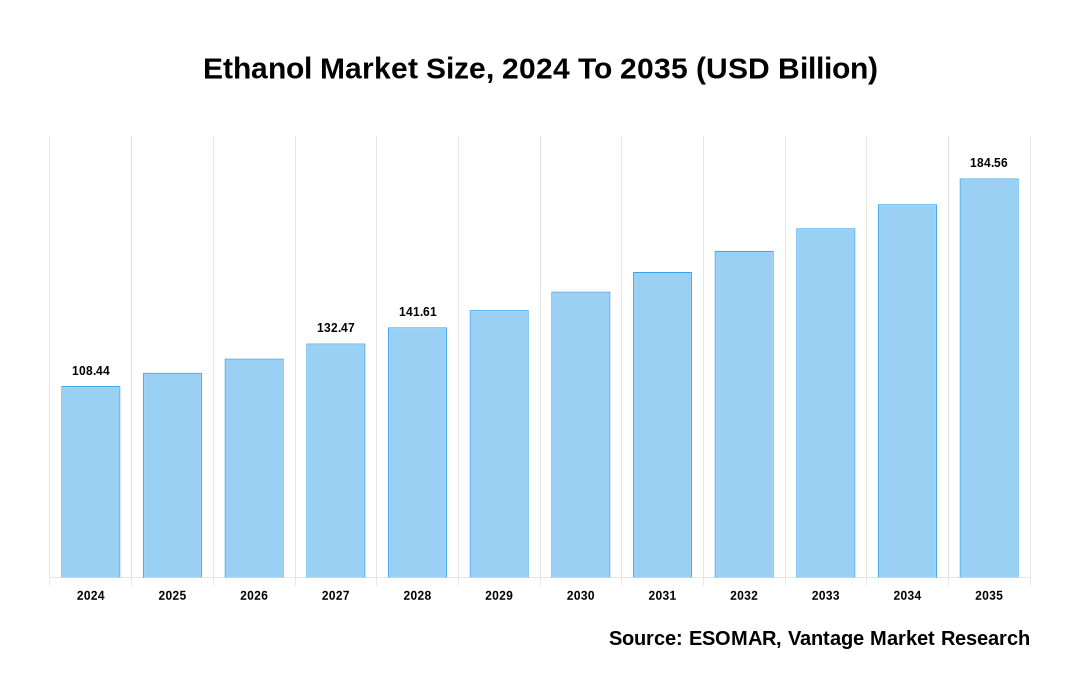

The global Ethanol Market is valued at USD 93.78 Billion in 2022 and is projected to reach a value of USD 130.33 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 4.20% between 2023 and 2030.

Premium Insights

The Ethanol industry is experiencing a transformation toward advanced biofuels like cellulosic ethanol, which is derived from non-food feedstocks such agricultural leftovers and algae in order to improve sustainability and lessen rivalry with food supplies. By converting waste and by products from the manufacture of ethanol into useful uses like bio-based chemicals, polymers, and bioplastics, the industry was also embracing the ideas of the circular economy and enhancing the value chain. For instance, according to the Renewable Fuels Association, U.S. ethanol production reached 15.4 billion gallons in 2022, with combined biodiesel/renewable diesel production at 3.1 billion gallons. Brazil maintained its position as the world's second-largest producer, with an output of 7.5 billion gallons the same year.

Ethanol Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Ethanol Market

- The introduction of low-carbon and even carbon-negative ethanol production techniques was being driven by the growing emphasis on carbon reduction and environmental sustainability. In order to make ethanol a more appealing choice in a decarbonizing environment, cutting-edge technology, carbon capture, and use strategies are being investigated.

- North America generated more than 42.3% of revenue share in 2022

- Asia Pacific is expected to grow at the quickest rate from 2023 to 2030

- The Grain Based segment accounted for the largest market growth. It contributed over 65.5% of the total revenue share in 2022 due to its widespread use as a primary feedstock for ethanol production.

- Denatured segment revealed the most significant market growth, contributing more than 52.8% of the total revenue share in 2022

- Fuel & Fuel Additives accounted for a significant market revenue of 33.2 % in 2022

Economic Insights

The economic landscape of the Ethanol market is greatly impacted by changes in feedstock prices, with corn and sugarcane representing large cost components (for example, corn accounts for roughly 60–70% of overall production costs in the U.S.). Government initiatives, such as blending requirements and subsidies, helped to shape demand. For example, the U.S. Renewable Fuel Standard mandates a 10-15% ethanol blend in fuel. The ability of ethanol to compete with other fuels was dependent on the price of crude oil. In addition, technological developments in enzyme development and cellulosic ethanol synthesis targeted to cut production costs by 15% to 30%.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Top Market Trends

- Increasing demand for ethanol as biofuel: A sustainable and renewable fuel, ethanol can aid in lowering greenhouse gas emissions. The demand for Ethanol is anticipated to increase as governments and companies throughout the world work to lessen their dependency on fossil fuels.

- Growing consumption of alcoholic beverages: Alcoholic beverages contain Ethanol as a main component, and consumption of these drinks worldwide is predicted to increase in the years to come. As a result, Ethanol demand will increase.

- Increasing adoption of alcohol-based hand sanitizers: Since alcohol-based hand sanitizers effectively kill germs, their use has considerably expanded throughout the COVID-19 pandemic. As a result, there is now more demand for Ethanol.

- Government programs to reduce environmental pollution: Environmental pollution reduction measures are being adopted by governments all over the world. To minimize emissions of greenhouse gases and other pollutants, this includes boosting the use of biofuels like Ethanol.

- Increasing use of Ethanol as a solvent in industry: A versatile solvent, Ethanol may be applied in a number of industrial processes. Demand for Ethanol in this application is anticipated to be driven by the expansion of the industrial sector.

Market Segmentation

Ethanol The global Ethanol market can be categorized into Source, Purity, Application, Region. The Ethanol market can be categorized into Sugar & Molasses Based, Grain Based, Second Generation based on Source. The Ethanol market can be categorized into Denatured, Undenatured based on Purity. The Ethanol market can be categorized into Industrial Solvents, Fuel & Fuel Additives, Beverages, Disinfectant, Personal Care, Others based on Application. The Ethanol market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Source

Grain Based hold the largest share

The grain-based sector led the global Ethanol market in 2022 With a dominating 65.5% market share. This leading position is attributed to a number of important factors, including the widespread viability of corn and sugarcane cultivation, which guarantees a reliable and affordable feedstock for ethanol production; the use of effective production technologies specifically designed for ethanol extraction from grains, which enables large-scale manufacturing at competitive costs; and the strengthening influence of government backing in the form of financial support.

Based on Purity

Denatured will dominate the market during Forecast Period

Denatured ethanol is poised to assert its dominance in the Ethanol market throughout the forecast period. Due to its extraordinary versatility, which includes its use as a fuel, solvent, and cleaning agent, it is well-suited to a broad range of applications and has a strong market appeal. Denatured ethanol continues to be the only ethanol variety that is allowed for particular usage throughout many countries, most notably in fuel applications, which is further supported by government rules. Its safety profile in these situations is strengthened by its inherent unfitness for human consumption. Furthermore, compared to its competitors, such as food-grade ethanol, denatured ethanol stands out for being a more affordable choice.

Based on Application

Fuel & Fuel Additives will lead the market during the forecast period

The fuel and fuel additives category, which is expected to dominate the Ethanol market throughout the projected period, is supported by a confluence of strong drivers. Ethanol is emerging as a renewable and environmentally benign alternative that can reduce greenhouse gas emissions as a result of increased global efforts to reduce dependency on fossil fuels, driven by both governmental and corporate pressure. The need for ethanol as a fuel source is being pushed even harder by laws enacted by governments all over the world that require ethanol-gasoline mixtures. The need for ethanol is simultaneously increased by the growing popularity of flex-fuel vehicles, which effortlessly switch between gasoline and ethanol.

Based on Region

North America will lead the market

North America is expected lead the market for Ethanol throughout the forecast year. The region has a considerable potential for producing ethanol, with the United States leading the way as the world's top producer and Brazil a close second. Government regulations in North America that demand ethanol-gasoline blends support the fuel's demand in addition to this capacity. The need for ethanol is simultaneously fueled by the growing popularity of flex-fuel vehicles, which can switch between using gasoline and ethanol with ease. These factors come together to support North America's potential market supremacy.

Competitive Landscape

The global Ethanol market is fragmented, including key players striving for innovation and market share. Partnerships, collaborations, and strategic acquisitions are common strategies to expand product portfolios, foster technological innovation, and amplify global reach. Research and development efforts were ongoing to explore advanced biofuels, such as cellulosic ethanol produced from non-food feedstocks like agricultural residues and dedicated energy crops. For instance, in January 2022, ADM, a leading global provider of solutions for agriculture, nutrition, and processing, and Wolf Carbon Solutions have partnered to accelerate the decarbonization of ethanol production.

The players in the global Ethanol market include United Breweries, Aventine Renewable Energy, AB Miller, Archer Daniels Midland Company, Kirin, Pure Energy Inc., British Petroleum, Cargill Corp.,Flint Hill Resources LP, Braskem among others.

Recent Market Developments

- February 2023: As part of its growing Kemin Bio Solutions lineup, Kemin Industries unveiled FermSAVER, a tea-extract product utilized in yeast fermentation for the generation of ethanol.

Segmentation of the Global Ethanol Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Source

By Purity

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 16-Jun-2022

Vantage Market

Research | 16-Jun-2022

FAQ

Frequently Asked Question

What is the global demand for Ethanol in terms of revenue?

-

The global Ethanol valued at USD 93.78 Billion in 2022 and is expected to reach USD 130.33 Billion in 2030 growing at a CAGR of 4.20%.

Which are the prominent players in the market?

-

The prominent players in the market are United Breweries, Aventine Renewable Energy, AB Miller, Archer Daniels Midland Company, Kirin, Pure Energy Inc., British Petroleum, Cargill Corp.,Flint Hill Resources LP, Braskem.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.20% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Ethanol include

- The demand for the ethanol is driven by growing usage of the ethanol as a biofuel

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Ethanol in 2022.