Esoteric Testing Market

Esoteric Testing Market - Global Industry Assessment & Forecast

Segments Covered

By Type Infectious Diseases Testing, Endocrinology Testing, Oncology Testing, Genetics Testing, Toxicology Testing, Immunology Testing, Neurology Testing, Other Testing

By Technology Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Mass Spectrometry, Real-Time PCR, DNA Sequencing, Flow Cytometry, Other Technologies

By End User Independent & Reference Laboratories, Hospital-Based Laboratories

By Region North America , Europe, Asia Pacific, Latin America, Middle-East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 27.31 Billion | |

| USD 62.43 Billion | |

| 10.89% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

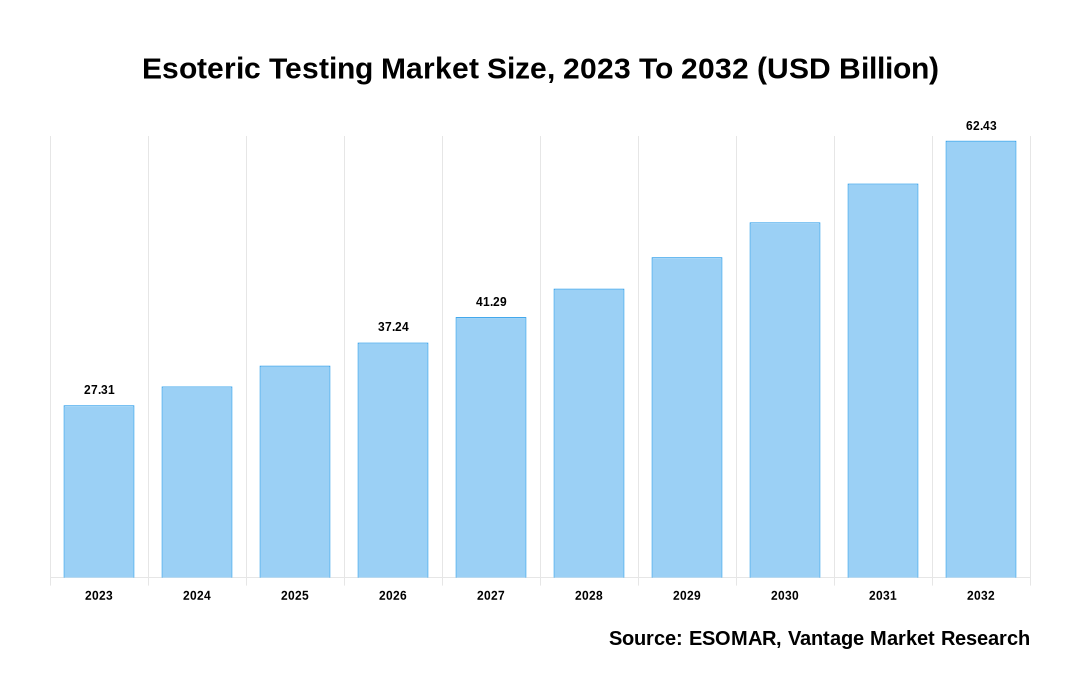

The global Esoteric Testing Market is valued at USD 27.31 Billion in 2023 and is projected to reach a value of USD 62.43 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 10.89% between 2024 and 2032.

Key Highlights of Esoteric Testing Market

- By Region, the North American region dominated the market in 2023, gaining the major market share above 43.3%,

- The Asia Pacific market is expected to grow significantly from 2024 to 2032,

- The US Esoteric Testing market, with a valuation of USD 9.96 billion in 2023, is projected to increase to approximately 17.24 billion by 2032,

- By Type, the Infectious Diseases Testing segment captured the highest market share of 31.1% in 2023,

- On the basis of the Technology, the Chemiluminescence Immunoassay category accounted for about 24.1% of the market share in 2023,

- Based on End User, the Independent & Reference Laboratories category accounted for the market share of about 57.7% in 2023,

- The growth of the testing Esoteric Testing market is driven by the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and autoimmune conditions, increased funding from both private and government organizations, and continuous technological advancements.

Esoteric Testing Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Esoteric Testing Market

Esoteric Testing Market: Regional Overview

The North America Esoteric Testing market exhibited substantial dominance in 2023, capturing 43.3% of the revenue share. In North America, several factors contribute to the prominence of the Esoteric Testing market. High healthcare spending, a significant elderly population, and prevalent medical conditions like diabetes play key roles. The presence of major corporations such as Laboratory Corporation of America Holdings, ARUP Laboratories, and Quest Diagnostics further drives market growth. Additionally, advancements in screening procedures and technology, including mass spectrometry, are fueling expansion. The region also witnessed the establishment of new Rare Disease Centers of Excellence, reflecting the growing demand for specialized testing. Overall, North America's well-established healthcare infrastructure, high purchasing power, and frequent product launches by key players fuel market growth.

U.S. Esoteric Testing Market Overview

The Esoteric Testing market in the U.S., with a valuation of USD 9.96 Billion in 2023, is projected to reach around USD 17.24 Billion by 2032. This forecast indicates a substantial % Compound Annual Growth Rate (CAGR) of 7.1% from 2024 to 2032. The U.S. Esoteric Testing market holds a substantial share due to various factors driving its growth. Rising healthcare spending per person, the presence of key market players, and the increasing utilization of effective measures contribute to this trend. Moreover, the nation's rising prevalence of diseases, such as prostate cancer, with an estimated 268,490 new cases in 2022, is expected to boost the adoption of Esoteric Testing. Additionally, advancements in personalized medicine are influencing market expansion. These established factors highlight the robust nature of the U.S. Esoteric Testing market and its promising trajectory for continued growth.

The global Esoteric Testing market can be categorized as Type, Technology, End User, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Technology

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Esoteric Testing Market: Type Overview

In 2023, the global Esoteric Testing market saw significant growth, particularly in the Infectious Diseases Testing sector, which held a dominant 31.1% share. The Type segment is separated into Infectious Diseases Testing, Endocrinology Testing, Oncology Testing, Genetics Testing, Toxicology Testing, Immunology Testing, Neurology Testing, and Other Testing. This surge is credited to the increased prevalence of infectious diseases and the introduction of advanced tests for respiratory diseases and HIV. Genetic testing emerged as the fastest-growing segment due to advancements in genomic techniques and rising awareness of personalized medicine. The sector's expansion is fueled by a rise in chronic diseases, technological advancements in clinical practices, and better healthcare facilities in emerging economies.

Esoteric Testing Market: Technology Overview

In 2023, the global Esoteric Testing market witnessed significant growth, with the Chemiluminescence Immunoassay category dominating at a remarkable 24.1% share. The Sourcing Type segment is categorized into Chemiluminescence Immunoassay, Enzyme-Linked Immunosorbent Assay, Mass Spectrometry, Real-Time PCR, DNA Sequencing, and Flow Cytometry. This was due to its versatility in detecting various substances like hormones, proteins, and nucleic acids and its ability to multiplex, enabling simultaneous measurement of multiple analytes. Despite this, DNA sequencing is expected to be the fastest-growing segment due to technological advancements and the increasing prevalence of rare genetic disorders. The Chemiluminescence Enzyme-Linked Immunosorbent Assay segment maintained the largest share, attributed to its superior performance, sensitivity, and selectivity, making it a preferred choice amidst rising immune disorders, diabetes, heart problems, and melanoma cases.

Esoteric Testing Market: End User Overview

In 2023, the global Esoteric Testing market witnessed significant growth, with the Independent & Reference Laboratories segment dominating at a remarkable 57.7% share. The End User segment is categorized into Independent & Reference Laboratories and Hospital-Based Laboratories. This was attributed to the advanced technologies available in these labs. However, Hospital-based Laboratories emerged as the fastest-growing segment due to increased facility development and more people opting for Esoteric Testing. SRL Diagnostics significantly contributed by launching a cutting-edge reference laboratory in Chennai that can conduct over one lakh tests monthly. The market expansion was further fueled by automation technology, national accreditation, comprehensive insurance coverage, and competitive incentives offered by suppliers, driving continuous growth in the sector.

Key Trends

- Next-generation sequencing (NGS), mass spectrometry, and advanced imaging techniques are boosting the uptake of Esoteric Testing. These technologies offer precision and accuracy in diagnosing rare diseases and complex conditions.

- Analyzing genetic makeup and unique molecular profiles enables tailored treatment plans. Esoteric Testing facilitate personalized medicine by identifying genetic susceptibilities and guiding individualized therapies.

- Companion diagnostics, integral to precision medicine, rely on Esoteric Testing for biomarker identification. This trend fuels market expansion, particularly in aligning targeted therapies with patient-specific genetic profiles.

- Esoteric Testing enables early disease detection before clinical symptoms manifest. Emphasis on early intervention enhances patient outcomes and reduces healthcare costs, driving the demand for Esoteric Testing in early diagnosis and prevention efforts.

Premium Insights

In the Esoteric Testing market, technological advancements and the rise of chronic diseases are major drivers. Chronic illnesses, responsible for 90% of deaths in the WHO European Region, are a significant factor. With 4 million deaths annually in the EU alone, there's a clear demand for advanced testing. R&D investments in the pharmaceutical industry are increasing, reaching EUR 41,500 million in 2021, fostering the development of new tests. With 20 million new cancer cases projected globally in 2023, oncology is a prime area for Esoteric Testing. These tests are crucial in cancer diagnosis, prognosis, and personalized treatment, driving precision oncology advancements. With 1,958,310 new cancer cases and 609,820 deaths expected in the US in 2023, the demand for Esoteric Testing is poised to grow further, offering lucrative opportunities in the market.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point.

Market Dynamics

The global Esoteric Testing market is experiencing significant growth, primarily due to the rising prevalence of chronic diseases such as cancer, cardiovascular disorders, and autoimmune conditions. This surge in chronic illnesses necessitates advanced diagnostic solutions for early detection and personalized treatment. Enzyme-linked immunosorbent assay (ELISA) and real-time polymerase chain reaction (RT-PCR) tests are in high demand, enabling healthcare professionals to identify specific genetic mutations and biomarkers associated with these diseases. Moreover, increased funding from private and government organizations and continuous technological advancements further fuel market expansion.

However, the market faces challenges such as the high cost of Esoteric Testing and limited insurance coverage, particularly in developing regions. Despite these obstacles, growth opportunities abound. The growing emphasis on preventive healthcare and the awareness of the benefits of early disease detection is expected to drive demand for Esoteric Testing. Furthermore, advancements in technology, such as next-generation sequencing and molecular diagnostics, promise to enhance the accuracy and efficiency of Esoteric Testing, presenting new avenues for market expansion.

Competitive Landscape

In the competitive landscape of the Esoteric Testing market, major players employ strategies like product launches, collaborations, and product approvals to expand their market share and offerings. In July 2023, Quest Diagnostics, a global leader in diagnostic information services, introduced its inaugural consumer-initiated genetic test. Utilizing advanced technology, this test helps individuals assess their inherited health risks. This launch strengthens Quest Diagnostics' position in the Esoteric Testing market. Companies like Eurofins Scientific, ACM Global Laboratories, and Mayo Foundation for Medical Education and Research are also pursuing strategic initiatives such as expanding testing services, acquisitions, and mergers to bolster their market presence.

Recent Market Developments

- In February 2024, Quest Diagnostics introduced the MelaNodal Predict™ test, personalizing melanoma risk prediction to help patients avoid invasive surgery.

- In January 2024, Labcorp, a global leader in innovative and comprehensive laboratory services, announced the launch and availability of a new, FDA-cleared blood test for risk assessment and clinical management of severe preeclampsia, a life-threatening blood pressure disorder that occurs during pregnancy and the postpartum period.

- In January 2023, The Enhanced Liver Fibrosis (ELF) Test from Siemens Healthineers will be available in the U.S., providing broad clinical access to the minimally invasive prognostic tool. Currently, the ELF Test is exclusively available through collaborations with LabCorp and Quest Diagnostics, providing access nationwide.

Vantage Market

Research | 03-May-2024

Vantage Market

Research | 03-May-2024

FAQ

Frequently Asked Question

What is the global demand for Esoteric Testing in terms of revenue?

-

The global Esoteric Testing valued at USD 27.31 Billion in 2023 and is expected to reach USD 62.43 Billion in 2032 growing at a CAGR of 10.89%.

Which are the prominent players in the market?

-

The prominent players in the market are ACM Global Laboratories (U.S.), ARUP Laboratories (U.S.), Baylor Esoteric and Molecular Laboratory (U.S.), BioAgilytix Labs (U.S.), BP Diagnostic Centre SDN BHD (Malaysia), BUHLMANN Diagnostics Corp. (U.S.), Cerba Xpert (Belgium), Eurofins Scientific (Luxembourg), Flow Health (U.S.), Foundation Medicine (U.S.), Georgia Esoteric & Molecular Laboratory LLC (U.S.), H.U. Group Holdings Inc. (Japan), Mayo Foundation for Medical Education and Research (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 10.89% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Esoteric Testing include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Esoteric Testing in 2023.