Endometrial Cancer Market

Endometrial Cancer Market - Global Industry Assessment & Forecast

Segments Covered

By Type of Cancer Endometrial Carcinoma, Uterine Sarcomas, Others

By Type of Therapy Immunotherapy, Radiation Therapy, Chemotherapy, Others

By Diagnosis Method Biopsy, CT Scan Hysteroscopy, Pelvic Ultrasound, Other Diagnosis Methods

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 28.2 Billion | |

| USD 46.86 Billion | |

| 5.8% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The global Endometrial Cancer Market is valued at USD 28.2 Billion in 2023 and is projected to reach a value of USD 46.86 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 5.8% between 2024 and 2032.

Key highlights

The integration of precision medicine into clinical practice drives the market by enabling tailored treatment strategies that consider the unique genetic makeup of each patient's cancer

- North America dominated the market in 2023, capturing an impressive 42.1% share of the total revenue

- The Asia Pacific region is primed for substantial growth, boasting a noteworthy projected CAGR throughout the forecast period

- Endometrial Carcinoma emerged as the primary contender in the market landscape in 2023, securing a significant share of 64.2%

- Chemotherapy maintained its leading position, commanding the largest market share of 29.5% in the market for 2023

- Biopsy emerged as the frontrunner in 2023, dominating a considerable portion of the market with 39.5% of market share

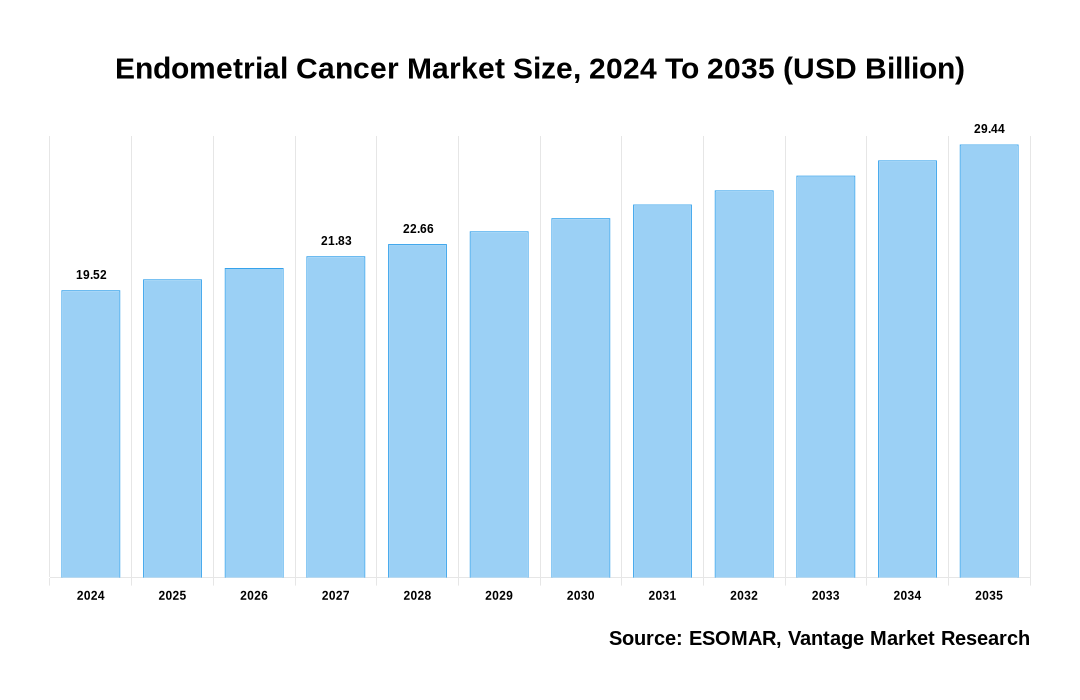

Endometrial Cancer Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Endometrial Cancer Market

Regional Overview

North America Dominated Sales with a 42.1% share in 2023. Endometrial cancer primarily affects post-menopausal women, with the average age of diagnosis being 60 years. Due to the region's well-established healthcare infrastructure and increased awareness of cancer diagnoses, the market in North America is expected to rise throughout the forecast period.

North America is well-positioned to maintain its leadership position in market due to growing emphasis on personalized medication, increasing spending on healthcare, an advanced healthcare infrastructure, significant investments in research and development and continuous medical technology improvements. To ensure equitable healthcare outcomes for all population segments, however, measures to improve screening and preventive programs and reduce gaps in access to healthcare will be essential. Sustained research funding, early detection programs, and therapeutic advancements will be crucial in the ongoing struggle against endometrial cancer in order to lower the disease's burden and enhance the lives of patients in the region. Moreover, the region is witnessing a various clinical studies focusing on market. For instance, in July 2022, Sunnybrook Health Sciences Centre, based in Canada, sponsored a clinical trial to evaluate the impact of megestrol acetate on grade 2 endometrioid endometrial cancer in patients awaiting definitive surgery.

U.S. Market Overview

The U.S. Endometrial Cancer market, valued at USD 8.9 Billion in 2023 to USD 15.06 Billion in 2032, is anticipated to grow at a CAGR of 6.01% from 2024 to 2032.

The United States has many clinical studies institutions, cutting-edge medical centers, and a regulatory environment this is supportive of the creation and broader use of revolutionary treatments. Furthermore, rising occurrence of risk factors such as obesity, hormone imbalances, and aging population demographics emphasizes the need for efficient endometrial cancer diagnosis and treatment alternatives. Due to this, pharmaceutical companies and healthcare professionals within the US are actively working collectively to develop treatment choices and enhance patient outcomes.

According to the World Cancer Research Fund International, there were 61,738 new cases of endometrial cancer in the US in 2020. The United States is an important player in the global fight against endometrial cancer because of its strong healthcare system and high degree of public cancer awareness.

Type of Therapy Overview

In 2023, the Chemotherapy segment dominated the market with the largest share of 29.5%. The market, segmented by the Type of Therapy, includes Immunotherapy, Radiation Therapy, Chemotherapy, Others.

The market is expected to witness growth in the chemotherapy segment due to indicates such the increasing incidence of endometrial cancer, which requires chemotherapy treatments, and the rapid advancement of chemotherapy products. Notably, a study that was published in February 2022 in PubMed highlighted the effectiveness of chemotherapy-based regimens in improving patient outcomes by showing that the combination of Lenvatinib and pembrolizumab resulted in prolonged progression-free survival and overall survival among patients compared to chemotherapy alone.

According to the American Cancer Society, chemotherapy for market often entails drugs such as doxorubicin (Adriamycin), liposomal doxorubicin (Doxil), cisplatin, and docetaxel (Taxotere). An article published in October 2022 demonstrated that the addition of trastuzumab to chemotherapy for high expressers of Her2/neu in endometrial serous carcinoma led to improved overall survival rates. Given the favorable outcomes and advancements in chemotherapy-based treatment regimens for endometrial cancer, the segment is poised for significant growth for market throughout the forecast period.

Government Initiatives

- In 2019, the U.S. Food and Drug Administration introduced Project Orbis, an endeavor coordinated by the FDA Oncology Center of Excellence (OCE). Project Orbis establishes a structure for the simultaneous submission and assessment of oncology medications with international partners. Within this initiative, the FDA, along with the Australian Therapeutic Goods Administration (TGA) and Health Canada, jointly evaluated applications for two oncology drugs, facilitating synchronized decisions across Australia and Canada.

- The National Cervical Screening Program in Australia is dedicated to cervical cancer prevention through routine testing. Utilizing the Cervical Screening Test, the program detects the presence of human papillomavirus (HPV). It is designed for individuals, specifically women and those with a cervix, aged between 25 and 74 years.

- In 2024, the Health Resources and Services Administration (HRSA) is strengthening its Accelerating Cancer Screening (AxCS) Initiative by injecting an additional $10 million into the Alcee L. Hastings Program for Advanced Cancer Screening. This injection brings the total program funding to over $25 million over a three-year period.

- In 2022, the $5 million dollar financing project was announced by the U.S. Department of Health and Human Services (HHS) with the goal of improving equity in cancer screening in community health centers. In line with President Biden's Cancer Moonshot goal, this expenditure, which is overseen by HHS's Health Resources and Services Administration, aims to increase access to vital cancer screenings.

Key Trends

- The market is increasingly focusing on personalized medicine, which involves tailoring treatments based on individual genetic profiles and tumor characteristics. Novel treatment targets and indicators are being identified as a result of deeper insights into the mechanisms behind endometrial cancer being provided by advances in genomic research and molecular profiling.

- There is a growing emphasis on early diagnosis and screening as it enables prompt and efficient therapeutic treatments, early diagnosis is essential for enhancing patient outcomes and survival rates. Developments in diagnostic technologies, including as imaging and molecular approaches, are improving the precision and efficacy of early detection strategies.

- There have been significant investments in research and development (R&D) aimed at discovering innovative treatments and novel therapeutic approaches for endometrial cancer. Businesses in the biotechnology and pharmaceutical industries are investing significant funds in research and development, with the goal of comprehending the disease's molecular causes and creating novel medications and treatments. It is anticipated that this greater emphasis on R&D would result in ground-breaking therapies and raise the standard for patients simultaneously.

Premium Insights

According to the American Cancer Society, uterine cancer is among the few cancers with a rising mortality rate, having increased by 1.7% annually since the mid-2000s. Currently, there are over 600,000 survivors of endometrial cancer in the United States. As per a September 2022 update from Cancer Australia, approximately 3,343 new cases of uterine cancer were diagnosed in Australia in 2022. Similarly, a May 2024 update from the Canadian Cancer Society estimated around 8,600 Canadian women to be diagnosed with uterine cancer in 2022. Improved diagnostic tools, such as transvaginal ultrasound and endometrial biopsy, have facilitated early and accurate detection, enhancing the effectiveness of treatment protocols.

Growing awareness campaigns and education initiatives have contributed to heightened vigilance and earlier medical consultation, which has significantly improved patient outcomes in Endometrial Cancer market.

In March 2023, Eisai Inc. launched the 'Spot Her' initiative to break the silence surrounding endometrial cancer and encourage women to prioritize their health. Conducted in partnership with SHARE Cancer Support (SHARE), Facing Our Risk of Cancer Empowered (FORCE), and Black Health Matters, the initiative aimed to raise awareness about endometrial cancer.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Rising prevalence of endometrial cancer and increasing research activities drive the growth of the Endometrial Cancer market

The global expansion of the Endometrial Cancer market is fueled, in part, by the increasing incidence of uterine cancer worldwide. Factors such as the aging population, lifestyle modifications, and environmental influences contribute to the growing prevalence of this disease.

Anticipated growth in the market during the forecast period is expected to be propelled by an increase in product approvals. For instance, in February 2023, the European Commission conditionally approved Hemgenix (etranacogene dezaparvovec), a one-time gene therapy developed for the treatment of adults with hemophilia B. This innovative therapy, primarily developed by uniQure, is authorized for use in adults with severe and moderately severe hemophilia B who do not have a history of inhibitors. It represents a significant advancement in the treatment landscape as the first gene therapy for hemophilia B available to patients across all European Union member states, as well as Iceland, Liechtenstein, and Norway.

Financial barriers to endometrial cancer treatment accessibility restraints the Endometrial Cancer market

The treatment modalities available for endometrial cancer, encompassing radiation therapy, chemotherapy, and surgical procedures, often come with considerable financial burdens. The accessibility of healthcare services may face obstacles due to the exorbitant costs associated with these treatments, particularly in regions with limited healthcare infrastructure. Typically, radiation therapy incurs costs ranging from USD 2,000 to USD 6,100 throughout the treatment duration, while surgical interventions typically range between USD 2,700 to USD 6,800. Furthermore, the expense of managing uterine cancer can fluctuate based on various factors, necessitating patients and their families to anticipate and plan for associated costs in market.

Competitive Landscape

The Endometrial Cancer market is marked by the presence of several leading pharmaceutical and biotechnology companies. Important companies including Pfizer Inc., AstraZeneca, Bristol-Myers Squibb, Merck & Co., Inc., and others are actively involved in research and development to bring modern drugs to market. These businesses are concentrating on creating cutting-edge treatments, such as targeted and immunotherapies, with the goal of bettering patient outcomes and meeting unmet medical needs. Additionally, smaller biotechnology firms and emerging players are also contributing to the competitive dynamics of the market by advancing their proprietary technologies and drug candidates through clinical trials. Companies like Tesaro (a subsidiary of GlaxoSmithKline), Clovis Oncology, and Eisai Co., Ltd. are notable for their efforts in exploring new treatment avenues. The competitive landscape is further shaped by regulatory approvals, market access strategies, and the ability to demonstrate the efficacy and safety of new therapies.

The key players in the global Endometrial Cancer market include - Pfizer Inc., GlaxoSmithKline PLC, Novartis AG, Merck & Co. Inc., AstraZeneca PLC, Roche Holding AG, Johnson & Johnson, Takeda Pharmaceutical Company Limited, Bayer AG, Amgen Inc., Eli Lilly and Company, AbbVie Inc., Sanofi among others.

Recent Market Developments

FDA Accepts sBLA for Dostarlimab-gxly Combo Therapy in Endometrial Cancer Treatment

- In April 2024, The FDA has accepted a supplemental biologics license application (sBLA) for the combination of dostarlimab-gxly (Jemperli) with standard-of-care chemotherapy, including carboplatin and paclitaxel. The phase 3 RUBY trial demonstrated a 31% improvement in overall survival (OS) and significant progression-free survival (PFS) benefits, regardless of microsatellite instability (MSI) status.

Sysmex Corporation Expands LYNOAMP CK19 Application to Include Endometrial and Cervical Cancer

- In October 2022, Sysmex Corporation, headquartered in Japan, announced an approved modification to the development and marketing authorization of its gene amplifying component, LYNOAMP CK19, in Japan. Initially designed for lymph node metastasis examination in gastric cancer, colorectal cancer, non-small cell lung cancer, and breast cancer, the modification extends its amplification capabilities to include endometrial cancer and cervical cancer.

FDA Grants KEYTRUDA Approval for Advanced Endometrial Carcinoma Therapy

- In March 2022, the United States Food and Drug Administration (FDA) authorized KEYTRUDA, Merck's anti-PD-1 therapy, as a monotherapy for the treatment of advanced endometrial carcinoma with microsatellite instability-high (MSI-H) or mismatch repair deficient (dMMR) status. These patients had experienced disease progression after prior systemic therapy and were not candidates for curative surgery or radiation.

The global Endometrial Cancer market can be categorized as Type of Cancer, Type of Therapy, Diagnosis Method, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type of Cancer

By Type of Therapy

By Diagnosis Method

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Endometrial Cancer in terms of revenue?

-

The global Endometrial Cancer valued at USD 28.2 Billion in 2023 and is expected to reach USD 46.86 Billion in 2032 growing at a CAGR of 5.8%.

Which are the prominent players in the market?

-

The prominent players in the market are Pfizer Inc., GlaxoSmithKline PLC, Novartis AG, Merck & Co. Inc., AstraZeneca PLC, Roche Holding AG, Johnson & Johnson, Takeda Pharmaceutical Company Limited, Bayer AG, Amgen Inc., Eli Lilly and Company, AbbVie Inc., Sanofi.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.8% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Endometrial Cancer include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Endometrial Cancer in 2023.