Electronic Funds Transfer Market

Electronic Funds Transfer Market - Global Industry Assessment & Forecast

Segments Covered

By Type Inter-Bank Transaction, Customer Transaction

By End User Individual, Enterprises

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 66.31 Billion | |

| USD 129.24 Billion | |

| 8.70% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

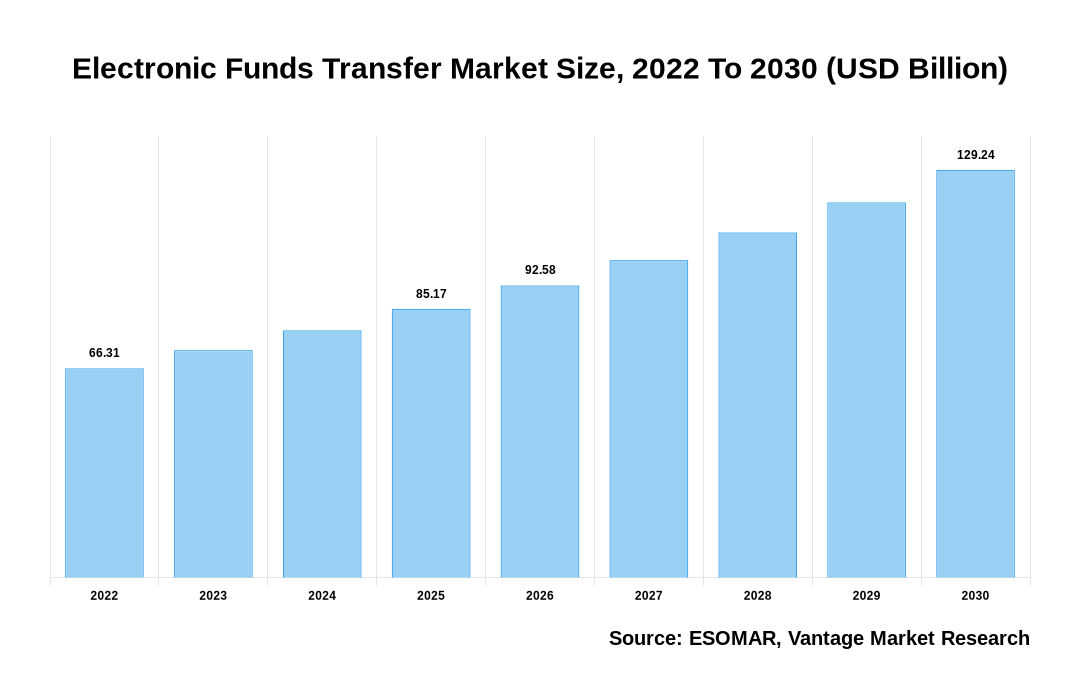

The Global Electronic Funds Transfer Market is valued at USD 66.31 Billion in the year 2022 and is projected to reach a value of USD 129.24 Billion by the year 2030. The Global Market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 8.70% over the forecast period.

Electronic Funds Transfer Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Electronic Funds Transfer Market

An Electronic Funds Transfer Market is a fund transfer system that allows for the instant transfer of money or securities. It is a common method of transferring funds from one account to another over a computer network. As soon as the transaction is transferred from the sending bank, it settles in the receiving bank. Furthermore, the term "gross settlement" refers to the handling and settlement of transactions as individuals rather than in batches or groups. While allowing customers to do their banking, electronic funds transfers replace paper transfers and human intermediaries. In addition, electronic funds transfers are secured by a personal identification number (PIN) or the login information used to access the customer's online banking service. An automated clearing house processes the payment (ACH). An automated clearing house processes the payment (ACH). This lays the groundwork for an Electronic Funds Transfer system.

The market is expanding due to the increased use of online banking services and customer demand for faster payment settlements. High deployment costs and increased market competition, on the other hand, are expected to stifle market growth. On the contrary, the increase in international trade can be viewed as a market opportunity. The increasing use of online banking services in daily life, combined with the increased use of advanced developments in financial services such as online payments, smartphone use, and the availability of advanced services, is driving demand. In recent years, users have increased consumer trust by adding a layer of verification to payment portals to secure information. As the demand for online payments has increased, so has the demand for faster payment portals. Furthermore, businesses across industries are embracing an online payment culture, which is expected to supplement demand for these Electronic Funds Transfer portals. As a result of these factors, the Electronic Funds Transfer Market is expanding.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Market Segmentation:

The Electronic Funds Transfer Market is segmented on the basis of Type and End User. On the basis of Type, the market is segmented into Inter-Bank Transaction and Customer Transaction. On the basis of End User, the market is segmented into Individual and Enterprises.

Based on Type

On the basis of Type, the market is segmented into Inter-Bank Transaction and Customer Transaction. The market is dominated by the interbank transaction segment. Any transfer between banks is referred to as an interbank transaction. Inter-bank transfers can be made using any means of electronic fund transfer, such as RTGS and NEFT. Interbank transactions can take place between two banks. Market growth is likely to be driven by changing lifestyles, the latest online retailing trends, and rising smartphone adoption. Fintech companies and banks now have a new approach to give mobile banking solutions to underserved and unbanked customers in distant places, thanks to the increased adoption of mobile technology in emerging nations.

Based on End User

On the basis of End User, the market is segmented into Individual and Enterprises. The market is dominated by the enterprise segment. Enterprises are entities with a workforce of more than 1,000 people. Large enterprises are adopting online payment solutions in order to digitize their payment landscape, cater to dynamic customer trends, streamline business operations, and increase market competitiveness. Large organizations use the omnichannel strategy to improve the customer experience.

North America Acquired the Largest Market Share in the Year 2021

North America held the largest market share during the year 2021 with a share of 36.10%. The presence of several key market participants distinguishes it. In addition, the region has been an early adopter of cutting-edge technologies. In the United States, the growing number of unmanned stores is also driving the use of mobile payments. The proliferation of mobile payment solutions in North America is primarily due to the growth of the e-commerce industry. With the widespread adoption of mobile technology in emerging markets, fintech companies and banks now have a new avenue for providing mobile banking solutions to underserved and unbanked customers in rural areas.

Competitive Landscape:

Key players operating in the Global Electronic Funds Transfer Market include- Royal Bank of Canada, Charles Schwab & Co., Citigroup Inc., UBS, Morgan Stanley, Bank of America Corporation, JPMorgan Chase & Co., Goldman Sachs, Julius Baer Group, Credit Suisse Group among others.

Segmentation of the Global Electronic Funds Transfer Market:

Parameter

Details

Segments Covered

By Type

By End User

By Region

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

FAQ

Frequently Asked Question

What is the global demand for Electronic Funds Transfer in terms of revenue?

-

The global Electronic Funds Transfer valued at USD 66.31 Billion in 2022 and is expected to reach USD 129.24 Billion in 2030 growing at a CAGR of 8.70%.

Which are the prominent players in the market?

-

The prominent players in the market are Royal Bank of Canada, Charles Schwab & Co., Citigroup Inc., UBS, Morgan Stanley, Bank of America Corporation, JPMorgan Chase & Co., Goldman Sachs, Julius Baer Group, Credit Suisse Group.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 8.70% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Electronic Funds Transfer include

- Increasing use of smart devices along with surge in affordable internet facilities

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Electronic Funds Transfer in 2022.

Vantage Market

Research | 28-Apr-2022

Vantage Market

Research | 28-Apr-2022