DNA Sequencing Market

DNA Sequencing Market - Global Industry Assessment & Forecast

Segments Covered

By Product Instruments, Consumables, Services

By Technology Third Generation DNA Sequencing, Next-Generation Sequencing, Sanger Sequencing

By Application Clinical Investigation, Oncology, Forensics & Agri-Genomics, Reproductive Health, HLA Typing, Other Applications

By End-Use Clinical Research, Academic Research, Biotechnology & Pharmaceutical Companies, Hospitals & Clinics, Other End-Uses

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 4.69 Billion | |

| USD 16.81 Billion | |

| 17.30% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Premium Insights

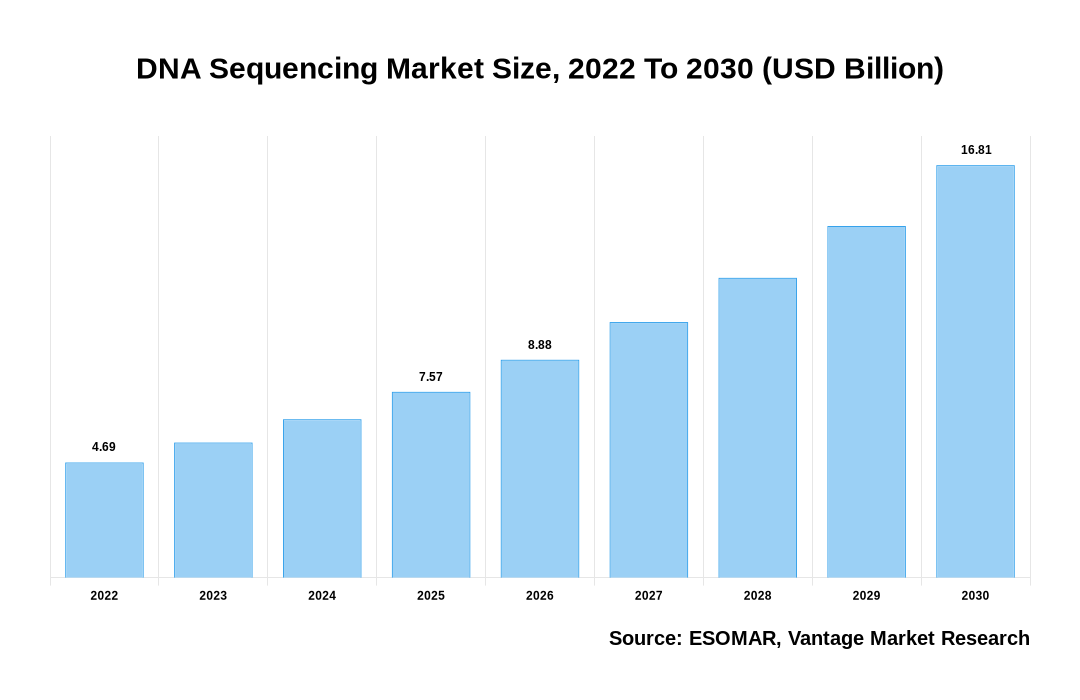

Global DNA Sequencing Market is valued at USD 4.69 Billion in 2022 and is projected to reach a value of USD 16.81 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 17.30% over the forecast period.

In recent years, the cost of DNA sequencing has fallen dramatically, making it more accessible for a wider range of research applications and clinical uses. For instance, in 2020, the average cost for a full human genome sequence was $3,000; by 2022, this price is expected to fall to $1,500. Additionally, new sequencing technologies are being developed that are more accurate and faster than ever before. For example, a technique called “deep sequencing” can sequence an entire genome in less than 24 hours. Another market trend that is expected to continue through 2022 is the growth of gene therapy products. Gene therapy products are treatments that use genes to repair or prevent disease. In 2020, there were only a few gene therapy products on the market; by 2022, this number is expected to grow to over 100 products. This increase in gene therapy products is due to the increasing knowledge and understanding of how genes work and how they can be used to treat diseases. This is mostly because sequencing technologies, such as next-generation sequencing (NGS), have gotten better over time. Government initiatives to reduce the cost of healthcare are also driving the growth of the DNA sequencing market. In the United States, the National Institutes of Health (NIH) has invested heavily in developing new genomic technologies and applications. For instance, the NIH's Cancer Genome Atlas (TCGA) project has a Sequence Read Archive (SRA), which contains more than 2 petabytes (PB) of data from over 10,000 cancer patients. This publicly available resource is helping researchers worldwide develop new cancer therapies and improve patient care. The growth of the DNA sequencing market is also helped by the fact that NGS technology is being used more and more in cancer genomics and personalized medicine.

DNA Sequencing Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about DNA Sequencing Market

This growth is driven by advances in technology that have made sequencing faster and more accurate, as well as by the increasing demand for genomic data to support research and clinical applications. As sequencing technology continues to improve, it will become increasingly accessible and affordable, which will open up new markets and applications. For example, whole-genome sequencing is already being used in clinical settings to diagnose rare genetic diseases and guide treatment decisions. In the future, it may also be used for routine screening of newborns or adults at risk for certain conditions. Similarly, DNA sequencing can be used to track the evolution of pathogens and inform public health interventions. The scope of the DNA sequencing market is thus broadening as the technology matures and finds new applications in research and medicine. The fastest-growing segments of the DNA sequencing market are single-cell DNA sequencing and whole genome sequencing. Several companies are focused on developing single-cell DNA sequencing technologies, and they are expected to achieve significant market share in this area. One of the leading companies in this field is Life Technologies Corporation. In 2020, it announced the launch of its SingleCellAnalyser®, which is a novel single-cell DNA sequencing technology that offers high-throughput, low-cost sequencing capabilities. The market for whole genome sequencing (WGS) is projected to grow from $2.2 billion in 2020 to $11.6 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 10.7%, due largely to its increasing use in population studies and clinical trials. Next-generation sequencing platforms such as Illumina's HiSeq 2000 platform and Sanger's SOLiD platform. These platforms allow labs to sequence up to 100 million sequences per day at a low cost.

The growing trend of outsourcing DNA sequencing services is also contributing to market growth. This is because service providers have expertise and experience in handling large data sets generated by next-generation sequencing (NGS) platforms. Moreover, they offer cost-effective solutions that help reduce the overall costs associated with DNA sequencing projects. Several market restraints are currently impeding the growth of the DNA sequencing market. Firstly, the high cost associated with DNA sequencing is a major barrier to adoption. Secondly, the complex nature of DNA sequencing data can make it difficult to interpret and use effectively. Finally, there is a lack of skilled personnel trained in DNA sequencing, which limits the availability of this technology.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Impact of DNA Sequencing Market on other industries

The DNA sequencing market is expected to have a positive impact on other industries such as the healthcare industry. The demand for DNA sequencing is expected to increase as the healthcare industry increasingly uses genomic information to improve patient care. In addition, the DNA sequencing market is expected to benefit from the development of new applications and technologies that can be used in other industries such as agriculture, forensics, and environmental sciences. As the DNA sequencing market continues to grow, it is having a ripple effect on other industries as well. For example, the demand for DNA sequencers is increasing the demand for computers and other high-tech equipment. This in turn is driving up the prices for these items. In addition, the need for qualified personnel to operate DNA sequencers is also increasing. As a result, companies that provide training services are seeing an uptick in business.

Top Market Trends

- North America is expected to dominate the global market in terms of revenue, followed by Europe and Asia-Pacific.

- Technological advancements in DNA sequencing are driving the growth of the market. For instance, the development of next-generation sequencing (NGS) platforms has made DNA sequencing more efficient and cost-effective.

- The increasing demand for personalized medicine is another key factor driving the growth of the market. Personalized medicine is an emerging field of medicine that uses a person's genomic information to predict their risk of developing certain diseases and to tailor treatments accordingly.

- The growing applications of DNA sequencing are also fuelling market growth. For instance, DNA sequencing is being used in cancer research to identify mutations that can be targeted with specific drugs. It is also being used in agricultural research to develop crops with improved traits such as disease resistance and higher yields.

- Increasing demand for high throughput sequencing: There is an increasing demand for high throughput sequencing services, particularly from the pharmaceutical and biotech industries. This is due to the need to sequence large numbers of genomes quickly and efficiently.

- Improved data quality: Thanks to advances in technology, DNA sequencing providers are now able to offer improved data quality. This means that you can expect more accurate results from your sequencing projects.

- Declining costs: The cost of DNA sequencing has been falling steadily over the past few years, making it more affordable for both scientific and commercial applications.

Market Segmentation

The global DNA sequencing market is segmented based on Product, Technology, Application, End-Use, and Region. Based on Product, the market is segmented into Instruments, Consumables, and Services. The Technology segment includes Third Generation DNA Sequencing, Next-Generation Sequencing, and Sanger Sequencing. The Application segment is bifurcated into Clinical Investigation, Oncology, Forensics & Agri-Genomics, Reproductive Health, HLA Typing, and Other Applications. The End-Use segment is divided into Clinical Research, Academic Research, Biotechnology & Pharmaceutical Companies, Hospitals & Clinics, and Other End-Uses. Furthermore, based on the Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Based on Product

The Instruments segment is expected to grow at the highest rate during the forecast period, followed by consumables and services. The growth in the Instrument segment is attributed to the increasing adoption of next-generation sequencing platforms, such as Ion Torrent PGM and Illumina HiSeq2000. The increase in demand for higher-resolution sequencing will propel the growth of this segment. The increase in the adoption of next-generation sequencing platforms will also spur the growth of consumables and service segments. The services segment is expected to grow at a faster rate than the other two segments owing to an increased need for specialist support for DNA sequencing operations. Moreover, this segment is expected to benefit from the increasing use of cloud-based solutions for DNA sequencing.

Based on Technology

Third Generation DNA Sequencing is the most recent and advanced sequencing technology. It has been in development for over a decade and is used for high-throughput sequencing. The Third Generation DNA Sequencing technology is gaining popularity due to its affordability and ease of use. NGS has emerged as the dominant sequencing approach due to its ability to generate high-quality sequence data at low costs. Moreover, NGS has been demonstrated to be more accurate than traditional sequencing approaches, which makes it suitable for applications such as cancer diagnosis and genomics research. As a result, NGS is expected to capture a major share of the DNA sequencing market shortly. Next-generation sequencing (NGS) platforms are massively parallel sequencers that can generate large amounts of data in a relatively short period. These platforms have revolutionized genomic research and have made it possible to sequence entire genomes in a matter of days. Next-Generation Sequencing technology is expected to garner a larger share of the market due to its high accuracy and detection capabilities. Sanger Sequencing is expected to remain the dominant technology in the DNA sequencing market due to its low cost and large sample size capacity.

Based on Application

The growth of the clinical investigation segment is expected to be high due to the increasing adoption of DNA sequencing as a diagnostic tool. The increase in the adoption of DNA sequencing for various medical applications, including disease detection and genotyping, is expected to drive the growth of this segment over the forecast period. The clinical investigation segment is estimated to account for the largest share of the DNA sequencing market in terms of revenue. This segment is expected to grow at a CAGR of over 22% during the forecast period. The oncology segment is estimated to account for the second-largest share of the DNA sequencing market in terms of revenue. This segment is expected to grow at a CAGR of over 18% during the forecast period. The increasing demand for genomic information related to cancer diagnosis and treatment is expected to drive the growth of this market. The forensics and agri-genomics segment is estimated to account for the third largest share of the DNA sequencing market in terms of revenue. This segment is expected to grow at a CAGR of over 17% during the forecast period. The increasing demand for genomic information related to food safety and agriculture is expected to drive the growth of this market. Reproductive health is one of the most popular applications of DNA sequencing. The Reproductive Health segment is expected to grow at a CAGR of 12.8% during the forecast period. This growth is attributable to factors such as increasing awareness about reproductive health issues, rising demand for prenatal and postnatal care, and increasing adoption of assisted reproductive technologies (ARTs). The HLA Typing segment is expected to grow at a CAGR of 10.9% over the forecast period. This growth is due to factors such as increased recognition of genetic disorders, increasing prevalence of multifactorial diseases, and growing adoption of molecular genetic testing for prenatal diagnosis. Other applications of DNA sequencing include forensics, paternity testing, and population genetics.

Based on End-use

The Clinical Research segment is expected to witness the highest growth rates due to the rising demand for precision health care. Increasing adoption of genomic medicine and increasing focus on personalized medicine is driving the growth in this segment. Additionally, factors such as the fast-growing geriatric population and the increase in chronic diseases are also contributing to the growth of this market. The academic research segment is projected to account for the largest share of the DNA sequencing market due to large investments made by various organizations in this field. High-quality data generated from genome sequencing projects helps researchers identify novel targets for drug development and improves understanding of human disease pathogenesis. This has led to increased interest from academia in DNA sequencing projects. The biotechnology & pharmaceutical companies segment is expected to witness rapid growth owing to increasing focus on personalized medicine and growing R&D spending by these companies. Increasing demand for precision healthcare products, the growing trend towards personalized genomics, and an increase in investment by major players in this space are some of the key drivers behind this market growth. Hospitals & clinics use DNA sequencing for diagnostic purposes and to develop personalized treatment plans for patients. The biotechnology & pharmaceutical companies segment is estimated to grow at a CAGR of around 9%. This is mainly due to the increasing demand for novel drugs and treatments. The hospitals & clinics segment is expected to grow at a CAGR of around 7%. This is due to the increased provision of healthcare facilities and patients belonging to this segment exercising their right to information about their health.

Competitive Landscape

The key players in the Global DNA Sequencing market include- Agilent Technologies, Illumina Inc., QIAGEN, Perkin Elmer, Thermo Fisher Scientific, Hoffmann-La Roche Ltd., Macrogen Inc., Bio-Rad Laboratories Inc., Oxford Nanopore Technologies Ltd., Myriad Genetics and others.

Recent Advancements

- Illumina HiSeq X Ten: This top-of-the-line sequencer can sequence up to 18 billion base pairs of DNA in a single run, making it ideal for large-scale sequencing projects. It costs around $1 million. November 2020 - Illumina's HiSeq X Ten Sequencing System debuts with superior throughput and expanded data analysis capabilities.

- May 2021 - Thermo Fisher Scientific launches its Genomic Solutions Platform, which offers comprehensive genomics services through a single platform.

- Roche 454 GS FLX+ System: This sequencing system is good for both small and large projects. It can sequence up to 700 million base pairs per run and costs around $250,000.

- Ion Torrent PGM System: This system is designed for small sequencing projects. It can sequence up to 100 million base pairs per run and costs around $50,000.

- In recent years, there has been a shift from whole genome sequencing (WGS) to targeted sequencing due to the falling costs of NGS technologies. Targeted sequencing is more economical than WGS and is used to sequence specific regions of interest in the genome. This technique is being increasingly adopted in clinical applications, such as cancer diagnosis and treatment, which is expected to fuel the growth of the DNA sequencing market during the forecast period. NGS platforms are being used in various applications, such as diagnostics, cancer genomics, and personalized medicine. These platforms offer several advantages over traditional sequencing techniques, including high throughput, low cost, and improved accuracy. The increasing adoption of these platforms is expected to drive the growth of the DNA sequencing market during the forecast period.

- The third generation of sequencing technology is based on single-molecule real-time (SMRT) sequencing. This platform was developed by Pacific Biosciences and was first commercialized in 2011. The key advantage of SMRT sequencing is its long read lengths, which allow for the assembly of genome sequences with fewer scaffolds than what is possible with second-generation technologies. Another advantage of this technology is that it can be used to sequence DNA with high GC content (>70%), which can be difficult to sequence using other technologies.

- DNA sequencing is being used to diagnose genetic diseases, screen for cancer risk factors, and track the spread of infectious diseases. Additionally, law enforcement agencies are using DNA sequencing to solve crimes and identify missing persons. The falling cost of DNA sequencing is also making it possible to sequence the genomes of large numbers of people. This is leading to the development of new genomic databases that can be used for population-level studies. These studies will help us to better understand the causes of disease and to develop new treatments and preventive measures.

Segmentation of the Global DNA Sequencing Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Technology

By Application

By End-Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 21-Nov-2022

Vantage Market

Research | 21-Nov-2022

FAQ

Frequently Asked Question

What is the global demand for DNA Sequencing in terms of revenue?

-

The global DNA Sequencing valued at USD 4.69 Billion in 2022 and is expected to reach USD 16.81 Billion in 2030 growing at a CAGR of 17.30%.

Which are the prominent players in the market?

-

The prominent players in the market are Agilent Technologies, Illumina Inc., QIAGEN, Perkin Elmer, Thermo Fisher Scientific, Hoffmann-La Roche Ltd., Macrogen Inc., Bio-Rad Laboratories Inc., Oxford Nanopore Technologies Ltd., Myriad Genetics.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 17.30% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the DNA Sequencing include

- Rise in incidence of genetic disorders and cancer

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the DNA Sequencing in 2022.