Digital Payments Market

Digital Payments Market - Global Industry Assessment & Forecast

Segments Covered

By Component Solutions, Services

By Deployment Type On-premises, Cloud

By Organization Size Small and Medium-sized Enterprises, Large Enterprises

By Vertical Banking Financial And InsuranceServices, Retail and Ecommerce, Healthcare, Travel and Hospitality, Transportation and Logistics, Media and Entertainment, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 99.96 Billion | |

| USD 303.65 Billion | |

| 14.90% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

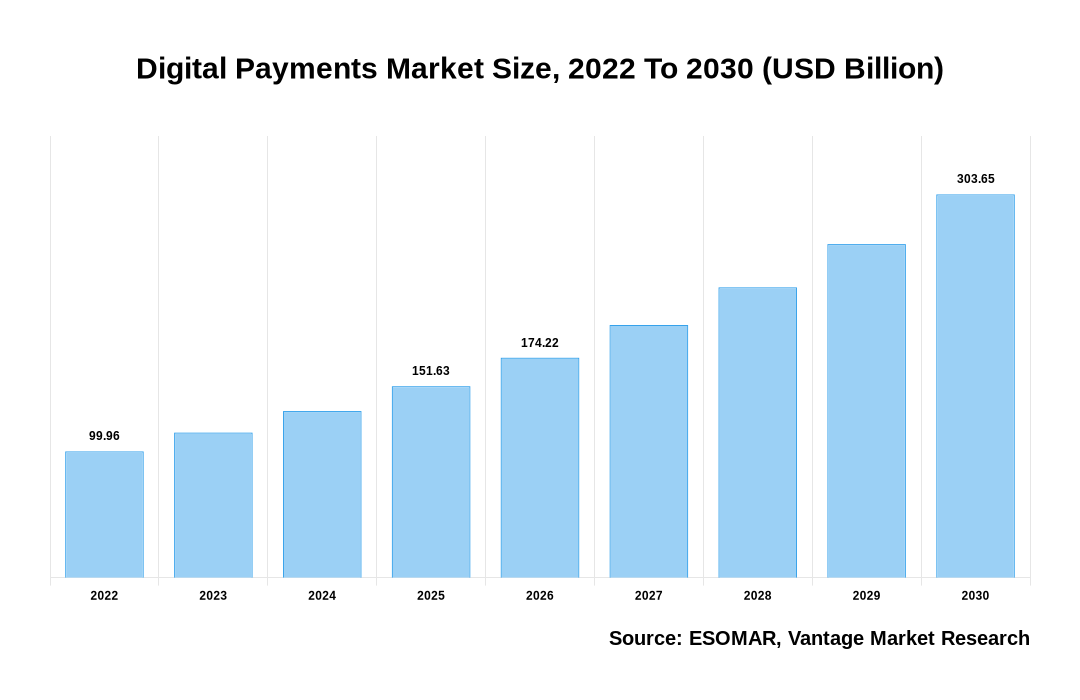

Global Digital Payments Market valued at USD 99.96 Billion in 2022 and is projected to reach a value of USD 303.65 Billion by 2030 at a Compound Annual Growth Rate (CAGR) of 14.90% over the forecast period from the year 2021 to 2028.

Digital Payments systems are used to transfer money electronically without using physical currency. These systems can be accessed through mobile phones, computers, or other electronic devices. They have been widely adopted across various industries due to their convenience and security features.

The increasing adoption of smartphones, tablets, and wearable technology has led to an increased usage of these devices as a means of payment at the point of sale (POS). In addition, the increasing use of online shopping platforms has resulted in greater demand for e-commerce transactions. Moreover, the growing popularity of social media networks has contributed to the rise of social commerce. All these factors are expected to drive the growth of the Digital Payments Market over the forecast period. However, the high costs associated with setting up a Digital Payments system may hinder its widespread adoption. The high cost of transaction fees and lack of awareness regarding the benefits offered by digital wallets may restrain the growth of the global market. The security concerns related to the usage of digital wallets may also hamper the growth of this market over the forecast period.

Digital Payments Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Digital Payments Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Component

By Deployment Type

By Organization Size

By Vertical

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Market Segmentation:

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The Global Digital Payments Market is segmented by component, deployment type, organization size, vertical, and region. Based on component, the market is bifurcated as solutions and services. By deployment type, the market is segmented as on-premises and cloud. By organization size, the market is segmented into small and medium-sized enterprises, and large enterprises. The market is segmented by vertical as banking, financial services and insurance (BFSI), retail and ecommerce, healthcare, travel and hospitality, transportation and logistics, media and entertainment, and other verticals.

The Solutions Component to Hold the Largest Share Within the Segment

The solutions segment is expected to hold the largest Compound Annual Growth Rate (CAGR) during the forecast period. Retailers are adopting payment processing solutions to provide customers with flawless checkout experiences as their preference for online shopping increases around the world. Major Digital Payments solution providers are gradually adopting smart technologies such as analytics, big data, and cloud computing to provide comprehensive solutions to potential customers. Payment gateways and payment processing are the most in-demand solutions among merchants.

On-Premises Component Tops in Deployment Types

On-premise Digital Payments are expected to dominate the global market over the forecast period. This is due to the increasing adoption of mobile wallets and card readers in retail stores. Moreover, the rise in e-commerce has increased the demand for online payment solutions. On-premises deployment of Digital Payments provides organizations with complete control over applications and systems that can be easily managed by the organization's IT staff.

The cloud segment is expected to grow at the highest CAGR during the forecast period. One of the primary drivers fueling the segment's growth is the continuing implementation of smart city projects, which is being accompanied by an increase in the number of unmanned retail establishments. Additionally, payment companies' efforts to integrate artificial intelligence features into their payment systems are projected to boost the segment's growth.

Large Enterprises are Seen to be Growing Substantially

The large enterprises segment accounted for the largest share of the Global Digital Payments Market in the forecast period. This can be attributed to the fact that they have adopted advanced technologies and have invested heavily in developing innovative products. Retailers employ Digital Payments methods such as smart banking cards, point-of-sale solutions, and e-wallets to shorten checkout times. At the same time, retailers are focusing on providing customers with innovative payment options. Moreover, companies have established partnerships with various banks and financial institutions, thereby enabling them to offer attractive discounts and other benefits to customers.

BFSI Holds a Major Share in the Digital Payments Market

The banking, financial services, and insurance (BFSI) segment dominated the market and accounted for the largest share of the global revenue. Banks are adopting Digital Payments solutions in response to the growing demand for digital remittance for cross-border and domestic transactions. Furthermore, banks are improving their offerings to compete with Digital Payments solution providers like Google, Amazon, and Facebook. For example, in June 2019, Bank of America launched a digital debit card to provide greater convenience to its customers.

Over the projected period, the retail & e-commerce segment is expected to increase at the fastest rate. One of the primary factors fueling the segment's growth is the increased adoption of mobile-based payment solutions among customers for retail payments. At the same time, the growing number of automated retail stores around the world is fueling market expansion.

North America Region Dominates as APAC Grows Tremendously in the Global Digital Payments Market

North America accounts 33.80% of market share in the Global Digital Payments Market, this was attributed to the increasing deployment and technology enhancements in ease for online payments. However, Asia Pacific is projected to witness the highest CAGR in the forecast period. This is mainly attributed to the increasing penetration of smartphones and tablets and the number of internet users, growing acceptance of online payments, and growing adoption of mobile wallets, coupled with the growing e-commerce sector. Furthermore, the government initiatives to promote Digital Payments have led to the growth of this market in the region.

Competitive Landscape:

Some of the major key players in the Digital Payments Market are PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), ACI Worldwide (US), Temenos (Switzerland), PayU (Netherlands), Apple (US), JPMorgan Chase (US), WEX (US), FLEETCOR (US), Aurus (US), PayTrace (US), Stax by FattMerchant (US), 2Checkout now Verifone(US), Spreedly (US), Dwolla (US), Braintree (US), Clover(US), OpenWay Group (Belgium), EBANX (Brazil)..

Segmentation of Digital Payments Market -

By Component -(Revenue- USD Million, 2016-2028)

- Solutions

- Services

By Deployment Type -(Revenue- USD Million, 2016-2028)

- On-premises

- Cloud

By Organization Size -(Revenue- USD Million, 2016-2028)

- Small and Medium-sized Enterprises

- Large Enterprises

By Vertical -(Revenue- USD Million, 2016-2028)

- Banking Financial And InsuranceServices

- Retail and Ecommerce

- Healthcare

- Travel and Hospitality

- Transportation and Logistics

- Media and Entertainment

- Others

By Region- (Revenue- USD Million, 2016-2028)

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

FAQ

Frequently Asked Question

What is the global demand for Digital Payments in terms of revenue?

-

The global Digital Payments valued at USD 99.96 Billion in 2022 and is expected to reach USD 303.65 Billion in 2030 growing at a CAGR of 14.90%.

Which are the prominent players in the market?

-

The prominent players in the market are PayPal (US), Fiserv (US), FIS (US), Global Payments (US), Square (US), Stripe (US), VISA (US), Mastercard (US), Worldline (France), Adyen (Netherlands), ACI Worldwide (US), Temenos (Switzerland), PayU (Netherlands), Apple (US), JPMorgan Chase (US), WEX (US), FLEETCOR (US), Aurus (US), PayTrace (US), Stax by FattMerchant (US), 2Checkout now Verifone(US), Spreedly (US), Dwolla (US), Braintree (US), Clover(US), OpenWay Group (Belgium), EBANX (Brazil)..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.90% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Digital Payments include

- Global initiatives for the promotion of digital payments

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Digital Payments in 2022.

Vantage Market

Research | 11-Apr-2022

Vantage Market

Research | 11-Apr-2022