Digital Patient Monitoring Devices Market

Digital Patient Monitoring Devices Market - Global Industry Assessment & Forecast

Segments Covered

By Type Wireless Sensor Technology, mHealth, Telehealth, Wearable Devices, Remote Patient Monitoring

By Product Diagnostic Monitoring Devices, Therapeutic Monitoring Devices

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 63.5 Billion | |

| USD 361.7 Billion | |

| 24.3% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

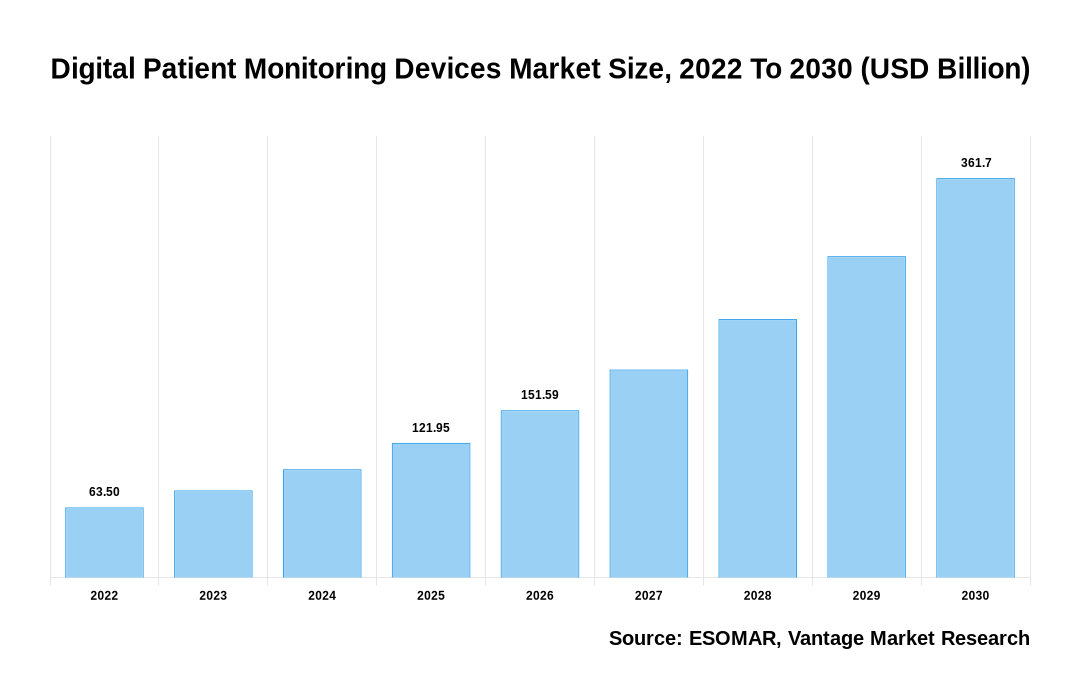

The global Digital Patient Monitoring Devices Market is valued at USD 63.5 Billion in 2022 and is projected to reach a value of USD 361.7 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 24.3% between 2023 and 2030.

Premium Insights

According to NIH, in 2001, chronic illnesses accounted for approximately 60% of the 56.5 million total reported deaths in the world and about 46% of the global burden of disease. Similarly, WHO said, by around 2050, chronic diseases such as cardiovascular diseases, cancer, diabetes and respiratory illnesses – will account for 86 per cent of the 90 million deaths each year: a staggering 90 per cent increase in absolute numbers, since 2019. Thus, the rising prevalence of chronic diseases, such as cardiovascular disorders, diabetes, respiratory diseases, and obesity, has created a growing demand for continuous monitoring of patients' health conditions. Digital patient monitoring devices provide an effective and convenient way to monitor vital signs, track disease progression, and manage chronic conditions, contributing to better disease management and reduced hospitalizations.

Digital Patient Monitoring Devices Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Digital Patient Monitoring Devices Market

Furthermore, the Canadian government announced an investment of USD 198.6 billion over the next 10 years to enhance healthcare services in Canada in February 2023. This funding would also include data and digital tools to help the health needs of Canadian citizens. Aditionally, the Health Minister of France invested USD 694.99 million (EUR 650 million), as a part of the 2030 Health Innovation Plan, to accelerate the digital health strategy of the nation in October 2022. Likewise, the Australian government invested around USD 9.8 billion during the pandemic to deliver better telehealth that provided better healthcare and medication to the citizens. Thus, growing healthcare investment by major healthcare providers & government are accelerating the growth of the market in coming years.

Moreover, The continuous advancements in technology have led to the development of digital patient monitoring devices that are more accurate, reliable, and easy to use. These devices offer features such as wireless connectivity, remote monitoring, and real-time data analysis, which are driving their adoption. For instance, Lupin launched its digital therapeutics solution LYFE for cardiac care to improve the quality of life of cardiac patients in January 2023. Similarly, an India-based company Dozee, launched its AI-powered ECG patch in October 2022. This device assists users in detecting early signs of various cardiovascular-related problems such as cardiac deterioration and arrhythmias.

Key Highlights

- North America accounted largest growth with revenue share of 48.5% in 2022

- Asia Pacific is expected to dominate the market during the forecast period

- On the basis of Type, Wearable Devices segment accounted the largest market growth and contributed more than 38.7% of the total revenue share in 2022

- Based on Product, the Diagnostic Monitoring Devices segment revealed the most significant market growth and contributed more than 59.2% of the total revenue share in 2022

Report Coverage & Deliverables

Get Access Now

Economic Insights

Economic changes, such as recessions or market fluctuations, can have both positive and negative effects on the digital patient monitoring devices market. During periods of economic downturn, consumers may cut back on non-essential healthcare spending, which could potentially impact the demand for digital patient monitoring devices. However, there is also a growing trend towards remote patient monitoring, which can help reduce healthcare costs and alleviate the burden on hospitals. This can lead to increased adoption of digital patient monitoring devices as a cost-effective alternative to traditional in-patient healthcare services. Additionally, disruptions in the global supply chain, as seen during the pandemic, can impact the availability and pricing of digital patient monitoring devices. Many of these devices are manufactured in countries with lower production costs, such as China and India. Any disruptions in the supply chain, whether due to political tensions, trade barriers, or natural disasters, can lead to delays in production and delivery of these devices, ultimately affecting their availability and pricing worldwide.

Top Market Trends

- Rising Prevalence of Artificial Intelligence and Machine Learning to Drive the Market: The integration of artificial intelligence and machine learning algorithms in digital patient monitoring devices is improving the accuracy and efficiency of data analysis. These technologies can analyze large amounts of patient data to identify patterns and trends, enabling personalized medicine and proactive healthcare interventions. For Instance, in 2021, a study published in the journal Nature Medicine demonstrated the effectiveness of an AI algorithm in predicting patient deterioration using wearable sensors. The algorithm analyzed data from wearable devices, including heart rate, respiration rate, and activity levels, to identify subtle changes in vital signs that indicated a decline in health.

- Increased Wearable Devices Product Launches to Promote Market Growth: The adoption of wearable devices for patient monitoring such as smartwatches, fitness bands, and medical-grade wearable devices is increasing. These devices track vital signs, activity levels, and other health parameters, enabling continuous remote monitoring of patients. Digital patient monitoring devices provide continuous monitoring of vital signs and health parameters. They can send real-time alerts to healthcare providers in case of any abnormalities or emergencies, enabling immediate intervention and reducing the risk of adverse health events. For Instance, In 2021, Google completed its acquisition of Fitbit, a leading manufacturer of wearable fitness trackers and smartwatches. This collaboration aims to leverage Fitbit's expertise in wearable technology and Google's capabilities in data analysis and artificial intelligence to enhance health-tracking features in wearable devices.

Market Segmentation

The global Digital Patient Monitoring Devices market can be categorized on the following: Type, Product, and Regions. Based on Type, the market can be categorized into Wireless Sensor Technology, mHealth, Telehealth, Wearable Devices, Remote Patient Monitoring. Additionally, by Product, the market can be split between Diagnostic Monitoring Devices and Therapeutic Monitoring Devices. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Type

Wearable Devices Category to Accommodate Maximum Market Share due to Technological Advancements

The wearable devices category attributed the largest growth of the market in 2022. This growth is accounted to the factors like the growing usage of connected devices and the growing end-user desire for high-end technology. For Instance, in 2021, Garmin, a prominent manufacturer of wearable devices, launched the Garmin Venu 2 and Venu 2S smartwatches. These devices featured enhanced health monitoring capabilities, including advanced sleep tracking, respiration rate monitoring, and menstrual cycle tracking for women. The dominance of wearable devices in the market for digital patient monitoring can be attributed to several factors. Firstly, the growing usage of connected devices, including smartwatches and fitness bands, has significantly contributed to the widespread adoption of wearable technology for health monitoring purposes. These devices provide individuals with convenient access to health data and insights, promoting proactive health management.

Based on Product

Diagnostic Monitoring Devices Segment to Express Dominion owing to Better Integration of Technology

The diagnostic monitoring devices segment drove the digital patient monitoring device market in 2022, accounting for the highest revenue share. The segment is expanding as a result of the rising senior population and the rising prevalence of illnesses including diabetes, obesity, cancer, and others. In recent years, there has been a surge in the development and adoption of diagnostic monitoring devices, particularly in the field of remote patient monitoring for chronic conditions. One notable recent development in this market is the expansion of remote glucose monitoring solutions for individuals with diabetes. For instance, in 2021, Medtronic, a leading medical device company, introduced the Guardian Connect CGM system, an advanced diagnostic monitoring device for individuals with diabetes. The system utilizes a continuous glucose monitoring (CGM) sensor and a connected mobile app to provide real-time glucose readings, alerts, and personalized insights for improved diabetes management.

Based on Region

North America to Lead Global Sales owing to Changing Lifestyles and Increasing Popularity

North America accounted the largest share of the market in 2022. The region has well-established healthcare infrastructure, increasing adoption of digital healthcare solutions, and a high prevalence of chronic diseases. Additionally, favorable reimbursement policies and government initiatives to promote remote patient monitoring are further fueling the market growth in this region. For instance, in the United States, the Centers for Medicare and Medicaid Services (CMS) expanded reimbursement policies for RPM services during the pandemic. This policy change facilitated the adoption of digital patient monitoring devices by healthcare providers, as they could now receive reimbursement for providing remote monitoring services to patients with chronic conditions.

The Asia Pacific region is expected to witness rapid growth in the digital patient monitoring devices market. Factors such as improving healthcare infrastructure, increasing healthcare spending, and the presence of a large patient pool are driving the market growth in this region. Additionally, the rising awareness about healthcare technology and the increasing penetration of smartphones and internet connectivity are also contributing to the market growth.

Competitive Landscape

Leading players operated in this market develops and manufactures digital patient monitoring devices such as blood pressure monitors, glucose meters, electrocardiogram (ECG) systems, and pulse oximeters. They invest in research and development to introduce innovative products that can offer accurate and real-time patient monitoring. These key players contribute to the growth and advancement of the Digital Patient Monitoring Devices Market. For instance, in January 2023, Lupin launched its digital therapeutics solution LYFE for cardiac care to improve the quality of life of cardiac patients.

The key players in the global Digital Patient Monitoring Devices market include - GE Healthcare (U.S.), AT&T (U.S.), Athena Health Inc. (U.S.), Abbott Laboratories (U.S.), Koninklijke Philips N.V. (Netherlands), Hill-Rom Services Inc. (U.S.), Medtronic PLC (Ireland), Omron Healthcare Inc. (Japan), FitBit Inc. (U.S.), Garmin Ltd. (U.S.), Vital Connect Inc. (U.S.), ResMed (U.S.), Siren (Ireland) among others.

Recent Market Developments

- May 2023: Siemens Healthineers has introduced its latest generation of hematology analyzers, aiming to enhance patient care through faster test results. The company has launched two new solutions, the Atellica HEMA 570 Analyzer and the Atellica HEMA 580 Analyzer, specifically designed for high-volume hematology testing.

- January 2023: Lupin Ltd., Indian multinational pharmaceutical company, launched its digital therapeutics solution LYFE for cardiac care to improve the quality of life of cardiac patients.

- March 2022: During the 74th Annual Conference of the Indian Radiological and Imaging Association (IRIA) 2022, Philips Health unveiled its latest offering, the MR 5300 imaging system. This advanced system integrates artificial intelligence (AI)-driven technologies to automate complex clinical and operational tasks.

Segmentation of the Global Digital Patient Monitoring Devices Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Product

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Digital Patient Monitoring Devices in terms of revenue?

-

The global Digital Patient Monitoring Devices valued at USD 63.5 Billion in 2022 and is expected to reach USD 361.7 Billion in 2030 growing at a CAGR of 24.3%.

Which are the prominent players in the market?

-

The prominent players in the market are GE Healthcare (U.S.), AT&T (U.S.), Athena Health Inc. (U.S.), Abbott Laboratories (U.S.), Koninklijke Philips N.V. (Netherlands), Hill-Rom Services Inc. (U.S.), Medtronic PLC (Ireland), Omron Healthcare Inc. (Japan), FitBit Inc. (U.S.), Garmin Ltd. (U.S.), Vital Connect Inc. (U.S.), ResMed (U.S.), Siren (Ireland).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 24.3% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Digital Patient Monitoring Devices include

- Rising demand for round-the-clock monitoring

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Digital Patient Monitoring Devices in 2022.