Dermatology Devices Market

Dermatology Devices Market - Global Industry Assessment & Forecast

Segments Covered

By Type Diagnostics Devices, Treatment Devices

By Application Diagnostics Devices, Treatment Devices

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 7.25 Billion | |

| USD 18.6 Billion | |

| 12.5% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

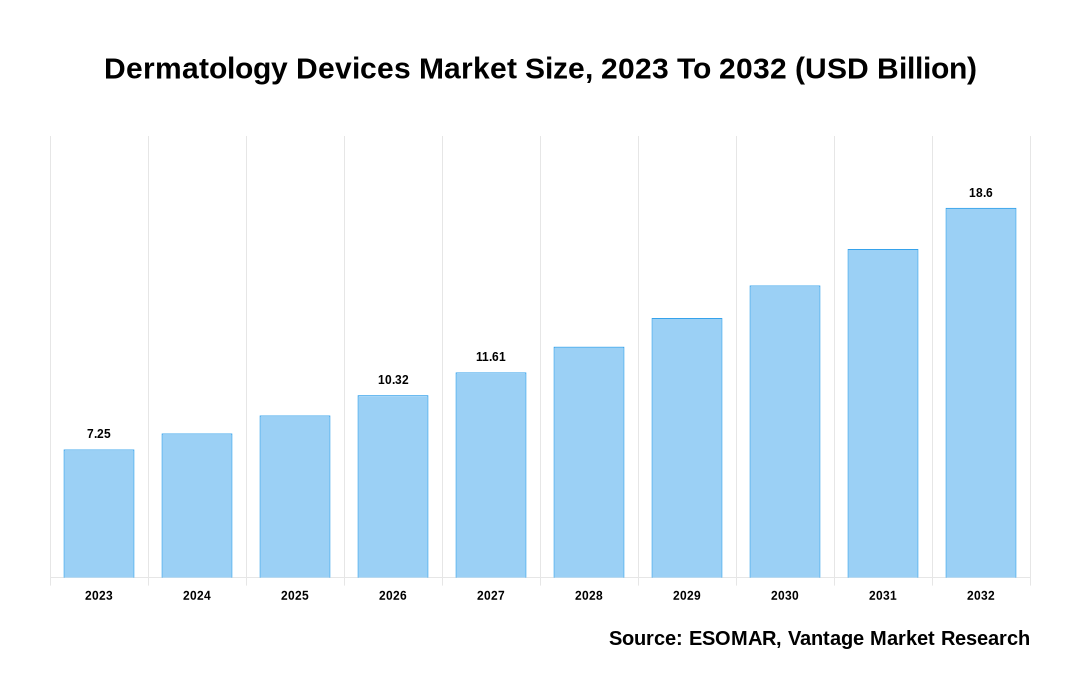

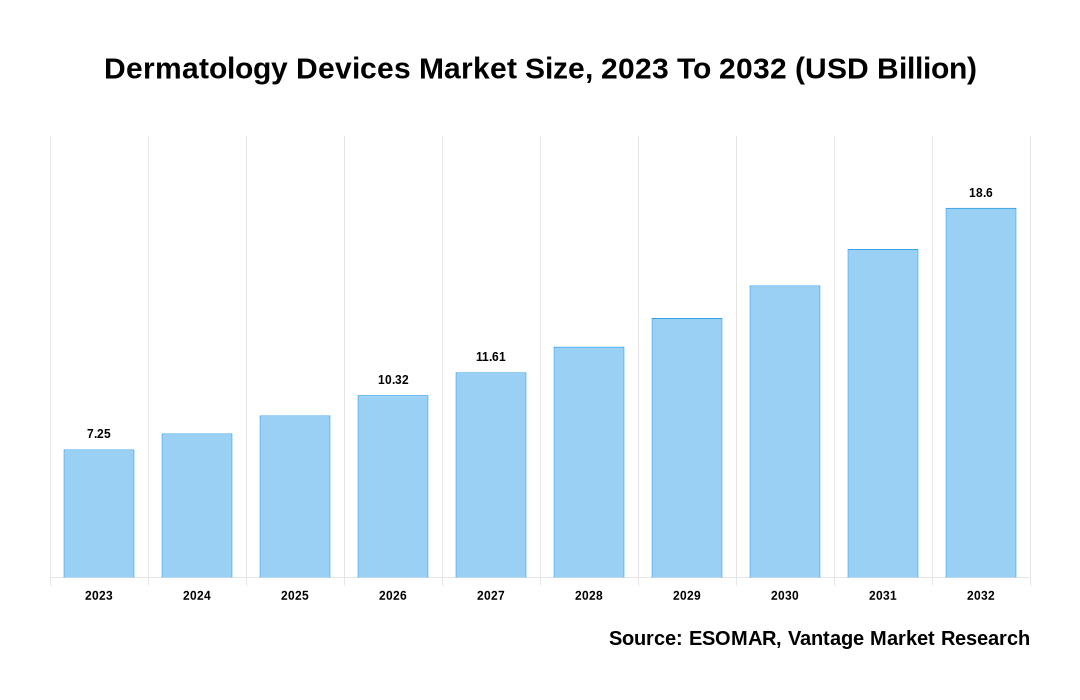

The global Dermatology Devices Market is valued at USD 7.25 Billion in 2023 and is projected to reach a value of USD 18.6 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 12.5% between 2024 and 2032.

Key highlights of Dermatology Devices Market

- The North America dominated the market in 2023, obtaining the largest revenue share of 42.2%,

- In 2023, the Asia Pacific region had a substantial market share and will witness remarkable growth with a CAGR during the forecast period,

- The Treatment Devices segment dominated the Dermatology Devices market with the largest market share of 80.02% in 2023,

- Hair Removal segment dominated the market with a significant market share in 2023,

- Advancements in technology, such as the development of minimally invasive and non-invasive procedures, further contribute to market expansion supported by patients’ inclination towards safer and more effective treatment options.

Dermatology Devices Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Dermatology Devices Market

Dermatology Devices Market: Regional Overview

North America Dominated Sales with a 42.2% share in 2023. The increasing prevalence of skin cancer, acne, rosacea, and eczema, combined with the expanding use of cosmetic procedures, are the main factors driving the Dermatology Devices market in North America. For instance, with the growing frequency of skin disorders and corresponding demand for dermatological equipment, an estimated 99,780 new cases of skin cancer were projected for 2022 in the United States alone. Innovations in medical technology, such as Lancer Skincare's Pro Polish Microdermabrasion Device, are driving the industry further. Companies are concentrating on providing efficient, cost-effective patient care. Similarly, new approved treatment alternatives, such as AbbVie Inc.'s JUVÉDERM VOLUMA XC for chin augmentation, further stimulate market growth. The Dermatology Devices market is expected to be driven by these advances, which are characterized by improved features and greater uses for skin diseases.

U.S. Dermatology Devices Market Overview

The US Dermatology Devices market, valued at USD 2.22 Billion in 2023 to USD 5.77 Billion in 2032, is anticipated to grow at a CAGR of 11.01% from 2024 to 2032. The U.S. Dermatology Devices market presents a dynamic landscape fueled by technological innovations and a rising need for advanced skincare solutions. This growth is propelled by a heightened focus on aesthetics and wellness alongside escalating concerns regarding skin disorders, with key drivers including the prevalence of skin cancer, advancements in laser technology, and a growing elderly population. The surge in minimally invasive procedures further amplifies the demand for devices like lasers, microdermabrasion equipment, and dermatoscopy. The COVID-19 pandemic has also accelerated market growth by adopting telemedicine and digital health solutions, underscoring the necessity for remote diagnosis and treatment options. Despite these opportunities, regulatory hurdles, reimbursement challenges, and the high costs associated with dermatological procedures pose significant barriers to market expansion. However, strategic collaborations, mergers, acquisitions, and ongoing research and development efforts are poised to sustain the market's growth momentum.

The global Dermatology Devices market can be categorized as Type, Application, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Dermatology Devices Market: Type Overview

In 2023, the Treatment Devices segment dominated the market with the largest share, accounting for 80.02%. The Dermatology Devices market, segmented by the Type, includes Diagnostics Devices (Imaging Devices, Dermatoscopes, Microscopes) and Treatment Devices (Light Therapy Devices, Lasers, Liposuction devices, Microdermabrasion devices, Cryotherapy devices, Electrosurgical equipment). In 2023, the Treatment Devices segment emerged as the market leader primarily due to its extensive applications in dermatological treatment. The advent of cutting-edge technology, especially in the laser device category, further fuels this lead. Nonetheless, growth in this market is anticipated to be driven by the predicted increase in the prevalence of skin cancer. Due to their broad acceptance, lasers are expected to grow fastest during the forecast period and hold the greatest market share in 2023.

Dermatology Devices Market: Application Overview

In 2023, significant revenue was generated by Dermatology Devices for Hair Removal. The Application segment is divided into Diagnostics Devices (Skin Cancer Diagnosis, Other Diagnostics Applications) and Treatment Devices (Hair removal, Psoriasis and Tattoo removal, Skin rejuvenation, Acne, Warts, Vascular and Pigmented Lesion removal and Weight management, Skin tags, Wrinkle removal and Skin resurfacing, Body contouring and Fat removal, Others Treatment Applications). The hair removal application segment, anticipated to flourish in the forecast period, encompasses various treatments, including skin rejuvenation, acne, psoriasis, wrinkle removal, tattoo removal, body contouring, and fat removal. Laser devices within this segment have demonstrated safety across diverse skin tones and hair colors, reducing treatment discomfort and propelling market expansion. Moreover, the escalating demand for cosmetic laser treatments, spanning skin resurfacing, tightening, and tattoo removal, underscores the increased adoption of dermatology devices. This surge in demand is reflected globally, with a notable uptick in cosmetic procedures reported by plastic surgeons, indicating a growing preference for aesthetic treatments in developing and developed nations. As technologically advanced and efficient dermatology devices become more widely adopted across regions, the market is poised for further growth. For instance, as per data from the International Society of Aesthetic Plastic Surgery, plastic surgeons across the globe have observed a notable uptick in the volume of procedures conducted in 2022. The statistics indicate an 11.2% increase in total procedures, encompassing over 14.9 million surgical and 18.8 million non-surgical procedures.

Key Trends

- There is a growing adoption of telemedicine in dermatology post-COVID-19. Technologies like high-resolution cameras for virtual skin examinations and remote diagnostic instruments have increased the incidence of virtual consultations and remote monitoring, leading to a demand for dermatology devices that facilitate telehealth initiatives.

- There is an increasing preference in consumers for minimally invasive dermatological procedures that offer effective results with minimal time and discomfort. Devices supporting procedures like microdermabrasion, chemical peels, and microneedling are in high demand as they address a wide range of cosmetic concerns with less risk and shorter recovery times than invasive surgical procedures.

- There is a growing trend towards home-use dermatology devices that allow individuals to address skincare concerns in the comfort of their own homes. These devices, which provide ease and accessibility to customers looking for professional-grade skincare solutions outside of clinical settings, range from handheld LED masks for acne treatment to at-home laser hair removal equipment.

Premium Insights

The growing awareness of the early skin problem identification and skin health enhances demand for dermatological devices, propelling market expansion. The need for novel devices specifically designed to address age-related skin issues is being driven by the notable increase in the demand for aesthetic procedures among the senior population. The market for Dermatology Devices is significantly shaped by the spread of social media platforms and the globalization of beauty standards. Global demand for dermatological treatments and devices is driven by people's increased desire for perfect skin and youthful appearance as beauty standards become more consistent across regions. Furthermore, the COVID-19 epidemic has prompted the creation of novel dermatology technologies that facilitate virtual patient treatment and monitoring, accelerating the use of telemedicine and remote consultations.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Rising adoption of aesthetic procedures among the aging population

A growing number of older people, especially those 65 years of age and older, are undergoing dermatological operations for cosmetic purposes. This has been driven by a variety of purposes, including as the need to look young, increase confidence, and remain competitive. The increasing acceptance of cosmetic operations and the development of dermatological technology have led to an increased interest in skin rejuvenation therapies, injectables, and laser treatments among older persons. As a result, there is an increasing need for dermatology devices designed specifically to cater to the needs of this demographic.

Dermatological procedures offer cosmetic benefits, but they also are associated with inherent risks and potential complications

Clinical risks and difficulties related to procedures in dermatology may include adverse reactions to treatment, infections, scarring, pigmentation changes, and in rare cases, severe allergic reactions or tissue damage. Furthermore, the results of dermatological procedures can differ depending on the patient's skin type, any pre-existing medical issues, and the dermatologist's expertise. The market for Dermatology Devices may be impacted as consumers and professionals balance the possible advantages of cosmetic procedures against the possible hazards due to concerns about these risks.

There is a shift of consumers towards minimally invasive and non-invasive dermatological procedures due to its advantages

Minimally invasive and non-invasive dermatological procedures offer several benefits over traditional surgical methods, including faster recovery times, a lower risk of problems, and less discomfort during treatment. Furthermore, a wider range of patients consider minimally invasive procedures appealing since they frequently yield results that look natural and leave minimal scars. Due to this, there is an increasing need for dermatological technologies, such as lasers, microdermabrasion systems, and energy-based skin-rejuvenation devices, that facilitate these minimally invasive procedures. Businesses that can lead the way in this area will benefit from the growing demand for less intrusive cosmetic procedures.

Competitive Landscape

The competitive landscape of the Dermatology Devices market is characterized by key companies, including DermaSensor Inc., continuously advancing technology to enhance skin cancer detection with FDA-cleared real-time, non-invasive evaluation systems, empowering primary care physicians to offer efficient point-of-care testing. Alongside established players, emerging companies focus on specialized niches, driving competition and spurring innovation across various dermatological applications, from diagnostic tools to therapeutic devices. As the market evolves, regulatory approvals, technological advancements, and strategic collaborations will shape the competitive dynamics, influencing the landscape's trajectory and the accessibility of advanced dermatological care.

The key players in the global Dermatology Devices market include - Alma Lasers Ltd. (Israel), Cutera Inc. (U.S.), Cynosure Inc. (U.S.), El. En. S.P.A. (Italy), Lumenis Ltd. (Israel), Solta Medical (U.S.), Candela Corporation (U.S.), Genesis Biosystems Inc. (U.S.), HEINE Optotechnik GmbH & Co. KG (Germany), PhotoMedex Inc. (U.S.), Leica Microsystems (Germany), FotoFinder Systems GmbH (Germany), Canfield Scientific Inc. (U.S.), Beijing Toplaser Technology Co. Ltd. (China), DermLite (U.S.), Aerolase (U.S.) among others.

Recent Market Developments

- In January 2024, DermaSensor Inc. revealed its real-time, non-invasive system for evaluating skin cancer and received clearance from the FDA. This marks a significant milestone as it enables all 300,000 primary care physicians in the U.S. to access quantitative, point-of-care testing for various forms of skin cancer. The aim is to enhance skin cancer identification in primary care settings, thereby expediting patients' access to essential care.

- In 2023, Canfield Scientific announced the 25th World Congress of Dermatology, which took place at the Suntec Singapore Convention & Exhibition Centre from July 4 to 7. The congress included live demonstrations of Canfield Scientific's most recent and cutting-edge dermatology tools and products, including VEOS, IntelliStudio, DermaGraphix, and VECTRA WB360.

- In April 2023, Canfield Scientific received certification for its quality management system to ISO 9001:2015 and ISO 13485:2016 standards.

- In February 2023, Health Canada has licensed and made available the dual-wavelength Frax Pro non-ablative fractional laser platform and the Nordlys multi-application platform with Selective Waveband Technology (SWT) by Candela Corporation, a global manufacturer of medical aesthetic devices.

- In May 2022, Cynosure, LLC, a Leading medical aesthetics systems and solutions provider, announced a $60 million fresh investment from principal investor Clayton, Dubilier & Rice today. The additional funding bolsters the company's intentions to keep investing ahead of rapid expansion to provide novel products to the market and offer its clients all-inclusive treatment programs with the best possible clinical outcomes.

- In March 2022, through a partnership with Laserplast, The Vascular Birthmarks Foundation, and Dr. Giacomo Colletti, Candela provided free laser treatments in Milan to over thirty pre-qualified patients from thirteen different nations.

FAQ

Frequently Asked Question

What is the global demand for Dermatology Devices in terms of revenue?

-

The global Dermatology Devices valued at USD 7.25 Billion in 2023 and is expected to reach USD 18.6 Billion in 2032 growing at a CAGR of 12.5%.

Which are the prominent players in the market?

-

The prominent players in the market are Alma Lasers Ltd. (Israel), Cutera Inc. (U.S.), Cynosure Inc. (U.S.), El. En. S.P.A. (Italy), Lumenis Ltd. (Israel), Solta Medical (U.S.), Candela Corporation (U.S.), Genesis Biosystems Inc. (U.S.), HEINE Optotechnik GmbH & Co. KG (Germany), PhotoMedex Inc. (U.S.), Leica Microsystems (Germany), FotoFinder Systems GmbH (Germany), Canfield Scientific Inc. (U.S.), Beijing Toplaser Technology Co. Ltd. (China), DermLite (U.S.), Aerolase (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 12.5% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Dermatology Devices include

- Rising Incidence of Skin disorders

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Dermatology Devices in 2023.

Vantage Market

Research | 03-May-2024

Vantage Market

Research | 03-May-2024