Dental Insurance Market

Dental Insurance Market - Global Industry Assessment & Forecast

Segments Covered

By Coverage Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, Other Coverage

By Type Major, Basic, Preventive

By Deographics Senior Citizens, Adults, Minors

By End User Individuals, Corporates

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 155.9 Billion | |

| USD 372.4 Billion | |

| 11.5% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

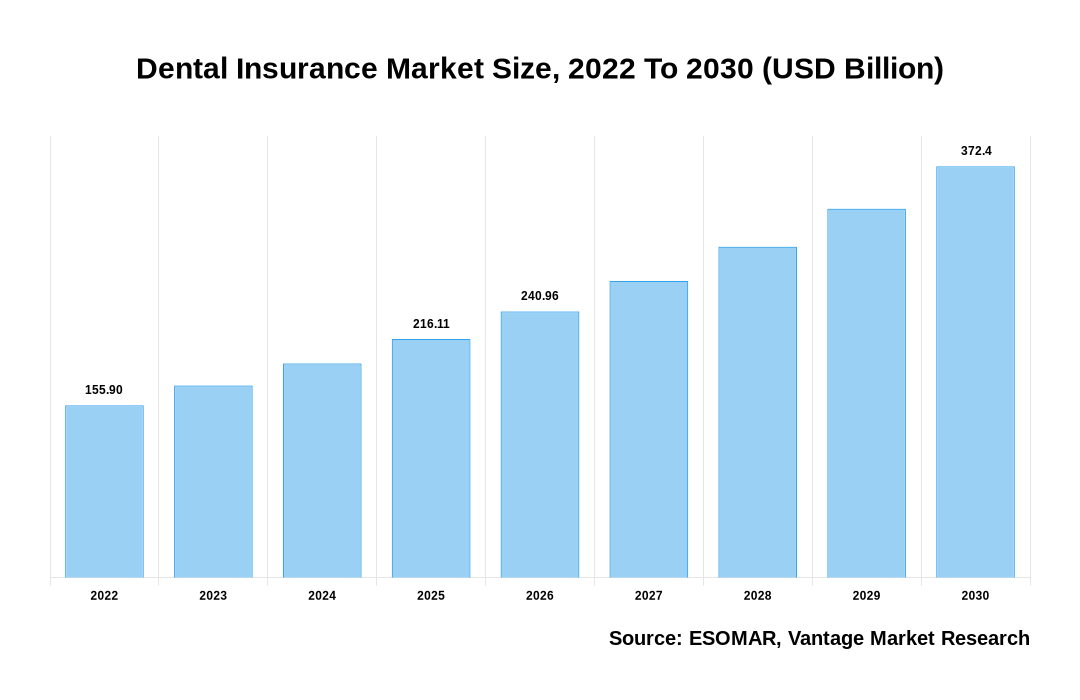

The global Dental Insurance Market is valued at USD 155.9 Billion in 2022 and is projected to reach a value of USD 372.4 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 11.5% between 2023 and 2030.

Premium Insights

The Dental Insurance market is driven by the growing worldwide population's awareness of oral health and the growing prevalence of dental problems. Accessible dental care is necessary, as evidenced by the fact that 42% of American people did not visit a dentist in 2020 because of financial worries, according to data from the American Dental Association (ADA). The increasing trend of preventative dental care, where people seek out routine cleanings and checkups to stave off more serious tooth issues, further characterizes this industry. Furthermore, since many people delayed regular dental treatments due to the COVID-19 pandemic, there may have been an increase in the need for treatment, underscoring the significance of Dental Insurance. Government initiatives that support dental coverage, like Medicaid expansion in some states, have an impact on the market as well since they increase the accessibility of Dental Insurance for low-income groups. In conclusion, the market for Dental Insurance is driven by government initiatives to expand coverage, a growing desire for accessible oral healthcare, and a tendency toward preventative dentistry.

Dental Insurance Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Dental Insurance Market

- The increasing awareness of the importance of oral health in overall well-being is a significant driver for the Dental Insurance market throughout the forecast period 2023 to 2030.

- The dental preferred provider organizations segment will continue to assert its dominance by coverage, capturing the largest market share globally throughout the forecast period 2023 to 2030.

- In 2022, North America exhibited its market prowess, achieving the highest revenue share of over 40.9%.

- The Asia Pacific region is poised for remarkable growth, displaying a noteworthy Compound Annual Growth Rate (CAGR) between 2023 and 2030.

Top Market Trends

- Integration of digital technologies and tele-dentistry is a notable ongoing development in the Dental Insurance business. Thanks to technological advancements, patients can now consult with dentists at a distance, improving access to care. The COVID-19 initiative has sped up this trend by encouraging a move toward digital record-keeping and virtual consultations, which make dental services more practical and effective for both patients and providers.

- To lower long-term expenses, Dental Insurance companies are putting more and more emphasis on preventive treatment practices. This entails providing incentives for routine examinations, cleanings, and early treatment of dental problems. The goal is to identify issues early on and act, which will ultimately improve oral health outcomes and reduce treatment costs.

- One noteworthy development in Dental Insurance is the shift to customized policies. Providers are realizing that one-size-fits-all strategies might not meet their customers' varied needs. As a result, they are providing greater personalization choices, enabling customers to select coverage that satisfies both their financial needs and unique oral health needs. In the Dental Insurance industry, this trend improves client retention and satisfaction.

Report Coverage & Deliverables

Get Access Now

Economic Insights

Economic insights have had a considerable impact on the Dental Insurance business, especially considering the COVID-19 pandemic. The American Dentistry Association (ADA) said that the pandemic caused a significant slowdown in the dentistry business, with dental spending projected to have decreased by 38% in 2020. The temporary closure of dental offices and patients postponing non-emergency procedures to lower the risk of virus transmission were the main causes of this dramatic decline. Positive effects have also occurred, too, since the epidemic highlighted the value of easily accessible dental coverage and sparked a rise in interest in Dental Insurance. The market is anticipated to increase as the economy gradually improves, propelled by the increasing awareness of the significance of oral health for general well-being and the necessity of having savings for unforeseen dental costs. This economic analysis shows how resilient the market is to setbacks and how much room there is for expansion as more people look for all-inclusive Dental Insurance in the wake of the pandemic.

Market Segmentation

The Global Dental Insurance Market is segregated into the segments as mentioned below:

The global Dental Insurance market can be categorized into Coverage, Type, Deographics, End User, Region. The Dental Insurance market can be categorized into Dental Preferred Provider Organizations (DPPO), Dental Health Maintenance Organizations (DHMO), Dental Indemnity Plans, Other Coverage based on Coverage. The Dental Insurance market can be categorized into Major, Basic, Preventive based on Type. The Dental Insurance market can be categorized into Senior Citizens, Adults, Minors based on Deographics. The Dental Insurance market can be categorized into Individuals, Corporates based on End User. The Dental Insurance market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Coverage

DPPO to Dominate in Terms of Value owing to a Valuable Cost-Benefit Ratio

Dental Preferred Provider Organizations (DPPO) are the most popular and well-liked Dental Insurance product on the market. There are various reasons why DPPOs are favored. First, they provide a cost-benefit ratio, enabling policyholders to see dentists in the network at a reduced cost while still having the option to see providers outside of the network. Customers who wish to keep their current dentist of choice place high importance on this flexibility. Second, patients seeking specialty dental treatments can expedite the process as DPPOs usually do not require referrals for specialist care. Furthermore, DPPOs provide policyholders with extensive alternatives because they frequently cover a broad range of dental services, including major, basic, and preventative operations. Overall, DPPOs are the go-to option for many people looking for Dental Insurance due to their adaptability, size, and coverage range.

Based on Type

Preventive Dental Insurance to Accommodate Wider Market Stance due to Increased Intervention and Maintenance Qualities

In 2022, preventive Dental Insurance is the most often utilized alternative for Dental Insurance coverage. Its emphasis on early intervention and maintaining good dental health is largely to blame for this. Preventive Dental Insurance usually includes regular cleanings, exams, and basic preventive care, including fluoride treatments and X-rays. Many people choose this coverage because they understand how important preventive care is to avert more serious dental problems in the future. A wider range of people can also afford preventive dentistry insurance because it is frequently less expensive than policies that only cover minor and major operations. It thus becomes the go-to option for people who want to emphasize routine dental checkups and preventative oral health care, which eventually helps explain its dominance in the Dental Insurance industry.

Based on Demographics

Adults to Provide the Most Value to the Market Owing to Increasing Inclination Towards Insurance Coverage

In 2022, adult Dental Insurance solutions are the most popular among the options available in the market. The main reason for this is that adults—especially those who are working age—generally have more freedom to choose their insurance plans and are more inclined to look for dental coverage on their own. Adults are more likely to get dental problems. Hence, insurance is practically required. Furthermore, adult-focused Dental Insurance plans fully cover the broader spectrum of dental services that adults frequently need, such as major, basic, and preventive procedures. Adult Dental Insurance products dominate the market because adults are more likely to have individual or employer-sponsored plans than minors, who may also need dental coverage but are often covered by family plans, Medicaid, or senior-specific Dental Insurance.

Based on End User

Corporate Dental Insurance to be Sold Rapidly Owing to Increasing Indulgence in Employee Benefit Package

In 2022, corporate Dental Insurance plans were the most popular choice accessible in the Dental Insurance industry. The main reason for this is that dental treatment is frequently included in employee benefit packages offered by businesses. People are very interested in these plans since they provide an affordable way to get full dental care. Insurance providers are negotiated group pricing by corporations, which lowers employee premiums. Furthermore, corporate dental plans are practical and can involve little to no employee investment. Because it serves a sizable segment of the working population and plays a key role in boosting employees' oral health and well-being, which raises job satisfaction and productivity, corporate-driven usage dominates the market.

Based on Region

North American Population to Buy the Maximum Dental Insurance due to Supportive Infrastructure

The United States and Canada together make up the North American area, which is leading in several fields, including innovation, technology, and economy. Its political stability, sophisticated infrastructure, mature financial markets, and entrepreneurial-friendly culture all contribute to its dominance. Furthermore, the workforce in North America is highly educated, which promotes creativity and global competitiveness. The existence of top global firms and easy access to a wealth of resources further cements its supremacy.

However, several factors are causing the Asia Pacific area to grow rapidly. Its middle class is growing, which propels consumer spending and economic growth. Furthermore, nations like China and India have embraced industrialization and technical breakthroughs, emerging as significant players in the world's manufacturing and technology industries. This region is positioned as a dynamic force in the global economy thanks to its strong economic growth, which is also being driven by rising foreign direct investment and an emphasis on education and skill development.

Competitive Landscape

There is a mix of more recent entrants and well-established insurers in the competitive Dental Insurance market. Prominent entities like UnitedHealth Group, MetLife Dental, and Delta Dental maintain a substantial portion of the industry due to their wide-ranging provider networks and varied product lines. But more recent digital-focused businesses like SmileDirectClub and Beam Dental are upending the industry with creative strategies and effective use of technology. Some regional players serve geographic markets. The competitive diversity in the Dental Insurance market offers consumers a variety of options, spurring innovation, and customer-focused strategies.

The key players in the global Dental Insurance market include - Allianz (Germany), HDFC ERGO Health Insurance Ltd. (Apollo Munich) (India), Metlife Services and Solutions LLC (U.S.), CIGNA (U.S.), AFLAC Inc. (U.S.), United Healthcare Services Inc. (U.S.), Delta Dental Plans Association (U.S.), AXA (France), AETNA Inc. (U.S.), AMERITAS (U.S.) among others.

Recent Market Developments

- To offer health coverage everywhere, Bajaj Allianz and Allianz Partners launched Global Health Care in June 2022. One of the broadest Sum Insured ranges on the Indian market, ranging from USD 100,000 to USD 1,000,000, is provided by the Global Health Care product. There are two plans for the product: the "Imperial Plan" and the "Imperial Plus Plan," which provide both domestic and international coverage.

- Aetna will start selling Medicare Advantage Prescription Drug (MAPD) plans in 46 states in January 2022. Aetna has expanded into 83 more counties, giving an extra 1 million Medicare enrollees access to its plans. In all, 53.2 million Medicare beneficiaries will be able to access MAPD plans in 1,875 counties by 2022.

Segmentation of the Global Dental Insurance Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Coverage

By Type

By Deographics

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Dental Insurance in terms of revenue?

-

The global Dental Insurance valued at USD 155.9 Billion in 2022 and is expected to reach USD 372.4 Billion in 2030 growing at a CAGR of 11.5%.

Which are the prominent players in the market?

-

The prominent players in the market are Allianz (Germany), HDFC ERGO Health Insurance Ltd. (Apollo Munich) (India), Metlife Services and Solutions LLC (U.S.), CIGNA (U.S.), AFLAC Inc. (U.S.), United Healthcare Services Inc. (U.S.), Delta Dental Plans Association (U.S.), AXA (France), AETNA Inc. (U.S.), AMERITAS (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 11.5% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Dental Insurance include

- Increase in awareness about oral hygiene

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Dental Insurance in 2022.

Vantage Market

Research | 29-Jan-2024

Vantage Market

Research | 29-Jan-2024