Cyber Insurance Market

Cyber Insurance Market - Global Industry Assessment & Forecast

Segments Covered

By Organization Size Size Large Companies, Small & Medium-sized Companies

By Industry Vertical BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Manufacturing, Government & Public Sector, Others

By Component Cybersecurity Insurance Analytics Platform, Disaster Recovery and Business Continuity, Cybersecurity Solution, Consulting/ Advisory, Security Awareness Training, Others

By Insurance Coverage Data Breach, Cyber Security liability

By Insurance Type Packed, Stand Alone

By Region North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 8.73 billion | |

| USD 51.04 billion | |

| 24.70% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

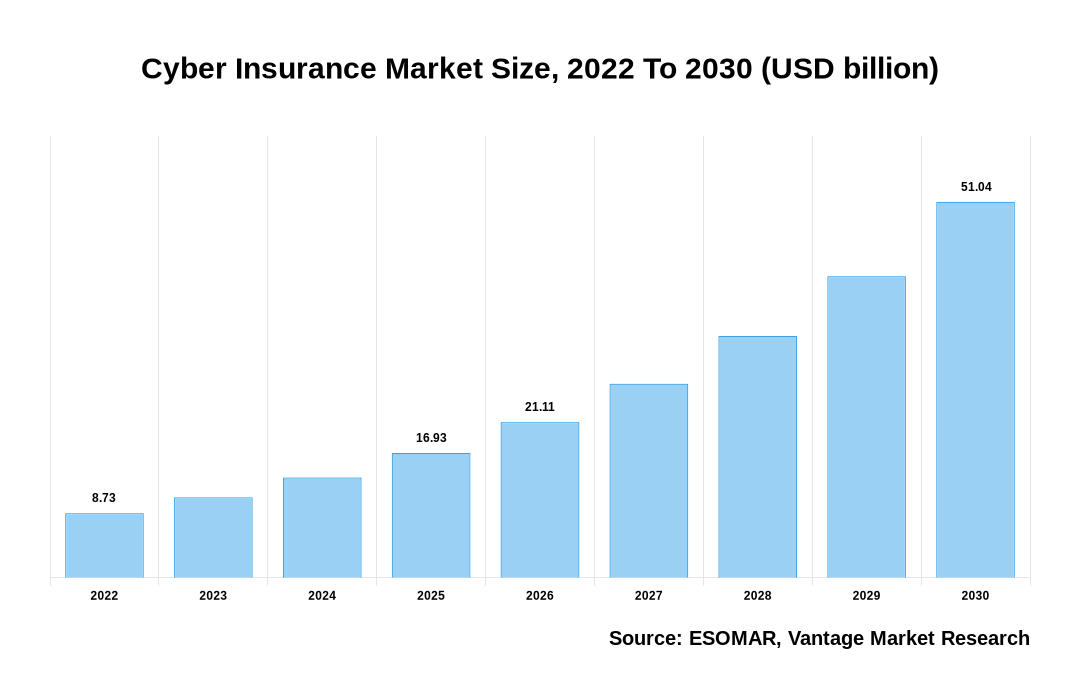

The Global Cyber Insurance Market is valued at USD 8.73 billion in 2022 and is projected to reach a value of USD 51.04 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 24.70% over the forecast period.

Cyber Insurance is intended to assist an organization in the event of a cyber-related security breach or similar event. It provides coverages for both first-party and third-party claims in order to reduce risk exposure by offsetting costs associated with the recovery of internet-based cyber losses. It typically includes losses resulting from network security breaches, loss of privacy, and indemnification from data breach-related lawsuits, among other things. These attacks have become more intense and frequent, posing a threat to individuals, organization, and countries, driving the adoption of Cyber Insurance solutions. Cyber-attacks have a negative impact on businesses, including decreased customer base, business disruption, regulatory fines, legal penalties and attorney fees, intellectual property loss, and reputational damage.

The increased adoption of Cyber Insurance products as a result of the increased implications of cyber-attacks on public safety, economic prosperity, and government cyber security has resulted in significant growth in the Cyber Insurance Market in recent years. Furthermore, increased awareness of business interruption (BI) cyber risks, as well as a growing number of mandatory data security legislations in various end-user industries such as banking, healthcare, and others, are some of the major factors driving the Cyber Insurance Market growth.

Cyber Insurance Market Size, 2022 To 2030 (USD billion)

AI (GPT) is here !!! Ask questions about Cyber Insurance Market

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Market Segmentation:

The Cyber Insurance Market is segmented on the basis of Company size and Industry vertical. On the basis of Company size, the market is divided into Large Companies and Small & Medium-sized Companies. On the Basis of industry vertical, the market is divided into BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Manufacturing, Government & Public Sector and Others.

Based on Company Size

On the basis of Company size, the market is divided into Large Companies and Small & Medium-sized Companies. Because of the rising number of cyberattacks and significant data breaches, large businesses are projected to dominate the market. To secure the safety of their clients' and organizations' data, huge corporations are heavily investing in risk management solutions. During the projection period, small and medium businesses are expected to grow at a high rate. Small businesses are the new target of hackers; thus, they are eager to invest in cybersecurity insurance solutions. Small and medium business insurance is being offered by a number of major providers.

Based on Industry Vertical

Based on industry vertical, the market is segmented into BFSI, IT & Telecom, Retail & E-commerce, Healthcare, Manufacturing, Government & Public Sector and Others. During the forecast period, BFSI is expected to obtain the most segment share. The cyber security risk is likely to rise as a result of fast digitization, more customer personal data, and use of mobile applications and internet banking. Because of the large amount of client data, the banking sector is likely to be a tempting target for hackers This is anticipated to increase demand for cyber security insurance in the financial services industry. Similarly, the retail sector is expected to gain significant market share over the forecast period. Insurance policy adoption aids shops in obtaining client trust and expanding their business. As a result of the growing number of cyber-attacks on patient data, the healthcare industry is expected to rise quickly. This is likely to increase insurance demand in the healthcare sector.

North America Region Dominates the Cyber Insurance Market with the Largest Share

During the forecast period, North America will hold the largest share of the market with a market share of 43.90%. The region's cybersecurity insurance demand is likely to be driven by rising cyberattacks and the high risk of data loss. The United States is expected to experience rapid growth as a result of the country's strong government regulation and strict cybersecurity policy. Furthermore, the country's significant presence of key Cyber Insurance companies is likely to fuel its growth. Increased cyber- attacks and a high risk of data loss are expected to stoke demand for cyber security insurance in the region.

Competitive Landscape:

Key players operating in the Global Cyber Insurance Market include Allianz, American International Group, Inc., Aon plc, AXA, Berkshire Hathway Inc., Lloyd’s of London Ltd., Lockton Companies Inc., Munich Re, The Chubb Corporation, Zurich.

Segmentation of the Global Cyber Insurance Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Organization Size Size

By Industry Vertical

By Component

By Insurance Coverage

By Insurance Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Cyber Insurance in terms of revenue?

-

The global Cyber Insurance valued at USD 8.73 billion in 2022 and is expected to reach USD 51.04 billion in 2030 growing at a CAGR of 24.70%.

Which are the prominent players in the market?

-

The prominent players in the market are Allianz, American International Group, Inc., Aon plc, AXA, Berkshire Hathway Inc., Lloyd’s of London Ltd., Lockton Companies Inc., Munich Re, The Chubb Corporation, Zurich.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 24.70% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Cyber Insurance include

- Growth in cyber-attacks

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Cyber Insurance in 2022.

Vantage Market

Research | 14-Apr-2022

Vantage Market

Research | 14-Apr-2022