Crop Protection Chemicals Market

Crop Protection Chemicals Market - Global Industry Assessment & Forecast

Segments Covered

By Type Herbicides, Insecticides, Fungicides, Disinfectants, Fumigants, Others (Rodenticides, Disinfectants, Fumigants, Plant Growth Regulators, and Mineral Oils)

By Source Natural, Biopesticide

By Form Dry, Liquid

By Application Foliar Spray, Seed Treatment, Soil Treatment, Others (Chemigation and Fumigation)

By Crop Type Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crops (Turfs & Ornamentals, Forage, and Plantation Crops)

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 64.64 Billion | |

| USD 79.37 Billion | |

| 2.60% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Global Crop Protection Chemicals Market

Crop Protection Chemicals Market- By Type, Source, Form, Application, Crop Type, and Region.

Market Synopsis:

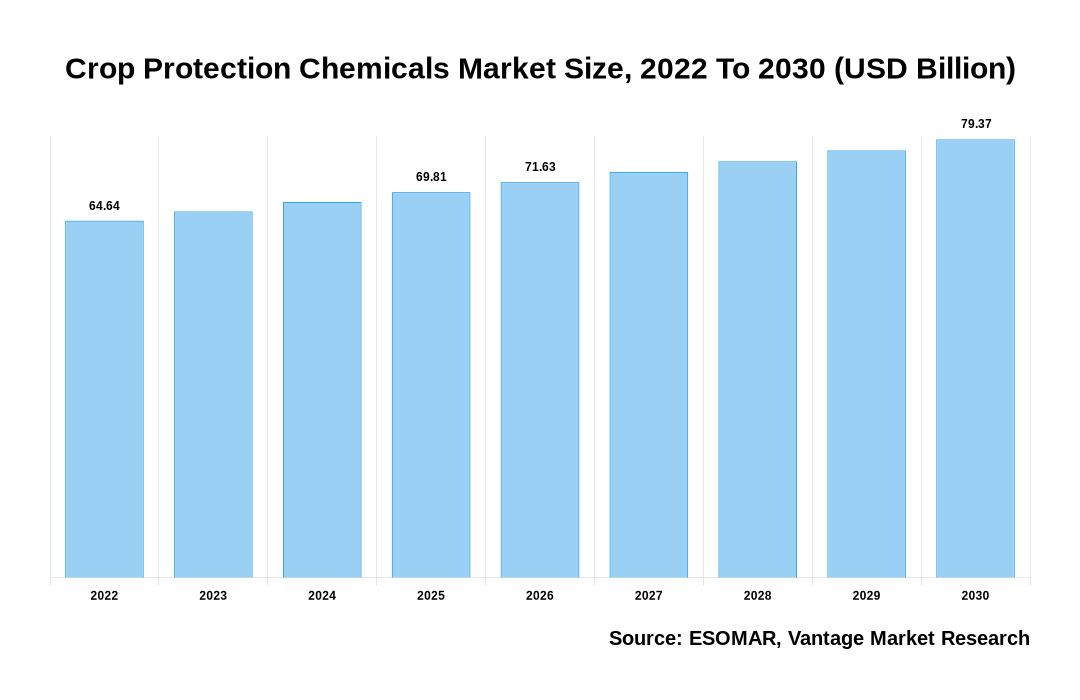

The Global Crop Protection Chemicals Market is valued at USD 64.64 Billion in the year 2022 and is projected to reach a value of USD 79.37 Billion by the year 2030. The Global Market is anticipated to grow exhibiting a Compound Annual Growth Rate (CAGR) of 2.60% over the forecast period.

Crop Protection Chemicals Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Crop Protection Chemicals Market

Crop Protection Chemicals are a low-cost option for farmers to improve the yield and quality of their crops. They also make harvesting easier and ensure that harvests are constant from year to year. Insecticides, herbicides, and fungicides are the three main types of crop protection agents. Selective herbicides, for example, prevent weeds from growing amid crops and competing with them for water, sunlight, and nutrients. Agriculture would be less efficient if Crop Protection Chemicals were not used. The major growth driver is a greater emphasis on high agricultural productivity to combat food security. In terms of regulatory interventions for safe farming and general farming culture and practices, the agricultural sector has made significant progress around the world. Growing food demand has prompted agrochemical-based companies to invest in research to improve their product and transition to greener alternatives. Companies have been seen commercializing bio-based chemicals derived from plant, mineral, bacterium, and animal sources.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Pesticides are persistent and have poisonous qualities, as well as bioaccumulation and lipophilicity, which can have negative effects on human health if taken. Due to the associated residual issues, there is growing concern about the same. Pesticides enter the human body through vegetables and fruits, resulting in serious health consequences such as neurological diseases, reproductive effects, birth defects, cancer, and more. Fruits and vegetables have been continuously monitored during production due to the linked and probable health dangers. Pesticides such as bifenthrin, glyphosates, and imidacloprid are among the pesticides detected in vegetables that reach consumers, influencing demand for crop protection chemicals.

Market Segmentation:

The Crop Protection Chemicals Market is segmented on the basis of Type, Source, Form, Mode of Application, and Crop Type. On the basis of Type, the market is segmented into Herbicides, Insecticides, Fungicides, and Others (rodenticides, disinfectants, fumigants, plant growth regulators, and mineral oils). On the basis of Source, the market is segmented into Natural and Biopesticide. On the basis of Form, the market is segmented into Dry and Liquid. On the basis of Mode of Application, the market is segmented into Foliar Spray, Seed Treatment, Soil Treatment, and Others (chemigation and fumigation). On the basis of Crop Type, the market is segmented into Cereals & grains, Oilseeds & pulses, Fruits & vegetables, and Other crops (turfs & ornamentals, forage, and plantation crops).

Based on Type:

On the basis of Type, Herbicides dominated the global market due to a labor shortage in many developing countries, including India and China, for mechanical weeding. The efficiency of herbicides over manual weeding methods is expected to drive market growth in the coming years. The Crop Protection Chemicals industry is growing due to the launch of new herbicide products with distinct features based on weed selectivity and crop emergence. Herbicides are being used increasingly frequently in agricultural production as the area under genetically modified crops develops in various regions.

Based on Crop Type:

On the basis of Crop Type, the cereals and grains business has seen rapid growth in recent years as a result of the increasing usage of Crop Protection Chemicals in cereal production. In addition, the expanding global population has led to a stronger focus on food security and high demand for crops, which has boosted the cereals segment's growth.

Asia Pacific Region Dominates the Crop Protection Chemicals Market with the Largest Share

Asia Pacific held the largest market share during the year 2021 with a share of 38.50%. Due to its enormous agricultural base, Asia-Pacific is the largest user of crop protection. Farmers in the region are gradually shifting toward the use of eco-friendly, natural insecticides and bio-insecticides as they become more aware of the impact of chemical pesticides on human health. As a result, the expansion of biopesticides has had an influence on the market for synthetic insecticides, particularly in developing nations like India and China.

The surge in demand for organic baby food is attributable to an increasing emphasis on the importance of organic products among the younger generation, as well as the growing number of women in the workforce and the increasing adoption of the health and wellness trend in China. Synthetic pesticides have been widely utilized in India to reduce crop losses caused by pests and illnesses. Higher demand for food grains, restricted arable land availability, rising exports, increase in horticulture and floriculture, and rising public awareness about pesticides and biopesticides are all driving the Indian Crop Protection Chemicals industry. Companies in Japan, on the other hand, place a high priority on conducting research and development, which is the backbone of the launch of new and enhanced pesticide products, raising demand for Crop Protection Chemicals throughout Asia.

Competitive Landscape:

The key players in the Global Crop Protection Chemicals Market include- BASF SE (Germany), The Dow Chemical Company (US), Dupont (US), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Bayer Cropscience AG (Germany), FMC Corporation (US), Nufarm Limited (Australia), Adama Agriclutural Solutions Ltd. (Israel), Verdesian Lifesciences (US), Bioworks Inc. (US), Valent US (US), Arysta Lifesciences Corporation (US), America Vanguard Corporation (US), Chr. Hansen (Denmark), Corteva Agriscience (US), UPL Limited (India), Jiangsu Yangnong Chemical Group Co Ltd (China), Agrolac (Spain), Lianyungang Liben Crop Science Co. Ltd. (HongKong), Nanjing Red Sun Co. Ltd. (China), Kumiai Chemicals (Japan), Wynca Chemical (China), Lier Chemicals (China), Simpcam Oxon (Italy) and others.

Segmentation of the Global Crop Protection Chemicals Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Source

By Form

By Application

By Crop Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Crop Protection Chemicals in terms of revenue?

-

The global Crop Protection Chemicals valued at USD 64.64 Billion in 2022 and is expected to reach USD 79.37 Billion in 2030 growing at a CAGR of 2.60%.

Which are the prominent players in the market?

-

The prominent players in the market are BASF SE (Germany), The Dow Chemical Company (US), Dupont (US), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Bayer Cropscience AG (Germany), FMC Corporation (US), Nufarm Limited (Australia), Adama Agriclutural Solutions Ltd. (Israel), Verdesian Lifesciences (US), Bioworks Inc. (US), Valent US (US), Arysta Lifesciences Corporation (US), America Vanguard Corporation (US), Chr. Hansen (Denmark), Corteva Agriscience (US), UPL Limited (India), Jiangsu Yangnong Chemical Group Co Ltd (China), Agrolac (Spain), Lianyungang Liben Crop Science Co. Ltd. (HongKong), Nanjing Red Sun Co. Ltd. (China), Kumiai Chemicals (Japan), Wynca Chemical (China), Lier Chemicals (China), Simpcam Oxon (Italy).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 2.60% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Crop Protection Chemicals include

- Increase in need for food security owing to the rise in population

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Crop Protection Chemicals in 2022.

Vantage Market

Research | 08-Jun-2022

Vantage Market

Research | 08-Jun-2022