Credit Card Payment Market

Credit Card Payment Market - Global Industry Assessment & Forecast

Segments Covered

By Card Type General Purpose Credit Cards, Specialty Credit Cards, Others

By Provider Visa, Mastercard, Others

By Application Food and Groceries, Health and Pharmacy, Restaurants and Bars, Consumer Electronics, Media and Entertainment, Travel and Tourism, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 510.87 Billion | |

| USD 884.36 Billion | |

| 7.10% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis

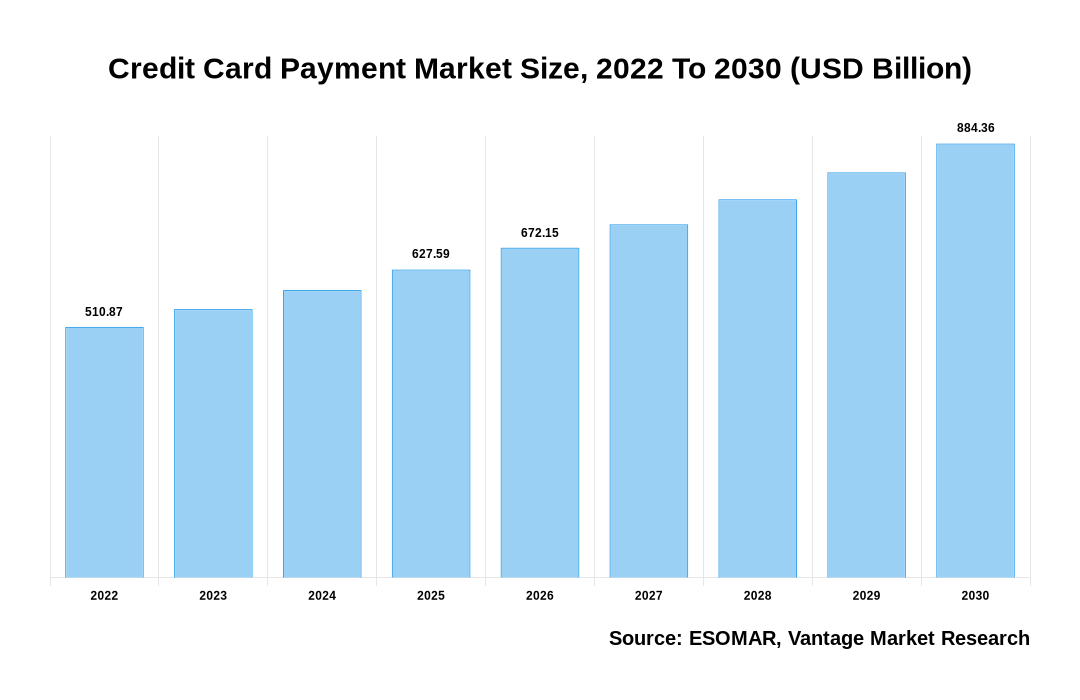

Global Credit Card Payment Market is valued at USD 510.87 Billion in 2022 and is projected to reach a value of USD 884.36 Billion by 2030 at a Compound Annual Growth Rate (CAGR) of 7.10% over the forecast period.

Credit Card Payment is a method of paying for goods and services using a plastic card instead of cash or checks. A credit card allows customers to pay for purchases without having to immediately provide their bank account details. This type of payment is popular among consumers who want to avoid the hassle of carrying large sums of money and waiting for days before receiving their funds.

The global market for Credit Card Payment systems has been witnessing significant growth over the past few years owing to increasing adoption of online transactions across various industries. This trend is expected to continue over the forecast period due to rising demand from e-commerce companies and other businesses that are adopting this mode of payment to increase their customer base. According to a Mastercard research report issued in 2020, 42% of Indians significantly improved their use of digital payment methods, which primarily comprise cashless and contactless credit cards, internet payments, and others, propelling the market's growth. Furthermore, in order to increase their market share in developing countries, many firms are giving valuable points, incentives, and cashbacks to their clients, which is propelling the expansion of the Credit Card Payments market. However, high cost associated with these solutions and lack of awareness among consumers regarding the benefits of using credit cards are some of the factors restraining the growth of the market over the forecast period.

| Parameter | Details |

|---|---|

| Segments Covered |

By Card Type

By Provider

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Credit Card Payment Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Credit Card Payment Market

Market Segmentation:

The Global Credit Card Payment Market is segmented by card type, provider, application, and region. By card type, the market is bifurcated as general- purpose credit cards, specialty credit cards, and others. On the basis of provider, the market is segmented as visa, Mastercard, and others. Based on application, the market is bifurcated into food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel and tourism, and others.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The general- purpose credit card is dominating the Credit Card Payment Market during the forecast period

General purpose credit cards are projected to maintain their dominance in the next years, since they offer a variety of exclusive incentives and perks, prompting many credit card users to switch to premium cards. The general-purpose cards can be used as debit cards in stores and for online payment deposits.

However, due to larger credit or spending restrictions granted by banks for these credit cards than for others, the specialty & other credit cards segment is predicted to increase the most. Furthermore, numerous firms are issuing customized credit cards to their employees in order to maintain track of employee spending on travel, stock or supply purchases, and other obligations, which is boosting the market's growth.

The North America region dominated the Credit Card Payment Market during the forecast period

North America accounted for the largest share of the Global Credit Card Payment Market nearly 32.90% in 2021 owing to the increasing use of credit cards for online purchases. In addition, the U.S. government’s initiative to promote digital payments through its Paycheck Protection Program is expected to drive the growth of the North American market. Furthermore, the increasing adoption of smartphones and tablets among consumers is likely to fuel the growth of the North America market. Asia Pacific is projected to witness a rapid growth rate during the forecast period. This can be attributed to the increasing adoption of smartphones in emerging economies such as India and China.

Competitive Landscape

Some of the major key players in the Credit Card Payment Market are American Express Company, Bank of America Corporation, Barclays PLC, Capital One Financial Corporation (Signet Financial Corporation), JPMorgan Chase & Co, Citigroup Inc., United Services Automobile Association, Mastercard Inc., The PNC Financial Services Group Inc., Synchrony, and Visa Inc.

Segmentation of the Global Credit Card Payment Market -

By Card Type -(Revenue- USD Million, 2016-2028)

- General Purpose Credit Cards

- Specialty Credit Cards

- Others

By Provider -(Revenue- USD Million, 2016-2028)

- Visa

- Mastercard

- Others

By Application -(Revenue- USD Million, 2016-2028)

- Food and Groceries

- Health and Pharmacy

- Restaurants and Bars

- Consumer Electronics

- Media and Entertainment

- Travel and Tourism

- Others

By Region- (Revenue- USD Million, 2016-2028)

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

FAQ

Frequently Asked Question

What is the global demand for Credit Card Payment in terms of revenue?

-

The global Credit Card Payment valued at USD 510.87 Billion in 2022 and is expected to reach USD 884.36 Billion in 2030 growing at a CAGR of 7.10%.

Which are the prominent players in the market?

-

The prominent players in the market are American Express Company, Bank of America Corporation, Barclays PLC, Capital One Financial Corporation (Signet Financial Corporation), Citigroup Inc., JPMorgan Chase & Co, Mastercard Inc., Synchrony, The PNC Financial Services Group Inc., United Services Automobile Association, Visa Inc..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.10% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Credit Card Payment include

- Rise in Demand for Credit Cards Among the Developing Nations

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Credit Card Payment in 2022.

Vantage Market

Research | 11-Apr-2022

Vantage Market

Research | 11-Apr-2022