Cosmetics Packaging Market

Cosmetics Packaging Market - Global Industry Assessment & Forecast

Segments Covered

By Type Bottles, Tubes, Jars, Containers, Blister & Strip Packs, Aerosol Cans, Folding Cartons, Flexible Plastics, Other Types (including Tins, Liquid Cartons, & Flexible Paper)

By Materials Glass, Metal, Paper-based, Rigid Plastic, Flexible Packaging

By Applications Skin Care, Hair Care, Color Cosmetic, Sun Care, Oral Care, Fragrances & Perfumes

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 51.2 Billion | |

| USD 68.74 Billion | |

| 4.3% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

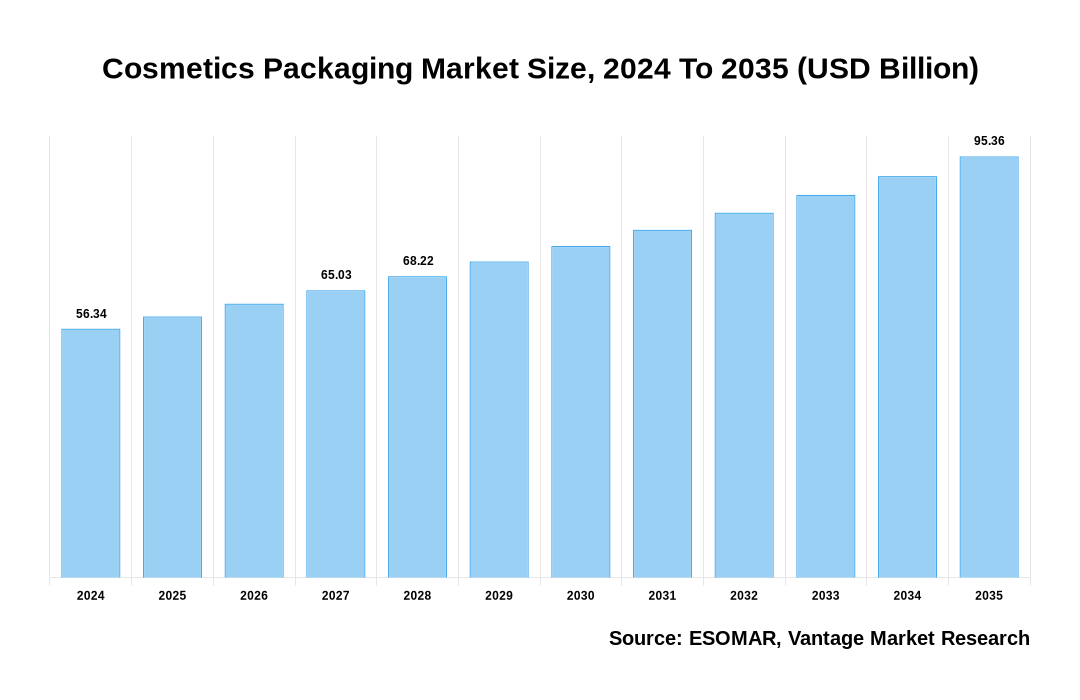

The global Cosmetics Packaging Market is valued at USD 51.2 Billion in 2022 and is projected to reach a value of USD 68.74 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 4.3% between 2023 and 2030.

Premium Insights

The Cosmetics Packaging market has experienced significant growth over the past few years, owing to increasing demand for cosmetics products, rising disposable incomes, and changing lifestyles and grooming habits. The packaging industry has also undergone various transformations as manufacturers focus on developing innovative and eco-friendly packaging solutions to cater to the changing needs of consumers.

Cosmetics Packaging Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Cosmetics Packaging Market

With the increasing popularity of beauty and grooming products, there is a growing demand for Cosmetics Packaging. Consumers now seek products that are easy to use, aesthetically pleasing, and functional. In addition, the increasing environmental concerns have also created a demand for eco-friendly packaging solutions. Manufacturers are now focusing on developing sustainable packaging solutions that help reduce waste and promote recycling.

Economic Insights

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The conflict between Russia and Ukraine can significantly impact the Cosmetics Packaging industry due to the potential disruption in the supply chain. Ukraine is a significant producer of plastic packaging materials, and any disruption in the supply of raw materials from Ukraine to other countries, such as Russia, can create supply chain problems. In addition, the sanctions imposed by Western countries on Russia can affect the trade of Cosmetics Packaging materials between Russia and other countries. The restrictions on exports and imports of products can limit the availability of packaging materials and increase their costs, leading to price hikes for cosmetics products.

Top Market Trends

- Sustainable and Eco-Friendly Packaging: The Cosmetics Packaging industry is shifting towards more sustainable and eco-friendly options to reduce its carbon footprint. For example, L'Oreal has launched a sustainable beauty brand, Seed Phytonutrients, which uses recyclable packaging made with post-consumer recycled materials. Another example is the brand "Ethique," which uses compostable and biodegradable packaging for personal care products.

- Personalized Packaging: Customized packaging is becoming increasingly popular as brands seek to create unique, personalized customer experiences. For example, the brand Glossier offers customers the option to customize their order with stickers and different types of packaging.

- Minimalist Packaging: Minimalist packaging is becoming more popular in the cosmetics industry as consumers seek simple, clean designs. For example, the brand "The Ordinary" uses minimalist packaging with simple white labels and black text, emphasizing the active ingredients in their products.

- Innovative Packaging: The Cosmetics Packaging industry continuously innovates to differentiate from competitors by providing unique and creative packaging solutions. For example, Sephora's Colorful Eyeshadow Collection comes in a unique triangular shape, making it easier to stack and store.

Market Segmentation

The global Cosmetics Packaging market can be categorized on the following: Type, Material, Application, and Region. Based on Type, the market can be categorized into Bottles, Tubes, Jars, Containers, Blister & Strip Packs, Aerosol Cans, Folding Cartons, Flexible Plastics, and Other Types (Tins, Liquid Cartons, & Flexible Paper). Furthermore, based on Material, the market is sub-segmented into Metal, Paper-based, Glass, Rigid Plastic, and Flexible Packaging. Additionally, based on Application, the market can be split further into Skin Care, Hair Care, Color Cosmetics, Sun Care, Oral Care, and Fragrances & Perfumes. Likewise, based on Region, the market is categorized into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Type

Bottles to Lead Maximum Market Share Due to Growing Demand for Sustainable and Eco-friendly Packaging

In 2022, bottles dominated the market. The increased demand for environmentally friendly and sustainable packaging has also contributed to expanding the bottle market. Many cosmetic brands are now seeking to use more sustainable materials in their packaging, such as biodegradable plastics, recycled glass, and compostable materials. These materials not only help minimise the environmental impact of packaging but also appeal to buyers looking for more environmentally friendly products.

Based on Material

Paper-based Segment to Mention Dominion Owing to the Increasing Demand for Premium Packaging

The paper-based segment accounted for the most significant growth of the market in 2022. Many cosmetics companies are focused on creating premium packaging that attracts customers and adds value to their products. Therefore, they are investing in high-quality paper-based packaging that looks good and is durable and functional.

Based on Application

Skin Care Segment to Express Dominion Owing to the Increasing Demand for Premium Packaging

The skin care segment accounted for the market's most significant growth in 2022. Consumers increasingly demand high-quality skin care products as their disposable money rises and their awareness of the need for self-care grows. This has increased demand for packaging that protects these products and enhances their appeal.

Based on Region

Asia Pacific to Dominate Global Sales Owing to the Presence of a Large Number of Companies

The Cosmetics Packaging industry has experienced significant growth in the Asia Pacific region over the past few years. The Region is home to some of the largest and fastest-growing markets, such as China, Japan, South Korea, and India, which drive demand for Cosmetics Packaging. One of the key factors behind the growth of the Cosmetics Packaging industry in the Asia Pacific region is the increasing demand for personal care products. As disposable incomes rise, people become more aware of the importance of looking good and feeling confident. This has led to a boom in the cosmetics industry, which has driven the need for attractive and functional packaging.

The growth of the Cosmetics Packaging industry in North America is expected to continue for the foreseeable future. The increasing demand for cosmetics, technological advancements, sustainable packaging, e-commerce, and private labeling are all set to contribute to the industry's growth. The main reason for developing the Cosmetics Packaging industry in North America is the increasing demand for cosmetics. The changing lifestyle of people, increasing disposable income, and the growing beauty consciousness are leading to a rise in the demand for cosmetic products. This, in turn, drives the demand for various packaging materials and designs.

Competitive Landscape

Major players in the Cosmetics Packaging industry play a crucial role in its growth and development. These players include manufacturers, designers, distributors, and retailers of Cosmetics Packaging. They invest in research and development to create attractive and functional packaging. They also work to ensure that the packaging is eco-friendly and sustainable, which is essential for the industry's growth. Overall, the Cosmetics Packaging industry has enormous growth potential, and major players will continue to play a critical role in its success.

The key players in the global Cosmetics Packaging market include - Bamboo Vision (Vietnam), EcoPlanet Bamboo (U.S.), Bamboo Australia (Australia), Bamboo Village Company Ltd. (Vietnam), Anji Tianzhen Bamboo Flooring Co. Ltd. (China), Moso International BV (Netherlands), Simply Bamboo Pty Ltd. (Australia), Kerala State Bamboo Corporation Limited (India), Dasso Group (China), Smith & Fong Company (U.S.) among others.

Recent Development

April 2022: Amcor, a global leader in creating and manufacturing environmentally responsible packaging solutions, stated that it would be the first to purchase certified circular polyethylene compounds for increased recycling utilizing ExxonMobil's Extend technology.

March 2022: Berry Global Group collaborated with Koa to introduce 100 % recycled plastic body cleanser and body moisturizer bottles. Berry Global is committed to generating a positive environmental impact through efficient processes, continuously engaged partners, and optimized goods as an industry leader in sustainability.

May 2022: Carlyle stated that entities affiliated with Baring Private Equity Asia would work together to acquire a 100 percent stake in HCP Packaging, a prominent producer of cosmetic packaging design, development, and manufacturing.

Segmentation of the Global Cosmetics Packaging Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Materials

By Applications

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 12-Oct-2022

Vantage Market

Research | 12-Oct-2022

FAQ

Frequently Asked Question

What is the global demand for Cosmetics Packaging in terms of revenue?

-

The global Cosmetics Packaging valued at USD 51.2 Billion in 2022 and is expected to reach USD 68.74 Billion in 2030 growing at a CAGR of 4.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Bamboo Vision (Vietnam), EcoPlanet Bamboo (U.S.), Bamboo Australia (Australia), Bamboo Village Company Ltd. (Vietnam), Anji Tianzhen Bamboo Flooring Co. Ltd. (China), Moso International BV (Netherlands), Simply Bamboo Pty Ltd. (Australia), Kerala State Bamboo Corporation Limited (India), Dasso Group (China), Smith & Fong Company (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.3% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Cosmetics Packaging include

- Rising penetration of cosmetics in the developing economies

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Cosmetics Packaging in 2022.