Composites Market

Composites Market - Global Industry Assessment & Forecast

Segments Covered

By Product Carbon Fiber, Glass Fiber, Others

By Manufacturing Process Layup Process, Filament Winding Process, Injection Molding Process, Pultrusion Process, Compression Molding Process, Resin Transfer Molding Process, Others

By End-Use Automotive & Transportation, Electrical & Electronics, Wind Energy, Construction & Infrastructure, Pipes & Tanks, Marine, Others

By Resin Type Thermoplastic, Thermosetting

By Region North America, Europe, Latin America, Asia-Pacific, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 120.9 Billion | |

| USD 258.1 Billion | |

| 8.8% | |

| Asia Pacific | |

| Europe |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

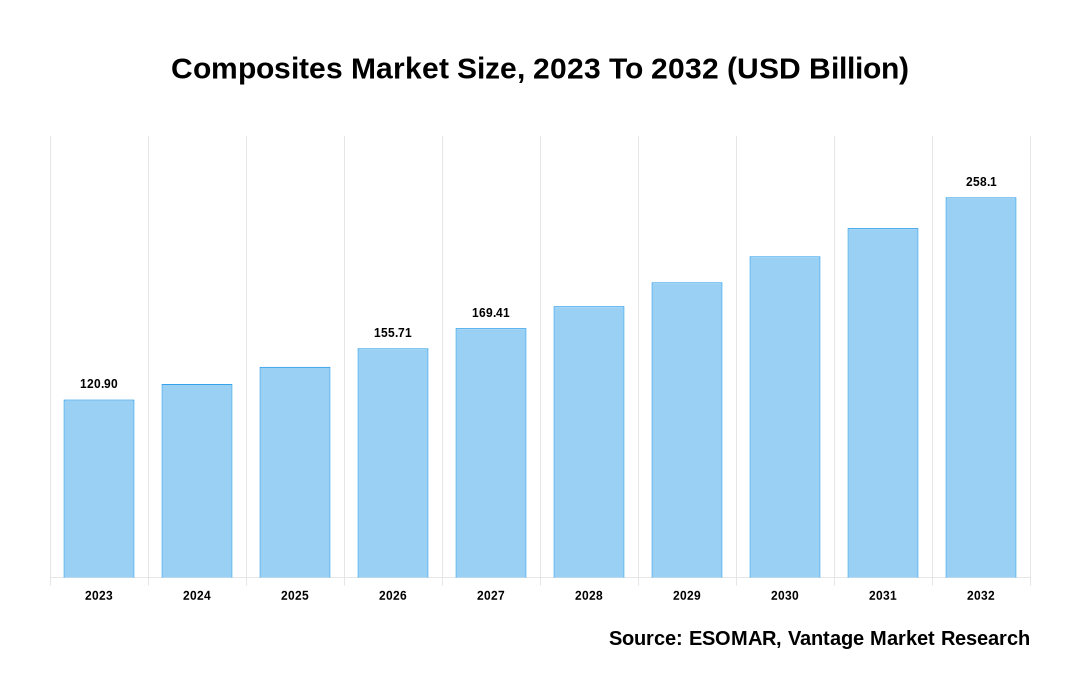

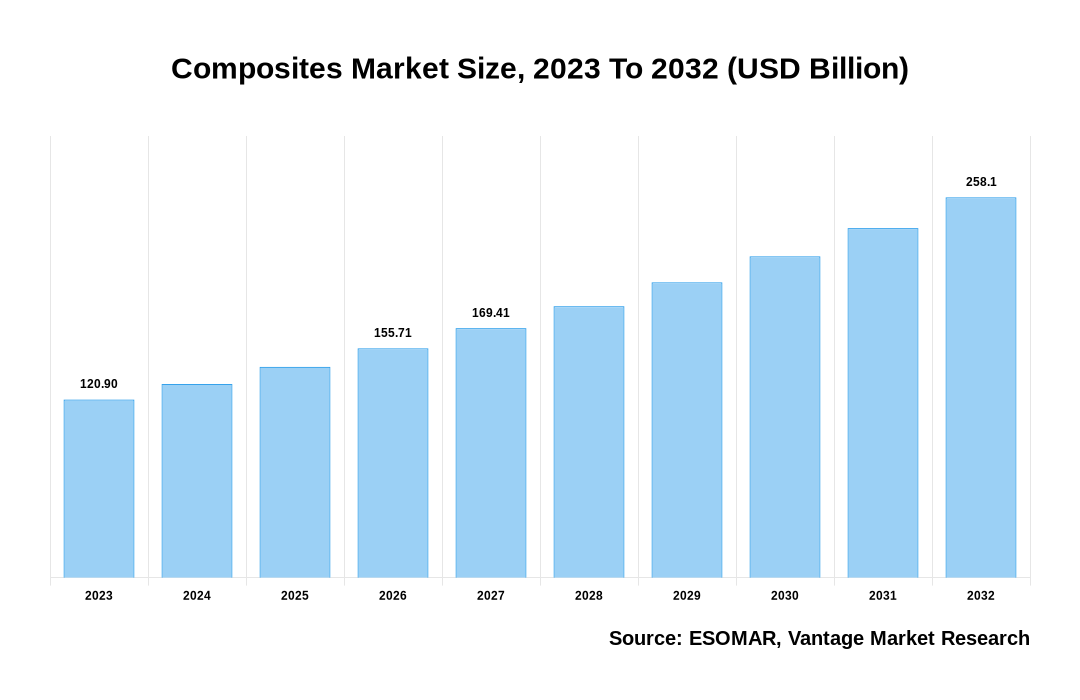

The global Composites Market is valued at USD 120.9 Billion in 2023 and is projected to reach a value of USD 258.1 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 8.8% between 2024 and 2032.

Key Highlights of Composites Market

- Europe predominantly led the Composites market in 2023, with 39.5% of the total market share

- Asia Pacific is projected to be the fastest-growing market in the forecast period

- In 2023, the Glass Fiber segment took the lead in the market, contributing a 20.9% substantial revenue share

- The Thermosetting segment significantly contributed to the market’s expansion, constituting over 83.6% of the overall revenue share in 2023

- The FAA sets stringent airworthiness standards for composite materials used in aircraft. These standards cover material testing, manufacturing processes, and structural integrity

- Like the FAA, EASA establishes certification specifications for aircraft airworthiness. These specifications include requirements for the use of composite materials in aviation

Composites Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Composites Market

Composites Market: Regional Overview

The Europe Composites market exhibited significant dominance in 2023, with 39.5% of revenue share. As a result of the widespread integration of reinforcing fibers into resin matrices in various sectors, Europe is a central hub of the global Composites market. Given the region's commitment to innovation, sustainability, and superior manufacturing, the European composite panorama is characterized by several packages. Market growth is pushed through the inherent flexibility of composite substances, which affords lightness, durability, and advanced overall performance answers in step with the changing needs of various sectors. The aerospace and defense sectors fuel the demand for advanced composite materials in Europe. Europe countries were at the lead of developing and imposing cutting-edge composite technology for plane production, contributing to regional leadership in aeronautical innovation.

U.S. Composites Market Overview

The Composites market in the United States, with a valuation of USD 29.6 Billion in 2023, is projected to reach around USD 58.9 Billion by 2032. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 7.9% from 2024 to 2032. The U.S. composite market is leading technological innovation and industry development, which has become crucial to North America’s production landscape. The automotive industry has become a significant contributor to the growth of the U.S. Composites market, in parallel with the aerospace sector. Fueled by a strategic focus on lightweight and the burgeoning popularity of electric vehicles, Composites have become instrumental in manufacturing components that optimize vehicle efficiency and reduce environmental impact. The construction and infrastructure sector in the U.S. has embraced Composites for diverse applications, ranging from bridges to various building components.

The global Composites market can be categorized as Product, End-Use, Resin Type, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Manufacturing Process

By End-Use

By Resin Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Composites Market: Product Overview

In 2023, substantial expansion was observed in the Global Composites market within the Glass Fiber category, commanding a revenue share of 20.9%. The Product segment is divided into Carbon Fiber, Glass Fiber, and Others. Glass Fiber is the largest and most pervasive segment in the composite materials market. Recognized for its affordability, versatility, and moderate strength, glass fiber Composites find extensive usage in numerous industries. Widely implemented in creation, automotive, and customer items, glass fiber’s popularity stems from its value-effectiveness even as delivering first-class performance. In construction, glass fiber Composites present durable and corrosion-resistant structures. Automotive applications gain from light-weight and moderate strength properties, balancing overall performance and cost.

Composites Market: Resin Type Overview

In 2023, there was significant growth in the Thermosetting segment, over 83.6% of the market share. Based on the Application, the Composites market is separated into Thermoplastic and Thermosetting. Thermosetting Composites are the most extensive and pivotal segment in the composite materials market. Renowned for their irreversible curing process when molded, these Composites offer a rigid structure with high strength and resistance to heat. This makes them indispensable in applications where durability and stability are paramount. Industries like aerospace, automotive, and construction heavily depend on thermosetting Composites for their structural components. In aerospace, the high strength of thermosetting materials contributes to the overall integrity of aircraft structures. In automotive manufacturing, these Composites provide enhanced durability for critical components.

Key Trends

- Advancements in Sustainable Composites: The Composites industry will likely experience significant developments in sustainable materials. This includes the continued growth of bio-based resins, recycled fibers, and other environmentally friendly alternatives. Manufacturers will focus on creating Composites with reduced environmental impact, aligning with global initiatives for sustainability and circular economy practices.

- Integration of Smart Technologies: Innovative technologies are being incorporated into composite materials, a trend to watch. Smart Composites with embedded sensors and monitoring capabilities are gaining traction, offering structural health monitoring, damage detection, and real-time performance analysis functionalities. This trend is particularly relevant in aerospace, automotive, and infrastructure applications, where continuous monitoring and data-driven insights are crucial for safety and efficiency.

- Rapid Evolution in 3d Printing for Composites: 3D printing for Composites is expected to advance rapidly. Additive production technologies offer the capacity for difficult and customized designs, reduced waste, and improved production efficiency. As 3D printing abilties increase, the Composites industry may also see improved adoption of this technology for developing complex composite systems, in particular in aerospace and healthcare sectors where customization and precision are paramount.

Premium Insights

Suppliers within the Composites market are setting a heightened emphasis on sourcing sustainable raw materials. This includes the improvement of bio-primarily based resins, recycled fibers, and environmentally friendly options. The push for sustainability aligns with market demand for eco-friendly answers and the broader enterprise’s commitment to reducing its environmental effect. Suppliers making an investment in sustainable sourcing and manufacturing techniques will probably benefit market. Moreover, the supply facet is marked by way of a growing collaborations and partnerships trends among industry gamers. Collaborative effort’s aim to deal with demanding situations which includes cost discount, fabric optimization, and the improvement of novel applications. These strategic alliances make contributions to a greater incorporated and dynamic supply chain, fostering a competitive and modern panorama in the Composites market.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The rise in significance of weight reduction in automotive and aerospace industries, driven by the need for improved fuel efficiency and sustainability, results from a combination of environmental concerns, regulatory pressures, and ongoing technological developments. Automakers, transitioning towards electrification and fuel-efficient vehicles, prioritize reducing vehicle weight through innovative approaches, such as utilizing lightweight composite materials like carbon fiber-reinforced polymers (CFRP) or glass fiber-reinforced plastics (GFRP). This reduction offers multifaceted advantages, including improved fuel efficiency, reduced emissions, and enhanced vehicle performance. Similarly, in aerospace, where every pound saved translates to significant fuel savings, lightweight composite materials like carbon fiber Composites are crucial for constructing aircraft structures that are both durable and significantly lighter than traditional metal counterparts, leading to enhanced fuel efficiency and reduced environmental footprint.

Continuous advances in composite manufacturing technologies, driven by the pursuit of cost-effective solutions that do not compromise performance, transform various sectors by providing innovative processes and materials. In addition, to reduce emissions and adopt eco-friendly practices worldwide, the broad adoption of Composites in industries is being driven by stringent environmental regulations to meet sustainability objectives. In addition, the role of composite materials in ensuring long-term structural integrity, durability, and resistance to environmental factors has been highlighted by increasing investment into infrastructure projects worldwide, contributing to resilient, innovative, and sustainable infrastructure solutions.

Competitive Landscape

The worldwide Composites market has many participants, predominantly led by established entities dictating market dynamics. Many firms prioritize forward integration, supplying goods directly to end-users across various industry sectors. Additionally, several companies leverage well-established distribution channels and sales networks to reach customers seamlessly across different regions. Intense competition prevails among composite manufacturers due to the significant presence of global and regional players in the market. The substantial processing and manufacturing expenses associated with Composites pose notable hurdles to the growth and profitability of manufacturers worldwide.

Recent Market Developments

- In May 2023, Huntsman announced the growth of innovative polyurethane, epoxy materials, and carbon nanotubes at The Battery Show this week, designed to help enhance the integration of batteries into EVs and enhance their protection & performance. In a move that aids in delivering high-performance composite battery structures, along with design and production flexibility, Huntsman has created a portfolio of customisable, high-strength, quick-cure polyurethane and epoxy resins that can be used to create underbody and top cover battery protection components up to 30% quicker than some existing technologies.

Vantage Market

Research | 24-Jan-2022

Vantage Market

Research | 24-Jan-2022

FAQ

Frequently Asked Question

What is the global demand for Composites in terms of revenue?

-

The global Composites valued at USD 120.9 Billion in 2023 and is expected to reach USD 258.1 Billion in 2032 growing at a CAGR of 8.8%.

Which are the prominent players in the market?

-

The prominent players in the market are Huntsman Corporation, SGL Carbon SE, Teijin Limited, PPG Industries Inc., Toray Industries Inc., Owens Corning, Hexcel Corporation, DuPont de Nemours Inc., Momentive Performance Materials, Jushi Group Co. Ltd..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 8.8% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Composites include

- Increasing Construction and Infrastructure Spending

Which region accounted for the largest share in the market?

-

Europe was the leading regional segment of the Composites in 2023.