Clear Aligners Market

Clear Aligners Market - Global Industry Assessment & Forecast

Segments Covered

By Age Adults, Teens

By End-Use Hospitals, Standalone Practices, Group Practices, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 3.86 Billion | |

| USD 28.86 Billion | |

| 28.60% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

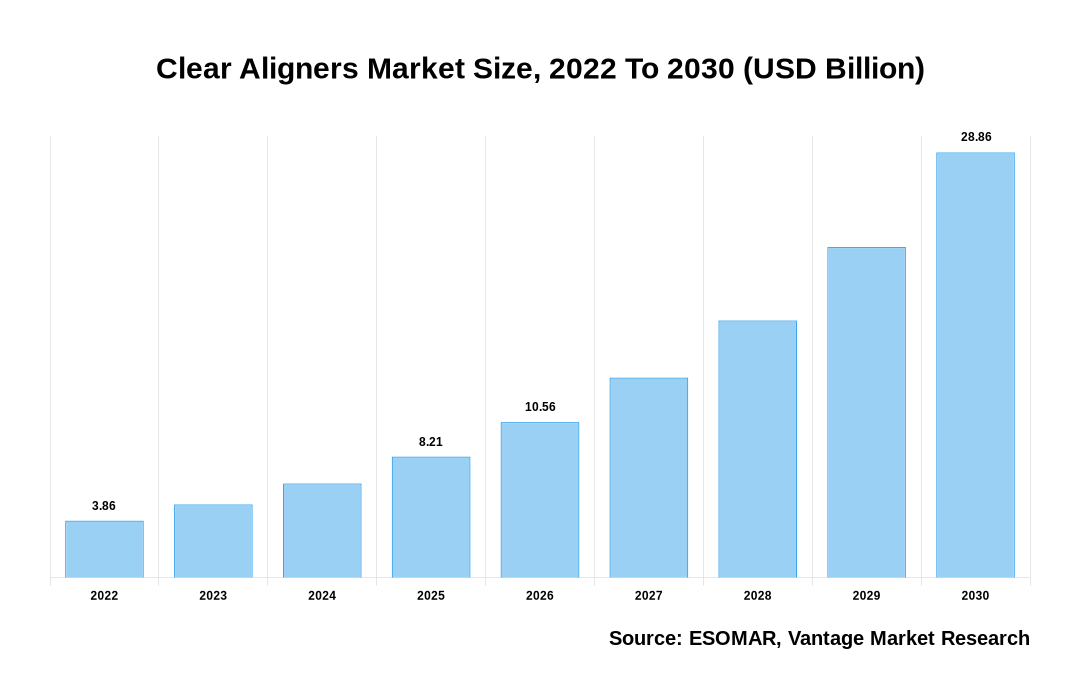

Global Clear Aligners market is valued at USD 3.86 Billion in 2022 and is projected to attain a value of USD 28.86 Billion by 2030 at a Compound Annual Growth Rate (CAGR) of 28.60% during the forecast period, 2022–2028. Clear Aligners are a set of custom-made mouthpieces or orthodontic devices that are used to straighten crooked or mismatched teeth. Clear aligners are nearly invisible and removable alternatives to braces that are built with patients' convenience and flexibility in mind. The overall market is being driven by factors such as the growing patient population suffering from malocclusions, rising technical breakthroughs in dentistry treatment, and rising demand for personalized clear aligners. Globally, the pandemic had a favorable impact on the market, and leading players rebounded in 2020 with higher revenues than in prior years.

The clear aligners industry is growing as individuals become more aware of the importance of dental care and as customer spending rises. Clear aligners have seen remarkable growth in recent years, allowing the provider network to develop and evolve as the market shifts toward increased clear aligner usage. The Global Clear Aligners Market research offers a comprehensive analysis of the industry.

Clear Aligners Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Clear Aligners Market

Technology Advancement

Virtual digital models, computer-aided design (CAD-CAM), and thermoformed plastic materials like co-polyester or poly-carbonate plastic are used to create these invisible aligners. Patients and dentists are increasingly using transparent aligners due to the inconvenience imposed by metal and ceramic braces, as well as the long-term gum discomfort that might cause. The Aligner is flexible and developed with the wearer's comfort in mind. Clear aligner technology, according to the Dental Tribune, has fast become a popular alternative to fixed equipment for tooth straightening since it is a more visually pleasing and pleasant option. Clear Correct, Inman Aligner, and Smart Moves are among the different brands of clear aligners produced by Invisalign.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

High Cost

Barriers to market growth include the high cost of clear aligners, a lack of dentists in emerging areas, and limited insurance coverage for orthodontic procedures. The arrival of COVID-19 to the dental market was a foregone conclusion, given the majority of elective treatments were postponed. The majority of dental practices were closed since dentistry is considered an elective and high-contact service.

The Clear Aligners market scope can be tabulated as below:

Market Segmentation:

The Global Clear Aligners Market can be segmented by Age, into Adult and Teen. Based on End Use, into Hospitals, Standalone Practices, Group Practices and Others. Based on Region, the Clear Aligners Market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

North America to Continue Dominating the Clear Aligners Market

In 2021, North America held the greatest proportion of the global market for Clear Aligners, followed by Europe. This is due to increased R&D investments as well as global players' local presence and efforts to gain new patents. According to a survey performed by the American Dental Association, 85 percent of people in the United States place a high priority on dental health and consider it to be an important part of overall health. In the United States, four million people use braces, with 25% of those being adults, and the introduction of clear tray-style aligners has piqued the interest of many patients who want to improve their smile but don't want the metal-mouth look of braces. People have been motivated by factors such as increased awareness of recent advancements in dental hygiene, different practical options for repairing tooth misalignment, and a rise in attractiveness standards.

Key Players:

Key participants operating in the Clear Aligners market are: Dentsply Sirona (US), 3M EPSE (US), Henry Schein Inc. (US), Patterson Companies Inc. (US), TP Orthodontics Inc. (US), Align Technology Inc. (US), Danaher Corporation Inc. (US), Dentsply International Inc. (US) and Straumann Group (Switzerland).

The Clear Aligners market is segmented as follows:

| Parameter | Details |

|---|---|

| Segments Covered |

By Age

By End-Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Clear Aligners in terms of revenue?

-

The global Clear Aligners valued at USD 3.86 Billion in 2022 and is expected to reach USD 28.86 Billion in 2030 growing at a CAGR of 28.60%.

Which are the prominent players in the market?

-

The prominent players in the market are Dentsply Sirona (US), 3M EPSE (US), Henry Schein Inc. (US), Patterson Companies Inc. (US), TP Orthodontics Inc. (US), Align Technology Inc. (US), Danaher Corporation Inc. (US), Dentsply International Inc. (US) and Straumann Group (Switzerland)..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 28.60% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Clear Aligners include

- Technology Advancement

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Clear Aligners in 2022.