Cleaner & Degreaser After Market

Cleaner & Degreaser After Market - Global Industry Assessment & Forecast

Segments Covered

By Type Water-Based, Solvent-Based

By Supply Mode Aerosol Can, Drum, Spray Bottle, Others

By Service Type Original Equipment Supplier (OES), Independent Aftermarket

By Vehicle Type Passenger Cars, Light Commercial Vehicles, Heavy Commercial Vehicles

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 42.3 Billion | |

| USD 52.3 Billion | |

| 2.4% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The global Cleaner & Degreaser After Market is valued at USD 42.3 Billion in 2023 and is projected to reach a value of USD 52.3 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 2.4% between 2024 and 2032.

Key Highlights of Cleaner & Degreaser After Market

- The market was mainly led by North America in 2023, accounting for 30.5% of the total market share

- Asia Pacific is anticipated to observe significant growth over the forecast period

- In 2023, the Passenger Cars segment played a crucial role in the market’s growth, representing the majority of the revenue share, i.e., 74.3%

- In 2023, the Water-Based segment took the lead in the market, contributing a substantial revenue share

- The Independent Aftermarket segment significantly contributed to the global market’s expansion in 2023

- The Spray Bottle segment is projected to witness the fastest growth in the market in the forecast period

- Manufacturers are looking to develop eco-friendly formulations, using biodegradable ingredients and reducing the carbon footprint of their products due to increasing awareness of environmental issues

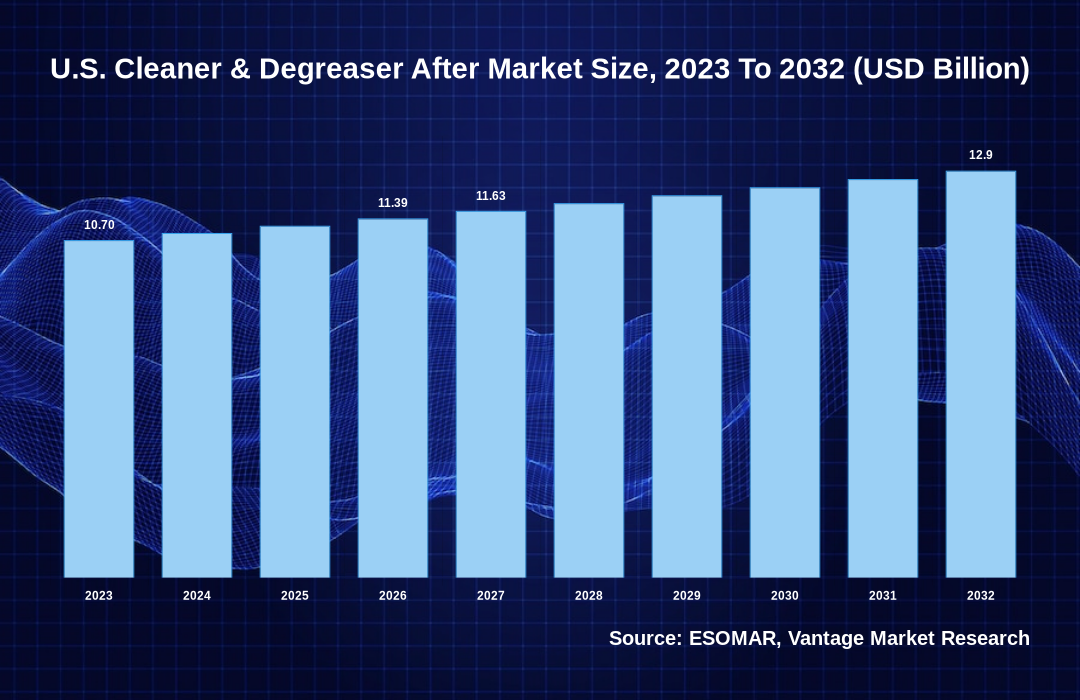

Cleaner & Degreaser After Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Cleaner & Degreaser After Market

Cleaner & Degreaser After Market: Regional Overview

The North America Cleaner & Degreaser After market showed significant dominance in 2023, with 30.5% of revenue share. The North America Cleaner & Degreaser After market is experiencing substantial growth, fueled by the growing emphasis on environmental sustainability and advanced cleaning technologies. Multinational corporations like 3M and Ecolab dominate the market with diverse products tailored to various industries. Emerging startups and niche players contribute to innovation, offering eco-friendly alternatives and specialized solutions. Moreover, the North America Cleaner & Degreaser After market continues to evolve to meet the demands of a discerning market with stringent regulatory compliance and increasing awareness of health and safety concerns.

U.S. Cleaner & Degreaser After Market Overview

The Cleaner & Degreaser After market in the United States, with a valuation of USD 10.7 Billion in 2023, is projected to reach around USD 12.9 Billion by 2032. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 2.1% from 2024 to 2032. The U.S. market is characterized by competition and innovation by key players. Emerging startups focus on eco-friendly solutions.

The global Cleaner & Degreaser After market can be categorized as Type, Supply Mode, Service Type, Vehicle Type, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Supply Mode

By Service Type

By Vehicle Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Cleaner & Degreaser After Market: Type Overview

There was remarkable growth in the Water-Based segment in 2023. Based on the Type, the Cleaner & Degreaser After market is categorized into Water-Based and Solvent-Based. The water-based segment in the Global Cleaner & Degreaser After market has experienced significant growth driven by environmental concerns and regulatory requirements. Water-based cleaners and degreasers reduce VOC emissions, minimize the risk of health hazards, and provide a more sustainable alternative to solvent-based cleaners. Due to the effectiveness of removing grease, oil, and grime from surfaces without making them toxic or flammable, this category benefits from widespread adoption in various sectors such as automotive, manufacturing, and food processing.

Cleaner & Degreaser After Market: Supply Mode Overview

The Spray Bottle segment is anticipated to observe the fastest growth in the market over the forecast period. The Supply Mode segment is divided into Aerosol Can, Drum, Spray Bottle, and Others. The spray bottle segment in the Global Cleaner & Degreaser After market will witness steady growth due to its convenience and ease of use. Consumers prefer spray bottles for their ability to deliver precise and targeted application of cleaning solutions. Manufacturers offer a variety of spray bottles with different designs, sizes, and nozzle types to cater to diverse customer preferences. Additionally, advancements in packaging technology, such as ergonomic designs and recyclable materials, contribute to the popularity of spray bottles. This segment remains a key component of the cleaner and degreaser market, providing consumers with efficient and practical cleaning solutions.

Cleaner & Degreaser After Market: Service Type Overview

In 2023, the Independent Aftermarket segment experienced significant growth in the global Cleaner & Degreaser After market. The Service Type segment is segmented into Original Equipment Supplier (OES) and Independent Aftermarket. The Independent Aftermarket segment in the Global Cleaner & Degreaser After market continues to grow as consumers increasingly turn to independent retailers and online platforms for their cleaning needs. This segment offers a broad range of products from various manufacturers, providing consumers with ample choice and competitive pricing. Independent retailers often specialize in niche products or cater to specific customer preferences, offering personalized service and expertise.

Cleaner & Degreaser After Market: Vehicle Type Overview

In 2023, substantial expansion was observed in the global Cleaner & Degreaser After market within the Passenger Cars category, commanding a revenue share of 74.3%. The Vehicle Type segment is segmented into Passenger Cars, Light Commercial Vehicles, and Heavy Commercial Vehicles. The Passenger Cars segment in the Global Cleaner & Degreaser After market is experiencing significant growth, driven by the increasing demand for vehicle maintenance and detailing products. Consumers seek effective cleaners and degreasers to maintain the appearance and performance of their vehicles. Manufacturers provide products that address specific cleaning needs, from interior upholstery cleaners to exterior degreasers for engines and wheels.

Key Trends

- Consumers have preferred using biodegradable cleaners and degreasing products derived from natural resources, such as plants or microbial. Concern over health hazards associated with traditional chemical-based cleaning products and the desire to find safer alternatives are driving this trend.

- Manufacturers are investing in R&D to develop more effective and efficient cleaner and degreaser formulations. This includes products with faster cleaning times, superior grease-cutting, and compatibility with various surfaces.

- The Industrial Sector continues to be a very important market for cleaners and degreasing products, particularly in the manufacturing, automotive, aeronautics, and food processing sectors. To meet the specific cleaning challenges in these sectors, e.g., high grease accumulation, machinery maintenance, and compliance with regulatory standards, there is a growing demand for specially formulated cleaners.

- Increasingly, Internet of Things technology and automation in cleaning products and detergents are becoming part of their manufacturing process. Innovative cleaning solutions are also being developed, which offer remote monitoring, predictive maintenance, and automated dosing systems, increase efficiency, and reduce labor costs.

Premium Insights

The use of chemicals in cleaning products is subject to strict guidelines by the EPA and other regulatory bodies worldwide. Consequently, creating cleaner and degreaser formulations that comply with these standards has encouraged manufacturers to invest in research and development. For instance, DeVere Company introduced its groundbreaking Green Heavy Duty Cleaner and Degreaser. This alkaline detergent surpasses the stringent standards of the U.S. Environmental Protection Agency (EPA) and other environmentally conscious organizations. This eco-friendly solution meets and exceeds the DfE (Design for the Environment) standards, ensuring optimal performance while minimizing environmental impact.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

A focus on environmental solutions by top players drives the market. A breakthrough in solvent alternatives addressing the need for effective, environmentally friendly solutions has been announced by 3M with the introduction of Novec Aerosol Cleaners. Designed as a replacement for HCFC-141b-based cleaners, Novec Aerosol Cleaners offer exceptional performance while aligning with economic and environmental considerations. Leveraging 3 M’s extensive technological expertise, these non-flammable aerosols stand out as among the highest-performing options available. Drawing from a foundation of segregated, non-flammable hydrofluoroethers, 3M has crafted a line of Novec cleaners that meet industry standards and remain cost-effective. Moreover, these cleaners boast non-ozone-depleting properties and lack HCFCs, HFCs, HAPs, or nPB, ensuring a sustainable choice.

The advanced solutions for parts cleaning and degreasing fuels the overall market. Permatex®, a foremost innovator in chemical technology for automotive maintenance and repair, offered a powerful parts cleaner and degreaser combining the functionality of a traditional spray cleaner with the compatibility and flexibility of being used as the parts cleaner solution in water-based parts cleaning systems. Spray Nine® Grez-Off® Parts Cleaner and Degreaser incorporates an inventive Carbon-Cutting Technology that removes tough carbon, oil, and grease without needing petroleum solvents, abrasives, or acids.

Competitive Landscape

The market for cleaning and degreasing is dominated by large multinational corporations, which rely on their enormous resources in R&D, production, or distribution. Companies like 3M, Dow Chemical Company, and BASF SE have a significant presence in this area. They offer a wide range of cleaning and degreasing products that cater to different industries and applications. For instance, 3M™ All Purpose Cleaner and Degreaser easily and quickly cuts through dirt and grime to clean exterior and interior surfaces. It is suitable for cleaning vinyl, cloth, and carpet. Because it contains no silicone, it’s safe for the paint shops. Through a 3MTM Diluter, the cleaner is mixed with water.

The key players in the global Cleaner & Degreaser After market include - BASF SE, DOW, 3M Company, The Penray Companies Inc. (PLZ Corp.), Ecolab, WD-40, Würth Group, Fuchs SE, ABRO, Zep Inc., CRC Industries, Permatex among others.

Recent Market Developments

- In March 2024, CRC launched a sustainable, high-performance brake cleaner. The first brake cleaners to be marketed are Brākleen H20 and Brākleen VOC Free from CRC Industries. These innovative products offer professional garages a real alternative to traditional hydrocarbon solvents in terms of sustainability and high performance.

- In June 2022, CRC Europe launched Evapo-Rust, a super-safe rust remover. Evapo-Rust® is a nontoxic rust remover for rapid and effective restoration. The award-winning formula is specifically designed for rust removal and requires no scrubbing or sanding. It’s safe, simple, and easy to use.

- In Feb 2023, Ecolab launched a consumer retail product line with Home Depot. For the first time, Ecolab has launched a new line of consumer retail products, Ecolab® Scientific Clean, which offers cleaning solutions for commercial, industrial, and residential use. It is available exclusively online and in Home Depot stores.

FAQ

Frequently Asked Question

What is the global demand for Cleaner & Degreaser After in terms of revenue?

-

The global Cleaner & Degreaser After valued at USD 42.3 Billion in 2023 and is expected to reach USD 52.3 Billion in 2032 growing at a CAGR of 2.4%.

Which are the prominent players in the market?

-

The prominent players in the market are BASF SE, DOW, 3M Company, The Penray Companies Inc. (PLZ Corp.), Ecolab, WD-40, Würth Group, Fuchs SE, ABRO, Zep Inc., CRC Industries, Permatex.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 2.4% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Cleaner & Degreaser After include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Cleaner & Degreaser After in 2023.