Chemical Reagents Market

Chemical Reagents Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Organic Reagents, Inorganic Reagents, Biochemical Reagents, Specialty Reagents

By Grade Analytical Grade, Technical Grade, Food Grade, Pharmaceutical Grade

By Application Industrial Applications, Academic Research & Laboratories, Environmental Testing, Clinical Diagnostics, Other

By End-Use Industry Pharmaceuticals & Biotechnology, Food & Beverages, Agriculture, Chemicals & Petrochemicals, Other

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2024 | |

| 2025 - 2034 | |

| 2019 - 2023 | |

| USD 73.43 Billion | |

| USD 130.27 Billion | |

| 5.9% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

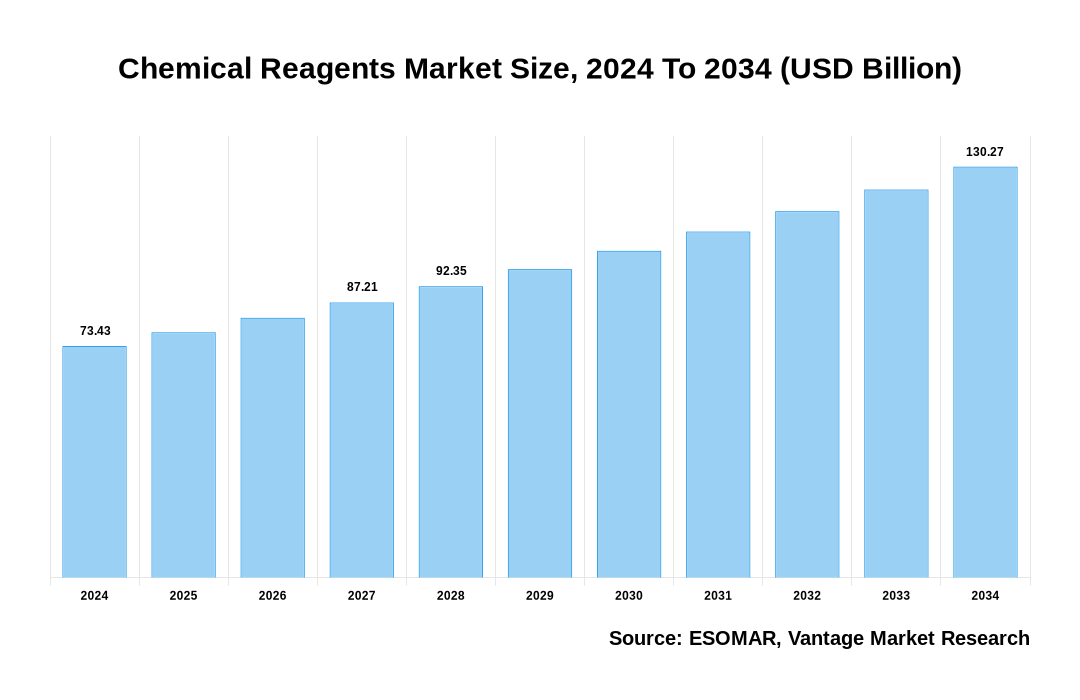

The global Chemical Reagents market size was USD 69.34 billion in 2023, and is calculated at USD 73.43 Billion in 2024. The market is projected to reach USD 130.27 Billion by 2034, and register a revenue 5.9% over the forecast period (2025-2034).

Premium Insights:

The global Chemical Reagents market continues to register a steady revenue growth rate, driven by factors including expanding demand from pharmaceuticals, biotechnology, and healthcare sectors, particularly for high-purity reagents in drug discovery, diagnostics, and genomics. Major industries highly dependent on chemical reagents currently include pharmaceuticals, environmental testing, and academic research. Demand is also increasing along with increasing initiatives in emerging applications and technologies, such as biopharmaceutical manufacturing, Next-Generation Sequencing (NGS), and gene editing. Also, trends in sustainable production and eco-friendly reagents align with regulatory standards and support further growth. Increased R&D spending, especially in emerging markets, and the integration of advanced production technologies, such as automation and digitalization, are also factors driving market growth.

Some commonly used are organic reagents, inorganic reagents, biochemical reagents, and specialty reagents. Chemical reagents also include types such as solvents, catalysts, buffers, chromatography reagents, high-purity reagents, biological reagents, and others. Grade of these reagents vary according to use and include, analytical grade, laboratory grade, industrial grade, food grade, and pharmaceutical grade among other. Functions include precipitation agents, oxidizing agents, reducing agents, staining agents, standards & buffers. Applications areas are varied, and chemical reagents are used in biotechnology, pharmaceuticals, diagnostics, academic & research, agriculture, environmental testing, food and beverage, chemicals & petrochemicals, and others.

High-quality reagents are in high demand for complex processes like drug synthesis, genetic research, and diagnostics. Raw materials used in reagent production include a range of specialty chemicals, solvents, and additives sourced for purity and stability. These reagents enable precision in laboratory and industrial applications, improving outcomes in fields that rely on accurate chemical interactions, such as molecular biology and clinical testing. Chemical reagents play a crucial role in specialized functions, such as facilitating accurate measurement, isolation, and testing, which are foundational to advancements in healthcare and environmental safety.

Some key trends in the market include a shift toward sustainable, eco-friendly reagents, prompted by implementation of increasingly stringent environmental regulations and the rising focus across end-use industries and sectors on reducing creation of hazardous byproducts. Advances in automation and digitalization, such as integration of digital twin technology, have streamlined reagent production, thereby enhancing both efficiency and scalability. Developments in high-purity reagent formulations are enabling more effective applications in next-generation fields like biopharmaceuticals, gene editing, and advanced diagnostics, helping meet increasing demand for precision and safety. Moreover, continuous R&D investments, particularly in emerging economies, is supporting growth of the global Chemical Reagents market to a major extent.

Chemical companies globally have also been addressing various challenges during the last few years in the industry, among which margin pressure was most prominent. This has been a major focal point along with efforts to explore and implement strategies to reduce costs, leverage revenue opportunities, and improve competitiveness. During 2022, major chemical companies registered significant profit growth, but challenges emerging in 2023 and into 2024, led to reduced demand due to destocking, further multiplying energy and feedstock challenges. The resulting imbalance in demand and supply resulted in slow-down of anticipated outcomes at the start of 2022, with high interest rates adding further to cost pressure, thereby leading to declining profits across the industry.

Furthermore, merger and acquisition activities, which had reduced globally by over 15% in 2023 compared to 2022 volumes, and was the lowest in a decade, has begun to rebound. Chemical companies have used the COVID-19 pandemic lesson to address gaps exposed in the supply chain, manpower challenges, and other disruptions, and are studying the evolving market scenarios after the lean period served to allow destocking of value chains and chemical production has begun in earnest to return and exceed old norms. Some major challenges have been market fragmentation, revenue stagnation, and profitability decline. These have been taken in stride and companies are leveraging improving capital, and consolidating on market segments with higher fragmentation and profit potential, and also enhancing operational efficiencies.

Chemical Reagents Market Size, 2024 To 2034 (USD Billion)

AI (GPT) is here !!! Ask questions about Chemical Reagents Market

Top Chemical Reagents Market Drivers and Trends:

- Rising Demand in Pharmaceuticals and Biotechnology: Demand for chemical reagents is being driven by extensive applications in pharmaceuticals, biotechnological research, and diagnostics. Demand for high-purity reagents, which are essential for drug discovery, gene sequencing, and molecular diagnostics, has been rising steadily owing to incline in focus on precision and safety in sensitive processes. The rise of the personalized medicine trend and increasing success and accuracy of genetic testing are further driving use of reagent.

- Advancements in R&D and Production Technology: Investment in Research and Development (R&D) has been expanding the scope and functionality of chemical reagents, particularly for advanced biopharmaceutical applications, genomic research, and environmental testing. Innovative manufacturing techniques, such as automation and digital twin technology are enabling streamlining of production, reducing costs and minimizing waste, which benefits end-users through improved quality and lower prices. These advancements, coupled with new eco-friendly formulations, align with the industry’s sustainability goals and regulatory compliance requirements.

- Increasing Use Across Industrial and Environmental Applications: Chemical reagents play a crucial role in sectors like environmental monitoring, manufacturing, and chemical analysis, where precise measurements and quality control are essential. For instance, reagents are used in water quality testing, pollution monitoring, and industrial synthesis processes. Implementation of increasingly stringent regulatory standards for environmental safety and manufacturing quality are also driving up demand for reliable, high-performance reagents. Also, the positive outcomes and accuracy are further strengthening use and importance in critical testing and compliance procedures.

- Global Expansion and Market Diversification: Increasing number of companies are expanding market presence in emerging economies and use of chemical reagents is increasing in applications in academic research and clinical testing. Moreover, companies are adopting strategies like mergers, acquisitions, and partnerships to enhance their product portfolios and strengthen distribution networks globally. This expansion into diverse applications, ranging from laboratory research to industrial and environmental settings, has been expanding scope for use of specialized reagents and is expected to continue to support revenue growth of the Chemical Reagents market over the forecast period.

Chemical Reagents Market Restraining Factor Insights

- Stringent Regulatory Standards and Compliance Costs: Compliance with stringent global and regional regulations on chemical safety and environmental standards can limit market growth. Regulatory bodies enforce strict guidelines on chemical production, storage, handling, and disposal, driving up operational costs and creating a barrier to entry for smaller players. Also, frequent updates to these regulations require continuous investment in monitoring and compliance, which can restrain potential growth in certain markets.

- High Costs and Limitations in R&D: Developing high-purity, specialized reagents requires extensive research and substantial investment, which can deter smaller companies from entering the market. R&D expenses are also amplified by the need for advanced technologies and specialized personnel, which limits innovation to major industry players. In addition, the ongoing need for sustainable and low-toxicity reagents demands continuous advancements in eco-friendly production processes, and this can cause incline in R&D spending and stretch timelines.

- Environmental and Health Concerns: Many chemical reagents are associated with toxic properties and hazardous byproducts, raising health and environmental concerns. Industrial and laboratory waste from reagents, particularly those with persistent organic compounds or heavy metals, pose disposal challenges and potential environmental hazards. This has led to calls for stricter restrictions and alternative solutions, which can negatively impact demand and deter market adoption, especially where eco-friendly substitutes are not available.

Chemical Reagents Market Opportunities

- Expansion into Emerging Markets: Demand for chemical reagents in emerging economies is rising steadily due to expanding industrial and biopharmaceutical sectors, particularly in countries across Asia Pacific and Latin America. Companies can strategically enter into these regions and tap into high-growth markets with fewer competitors, thereby strengthening global footprint. Partnerships with local firms, region-specific product launches, and targeted pricing strategies can help major companies cater to local demand while offsetting regulatory and import challenges.

- Product Innovation and R&D Investments: Developing high-purity, sustainable, and specialized reagents offers significant revenue potential, particularly as sectors like genomics, personalized medicine, and biopharmaceuticals evolve. Investing in eco-friendly formulations, non-toxic alternatives, and biocompatible reagents addresses regulatory demands and consumer preference for sustainable options. Leading firms can leverage advanced technologies, like digital twins and process automation, to enhance production efficiency and product quality, thus gaining a competitive edge.

- Strategic Partnerships, Mergers, and Acquisitions: Collaborations with technology firms, acquisitions of smaller innovative players, or mergers with complementary businesses allow companies to diversify product portfolios, access new markets, and streamline supply chains. Strategic agreements with biopharmaceutical firms or research institutes for custom reagents can further enhance market penetration and create stable, high-value revenue streams.

Chemical Reagents Market Segmentation:

By Product Type

- Organic Reagents

- Inorganic Reagents

- Biochemical Reagents

- Specialty Reagents

By Grade

- Analytical Grade

- Technical Grade

- Food Grade

- Pharmaceutical Grade

By Application

- Industrial Applications

- Academic Research & Laboratories

- Environmental Testing

- Clinical Diagnostics

- Other

By End-Use Industry

- Pharmaceuticals & Biotechnology

- Food & Beverages

- Agriculture

- Chemicals & Petrochemicals

- Other

Segment Insights:

By Product Type:

The biochemical reagents segment among the product type segments is expected to account for largest revenue share over the forecast period. Rising demand in biotechnology and pharmaceutical research, particularly in genomics and proteomics, is a primary driver attributed to this steady revenue growth. Biochemical reagents are critical in various laboratory procedures, including cell culture, DNA/RNA analysis, and molecular diagnostics. Rising popularity of personalized medicine, combined with increased research and development activities for drug discovery and vaccine development, are factors driving further demand for high-quality biochemical reagents. Also, the COVID-19 pandemic has served to attract increased investments in molecular biology and diagnostics, and this is also a key factor supporting rising need for biochemical reagents in these fields, and driving revenue growth of this segment.

By Grade:

Among the grade segments, the analytical grade segment is expected to account for largest revenue share over the forecast period. Analytical grade reagents are essential for laboratory and research settings requiring high purity and accuracy. Adoption is particularly high in pharmaceuticals, environmental testing, and academic research, where precise measurements are critical. Regulatory requirements for purity in pharmaceuticals and food & beverage testing also reinforce the need for analytical-grade reagents. These reagents also play a central role in emerging applications like environmental monitoring and forensic analysis, driven by increasing awareness and regulatory support for safety and quality standards across industries.

By Application:

Among the application segments, the clinical diagnostics segment is expected to account for majority revenue share over the forecast period. Clinical diagnostics is highly dependent on chemical reagents for tests, including blood analysis, enzyme assays, and Polymerase Chain Reactions (PCR). Rising prevalence of chronic diseases, aging global population, and increased health screening are key factors contributing to steady demand for reagents in clinical diagnostics. The trend toward preventive healthcare and Point-of-Care (POC) testing is also creating rising need for rapid and accurate diagnostic tools, where chemical reagents play a pivotal role. Growth of this segment is also supported by technological advancements such as high-throughput screening and automation, which are enabling streamlining of clinical diagnostics and driving adoption.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

By End-Use Industry:

Among the end-use industry segments, the pharmaceuticals & biotechnology segment is expected to account for largest revenue share over the forecast period. Rising demand for chemical reagents from this sector is driven by a surge in drug discovery and vaccine development initiatives and programs, and research into biologics. Regulatory emphasis on quality control and high-purity reagents further supports this trend. Increasing traction of biosimilars and biopharmaceuticals, along with increasing focus on precision medicine, further drives need for reliable chemical reagents in this sector. Also, collaborations between reagent manufacturers and pharmaceutical companies to accelerate research is expected to support growth of this segment.

Regions and Countries

North America

- United States

- Canada

- Mexico

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

Chemical Reagents Market Regional Landscape:

Among the regional markets, North America Chemical Reagents market leads in terms of revenue share, driven by robust pharmaceutical and biotechnology industries, advanced R&D, and high healthcare expenditure. The US Chemical Reagents market, among the country level markets, is the major revenue contributor due to presence of major pharmaceutical companies, extensive research facilities, and substantial government and private funding for life sciences.

The Asia Pacific Chemical Reagents market is expected to register fastest revenue growth rate over the forecast period, with China and India leading in terms of revenue share and volume consumption due to rapid increase in pharmaceutical manufacturing, rising investments in biotechnology, and expanding academic research. Also, cost-effective manufacturing capabilities and increasing focus on generic drug production are factors supporting revenue growth of the market I in the region.

In the Europe Chemical Reagents market, Germany and the UK are major markets, supported by stringent quality standards, advanced medical research, and substantial government funding in biotechnology and healthcare sectors.

In Latin America Chemical Reagents market, Brazil is a primary revenue contributor, supported by expanding healthcare infrastructure and increasing pharmaceutical demand.

Some of the common factors driving demand in the major regional markets are rising investments in pharmaceuticals and life sciences, technological advancements in biotechnology, diagnostics, and material sciences, and increasingly stringent regulatory requirements for quality control in healthcare, environmental, and food industries.

Chemical Reagents Market Competitive Landscape:

Company List:

- Merck KGaA

- Thermo Fisher Scientific

- TCI

- Avantor Inc.

- American Elements

- Sinopharm Chemical Reagent

- Sigma-Aldrich

- Xilong Chemical

- PerkinElmer Inc.

- Beckman Coulter

- Glentham Life Sciences

- BOC Sciences

- Wako Pure Chemical Industries

- ABCR GmbH

- Kanto Chemical Co., Inc.

Competitive Landscape:

The competitive landscape in the global Chemical Reagents market is dynamic, with key players ranging from established chemical companies to specialized reagent manufacturers competing across diverse application areas. Leading companies such as Merck KGaA, Thermo Fisher Scientific, Avantor, Inc., and Agilent Technologies maintain a strong presence through extensive product portfolios and strategic expansions into high-demand sectors like biotechnology, pharmaceuticals, and environmental testing. Companies are also focused on a combination of innovation, extensive R&D, and high product standards to meet increasing demand for specialized reagents.

Other key strategies include product innovation and R&D investment to introduce high-purity, reliable reagents tailored for advanced applications in genetic testing, drug development, and diagnostics. In addition, companies are increasingly adopting sustainability measures in response to environmental regulations, and developing eco-friendly reagents that meet stringent industry standards. Strategic partnerships and acquisitions are central to expanding market reach and technology capabilities, with companies acquiring smaller reagent manufacturers or entering joint ventures to accelerate innovation and enter emerging markets.

Furthermore, geographic expansion into fast-growing regions, particularly in Asia Pacific, is a common approach, as companies set up manufacturing and distribution facilities to cater to rising local demand. Digital transformation initiatives, such as the integration of data analytics and e-commerce channels, are further aiding companies in reaching a broader consumer base with personalized service offerings.

Recent Developments

- August 1, 2024: Merck, which is a leading science and technology company, announced completion of acquisition of Mirus Bio for approximately US$ 600 million. With this strategy, Merck moves towards the objective of offering solutions for every step of viral vector manufacturing, as well as reinforces the company’s commitment to supporting customers in advancing cell and gene therapies from preclinical through commercial production. Acquisition of Mirus Bio was made from Gamma Biosciences, which is a life sciences platform established by global investment firm KKR. Mirus Bio specializes in development and commercialization of transfection reagents, such as TransIT-VirusGEN, which play a critical role in the production of viral vector-based gene therapies.

- May 3, 2024: Wynnchurch Capital announced it had acquired Reagent Chemical & Research LLC in partnership with members of the company’s senior management team. The family-owned Reagent Chemical & Research is a specialty distributor of hydrochloric acid and sodium hydroxide, and the company has been catering to caustic soda needs for manufacturing of soaps and detergents, pulp and paper, water treatment, and textiles.

- May 1, 2024: Thermo Fisher Scientific announced that effective May 1, 2024, it would enter into a strategic European distribution agreement with Bio-Techne, which is a global life sciences company providing innovative tools and bioactive reagents for the research and clinical diagnostic communities. This alliance brings together two key players in biotechnology, diagnostics, and scientific research, and through this agreement, Thermo Fisher’s European Fisher Scientific Channel will distribute Bio-Techne’s wide range of specialized products, including antibodies, proteins, immunoassay kits, reagents, and enzyme, making these resources accessible to laboratories and research centers throughout Europe.

Frequently Asked Questions:

Q: What is the global Chemical Reagents market size in 2024 and what is the projection for 2034?

A: The global Chemical Reagents market size was calculated at USD 73.43 billion in 2024 and expected to reach USD 130.27 billion 2034

Which regional market accounted for largest revenue share in 2023, and what is the expected trend over the forecast period?

A: Asia Pacific accounted for largest revenue share in the global market in 2023, and is expected to continue to maintain its lead during the forecast period.

Q: Which are the major companies are included in the global Chemical Reagents market report?

A: Major companies in the Chemical Reagents Market report are Merck KGaA, Thermo Fisher Scientific, TCI, Avantor Inc., American Elements, Sinopharm Chemical Reagent, Sigma-Aldrich, Xilong Chemical, PerkinElmer Inc., Beckman Coulter, Glentham Life Sciences, BOC Sciences, Wako Pure Chemical Industries, ABCR GmbH, Kanto Chemical Co., Inc.

Q: What is the projected revenue CAGR of the global Chemical Reagents market over the forecast period?

A: The global Chemical Reagents market is expected to register a CAGR of 5.9% between 2025 and 2034.

Q: What are some key factors driving revenue growth of the Chemical Reagents market ?

A: Some key factors driving market revenue growth are expanding demand from pharmaceuticals, biotechnology, and healthcare sectors, particularly for high-purity reagents in drug discovery, diagnostics, and genomics, as well as increasing initiatives in emerging applications and technologies, such as biopharmaceutical manufacturing, Next-Generation Sequencing (NGS), gene editing, and automation and integration of digital twin technology to0 streamline reagent production.

Vantage Market

Research | 08-Nov-2024

Vantage Market

Research | 08-Nov-2024

FAQ

Frequently Asked Question

What is the global demand for Chemical Reagents in terms of revenue?

-

The global Chemical Reagents valued at USD 73.43 Billion in 2024 and is expected to reach USD 130.27 Billion in 2034 growing at a CAGR of 5.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Merck KGaA, Thermo Fisher Scientific, TCI, Avantor Inc., American Elements, Sinopharm Chemical Reagent, Sigma-Aldrich, Xilong Chemical, PerkinElmer Inc., Beckman Coulter, Glentham Life Sciences, BOC Sciences, Wako Pure Chemical Industries, ABCR GmbH, Kanto Chemical Co., Inc..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.9% between 2025 and 2034.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Chemical Reagents include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Chemical Reagents in 2024.