CBD Nutraceuticals Market

CBD Nutraceuticals Market - Global Industry Assessment & Forecast

Segments Covered

By Product CBD Tincture, Capsules & Soft Gel, CBD-based Protein, CBD Gummy, Other Products

By Application Wellness, Workout Supplement, Edible & Fortified Food, Other Applications

By Distribution Channel Retail Store, Pharmacy, E-Commerce Portal, Other Channels

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 7.2 Billion | |

| USD 28.2 Billion | |

| 18.9% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

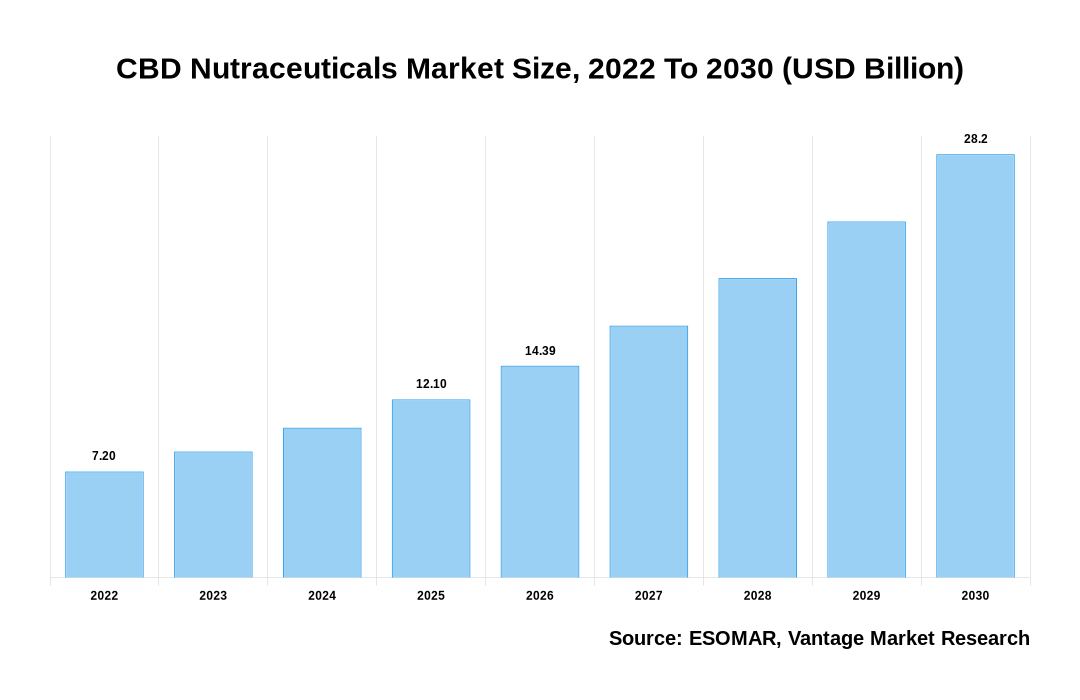

The global CBD Nutraceuticals Market is valued at USD 7.2 Billion in 2022 and is projected to reach a value of USD 28.2 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 18.9% between 2023 and 2030.

Premium Insights

According to CDC, among U.S. adults aged 20 and over, 57.6% used any dietary supplement in the past 30 days, and use was higher among women (63.8%) than men (50.8%). Dietary supplement use increased with age, overall, and in both sexes, and was highest among women aged 60 and over (80.2%). Likewise, according to National Health and Nutrition Examination Survey, 52% of adults reported taking a dietary supplement in the past month; 35% took a multivitamin/multimineral. CBD is increasingly recognized as a dietary supplement and incorporated into various nutraceutical products like oils, capsules, gummies, and beverages. It provides a natural way to support overall health and well-being. Thus, the increased use of dietary supplements is driving the market’s growth.

CBD Nutraceuticals Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about CBD Nutraceuticals Market

Furthermore, according to the National Conference of State Legislatures, the U.S. stated that 18 states, two territories, and the District of Columbia have legalized small amounts of cannabis for adult recreational use. Although the national government in Europe does not support legalizing cannabis sales for recreational use, all countries have prison sentences for illegal supply of cannabis-based. But the usage and consumption of cannabis-related products for medicinal purposes have been allowed by governments in various countries such as Germany, France, Italy, and Spain; said the European Monitoring Centre for Drugs and Drug Addiction (EMCDDA). Thus, CBD's growing acceptance and legalization will propel market growth in the coming years. Moreover, manufacturers continuously develop new CBD Nutraceutical products catering to consumer preferences and needs. This includes CBD-infused beverages, cosmetics, skincare products, and pet supplements. For instance, Canopy Growth launched its CBD-infused soft gels under "First & Free." The soft gels are formulated with pure CBD isolate derived from hemp and are available in various strengths. Similarly, Elixinol Global launched a new line of CBD-infused sports supplements under its brand name, "Athlete's Choice." The supplements contain CBD and other natural ingredients to support athletic performance and recovery.

Key Highlights

- North America accounted for the largest growth, with a revenue share of 42.9% in 2022.

- The Asia Pacific is expected to dominate the market during the forecast period.

- Based on Product, the CBD Tincture segment accounted for the largest market growth and contributed more than 35.4% of the total revenue share in 2022.

- Based on Application, the Edibles & Fortified Foods segment revealed the most significant market growth and contributed more than 38.3% of the total revenue share in 2022.

- Based on Distribution Channels, the Retail Store segment accounted for the potential growth in the market and contributed more than 40.5% of the total revenue share in 2022.

Economic Insights

Economic changes have played a crucial role in shaping the CBD Nutraceuticals market. The global economic downturn caused by the COVID-19 pandemic has had mixed effects on the industry. While some businesses have faced challenges due to disruptions in the supply chain and reduced consumer spending, others have experienced increased sales as people seek natural remedies for stress, anxiety, and other health issues. In addition, the supply chain for CBD Nutraceuticals is complex and spans various countries. Hemp, the primary source of CBD, is cultivated in different regions, including the United States, Europe, and Asia. Once harvested, hemp is processed to extract CBD, which is then used to manufacture various nutraceutical products. These products are often sold through retail stores, online platforms, or directly through dispensaries, depending on the legal framework in each country.

Top Market Trends

- Growing popularity of CBD-infused supplements: There has been a surge in demand for CBD-infused supplements in recent years. CBD is associated with possible health advantages such as lowering anxiety, improving sleep, and reducing inflammation. This has resulted in many companies entering the market with CBD-infused supplements ranging from gummies to capsules.

- Increased investment in research and development: The increased interest in CBD has led to significant research and development investments. Many companies are investing in clinical trials to establish the efficacy of CBD in treating health conditions. The findings of these studies are expected to boost the growth of the CBD Nutraceuticals market.

- Adoption of alternative medicines: There has been a rise in the adoption of alternative medicines, and many people are now exploring the potential benefits of CBD. This trend has positively impacted the CBD Nutraceuticals market, as more consumers are willing to try new products that may offer health benefits without relying on prescription medication.

Market Segmentation

The global CBD Nutraceuticals market can be categorized as Product, Application, Distribution Channel, and Region. Based on Product segment, the market can be categorized into CBD Tincture, Capsule & Soft Gel, CBD-Based Protein, CBD Gummy, and Other Products. Furthermore, based on Application, the market is divided further into Wellness, Workout Supplement, Edible & Fortified Food, and Other Applications. In addition, based on the Distribution Channel, the market can be split further into Retail Store, Pharmacy, E-Commerce Portal, and Other Channels. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product

CBD Tinctures to Lead Maximum Market Share Due to Expanding Knowledge of the Health Benefits of Cannabidiol Tinctures

In 2022, CBD tinctures dominated the market, owing to their increasing use in treating insomnia, cancer cell growth, seizures, anxiety, depression, and chronic pain. Growing obesity rates, the development of lifestyle disorders, expanding knowledge of the health benefits of cannabidiol tinctures, and rising disposable income are the primary drivers driving the expansion of this industry.

Based on Distribution Channel

Retail Stores to Express Dominion Owing to the Increasing Collaboration of Manufacturers and Retailers

The Retail store segment accounted for the maximum growth of the market in 2022. The expanding collaboration of manufacturers and retailers to enhance their distribution network drives segment growth. For example, CV Sciences Inc. entered into a distribution arrangement with The Vitamin Shoppe and began selling its products across 383 shops in the United States in September 2019. Furthermore, the company increased its distribution network in October 2019 and now serves its products through 515 Vitamin Shoppe locations.

Based on Application

Edibles & Fortified Foods to Express Dominion Owing to Increasing Innovation and Development of New Products

The edibles & fortified foods segment accounted for the maximum growth of the market in 2022. As more people become aware of the health benefits of CBD and look for convenient ways to consume it, the demand for these products is likely to increase. CBD Nutraceuticals companies are also constantly innovating and developing new products, which will only add further momentum to the growth of edibles and fortified foods in the market.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Based on Region

North America to Dominate Global Sales Owing to the Growing Awareness About the Health Benefits of CBD

North America is witnessing the most significant growth of the market in 2022. The growing awareness about the health benefits of CBD has contributed to the development of the CBD Nutraceuticals market in North America. People are more interested in natural remedies for various health issues, and CBD has emerged as a promising alternative to traditional medications. It is considered to have anti-inflammatory, analgesic, and anxiolytic qualities, making it a favorite choice among many people. The CBD Nutraceuticals market is experiencing significant growth in Asia due to the rising demand for natural health and wellness products. With the rise in awareness about the therapeutic benefits of cannabis, consumers are looking for CBD-based products that can help manage various health conditions. In addition, legalizing medical cannabis in several countries has created opportunities for the CBD Nutraceuticals market in the Region. Governments like Thailand, South Korea, and Japan have legalized medical cannabis, developing a legal market for CBD products. This has made accessing high-quality CBD Nutraceutical products easier for consumers in these countries.

Competitive Landscape

Major companies have partnered with regional participants to improve retail sales and engaged in various distribution arrangements with shops. These players constantly attempt to enhance their product offerings and are up against stiff competition from established players. For instance, HempFusion Wellness announced that it had received USDA Organic Certification for its CBD tincture products. This certification confirms that the products are made with organic ingredients and meet strict organic standards.

The key players in the global CBD Nutraceuticals market include - Charlotte's Web (U.S.), Elixinol (Australia), Medical Marijuana Inc. (U.S.), CV Sciences Inc. (U.S.), Irwin Naturals (U.S.), Diamond CBD (U.S.), Green Roads (U.S.), Foria Wellness (U.S.), Garden of Life (U.S.), Bluebird Botanicals (U.S.) among others.

Recent Market Developments

- May 2024, CV Science Inc. acquired Elevated Softgels LLC, one of the key companies in encapsulated softgels and tinctures industry. With this acquisition, CV Sciences aims to strengthen its position in CBD nutraceuticals market globally.

- November 2023, Charlotte's Web expanded one of its brands, ReCreate product portfolio, with the launch of new CBD gummy products formulated with functional botanicals, focusing on sports and wellness space. The newly introduced CBD gummies are endurance gummies, muscle recovery gummies, brain support gummies, and rest gummies.

- February 2023: Medical Marijuana, Inc. announced its subsidiary HempMeds® recently took part in a collaboration on a study to demonstrate the effectiveness of hemp-based cannabidiol (CBD) in treating Parkinson's Disease.

- January 2023: CV Sciences, Inc. announced the launch of their popular +PlusCBD™ Reserve Collection Softgels in a 30-count bottle.

- January 2022: Elixinol, a hemp-derived CBD brand and industry veteran, launched two new innovative CBD products that support sleep. Elixinol's Sleep Rapid Rest Liposome and Sleep Gummies are unique, melatonin-free options for consumers to support optimal sleep.

Segmentation of the Global CBD Nutraceuticals Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Application

By Distribution Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for CBD Nutraceuticals in terms of revenue?

-

The global CBD Nutraceuticals valued at USD 7.2 Billion in 2022 and is expected to reach USD 28.2 Billion in 2030 growing at a CAGR of 18.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Charlotte's Web (U.S.), Elixinol (Australia), Medical Marijuana Inc. (U.S.), CV Sciences Inc. (U.S.), Irwin Naturals (U.S.), Diamond CBD (U.S.), Green Roads (U.S.), Foria Wellness (U.S.), Garden of Life (U.S.), Bluebird Botanicals (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 18.9% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the CBD Nutraceuticals include

- Increasing awareness about the health benefits of CBD suppliments

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the CBD Nutraceuticals in 2022.

Vantage Market

Research | 01-Aug-2023

Vantage Market

Research | 01-Aug-2023