Cannabis Edibles Market

Cannabis Edibles Market - Global Industry Assessment & Forecast

Segments Covered

By Nature Organic, Conventional

By Type Chocolates & Candies, Gummies, Snacks, Supplements, Beverages, Others

By Sales Channel Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 11.09 Billion | |

| USD 36.5 Billion | |

| 14.2% | |

| Europe | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

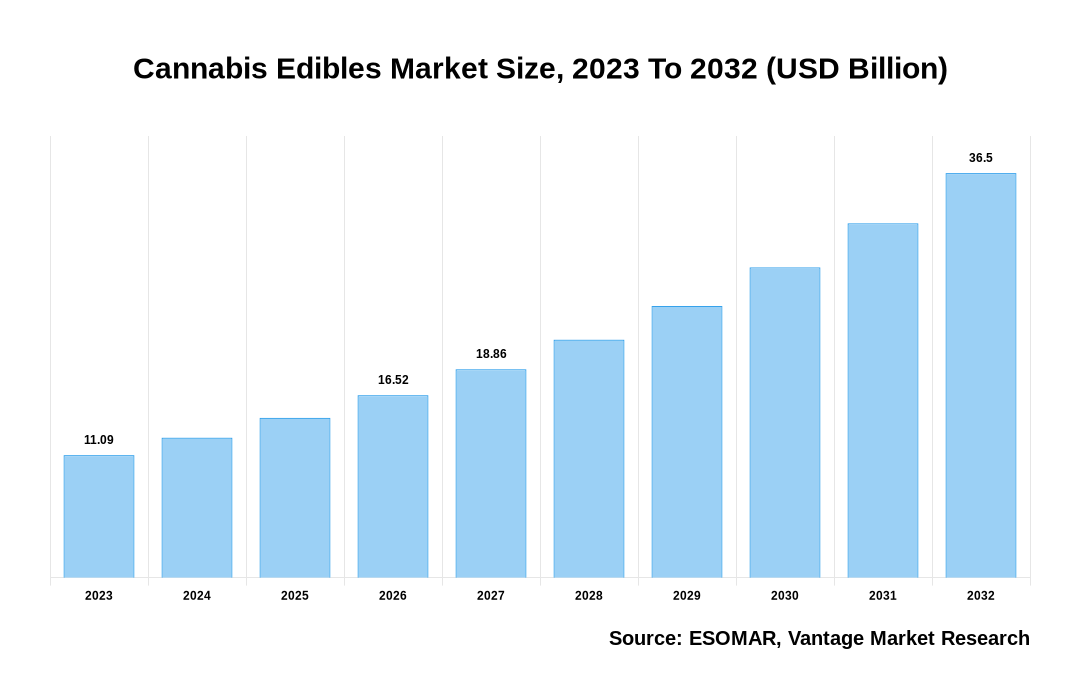

The global Cannabis Edibles Market is valued at USD 11.09 Billion in 2023 and is projected to reach a value of USD 36.5 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 14.2% between 2024 and 2032.

Key Highlights of Cannabis Edibles Market

- North America generated more than 43.1% of revenue share in 2023

- The Asia Pacific region is anticipated to experience the highest growth rate between 2024 and 2032

- The conventional segment accounted for the most considerable market growth and contributed over 52.8% of the total revenue share in 2023

- The chocolates & candies segment revealed the most significant market growth, contributing more than 43.2% of the total revenue share in 2023

- The online retail segment accounts for the most significant revenue of 34.6% in 2023

- The cannabis market is booming, with a 144% growth in adult-use cannabis sales in North America from 2020 to 2025. Legal sales are projected to hit $39.1 billion by 2025, fueled by factors like the legalization of cannabis in U.S. states, ongoing product innovation, and a rising trend in cannabis consumption

Cannabis Edibles Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Cannabis Edibles Market

Cannabis Edibles Market: Regional Overview

North America generated more than 43.1% of revenue share in 2023. This is owing to the more jurisdictions worldwide legalize medical or recreational consumption. Canada and the United States have played pioneering roles in replacing black markets with highly regulated, legal markets, setting a precedent for G7 countries. Under this framework, advancements in extraction technology, production scalability, and product variety have flourished. In the United States, there is a notable shift in market share from traditional dried flower consumption to edibles and beverages. However, challenges such as inconsistent effects, short shelf lives, and undesirable tastes in ingestible products persist, primarily due to issues with analytical testing and a limited understanding of food science principles. Addressing these challenges presents an opportunity to enhance the taste, stability, consistency, and dose accuracy of cannabis by leveraging the expertise and best practices of the food industry.

U.S. Cannabis Edibles Market Overview

The U.S. Cannabis Edibles Market is valued at USD 3.4 Billion in 2023 and is projected to reach around USD 13.04 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 18.3% between 2024 and 2032. One example of a company benefiting from this growth is Kiva Confections. Kiva is a California-based cannabis-infused edibles company known for its high-quality products and innovative flavors. They offer a wide range of edibles including chocolate bars, gummies, mints, and more, all infused with THC or CBD. In addition to Kiva, several other established players in the cannabis industry, as well as new entrants, are witnessing significant growth in the Cannabis Edibles market. With increased acceptance and legality of cannabis in many states, consumers are increasingly opting for edibles as a discreet and convenient way to consume cannabis. As a result, the market is expected to continue growing in the coming years, presenting opportunities for both existing and new players in the U.S. cannabis industry.

The global Cannabis Edibles market can be categorized as Nature, Type, Sales Channel, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Nature

By Type

By Sales Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Cannabis Edibles Market: Nature Overview

In 2023, the conventional segment accounted for the most considerable market growth and contributed over 52.8% of the total revenue share. Based on Nature, the Cannabis Edibles market is classified into Organic and Conventional. Several factors drive this growth, including the lower cost of traditional ingredients like butter, flour, and sugar, making conventional edibles more affordable for budget-conscious consumers. Furthermore, the familiarity and comfort associated with flavors like cookies and brownies attract new customers and encourage repeat purchases. As of August 2022, Barry Callebaut AG, a Swiss-Belgian cocoa processor and chocolate manufacturer, reported a 9.4% year-over-year increase in sales for the cookie’s category, reaching $10.8 billion. The widespread availability of these edibles, made possible by easily accessible ingredients, allows a wide range of manufacturers, including small businesses, to contribute to the segment's expansion. In some regions, strict regulations on organic or health-focused edibles limit their availability, giving conventional edibles a competitive advantage. Successful marketing strategies that tap into nostalgia or create a sense of familiarity further enhance the appeal of conventional edibles, playing a significant role in their unexpected rise in popularity.

Cannabis Edibles Market: Type Overview

In 2023, the chocolates & candies segment revealed the most significant market growth, contributing more than 43.2% of the total revenue share. The Type segment is divided into Chocolates & Candies, Gummies, Snacks, Supplements, Beverages, and Others. This growth is attributed owing to factors such as taste, privacy, accurate dosing, variety, and creativity. This growth is attributed owing to factors such as taste, privacy, accurate dosing, variety, and creativity. These products provide a pleasurable and inconspicuous way to consume cannabis, with individually wrapped candies making it easy to control the dose. For instance, the London-based marijuana producer received Health Canada's approval to sell edibles, extracts, and topicals. They've started shipping cannabis-infused chocolate bars to provinces like Ontario, Nova Scotia, Alberta, Saskatchewan, Manitoba, and B.C., catering to changing preferences with new flavors and textures. The social aspect of sharing enhances the popularity of these products. Additionally, the increasing legalization of cannabis, changing consumer preferences, the emphasis on smaller doses, and effective marketing strategies all contribute to the strong growth of this segment.

Cannabis Edibles Market: Sales Channel Overview

The online retail segment accounts for the most significant revenue of 34.6% in 2023, due to the changing consumer preferences, advancements in technology, and specific regulations related to cannabis. By Sales Channel, the Cannabis Edibles market is classified into Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, Online Retail. Online platforms offer convenience and privacy, making it easier for consumers to access various edibles. Technological advancements such as improved delivery options and targeted marketing further enhance the online shopping experience. Additionally, the regulatory environment, which includes limitations on physical distribution channels and expanding laws surrounding cannabis, drives consumers towards online options. Factors like increased e-commerce adoption and subscription services also contribute to this growth. However, there are challenges to overcome, including regulatory restrictions, complexities in delivery, and increased competition, to maintain success in this evolving industry.

Key Trends

- Global cannabis legalization has driven a surge in the popularity of innovative Cannabis Edibles. With a focus on appropriate dosage, edibles provide a covert and socially acceptable way for people to enjoy the effects of cannabis in light of changing attitudes and growing health consciousness.

- Cannabis Edibles are recognized for potential health benefits, including pain relief, anxiety reduction, improved sleep, and appetite stimulation. Research explores their applications in addressing conditions like cancer symptoms, neurological disorders, inflammatory issues, mental disorders, and digestive problems.

- Recent surveys reveal changing cannabis market preferences, emphasizing THC percentage and price in purchasing decisions. A significant shift shows individuals aged 21-34 replacing alcohol with cannabis, prompting brands to adjust strategies with a focus on THC percentage and competitive pricing to meet evolving consumer demands.

- Cannabis Edibles drive food industry innovation with acquisitions of plant-based companies. Products like +PlusCBD Reserve Collection Extra Gummies meet consumer demands for enhanced effects. Companies like Aurora Cannabis and Cronos Group introduce novel items, showcasing ongoing market advancements.

- Led by countries like Canada and the United States, the global cannabis market sees advancements in technology, production, and diverse products. Companies like Cresco Pharma strategically acquire international distributors, signaling a trend of global expansion in the evolving cannabis industry.

Premium Insights

The Cannabis Edibles Market is transforming, propelled by insights from a recent survey of 1,000 U.S. and 1,000 Canadian consumers. A staggering 79% of respondents have either used or know someone who has used cannabis, with more than half expressing an inclination to try recreational cannabis once it is legalized. Notably, despite 39% stating they purchased less expensive cannabis in 2022, a paradoxical 73% increased their spending per transaction. In a marked change from last year, where branding and strain type took precedence, the survey reveals that THC percentage (60%) and price (58%) now dictate consumer choices. Furthermore, the study highlights a significant demographic shift, with 21-24-year-olds (34%) and 25-34-year-olds (24%) leading the charge in replacing alcohol with cannabis. To navigate this evolving landscape, industry players should pivot towards product innovation, strategic pricing models targeted marketing, and a heightened focus on THC education to capitalize on emerging opportunities.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Economic Insights

The Cannabis Edibles Market is experiencing significant growth due to increased acceptance and legalization of cannabis. Projections indicate legal sales reaching $39.1 billion by 2025, driven by factors like state legalization, product innovation, and rising cannabis consumption. Companies like CV Sciences, Aurora Cannabis, and Cronos Group are capitalizing on this trend with innovative products. However, businesses must navigate evolving regulations, including packaging laws. The market's economic impact extends globally, with companies like Cresco Pharma making strategic acquisitions to enter new markets. Comprehending client tastes, guaranteeing product quality, and adjusting to the ever-changing cannabis terrain are critical components of success.

Competitive Landscape

Major players in the Cannabis Edibles sector are strategically positioning themselves for success. The recent acquisition of Cultured Foods, a Polish plant-based vegan food company, by CV Sciences Inc., a California-based company, marks their entry into the realm of convenient and sustainable plant-based foods. This move, combined with the integration of B2B distribution networks and expansion into the European market, underscores the industry's vast potential for growth and innovation. For instance, California-based CV Sciences Inc.'s acquisition of Polish plant-based vegan food company Cultured Foods signifies a foray into convenient and sustainable plant-based foods. The integration of B2B distribution networks and expansion into the European market showcases the industry's potential for growth and innovation.

The players in the global Cannabis Edibles market include Aurora Cannabis Inc., Pure Kana, CV Sciences, Canopy Growth, Tisodiol International, Elixinol Global Ltd, Charlottes Web Holdings Inc, Medical Marijuana Inc, MGC Pharmaceuticals Ltd., Creso Pharma Ltd., Cronos Group Inc, Curaleaf Holdings Inc., Green Thumbs Industries Inc., Tilray Inc., TGOD Holdings Ltd., Zoetic International PLC among others.

Recent Market Developments

- In December 2023, CV Sciences Inc., a company based in California, has acquired Cultured Foods, a Polish plant-based vegan food company. CV Sciences Inc. will now own Cultured Foods as its subsidiary. The acquisition involved a cash payment of $175,000 and 7,074,270 shares of CV Sciences' common stock, which were valued at $250,000. The total consideration for the purchase was up to $535,000.

- In April 2023, CV Sciences, a company focused on consumer wellness and hemp extracts, has introduced a new product called +PlusCBD Reserve Collection Extra Gummies. This is an addition to their existing +PlusCBD product line. The +PlusCBD Reserve Collection offers a carefully selected blend of full-spectrum cannabinoids known for their potent and robust properties, providing a sense of relief and calmness in times when strong support is required.

- In June 2023, Aurora Cannabis introduced a new range of exciting products that are now accessible to patients through Aurora Medical and consumers via retailers nationwide. The company continues to expand its collection, which now features 1mg format options, easily consumable edibles, high-quality resin vape cartridges with distinct and intense flavors, and a signature hash that stays true to its traditional form.

- In December 2023, Cronos Group Inc. has introduced the much-anticipated Lord Jones® Live Resin Vapes in two different hardware options. These products have been carefully created with the needs of cannabis enthusiasts in mind and showcase the company's dedication to providing exceptional quality. They offer a unique blend of specially selected cannabis strains, pure live resin, and sophisticated, top-notch hardware.

FAQ

Frequently Asked Question

What is the global demand for Cannabis Edibles in terms of revenue?

-

The global Cannabis Edibles valued at USD 11.09 Billion in 2023 and is expected to reach USD 36.5 Billion in 2032 growing at a CAGR of 14.2%.

Which are the prominent players in the market?

-

The prominent players in the market are Aurora Cannabis Inc., Pure Kana, CV Sciences, Canopy Growth, Tisodiol International, Elixinol Global Ltd, Charlottes Web Holdings Inc, Medical Marijuana Inc, MGC Pharmaceuticals Ltd., Creso Pharma Ltd., Cronos Group Inc, Curaleaf Holdings Inc., Green Thumbs Industries Inc., Tilray Inc., TGOD Holdings Ltd., Zoetic International PLC.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.2% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Cannabis Edibles include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Cannabis Edibles in 2023.