Calcium Propionate Market

Calcium Propionate Market - Global Industry Assessment & Forecast

Segments Covered

By Form Dry, Lquid

By Application Food, Feed, Pharmaceutical, Animal Feed , Bakery Product, Personal Care , Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 284.6 Million | |

| USD 416.7 Million | |

| 5.6% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

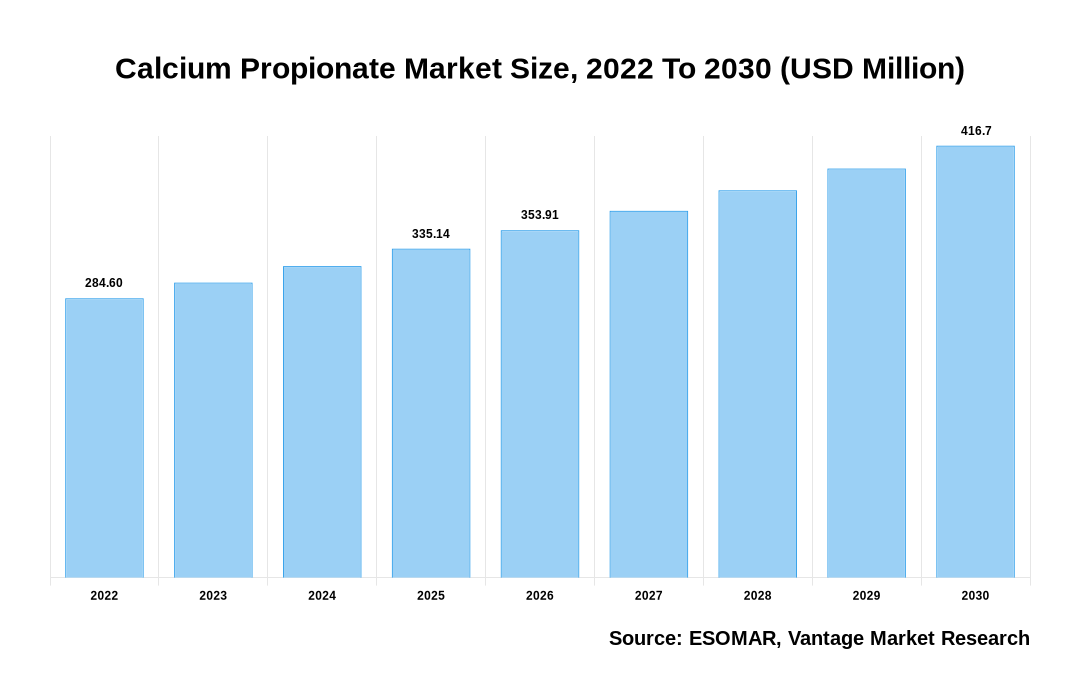

The global Calcium Propionate Market is valued at USD 284.6 Million in 2022 and is projected to reach a value of USD 416.7 Million by 2030 at a CAGR (Compound Annual Growth Rate) of 5.6% between 2023 and 2030.

Premium Insights

Calcium Propionate, a food additive, has antibacterial properties and is used as a preservative in many products. It helps to extend the shelf life of food by inhibiting the growth of germs and fungi. This market rapidly expands as consumer tastes shift towards fresh food, hygiene, and long-shelf-life products. Calcium Propionate is less hazardous than other preservatives. Preservatives like sodium propionate irritate the skin, eyes, and mucous membranes, whereas Calcium Propionate is not.

Calcium Propionate Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Calcium Propionate Market

It is a more cost-effective solution than other preservatives, a central driving element in the market. Apart from being used as a preservative, it has various functions that drive the market, such as being utilized as a cow feed addition. It prevents the spread of milk fever sickness among cows when used as an additive. Furthermore, it can be utilized as a plant pesticide. The market's key restriction is the rising demand for 'free-from' foods, such as non-preservative ones. Furthermore, raw material scarcity and rising prices are impeding manufacturing levels. Product demand is growing in emerging regions such as Asia Pacific and Latin America, which are mostly untapped. As a result, good expansion planning in these areas would be a fantastic opportunity. Furthermore, manufacturers focus on various R&D and innovation investments to develop new products.

Economic Insights

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The war between Russia and Ukraine could disrupt trade relations and supply chains between the countries and other countries with economic ties. Calcium Propionate is produced and exported from Russia and Ukraine, and both countries are major players in the global food preservatives market. Any disruption in production, transportation, or quality control standards could impact the availability and pricing of Calcium Propionate in the international market. Political instability and economic uncertainty could also affect the demand for Calcium Propionate in Ukraine and neighboring countries. A prolonged conflict could lead to declining consumer purchasing power, food production, and foreign investments. As a result, food manufacturers may cut back on their use of preservatives or switch to cheaper alternatives.

Top Market Trends

- Increasing demand in the food industry: The demand for Calcium Propionate as a preservative has been steadily growing in the food industry due to an increase in the need for packaged and processed food products that require a longer shelf life. The increasing demand for Calcium Propionate in the food industry is expected to sustain the industry's growth in the future. In addition, consumers are becoming increasingly health-conscious and are avoiding food products containing synthetic preservatives. This has led to the market's development of natural and alternative food preservatives. However, regulatory authorities consider Calcium Propionate safe and widely used in the food industry.

- Technological advancements in packaging: With technological advances, packaging manufacturers are developing food packaging materials that have a longer shelf life and require fewer preservatives. This can impact the future demand for Calcium Propionate, as food companies may opt for alternative packaging materials that need fewer preservatives. In addition, consumers increasingly demand clean-label food products, free from artificial additives, preservatives, and other chemicals. This has led to the development of natural preservatives and alternative food preservatives such as cultured dextrose, vinegar, and citrus extracts. Calcium Propionate is a synthetic food preservative, and the trend toward clean-label food products could affect the demand for Calcium Propionate in the future.

Market Segmentation

The global Calcium Propionate market can be categorized on the Form, Application, and Region. Based on Form, the market is divided into Dry and Liquid. Additionally, based on Application, the market can be split further into Pharmaceutical, Food, Bakery Products, Animal Feed, Personal Care, and Others. Similarly, based on Region, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Based on Form

Dry Segment to Express Maximum Market Share Due to Safety and Regulatory Compliance

In 2022, the dry-form segment dominated the market. Calcium Propionate is a safe and effective preservative approved for food use by regulatory agencies like the FDA. The dry form of Calcium Propionate also ensures manufacturers comply with food safety regulations. For instance, a significant company like DuPont Nutrition & Biosciences, which offers Calcium Propionate products under the brand name GRINDSTED® PC, introduced a new dry formulation of Calcium Propionate in 2019. This product is intended to increase the efficiency of the baking process and reduce waste while maintaining the quality and freshness of baked goods.

Based on Application

Food Category to Show Dominion Owing to Growing Demand for Healthier Food Options

The food application segment accounted for the market's most significant growth in 2022 due to the rising demand for healthier options. Growing knowledge of the health advantages of a balanced diet has led to rising demand for healthier food options. Calcium Propionate is a safe and effective food preservative with no negative health effects, making it a great answer for food manufacturers looking to meet the need for healthier food options. Furthermore, changing consumer lifestyles have raised the desire for quick and easy-to-prepare convenience foods. These foods often require longer shelf lives, which can be achieved through preservatives such as Calcium Propionate.

Based on Region

North America to Dominate Global Sales Due to the Increasing Consumption of Bakery Products

The rising popularity of bakery items such as bread, cakes, and pastries also contributes to the growth of North America Calcium Propionate industry. Calcium Propionate is a common preservative used in baked items to increase shelf life. The development of the bakery industry in North America is driving the demand for Calcium Propionate. In addition, the growing demand for clean-label products, i.e., products with simple and natural ingredients, is driving the growth of the Calcium Propionate industry. Calcium Propionate is a naturally occurring substance obtained from various sources, such as milk, cheese, and fruits. Hence, it is considered a clean-label ingredient, and its use is increasing in natural and organic food products.

The Asia Pacific region has grown significantly for Calcium Propionate over the past few years. The rising consumption of bakery products in countries such as China, India, Indonesia, and Australia has increased production. Calcium Propionate is utilized as a preservative in bakery products, and the baking business has expanded the demand for Calcium Propionate.

Competitive Landscape

Leading players produce Calcium Propionate in various forms and grades. They also invest in research and development to introduce new and innovative products that cater to customers' evolving needs. Additionally, they adopt mergers, acquisitions, partnerships, and collaborations to grow their market presence and boost their product offerings.

The key players in the global Calcium Propionate market include - Kerry Group PLC (Ireland), ADDCON GmbH (Germany), Impextraco NV (Belgium), Macco Organiques Inc. (Czech Republic), Perstorp Chemicals Pvt. Ltd. (India), Kemira (Finland), A.M. FOOD CHEMICAL Co. Ltd. (China), Eastman Chemical Company (U.S.), Fine Organics (India), Bell Chem Corp. (U.S.), Krishna Chemicals (India) among others.

Recent Market Developments

March 2023: BioVeritas invented a clean-label mold inhibitor created through the BioVeritas Process. The BioVeritas Calcium Propionate cultured extract extended its shelf life by an average of nearly 30% compared to petrochemical-derived Calcium Propionate.

April 2022: Perstorp planned to have an additional capacity of roughly 70,000 tons/year for carboxylic acid production onstream. As a result, the company intends to significantly boost Calcium Propionate production capacity, which is currently located in Italy. The additional capacity might be operational as early as 2024.

February 2022: ABF Ingredients acquired Fytexia Group, a life science company offering scientifically supported active nutrients for dietary supplements. This initiative will strengthen ABFI's portfolio of products and capabilities to augment the pharmaceutical, nutritional, and food market sectors.

June 2022: Kerry Group plc ("Kerry"), the global taste and nutrition company, acquired Hare Topco, Inc. trading as Niacet Corp. ("Niacet") from an affiliate of funds advised by SK Capital Partners, LP ("SK Capital") and other shareholders for, subject to customary closing adjustments, on a debt-free and cash-free basis.

Segmentation of the Global Calcium Propionate Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Form

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Calcium Propionate in terms of revenue?

-

The global Calcium Propionate valued at USD 284.6 Million in 2022 and is expected to reach USD 416.7 Million in 2030 growing at a CAGR of 5.6%.

Which are the prominent players in the market?

-

The prominent players in the market are Kerry Group PLC (Ireland), ADDCON GmbH (Germany), Impextraco NV (Belgium), Macco Organiques Inc. (Czech Republic), Perstorp Chemicals Pvt. Ltd. (India), Kemira (Finland), A.M. FOOD CHEMICAL Co. Ltd. (China), Eastman Chemical Company (U.S.), Fine Organics (India), Bell Chem Corp. (U.S.), Krishna Chemicals (India).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.6% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Calcium Propionate include

- Functional Potential of Calcium Proplonate in New Product Lines

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Calcium Propionate in 2022.