Buy Now Pay Later Market

Buy Now Pay Later Market - Global Industry Assessment & Forecast

Segments Covered

By Channel Online Channel, POS Channel

By Application Retail Goods, Media & Entertainment, Healthcare & Wellness, Automotive, Home Improvement, Others

By End User Generation X, Generation Z/Millennials, Baby Boomers

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 6021.76 Million | |

| USD 35209.11 Million | |

| 24.70% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Global Buy Now Pay Later Market

Buy Now Pay Later Market- By Channel, Application, End User and Region.

Market Synopsis:

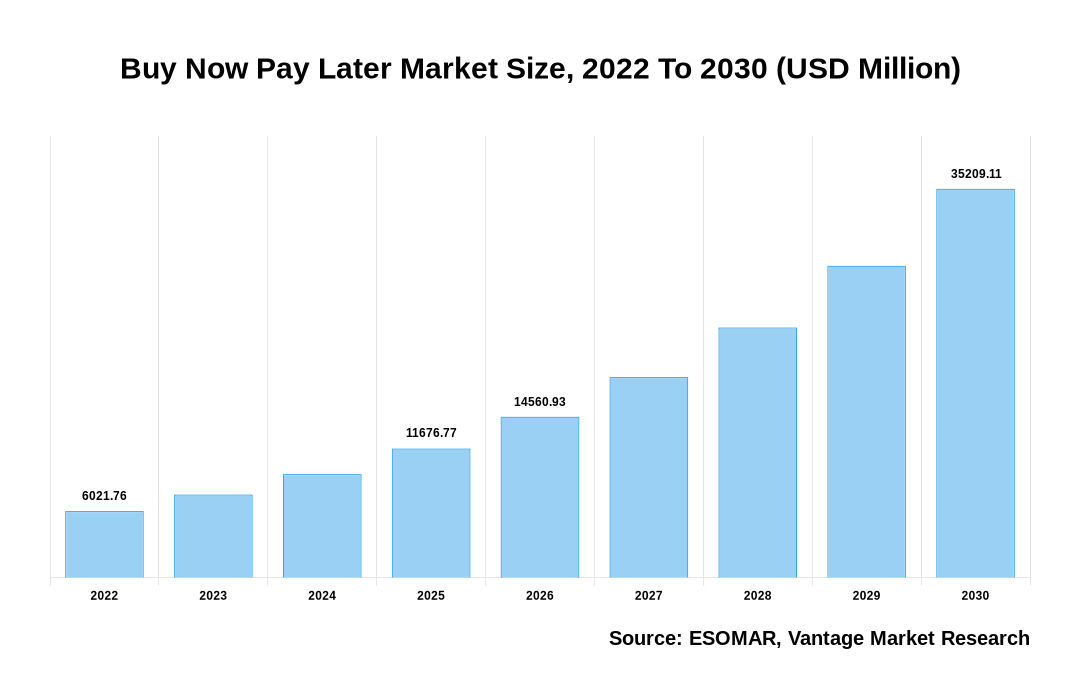

The Global Buy Now Pay Later Market is valued at USD 6021.76 Million in the year 2022 and is forecasted to reach a value of USD 35209.11 Million by the year 2030. The Global Market is anticipated to grow exhibiting a Compound Annual Growth Rate (CAGR) of 24.70% over the forecast period.

Buy Now Pay Later Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Buy Now Pay Later Market

Retailers are now offering buy now, pay later options, allowing customers to acquire everyday necessities by selecting an affordable financing plan and paying in installments rather than in one lump sum. Several business owners throughout the world have been using the Buy Now Pay Later payment platform to finance significant equipment, purchase raw materials, and pay staff salaries, fueling the worldwide Buy Now Pay Later Market.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Furthermore, as a result of the increased adoption of Buy Now Pay Later payment technology among the youth, which provides several benefits such as purchasing high-cost smartphones and laptops, paying tuition fees and stationery products, and paying the canteen bill, the Buy Now Pay Later Market is expected to grow. In the major countries, the purchase now pay later PayPal offers four interest-free payments using an online payment method. These market leaders provide services in a variety of industries, including travel and tourism, consumer electronics, e-commerce and retail, healthcare insurance, and banking and financial services. The top companies in this business also provide Buy Now Pay Later airfares and Buy Now Pay Later electronics. The global market is growing due to an increase in the number of e-commerce platforms and rising service use among millennials in developed countries.

The rise of the purchase now pay later business is accelerating as more people in emerging countries utilize online payment methods. The Global Buy Now Pay Later Market trends are being driven by economical and convenient payment services provided by Buy Now Pay Later platforms, as well as global e-commerce expansion. However, substantial late and returned payment costs restrict market expansion. On the contrary, the Buy Now Pay Later sector is likely to benefit from rising demand for delayed payments for online purchases and increased spending on luxury goods among the adult population.

There are a variety of payment alternatives available, including credit card and debit card loans, postdated checks, and others. Consumers and merchants in various emerging countries, like India, Brazil, Asia, and others, are ignorant of the BNPL service. Before delivering BNPL services to customers, credit scores must be checked. The program provides consumers with simple monthly installment payment choices in BNPL. Overall growth is hampered by a lack of awareness among consumers, retailers, and merchants, as well as the availability of multiple payment choices.

Market Segmentation:

The Buy Now Pay Later Market is segmented on the basis of Channel, Application, and End-user. On the basis of Channel, the market is segmented into Online Channel and POS Channel. On the basis of Application, the market is segmented into Retail Goods, Media & Entertainment, Healthcare & Wellness, Automotive, Home Improvement, and Others. On the basis of End-user, the market is segmented into Generation X, Generation Z/Millennials, and Baby Boomers.

Based on Application:

On the basis of Application, the market is segmented into Retail Goods, Media & Entertainment, Healthcare & Wellness, Automotive, Home Improvement, and Others. Due to a rise in consumers spending on everyday basic products and services at retail outlets via the purchase now pay later platform, the retail goods segment generated the greatest market share in 2021. However, due to rising treatment costs for various severe conditions such as chronic heart disease, cancer, and cardiovascular disorders, the healthcare & wellness category is predicted to grow at the fastest rate throughout the projection period. Furthermore, due to the increasing proliferation of COVID-19 patients around the world and the increased demand for treatment, people all over the world are turning to purchase now pay later services, which is predicted to be a lucrative potential for the Buy Now Pay Later platform in the healthcare industry.

Based on Channel:

On the basis of Channel, the market is segmented into Online Channel and POS Channel. The online channel sector, which accounted for more than 64.0 percent of global sales in 2021, topped the market. A number of companies throughout the world are developing partnerships to focus on the adoption of the fastest-growing online payment methods, such as buy now pay later, as part of their post-pandemic resuscitation strategies. In August 2021, Uplift, Inc., a BNPL solution provider, forged a collaboration with Tripster, an all-in-one trip booking platform.

North America is projected to acquire the largest market share during the year 2021

North America is projected to acquire the largest market share during the year 2021 with a share of 37.50%. The presence of a significant number of prominent firms can be credited to the regional market's growth. Furthermore, a number of fintech companies in the region are forming partnerships with entertainment organizations to provide BNPL hotel booking services. Uplift, Inc., a BNPL solution provider, teamed with SeaWorld Parks & Entertainment, Inc., an American theme park and entertainment corporation, in September 2021.

Competitive Landscape:

Key players operating in the Global Buy Now Pay Later Market include- Affirm Holdings Inc., Afterpay, Klarna Bank AB, Laybuy Group Holdings Limited, PayPal Holdings Inc., Payl8r (Social Money Ltd.), Perpay, Quadpay, Sezzle, Splitit and others.

Segmentation of the Global Buy Now Pay Later Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Channel

By Application

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Buy Now Pay Later in terms of revenue?

-

The global Buy Now Pay Later valued at USD 6021.76 Million in 2022 and is expected to reach USD 35209.11 Million in 2030 growing at a CAGR of 24.70%.

Which are the prominent players in the market?

-

The prominent players in the market are Affirm Holdings Inc., Afterpay, Klarna Bank AB, Laybuy Group Holdings Limited, PayPal Holdings Inc., Payl8r (Social Money Ltd.), Perpay, Quadpay, Sezzle, Splitit.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 24.70% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Buy Now Pay Later include

- Increasing number of internet users

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Buy Now Pay Later in 2022.

Vantage Market

Research | 06-Jun-2022

Vantage Market

Research | 06-Jun-2022