Biopesticides Market

Biopesticides Market - Global Industry Assessment & Forecast

Segments Covered

By Crop Type Cereal & Grains, Oilseeds & Pulses, Fruits & Vegetables, Other Crop Types

By Formulation Type Liquid Formulation, Dry Formulation

By Source Microbial Pesticides, Biochemical Pesticides, Plant-Incorporated Protectants

By Mode of Application Seed Treatment, Soil Treatment, Foliar Spray, Other Modes of Application

By Product Bio Insecticides, Bio Fungicides, Bio Herbicides, Bionematicides, Others (including Plant Growth Regulators)

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 5.75 Billion | |

| USD 17.57 Billion | |

| 15.00% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Premium Insights:

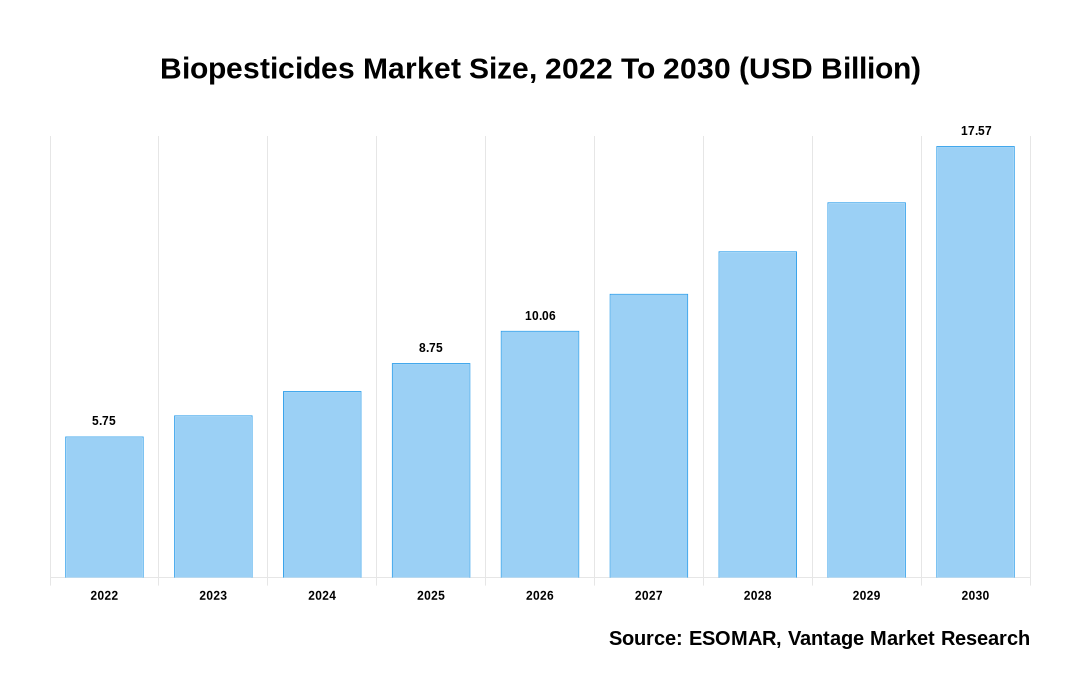

Premium Insights:The Global Biopesticides Market was valued at USD 5.75 Billion in 2022 and is forecast to reach a value of USD 17.57 Billion by 2030. The Global Market is anticipated to grow to exhibit a CAGR (Compound Annual Growth Rate) of 15.00% over the forecast period. The demand for biological pesticides rises as organic food and agriculture spread around the globe, fueling the expansion of the Biopesticides Market. Farmers worldwide are increasingly using biopesticides to minimize crop deterioration caused by chemical pesticides, as well as to address growing environmental concerns. Consumers are supporting alternatives to chemical-based agriculture as they become more aware of the chemicals used in food production and the possible risks of chemical residue on their health.

Hazardous chemical pesticides can be categorized as teratogenic (can cause congenital disabilities), neurotoxic (can damage the brain), or carcinogenic (can cause cancer) based on their possible effects on human health (can cause damage to a fetus). This is encouraging farmers to practice organic farming, which in turn is increasing the demand for biopesticides. Furthermore, agro-product advancements, such as plant extract-based and essential oils solutions, aid in disease control. They can potentially improve the efficacy of biopesticides for integrated pest management (IPM) programs for a wide range of crops worldwide. This drives the Biopesticides Market's expansion.

Synthetic fertilizers and pesticides are known to leave a hazardous residue that can disrupt the microbial balance, pollute the soil, and lower the concentrations of biocontrol agents. To minimize the harm of fungicides and disease-causing microorganisms, extremely effective b fungicides have been developed due to technological breakthroughs.

Biopesticides Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Biopesticides Market

Bio Fungicides are living creature formulations that limit the activity of harmful plant fungi and bacteria. In addition, the opportunities for the biopesticides market have been created by increased investments in developing a strong agriculture industry. The demand for more productive cash and food crops is anticipated to drive growth in the Global Biopesticides Market.

It is projected that the non-toxic properties of biopesticides, along with their inherent capacity to improve soil fertility, will expand their market share globally. Additionally, the availability of agricultural research and development courses at various colleges and research organizations greatly increases public knowledge of biopesticides, driving the growth of the Biopesticides Market. However, factors like poor shelf-life & inconsistent performance, low shelf-life & low acceptance rate of biopesticides are anticipated to partially restrain the growth of the Biopesticides Market. Additionally, due to the lower manufacturing costs of synthetic pesticides, the growth of the Global Biopesticides Market could be constrained during the forecasted period.

Top Market Trends

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

- The demand for biological pesticides rises as organic food and agriculture spread around the globe, fueling the expansion of the Biopesticides Market.

- In 2021, the fruits and vegetable segment is estimated to register the highest growth in the market, about 55%.

- In 2021, the bio fungicides segment recorded the highest share in the Biopesticides Market at 43%.

- The market for Biopesticides is fragmented due to numerous local and international businesses that control industry development.

- To enhance the market, biopesticide manufacturers are developing new products and cooperating with well-known brands. They also prepare items following regional climatic variances.

Market Segmentation:

The Biopesticides Market is segmented based on Crop Type, Formulation Type, Source, Mode of Application, Product, and Region. Based on the Crop Type, the market is segmented as Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others (Including Nursery and Turf). In addition, based on the Formulation Type, the market is further bifurcated into Liquid Formulation and Dry Formulation. Furthermore, based on the Source, the market is further divided into Microbial Pesticides, Biochemical Pesticides, and Plant-Incorporated Protectants. In addition, based on the Mode of Application, the market is further bifurcated into Seed Treatment, Soil Treatment, Foliar Spray, and Other Modes of Application. Additionally, based on the Product, the market is bifurcated into Bioinsecticides, Bio Fungicides, Bioherbicides, Bionematicides, and Others (including Plant Growth Regulators).

Based on Crop Type:

The Fruits & Vegetables category dominated the market in 2021

The Fruits & Vegetables category is anticipated to experience the fastest growth during the forecast period. Farmers are under pressure to switch to a sustainable agricultural practice due to the shift in eating patterns. The cost of growing fruits and vegetables is rising, and the demand for biopesticides is rising because of the massive infestation of Fruits & Vegetables in greenhouses and open fields. Additionally, farmers are implementing the usage of Biopesticide in conjunction with conventional chemicals to meet the export demand for residue-free crops. As global consumer food habits change, farmers in many nations are converting to sustainable farming practices. The sector is increasing due to rising interest in eating healthily and rising demand for organic fruits and vegetables. Therefore, the growing popularity of organic foods is encouraging farmers to use biopesticides.

Based on Product:

Bio Fungicides category dominated the market in 2021

The Bio Fungicides segment is anticipated to represent the highest share of the Global Biopesticides Market in 2021. Bio Insecticides are being more widely used due to rising pest resistance and a revival in agricultural production. Many insect pests are known to harm plant growth and crops after harvest or while in storage, which causes agricultural loss. The infestation brought on by insect pests also lowers the crops' marketability. The need for alternative solution approaches to control invasive pests is driven by regulatory bans and the phase-out of essential active components. As a result, Bioinsecticides that do not harm pests' natural adversaries, pollute the environment, or leave residues in products are widely used. Another element that has increased acceptance is the simplicity of producing Bio Fungicides.

Based on Regional Analysis:

North America had the Largest Share in 2021

North America accounted for the largest share of the market in 2021. Synthetic crop protection chemicals are subject to strict rules and regulations to safeguard the environment from unfavorable consequences, driving the regional market. The intense hunt for greener crop inputs drives the product's sales in the local market. Farmers are being pushed to use biological crop protection inputs by the requirement to meet international export standards. Farmers in this region are also being prompted to use biopesticides by rising customer demand for organic food and worries about residue levels in food. The North American region is home to numerous significant biopesticide producers, stimulating interest in and funding for biological crop protection products. Strong government laws and a thriving organic business promote organic farming practices in the area. Additionally, the demand for biopesticides in the U.S. will increase as more are used in greenhouses there.

Recent Developments:

- In May 2022, a strategic partnership was announced between UPL limited and AISTech (U.S.), a world leader in agricultural biological innovation. Through this collaboration, UPL would distribute AISTech's BioSolutions, starting with two bioinsecticides, Halogen and Fuligin. Through this collaboration, UPL would distribute AISTech's BioSolutions, starting with two bioinsecticides, Halogen and Fuligin. This would ultimately help UPL expand its bioinsecticides portfolio.

- In March 2021, BASF launched a new bio fungicide, Howler, into the European market and key countries of the Middle East and Africa. Howler is based on Pseudomonas colors, prehistorian AFS009, used in turf and golf courses. This was formulated to be effective against Pythium, Fusarium, Rhizoctonia, and Botrytis. This launch would help BASF SE broaden its BioSolutions portfolio provided by the Agricultural Solutions segment, especially in Europe.

- In March 2020, Bayer AG launched its first bio fungicide, Serenade, in China, containing QST713, a biocontrol microorganism; this would help plants absorb more effective nutrients and enhance plant immunity, reducing the incidences of diseases. The launch enabled Bayer AG to expand its product offering to the Chinese market.

Competitive Landscape:

The key players in the Global Biopesticides Market include- Certis USA LLC, Syngenta International AG, Nufarm Ltd, Bayer AG, Novozymes A/S, Gujarat State Fertilizers & Chemicals Ltd., FMC Corporation, Agri Life, Symborg S.L., Biotech International Limited, T. Stanes & Company Limited, Summit Chemical Inc., BioSafe Systems LLC and others.

Segmentation of the Global Biopesticides Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Crop Type

By Formulation Type

By Source

By Mode of Application

By Product

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Biopesticides in terms of revenue?

-

The global Biopesticides valued at USD 5.75 Billion in 2022 and is expected to reach USD 17.57 Billion in 2030 growing at a CAGR of 15.00%.

Which are the prominent players in the market?

-

The prominent players in the market are Certis USA LLC, Syngenta International AG, Nufarm Ltd, Bayer AG, Novozymes A/S, Gujarat State Fertilizers & Chemicals Ltd., FMC Corporation, Agri Life, Symborg S.L., Biotech International Limited, T. Stanes & Company Limited, Summit Chemical Inc., BioSafe Systems LLC.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 15.00% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Biopesticides include

- High costs associated with the development of new synthetic crop protection products

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Biopesticides in 2022.

Vantage Market

Research | 22-Sep-2022

Vantage Market

Research | 22-Sep-2022