Big Data Security Market

Big Data Security Market - Global Industry Assessment & Forecast

Segments Covered

By Component Software, Services

By Software Data Discovery and Classification, Data Authorization and Access, Data Encryption, Tokenization and Masking, Data Auditing and Monitoring, Data Governance and Compliance, Data Security Analytics, Data Backup and Recovery

By Deployment Type Cloud, On-Premises

By Organization Size Large Enterprise, SMEs

By Verticals IT and ITES, Telecommunications, Healthcare and Social Assistance, Financial and Insurance, Retail Trade, Utilities, Other Verticals

By Regions North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 20361.42 Million | |

| USD 48991.60 Million | |

| 11.60% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Big Data Security Market

Market Synopsys

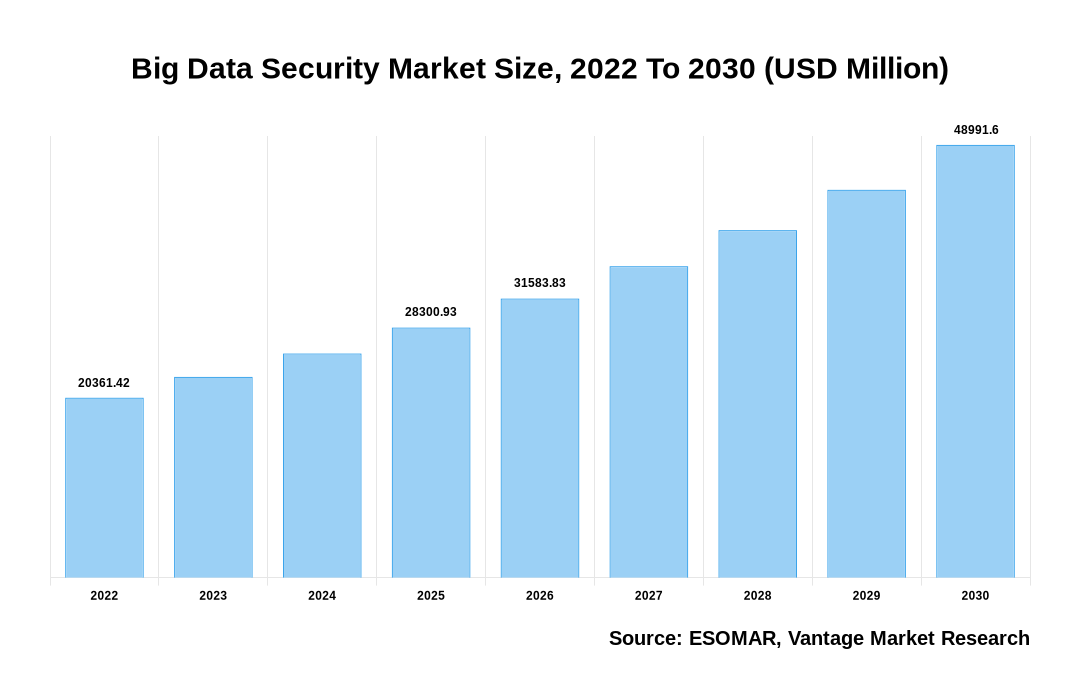

Global Big Data Security market is valued at USD 20361.42 Million in 2022 and is projected to reach a value of USD 48991.60 Million by 2030 at a CAGR of 11.60% over the forecast period.

Big Data Security refers to the process of protecting data and analytics processes, both in the cloud and on premise, from a variety of threats that could jeopardize their confidentiality which is the major factor for the growth of Big Data Security market during the forecast period. Enterprises are increasingly embracing big data, relying on powerful analytics to drive decision-making, identify opportunities, and improve performance during the forecast period. However, the massive increase in data usage and consumption raises concerns about Big Data Security is due to factors such as the rapid adoption of digital technologies and the growing importance of data-based trend analysis methods. Additionally, the rise in data privacy and security concerns has created a solid foundation for the market. Furthermore, advancements in big data techniques are expected to drive the use of big data analytics technology, providing a lucrative opportunity for market growth in the years to come. A small budget for Big Data Security and a high installation cost. Emerging startups' cybersecurity budgets are insufficient to implement Next-Generation Firewalls (NGFWs) and Advanced Threat Protection (ATP) solutions. Lack of investment and limited funding are key factors that are expected to limit the adoption of Big Data Security solutions by small businesses in developing economies during the forecast period. Furthermore, the increasing awareness and investment in Big Data Security solutions across global organizations operating across verticals can be attributed to the market's growth during the forecast period.

Big Data Security Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Big Data Security Market

Market Segmentation:

The Big Data Security market is segmented on the basis of component, software, deployment type, and organization size. Based on component, the market is segmented as Software, Services. By software, the market is segmented as Data Discovery and Classification, Data Authorization and Access, Data Encryption, Tokenization and Masking, Data Auditing and Monitoring, Data Governance and Compliance, Data Security Analytics, Data Backup and Recovery. By deployment type, the market is Cloud, On-Premises. By organization size, the market is segmented as Large Enterprises, Small and Medium-sized Enterprises. By verticals, the market is segmented as IT and ITES, Telecommunications, Healthcare and Social Assistance, Financial and Insurance, Retail Trade, Utilities, Other.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Based on deployment type, the cloud segment is proved to be the largest in the Big Data Security market

The cloud category had a major share in the global Big Data Security market in 2021 Big Data Security solutions can be deployed on-premises or in the cloud, depending on the needs of the business. The on-premises deployment mode gives organizations greater control over all Big Data Security solutions, including next-generation firewalls and intrusion prevention systems which is increasing the demand of cloud segment in the Big Data Security market during the forecast period. Enterprises benefit from the cloud deployment mode of Big Data Security solutions because cloud-based solutions provide speed, scalability, and enhanced IT security which is expected to increase the demand for cloud segment during the forecast period. As more applications are deployed in the cloud, there is a growing demand among SMEs and large enterprises for cloud-based Big Data Security solutions during the forecast period.

Organization size - large enterprises holds the largest market share

The Large Enterprises category had a major share in the global Big Data Security market in 2021. Large enterprises are reshaping their security policies and architecture to incorporate big data in order to protect critical assets from various cyber-attacks. Large organizations rely heavily on Big Data Security to protect their networks, endpoints, data centers, devices, users, and applications from unauthorized access and malicious ransom ware attacks. Enterprises are increasingly embracing big data, relying on powerful analytics to drive decision-making, identify opportunities, and improve performance. However, the massive increase in data usage and consumption raises concerns about Big Data Security.

In the North America region, the Big Data Security Market is growing at the highest CAGR during the forecast period.

The region of North America had the largest market share. Because the majority of security vendors are based in North America, the region is a pioneer in the adoption of new and advanced security technologies during the forecast period. Furthermore, an increase in sophisticated cyber-attacks is expected to drive the implementation of Big Data Security in a variety of industries, including banking, finance, government, and healthcare. With the widespread adoption of digital payments, the cloud-based applications, IoT, and security ecosystems have become more complex. Businesses in the region, including major technology companies like Intel, are increasingly embracing the Big Data environment. Enterprises in the region, including large technology companies like Intel, are increasingly embracing the Big Data environment. Furthermore, the White House has invested more than USD 200 million in Big Data projects during the forecast period. Furthermore, SaaS adoption is growing among local SMEs, making them vulnerable to threats. With data breaches on the rise, there is a significant need for Big Data Security in the region is required.

Competitive Landscape

The key players in the Big Data Security market are launching different strategies for the development of Big Data Security market such as new product development, geographic enhancement, mergers and amp; acquisitions, and product enhancement among others to increase their presence in the market and in market shares as well. Some of the major key players in the Big Data Security market are IBM (US), Oracle (US), Microsoft (US), Google (US), Amazon Web Services (US), Hewlett Packard Enterprise (US), Talend (US), Micro Focus (UK), Check Point (Israel), FireEye (US), Rapid7 (US), Thales (France), Informatica (US), McAfee (US), Centrify (US), Sisense (US), Imperva (US), Proofpoint (US), Varonis (US), Cloudera (US), Fortinet (US), Digital Guardian (US), SentinelOne (US), DataVisor (US), and Zettaset (US).

Big Data Security Market is segmented as follows:

Parameter

Details

Segments Covered

By Component

By Software

By Deployment Type

By Organization Size

By Verticals

By Regions

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Big Data Security Market is tabulated as follows:

FAQ

Frequently Asked Question

What is the global demand for Big Data Security in terms of revenue?

-

The global Big Data Security valued at USD 20361.42 Million in 2022 and is expected to reach USD 48991.60 Million in 2030 growing at a CAGR of 11.60%.

Which are the prominent players in the market?

-

The prominent players in the market are IBM (US), Oracle (US), Microsoft (US), Google (US), Amazon Web Services (US), Hewlett Packard Enterprise (US), Talend (US), Micro Focus (UK), Check Point (Israel), FireEye (US), Rapid7 (US), Thales (France), Informatica (US), McAfee (US), Centrify (US), Sisense (US), Imperva (US), Proofpoint (US), Varonis (US), Cloudera (US), Fortinet (US), Digital Guardian (US), SentinelOne (US), DataVisor (US), and Zettaset (US)..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 11.60% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Big Data Security include

- rapid adoption of digital technologies and the growing importance of data-based trend analysis methods

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Big Data Security in 2022.

Vantage Market

Research | 16-Mar-2022

Vantage Market

Research | 16-Mar-2022