Automotive Pillars Market

Automotive Pillars Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Pillar A, Pillar B, Pillar C, Pillar D

By Vehicle Type Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicles

By Material Aluminum, Steel, Plastic, Composites

By Sales Channel OEM, Aftermarkets

By Region North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 7.2 Billion | |

| USD 10.7 Billion | |

| 4.5% | |

| Europe | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

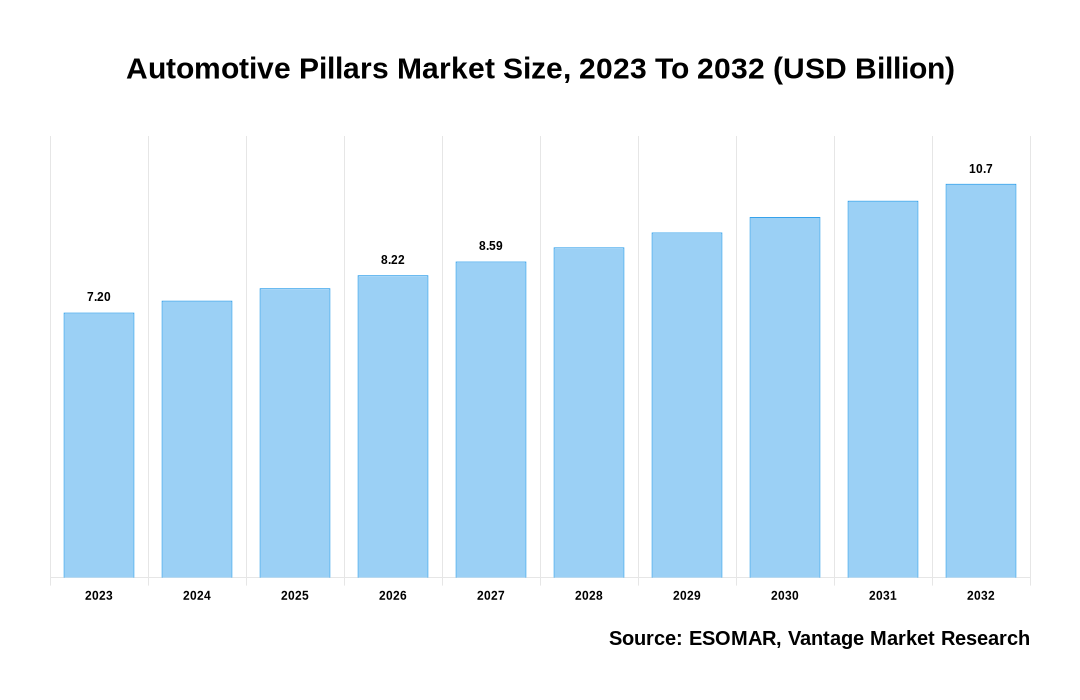

The global Automotive Pillars Market is valued at USD 7.2 Billion in 2023 and is projected to reach a value of USD 10.7 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 4.5% between 2024 and 2032.

Key highlights of Automotive Pillars Market

- Asia Pacific dominated the Automotive Pillars market in 2023 and obtaining the largest revenue share of 38.6%

- The Europe is expected to witness the remarkable growth during the forecast period

- In 2023, the Pillar A segment dominated the Automotive Pillars market with revenue share of 48.2%

- The Passenger Car segment asserted to have the largest revenue share of 74.2% in 2023

- OEM segment accounted to have the largest growth of the Automotive Pillars Market in 2023

- Environmental concerns are driving automakers to explore sustainable materials and manufacturing processes for Automotive Pillars. For instance, Gestamp made agreement with Tata Steel UK to nearly double recycled-steel content supplied to the automotive sector.

Automotive Pillars Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Automotive Pillars Market

Automotive Pillars Market: Regional Overview

Asia Pacific dominated the Automotive Pillars Market with revenue share of 38.6% in 2023. The large presence of automobile producers such as, Honda, Hyundai, and Toyota are augmenting the growth of the Automotive Pillars Market in this region. The increasing importance of safety and security in vehicles is also propelling to the growth of the Automotive Pillars market in this region. The growth of the Automotive Pillars market in Asia Pacific is also driven by the increasing demand for lightweight and durable materials. In recent years, various companies are largely concentrating on developing advance materials which help in reducing the weight of the pillars and maintain their strength and durability. For example, Audi A8 developed a lightweight frame made of high-strength steel, magnesium, and carbon fiber composites. These materials can reduce vehicle weight by 30–70%, and improve performance and emissions without compromising on safety.

China Automotive Pillars Market Overview

The China Automotive Pillars market, valued at USD 0.8 Billion in 2023 to USD 1.12 Billion in 2032, is anticipated to grow at a CAGR of 3.8% from 2024 to 2032. Over past few decades, automotive sector in China is growing rapidly because of rising growth in passenger and commercial vehicles. For instance, in 2022, approximately 23.56 million passenger cars and 3.3 million commercial vehicles had been sold in China. In addition, growing electric vehicle demand is also augmenting the growth of the Automotive Pillars Market in China. As per the findings from the China Association of Automobile Manufacturers (CAAM), the sales of electric vehicles in the nation experienced a remarkable surge, jumping by 177% to reach 185,000 cars in 2022 compared to last year. Concurrently, the broader market for passenger cars in China saw a modest uptick of 1.1%, reaching a total of 1.66 million units sold. This increased production has naturally led to higher demand for automotive components, including pillars.

The global Automotive Pillars market can be categorized as Product Type, Vehicle Type, Material, Sales Channel, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Vehicle Type

By Material

By Sales Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Automotive Pillars Market: Product Type Overview

In 2023, Pillar A generated a significant revenue share of 48.2% in Automotive Pillars Market. The Product Type segment is divided into Pillar A, Pillar B, Pillar C, and Pillar D. A pillar is an important component in providing structural integrity for the vehicle by supporting efficient windshield and roof. The requirement of a sturdy A-pillar design to enhance the safety of passenger during frontal collisions is anticipating the largest market growth. This is due to the stringent safety regulations and standards for roof crush resistance and growing concerns about crashworthiness. Moreover, the integration of Advanced Driver Assistance Systems (ADAS) features, such as lane departure warning and forward collision warning, often requires the placement of sensors, cameras, and LiDAR systems near the A-pillar. The increasing demand for vehicles equipped with ADAS technology has propelled the need for well-engineered A-pillars capable of accommodating these components without compromising functionality.

Automotive Pillars Market: Vehicle Type Overview

The Passenger Car segment held a significant revenue share of 74.2% in 2023. The Vehicle Type segment is classified into Passenger Car, Light Commercial Vehicle, and Heavy Commercial Vehicles. With passenger safety being a top priority for car manufacturers, there is a consistent demand for well-designed pillars, including A-pillars, B-pillars, C-pillars, and sometimes D-pillars, to meet stringent safety regulations and standards. Modern passenger cars are equipped with advanced technologies such as ADAS (advanced driver assistance systems), which require the integration of sensors, cameras, and other components within or near the pillars. For instance, the driver is alerted to vehicles in the offset rear blind area when a sensor in the outer rearview mirrors detects oncoming traffic. Furthermore, the driver can see what's in their blind area due to cameras mounted in the door mirrors that face rearward. In addition, passenger cars often prioritize design and aesthetics to attract consumers. Sleek and stylish pillar designs, especially B-pillars and C-pillars, contribute to the overall visual appeal of the vehicle. Automakers invest in innovative pillar designs that balance safety requirements with design considerations to create attractive passenger cars.

Key Trends

- The integration of advance technologies such as, cameras, sensors, and antennas in Automotive Pillars to support various vehicle systems is augmenting the market growth in recent years. For example, Ford's Co-Pilot360 system utilizes sensors and cameras mounted near the A-pillars to provide features like lane-keeping assist and automatic emergency braking.

- The utilization of advance manufacturing techniques such as hydroforming, laser wending, and hot stamping helps to develop the Automotive Pillars with complex shapes and reduced weight while maintaining strength. For instance, Volkswagen utilizes laser welding technology to join aluminum parts in the production of A-pillars for models like the Golf.

- Consumers are seeking customizable options for their vehicles, including pillar designs and finishes. Automakers like Audi offer customizable pillar trims as part of their interior design packages, allowing customers to personalize their vehicles according to their preferences.

- Major focus on innovative pillar design to boost the vehicle's overall aesthetic appeal is responsible for the growth of the Automotive Pillars Market. For instance, the Tesla Model X features sleek and futuristic Falcon Wing doors supported by unique B-pillar designs, enhancing both functionality and visual appeal.

Premium Insights

Environmental concerns are driving the adoption of sustainable materials and manufacturing processes in the automotive industry, including the production of eco-friendly pillars. To develop sustainable product, various company are focusing on achieve its sustainability goals and decarbonize its supply chain. A prime example for this is the KIRCHHOFF Automotive’s agreement with Swedish company H2Green Steel to supply virtually emission-free steel to the tune of 130 million euros. According to them, approximately 90% of the CO2 emissions footprint stems from the utilization of conventionally manufactured steel and aluminum. In addition, automakers are increasingly recognizing that plastic is both a good design material and an ideal choice for improving vehicle performance and sustainability. For example, Toyota's Prius utilizes bio-based plastics for interior pillar trims, reducing the vehicle's environmental footprint.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The Automotive Pillars market is driven by the utilization of light-weight material

Major manufacturers are utilizing lightweight material like aluminum, carbon fiber, and high-strength steel in the production of Automotive Pillars in order to maintain structural integrity and help in reducing overall vehicle weight. For instance, The BMW i3, an electric vehicle, incorporates A-pillars made of carbon fiber-reinforced plastic (CFRP), contributing to a lighter and sturdier passenger compartment. The use of carbon frame helps to connect the interior and exterior, while the two-dimensional carbon matting provides the exposed structure with a practical aesthetic. Within the cabin, it features a carbon fiber monocoque structure weighing approximately 101.3 kg, inclusive of thermoplastic resin, adhesives, and foams. Of this weight, carbon fiber-reinforced plastic (CFRP) constitutes roughly half, totaling 68.5 kg. The remaining 36.8 kg accounts for the weight of the body structure, excluding the chassis, powertrain, and battery components. Thus, the use of light weight material in the development of automotive pillar is fueling the growth of the Automotive Pillars Market in recent years.

Growing emphasis on safety and visibility features is driving the growth of the Automotive Pillars Market

The utilization of enhanced safety and visibility features in vehicle design is accelerating the maximum growth of the Automotive Pillars Market. With a focus on meeting stringent crash safety standards and bolstering occupant protection during collisions, Automotive Pillars are undergoing reinforcement and redesign. For example, Volvo provides its safety cage design, reinforcing A-pillars in models like the XC90 to offer superior crash protection. Innovations such as metal box construction combined with see-through Plexiglass enable drivers to see through A-pillars, improving visibility. Furthermore, B-pillars are curved inwards to offer an unobstructed field of vision to the offset rear, enhancing driver awareness. Integration of sensors in outer rear-view mirrors detects approaching vehicles, alerting drivers to potential blind spots, while rearward-facing cameras provide additional visibility into these areas. This emphasis on safety and visibility features is driving advancements in automotive pillar design, shaping the market's trajectory towards safer and more user-friendly vehicles.

Competitive Landscape

The competitive landscape of the Automotive Pillars Market support strategic partnerships and joint development initiatives in order to expand manufacturing capabilities and driving innovation in the market. For instance, in October 2023, Martinrea International Inc. established a strategic relationship with Yamada Manufacturing Co., Ltd., to enhance the Yamada's production expertise and network in Japan and bolster Martinrea's global manufacturing footprint. Likewise, in July 2022, G-TEKT Corporation and Ahresty Corporation embarked on a joint development venture focused on auto body components and EV-related parts, aiming to create new value and contribute to the rapid adoption of electric vehicles (EVs) and carbon neutrality efforts within the automotive industry. These collaborations highlighted the dynamic nature of the landscape by providing partnerships and innovation and help in driving growth in the Automotive Pillars Market.

The key players in the global Automotive Pillars market include - KIRCHHOFF Automotive GmbH, Gestamp, Toyoda Iron Works Co. Ltd., Magna International Inc., Aisin Seiki Co. Ltd., Trinseo SA, GEDIA, Automotive Group, G-Tekt Corporation, Martinrea International Inc., Tower International, Benteler International AG, Meleghy Automotive GmbH & Co. KG, Shiloh Industries, Sewon, ELSA LLC among others.

Recent Market Developments

- In March 2024, Gestamp has signed agreements with steelmakers SSAB and Tata Steel UK to increase the amount of fossil-free steel used in body-in-white and chassis-system products.

- In October 2023, Martinrea International Inc. announced a strategic relationship with Yamada Manufacturing Co., Ltd. based in Gunma, Japan. The strategic relationship signifies a broader global manufacturing footprint for Martinrea in Japan, encompassing Yamada’s production expertise and network.

- In July 2022, G-TEKT Corporation and Ahresty Corporation have agreed to start joint development of auto body components and EV-related parts with the aim of creating new value that contributes to the rapid shift to EVs in the automotive industry and to efforts to become carbon neutral.

FAQ

Frequently Asked Question

What is the global demand for Automotive Pillars in terms of revenue?

-

The global Automotive Pillars valued at USD 7.2 Billion in 2023 and is expected to reach USD 10.7 Billion in 2032 growing at a CAGR of 4.5%.

Which are the prominent players in the market?

-

The prominent players in the market are KIRCHHOFF Automotive GmbH, Gestamp, Toyoda Iron Works Co. Ltd., Magna International Inc., Aisin Seiki Co. Ltd., Trinseo SA, GEDIA, Automotive Group, G-Tekt Corporation, Martinrea International Inc., Tower International, Benteler International AG, Meleghy Automotive GmbH & Co. KG, Shiloh Industries, Sewon, ELSA LLC.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.5% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Automotive Pillars include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Automotive Pillars in 2023.