Autoinjectors Market

Autoinjectors Market - Global Industry Assessment & Forecast

Segments Covered

By Usage Disposable Autoinjectors, Reusable Autoinjectors

By Technology Manual Autoinjectors, Automatic Autoinjectors

By Route of Administration Subcutaneous, Intramuscular

By Therapy Diabetes, Rheumatoid Arthritis, Multiple Sclerosis, Anaphylaxis, Other Therapy Areas

By Region North America, Aisa Pacific, Europe, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 0.97 Billion | |

| USD 3.27 Billion | |

| 14.5% | |

| Aisa Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

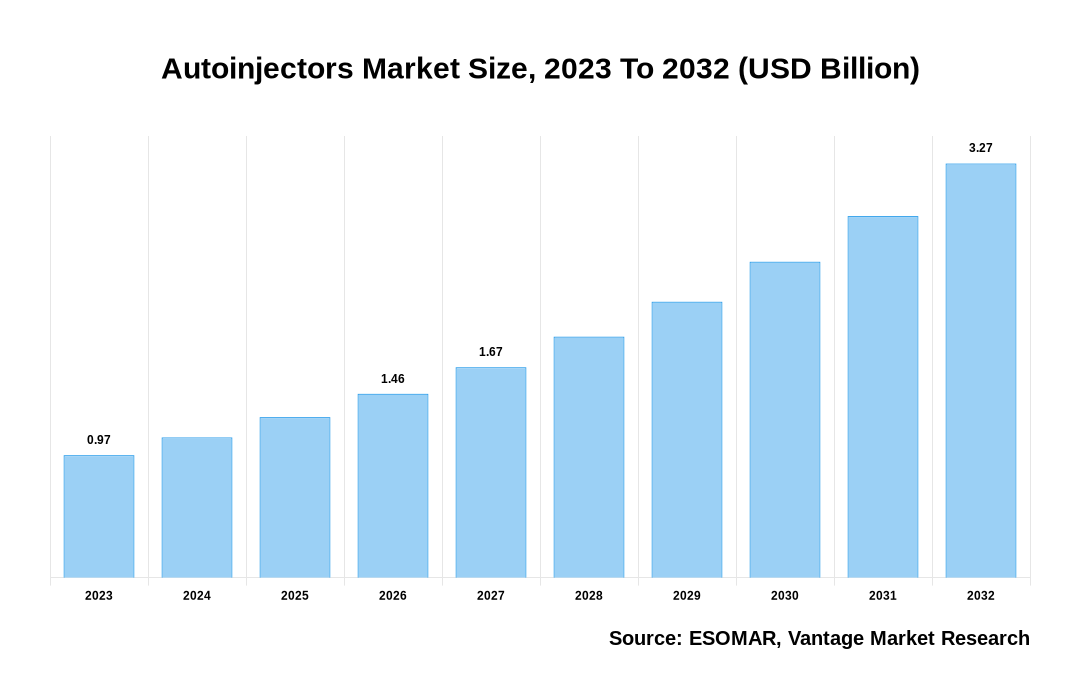

The global Autoinjectors Market is valued at USD 0.97 Billion in 2023 and is projected to reach a value of USD 3.27 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 14.5% between 2024 and 2032.

Key Highlights

- In 2023, The North American led the market with 60.5% of the total market share

- The Asia Pacific region is projected to remain the fastest-growing region during the forecast period,

- The Disposable Autoinjectors segment significantly contributed to the market’s expansion, constituting over 60.2% of the overall revenue share in 2023,

- In 2023, the Subcutaneous segment took the lead in the global market,

- The Diabetes segment played a substantial role in driving the market’s growth in 2023.

Autoinjectors Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Autoinjectors Market

Regional Overview

In 2023, the North American market captured 60.5% of the revenue share. The region's large population, high healthcare spending, and advanced medical infrastructure are key drivers. A wide range of medical needs, including chronic diseases such as diabetes, rheumatoid arthritis, and severe allergy, are provided across North America. The expansion of the market is facilitated by regulatory support and a favorable healthcare environment. Demand for Autoinjectorss that are user-convenient and easy to use is supported by an increase in the trend of self-administration and personal healthcare. Additionally, the patient compliance and safety are enhanced by ongoing technological advances, such as connectivity and smart features.

In 2023, the market in the United States was valued at USD 0.46 Billion, poised to ascend to approximately USD 1.4 Billion by 2032. In line with the sector's robust expansion, forecasts predict a significant compound annual growth rate of 13% between 2024 and 2032. The U.S. market is driven by high healthcare costs, a large patient base, and an established medical infrastructure. Demand for these injectors in the U.S. is fuelled by the prevalence of chronic conditions like diabetes and autoimmune diseases, as well as anaphylaxis.

Usage Overview

In 2023, substantial expansion was observed in the overall market within the Disposable Autoinjectors segment accounting for 60.2% of revenue. Based on the Usage, the market is bifurcated into Disposable Autoinjectors and Reusable Autoinjectors. Due to their convenience and ease of use, compact autoinjectors are an increasing segment within the global market for autoinjectors. These devices enable patients to administer their own heparin without extensive medical training through a prefilled, single-use method. It is particularly helpful in the case of conditions that require regular injections, e.g. autoimmune disorders and severe hypersensitivity reactions. Due to their reduced risk of contamination and elimination of the need for periodic cleaning and maintenance, disposable autoinjectors have become popular among patients and healthcare professionals. The growing incidence of diseases, rising preference for self-administration, and better patient compliance drive worldwide demand for these devices.

Route of Administration Overview

There was significant growth in the Subcutaneous category in 2023. Based on the Route of Administration, market segmentation includes Subcutaneous and Intramuscular. An essential component is the subcutaneous segment of the global injector vehicle market, catering to various therapeutic areas. Subcutaneous Autoinjectors is commonly used for conditions such as diabetes, rheumatoid arthritis, and anaphylaxis, providing a reliable means for patients to manage chronic conditions. As a result of the convenience offered, increased patient compliance, and reduced reliance on healthcare facilities, the demand for this segment is increasing. Technological progress and improvements in the design of subcutaneous autoinjectors, enabling them to be more secure, easy to use, and effective, are driving market development.

Key Trends

- Autoinjectors designed for ease of use, portability, and reduced pain during injection are being developed due to the growing emphasis on patient-centered healthcare. Patients can take their treatment more independently due to that focus.

- With telemedicine and home healthcare becoming increasingly common, these devices are essential to enable patients to receive treatment without frequent hospital stays. This trend, especially after the COVID-19 pandemic, has been accelerated.

- Patients are learning more about their health status and the treatment options available. This awareness contributes to the popularity and also as an alternative to traditional injections in medical facilities.

- The Autoinjectors with safety features such as needle guards and automatic retraction are designed to minimize errors and injuries during injection. This trend aligns with the broader aim of enhancing patient safety.

- Pharmaceutical companies and manufacturers often collaborate to develop and market new devices, resulting in a wide range of products. Innovation is stimulated by these partnerships, and the scope of markets expands.

Premium Insights

Due to these devices' flexibility and different applications, the worldwide market has been growing strongly. Autoinjectorss are used for a wide range of medical needs, from emergency cases to treatment of chronic diseases. An outline of the regulatory framework applicable to Autoinjectors is provided in a guidance document from the Food and Drug Administration that provides approval guidelines for these devices. Performance testing for these combination product devices, pre-filled with their intended drug product, follows the ISO 11608-5:2022 standard. To ensure that these critical functions operate reliably and prevent device failure, this updated standard emphasizes a greater emphasis on the primary function of needle-based injection systems. These functions, which demonstrate the critical need for strict testing and compliance with standards, guarantee the safety and performance of devices and assure that medication is delivered precisely by a proper route without exposing patients to any harm.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

There is an increased trend for flexible design injectors, which allow for customized dosing, which is ideal for a wide range of treatments, including diabetes, fertility, growth hormone, obesity, and osteoporosis. Thus, companies are engaged in developing such products, For instance, Phillips-Medisize, a Molex company specializing in drug delivery, diagnostic, and MedTech devices, launched of a new disposable pen injector. PhillipsMedisize's product portfolio is intended for high-volume production, offering pharmaceutical companies a familiar pen injector and a competitive pen to allow quicker, more efficient, and cost-effective entry into the market. The pen injector reflects the familiar design of disposable pens but with a noticeably smaller size than similar products on the market to meet user expectations.

The global market is evolving with strategic partnerships and increased demand for self-injection devices. FUJIFILM Diosynth Biotechnologies, a leading contract development and manufacturing organization (CDMO), has entered into a strategic partnership with SHL Medical, a major provider of advanced drug delivery systems, to meet the growing demand for autoinjector medicines. This cooperation aims at improving the efficiency and effectiveness of pharmaceutical or biotechnology processes. Under SHL's Alliance Management Program, the partnership focuses on expanding these services through SHL's flagship platform, Molly®. FUJIFILM Diosynth Biotechnologies will provide pre-validated final assembly services for Molly autoinjectors, targeting a production capacity of up to 30 million units annually by early 2025. The agreement reflects a broader industry trend towards patient-centric solutions and the growing need for self-injection devices. Autoinjectors offer patient-friendly methods for administering medications through subcutaneous or intramuscular routes.

Competitive Landscape

Leading manufacturers invest heavily in research and development to create and develop advanced features like ergonomic design, dose precision, and enhanced safety mechanisms. Companies compete on aspects such as product reliability, ease of use, and cost-effectiveness. For instance, Jabil Healthcare, a division of Jabil Inc., declared the launch of the Qfinity™ autoinjector platform, a simple, reusable, and modular solution for subcutaneous drug self-administration, at a lower cost than market substitutes— supporting the emerging prioritization of sustainable drug delivery within the pharmaceutical industry.

Recent Market Developments

Ypsomed Transfers Pen Needle and BGM Businesses to MTD

- In March 2024, Ypsomed and Medical Technology and Devices S.p.A. (MTD) have agreed to transfer the pen needle and blood glucose monitoring systems (BGM) businesses to MTD. This move will ensure a steady supply of a distinctive pen needle range. Ypsomed plans to invest more than CHF 100 million over the next four years to expand its autoinjector production capacities at its Solothurn facility as part of its growth strategy.

Strategic Partnerships and Alliances

- In September 2023, SHL Medical unveiled a strategic alliance program for its autoinjector services. As a leading provider of advanced drug delivery systems, such as autoinjectors and specialized delivery solutions, SHL Medical announced the launch of a global Alliance Management program.

- In May 2023, SHL Medical announced a collaboration agreement with MoonLake Immunotherapeutics, a clinical-stage biotechnology company specializing in developing advanced therapies for inflammatory diseases. The partnership aims to create an autoinjector for the clinical and potential commercial supply of MoonLake's Nanobody® sonelokimab, utilizing SHL Medical's Molly® autoinjector technology.

- In September 2023, Ypsomed has signed a long-term supply agreement with Novo Nordisk to provide large quantities of Autoinjectorss. These will be used for self-administering medications across various metabolic conditions. Ypsomed is currently expanding its annual manufacturing capacity significantly in multiple stages, with plans to complete the expansion by 2031.

The global Autoinjectors market can be categorized as Usage, Route of Administration, Therapy, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Usage

By Technology

By Route of Administration

By Therapy

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 16-May-2024

Vantage Market

Research | 16-May-2024

FAQ

Frequently Asked Question

What is the global demand for Autoinjectors in terms of revenue?

-

The global Autoinjectors valued at USD 0.97 Billion in 2023 and is expected to reach USD 3.27 Billion in 2032 growing at a CAGR of 14.5%.

Which are the prominent players in the market?

-

The prominent players in the market are Becton Dickinson and Company (U.S.), SHL Medical (Switzerland), Ypsomed Holding AG (Switzerland), Owen Mumford (UK), Teva Pharmaceuticals USA Inc. (U.S.), Phillips-Medisize Corp. (U.S.), Jabil Inc. (U.S.), Haselmeier (Germany), Gerresheimer AG (Germany), E3D Elcam Drug Delivery Devices (Israel), Oval Medical Technologies Ltd. (UK).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.5% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Autoinjectors include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Autoinjectors in 2023.