Atherectomy Devices Market

Atherectomy Devices Market - Global Industry Assessment & Forecast

Segments Covered

By Product Directional Atherectomy Devices, Orbital Atherectomy Devices, Photo-Ablative Atherectomy Devices, Rotational Atherectomy Devices, Support Devices

By Application Peripheral Vascular, Cardiovascular, Neurovascular

By End User Hospitals & Surgical Centers, Ambulatory Care Centers, Research Laboratories & Academic Institutes

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 1.1 Billion | |

| USD 1.81 Billion | |

| 6.42% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

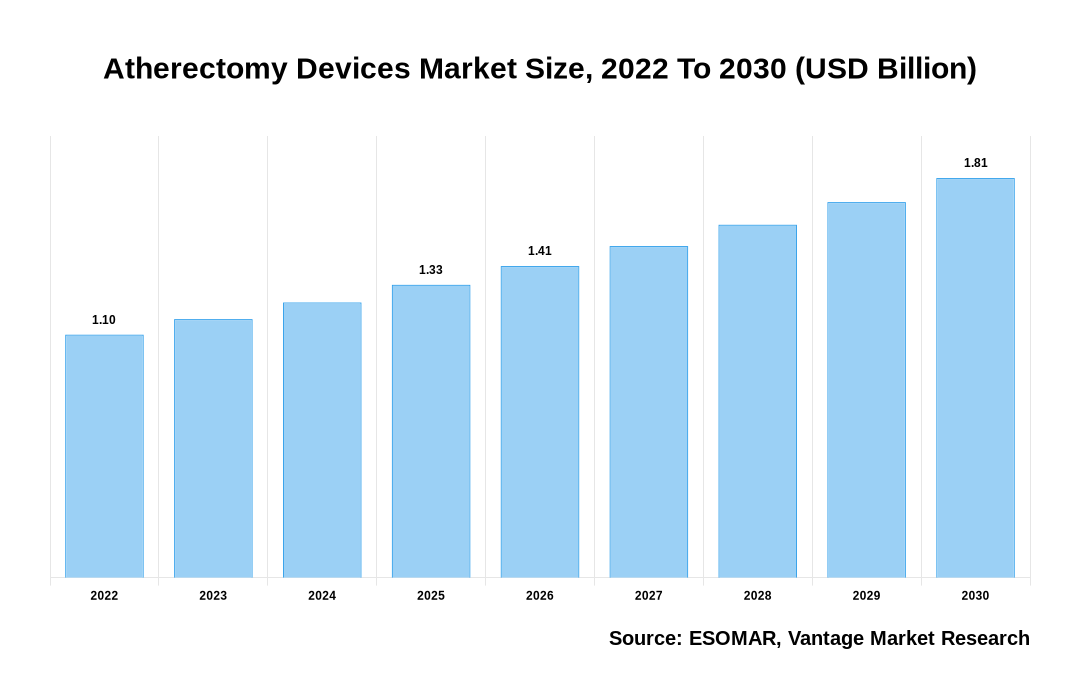

The global Atherectomy Devices Market is valued at USD 1.1 Billion in 2022 and is projected to reach a value of USD 1.81 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 6.42% between 2023 and 2030.

Premium Insights

The Atherectomy Devices market is poised for robust growth in the coming years, driven by a confluence of factors. The impact of the COVID-19 pandemic, marked by a significant reduction in cardiac surgery volumes and elective cases, is gradually subsiding with the easing of restrictions worldwide. The global market is witnessing a resurgence as healthcare systems recover and patients increasingly opt for minimally invasive surgeries. The adoption of such procedures is bolstered by continuous advancements in percutaneous coronary intervention (PCI) and the development of minimally invasive cardiac surgery (MICS) techniques. Moreover, the market is witnessing a product development and commercialization surge, exemplified by recent launches such as Philips' Nexcimer laser system. Reimbursement reforms illustrated by the Centers for Medicare and Medicaid Services (CMS) increasing reimbursement for peripheral intravascular lithotripsy procedures in 2022 further enhance the market's growth prospects. However, stringent regulatory scenarios remain a potential constraint.

Atherectomy Devices Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Atherectomy Devices Market

- Based on the Product, the Directional Atherectomy Devices segment is expected to sustain its dominance in the market owing to its ability to remove plaque and restore the blood flow in a more controlled and precise manner.

- By End User, the Hospitals & Surgical Centers segment is expected to witness maximum market growth over the projected period.

- By Application, the Cardiovascular segment dominated the largest market share globally from 2023 to 2030 owing to the rising prevalence of cardiovascular diseases and the increasing adoption of Atherectomy Devices for their treatment.

- In 2022, North America led the market with the highest revenue share of 41.30%.

- The Asia Pacific region is expected to witness maximum market growth during the forecast period.

Top Market Trends

- Minimally Invasive Procedures Surge: The demand for minimally invasive surgeries is escalating, boasting a success rate of around 90%. Atherectomy procedures align with this trend, offering reduced trauma and faster patient recovery, contributing to the market's growth.

- Technological Advancements Driving Adoption: Technological innovations, including laser Atherectomy Devices, are amplifying market development. Advancements such as novel image-guided atherectomy systems are enhancing treatment effectiveness, fostering demand.

- Reimbursement Reforms Impacting Growth: Increasing reimbursement policies for atherectomy procedures, exemplified by CMS's elevated reimbursements, are positively influencing market expansion, and incentivizing treatment adoption.

- Global Health Trends & Disease Prevalence: Poor eating habits, sedentary lifestyles, and escalating cardiovascular diseases worldwide are fueling the demand for Atherectomy Devices, pushing market growth.

Report Coverage & Deliverables

Get Access Now

Economic Insights

The market has witnessed a volatile trajectory, initially disrupted by the COVID-19 pandemic's impact on elective surgeries. The subsequent recovery post-easing of restrictions and increasing healthcare investments, especially in North America, have led to a resurgence in demand for Atherectomy Devices. Favorable reimbursement policies, technological advancements, and strategic industry moves are contributing to steady market growth. Europe's market, although mature, is experiencing price depreciation in most segments, yet new investments in innovative premium products are offsetting declines.

Market Segmentation

The Global Atherectomy Devices Market is categorized into the segments as mentioned below:

The global Atherectomy Devices market can be categorized into Product, Application, End User, Region. The Atherectomy Devices market can be categorized into Directional Atherectomy Devices, Orbital Atherectomy Devices, Photo-Ablative Atherectomy Devices, Rotational Atherectomy Devices, Support Devices based on Product. The Atherectomy Devices market can be categorized into Peripheral Vascular, Cardiovascular, Neurovascular based on Application. The Atherectomy Devices market can be categorized into Hospitals & Surgical Centers, Ambulatory Care Centers, Research Laboratories & Academic Institutes based on End User. The Atherectomy Devices market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Product

Directional Atherectomy Devices will account for the Largest Market Share in the Projected Period

In 2022, Directional Atherectomy Devices dominated the market. Directional Atherectomy Devices offer several advantages over other techniques, such as their ability to remove all types of plaque and their high success rates in restoring blood flow. Additionally, these devices have shown promising results in reducing the risk of restenosis and the need for additional interventions. As a result, the directional Atherectomy Devices segment is expected to experience significant growth and remain the preferred choice for physicians and patients alike.

Based on Application

The Cardiovascular segment will Dominate the Market during the Forecast Period

The cardiovascular segment is expected to experience the greatest market growth during the forecast period. Atherectomy Devices are primarily used in the treatment of cardiovascular diseases, particularly in the removal of plaque buildup in the arteries. The high prevalence of cardiovascular diseases, along with the increasing demand for minimally invasive procedures, is driving the growth of this segment. Additionally, advancements in technology and the introduction of innovative devices with enhanced capabilities are further propelling market growth. The cardiovascular segment is anticipated to witness significant growth during the forecast period, owing to the rising prevalence of cardiovascular diseases and the increasing adoption of Atherectomy Devices for their treatment.

Based on End User

Hospitals & Surgical Centers segment Expected to Dominate the Market during Forecast Period

The cardiovascular segment is expected to experience the greatest market growth during the forecast period. This can be attributed to the increasing number of patients opting for atherectomy procedures in hospitals and surgical centers. Hospitals and surgical centers generally have advanced infrastructure and skilled healthcare professionals, making them the preferred choice for performing atherectomy procedures. Additionally, hospitals and surgical centers generally have a wide range of specialized equipment, including Atherectomy Devices, which further contributes to their dominance in the market. Moreover, these facilities have better accessibility to patients, higher patient footfall, and effective reimbursement policies, which further enhance their market share in the Atherectomy Devices market.

Based on Region

North America will Lead the Market in the Forecast Period

North America asserted its dominance in the Atherectomy Devices market, capturing the largest revenue share of 41.30% in 2022. With advanced healthcare infrastructure, high FDA-approved device availability, and favorable reimbursement policies, the region continues to drive market growth through continuous R&D investments and a rising preference for minimally invasive surgeries.

The Asia Pacific region's precious metal market is anticipated to grow at a noteworthy CAGR over the forecast period. The region's increasing prevalence of cardiovascular diseases, coupled with rising product approvals and advancements, signifies substantial opportunities for market expansion, as witnessed by recent approvals like Lepu Medical Technology Co. Ltd.'s peripheral cutting balloon in China.

Competitive Landscape

The competitive landscape in the Atherectomy Devices market is vibrant, characterized by key players focusing on R&D, product innovations, and strategic collaborations to enhance their market presence. Notable recent developments include significant acquisitions and partnerships, such as Abbott's acquisition of Cardiovascular Systems Inc., aimed at expanding product portfolios and strengthening footholds in the competitive arena. Key players like Boston Scientific Corporation, Medtronic, and Koninklijke Philips N.V. are investing heavily in obtaining regulatory approvals and advancing their atherectomy systems' commercialization.

The key players in the global Atherectomy Devices market include - Boston Scientific Corporation (U.S.), Cardiovascular Systems Inc. (U.S.), Medtronic PLC (Ireland), Avinger Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Becton Dickinson and Company (U.S.), Abbott (U.S.), Cordis Corp. (U.S.), Terumo Medical Corporation (Japan) among others.

Recent Market Developments

- In October 2023, Cardio Flow secured a 510(k) clearance for its orbital atherectomy peripheral platform, leveraging modern mechanisms to address plaque blockages, further enriching the competitive landscape.

- February 2023, witnessed Abbott's strategic move to acquire Cardiovascular Systems Inc., augmenting its portfolio and market position significantly, emphasizing the growing consolidation trend in the sector.

Segmentation of the Global Atherectomy Devices Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Application

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Atherectomy Devices in terms of revenue?

-

The global Atherectomy Devices valued at USD 1.1 Billion in 2022 and is expected to reach USD 1.81 Billion in 2030 growing at a CAGR of 6.42%.

Which are the prominent players in the market?

-

The prominent players in the market are Boston Scientific Corporation (U.S.), Cardiovascular Systems Inc. (U.S.), Medtronic PLC (Ireland), Avinger Inc. (U.S.), Koninklijke Philips N.V. (Netherlands), Becton Dickinson and Company (U.S.), Abbott (U.S.), Cordis Corp. (U.S.), Terumo Medical Corporation (Japan).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.42% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Atherectomy Devices include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Atherectomy Devices in 2022.

Vantage Market

Research | 17-Jan-2024

Vantage Market

Research | 17-Jan-2024