Artificial Disc Replacement Market

Artificial Disc Replacement Market - Global Industry Assessment & Forecast

Segments Covered

By Material Type Metal, Metal & Plastic

By Indication Cervical Disc Replacement, Lumbar Disc Replacement

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 0.6 Billion | |

| USD 1.3 Billion | |

| 12.3% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

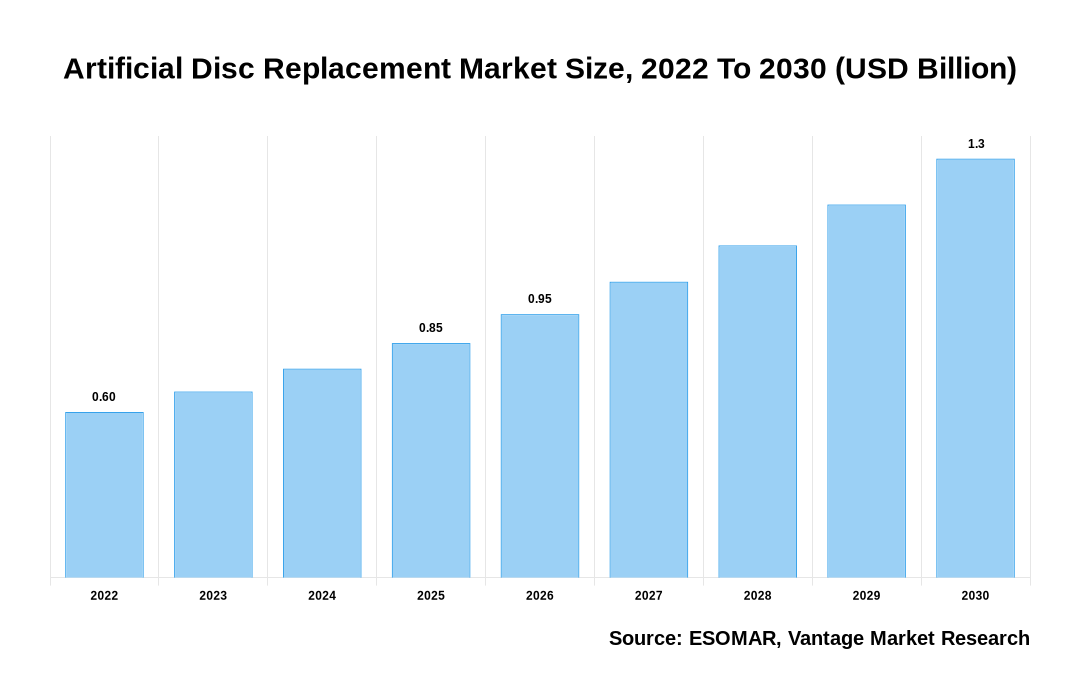

The global Artificial Disc Replacement Market is valued at USD 0.6 Billion in 2022 and is projected to reach a value of USD 1.3 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 12.3% between 2023 and 2030.

Premium Insights

Increasing trauma-related and sports injuries and orthopedic surgeries are expected to boost the market growth. According to the NFL Physicians Society, approximately 1.2 million football-related injuries are sustained annually. The rise in disc replacement surgeries combined with a higher success ratio of artificial discs compared to traditional spinal implants is estimated to drive the market's growth. For example, in April 2022, the DISC Surgery Center, located in California, U.S., successfully performed its 1000th Artificial Disc Replacement procedure. Disc replacement surgeries were complex earlier because of their invasive nature. Developing innovative techniques, like minimally invasive procedures, has made such replacements more streamlined and effective. This has further supported the acceptance of artificial disc implants and gained popularity among orthopedic communities, raising awareness of its applications and benefits to patients suffering from long-term spinal conditions. According to a recently published research study in Acta Neurochirurgica in 2022, there has been an increased preference among medical practitioners in the United States for surgical treatment of cervical spine injuries. The study reveals that approximately 33.5% of these injuries are now treated through corrective surgeries, shifting away from traditional conservative therapies.

Artificial Disc Replacement Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Artificial Disc Replacement Market

- The increasing prevalence of degenerative disc disease owing to chronic back pain is raising the number of spinal surgeries performed around the globe. This is one of the main factors driving the industry's growth

- The metal + plastic material type segment led the market in 2022 owing to the vast usage of plastics for manufacturing artificial discs, while the metal segment held a significant share due to rising research activities in the segment

- The cervical disc replacement segment held the largest share of the market in 2022 because of the high product availability

- North America led the global Artificial Disc Replacement industry in 2022, accounting for a revenue share of more than 42.90% owing to the presence of significant companies in the area

- Asia Pacific is expected to be the fastest- CAGR from 2023 to 2030 because of the rising awareness regarding spinal surgeries in the region

Top Market Trends

- Degenerative disc diseases, such as herniated discs and spinal stenosis, are becoming increasingly common, particularly among the aging population. This has led to a surge in the demand for Artificial Disc Replacement procedures as an alternative to traditional spinal fusion surgeries. For Example, according to the American Association of Neurological Surgeons, 40% of individuals aged 40 years and above have some degree of disc degeneration.

- There has been a steady increase in healthcare expenditure worldwide, particularly in developing economies. This has resulted in improved access to advanced medical treatments, including Artificial Disc Replacement; according to the World Health Organization, the report shows that global spending on health continually rose between 2000 and 2018 and reached US$ 8.3 trillion or 10% of global GDP.

- Governments and regulatory bodies worldwide are rising to acknowledge the benefits of Artificial Disc Replacements and provide regulatory support for their development and commercialization. For instance, the US FDA has approved various synthetic disc replacement products, including the Mobi-C® Cervical Disc.

- Minimally invasive techniques for Artificial Disc Replacement, such as laparoscopic or endoscopic approaches, have gained popularity due to their reduced post-operative pain, faster recovery, and smaller incisions. These techniques are being widely adopted by surgeons, thereby driving market growth. A review published in the Journal of Spinal Disorders & Techniques reported that patients who underwent minimally invasive Artificial Disc Replacement experienced shorter hospital stays and significantly fewer complications than those who underwent traditional open surgeries.

- Manufacturers continuously improve the design and materials used in artificial disc implants, improving clinical outcomes and patient satisfaction. The introduction of innovative technologies such as ball and socket designs and biomaterial coatings has enhanced the durability and performance of these implants. In 2019, Simplify Medical received FDA approval for their Simplify Disc, which features a compatible magnetic resonance imaging (MRI) design, allowing for better visualization of the disc during imaging diagnostics.

Report Coverage & Deliverables

Get Access Now

Economic Insights

Artificial Disc Replacement procedures are performed on patients with spine pain due to degenerative discs. American Chiropractic Association stated that 80% of the population experiences spine pain at least once in their lifetimes. It also noted that low spine pain costs Americans around USD 50 billion in healthcare annually. The indirect costs of SCI averaged USD 82,329 per year in the United States in 2022. Hence, the high burden of spinal cord injury in the United States is expected to increase the demand for artificial discs replacement. The rising geriatric or target population, highly prone to back pain, will also help the market growth. According to the data released by the United Nations in 2022, it is estimated that the share of people aged 65 years in the global population and above is expected to increase from 10 percent in 2022 to 16 percent in 2050. The pandemic significantly impacted market growth due to the reduction in the number of spinal cord surgeries worldwide. Zimmer Biomet, a prime example, experienced a detrimental effect of COVID-19 on its annual revenue in 2020. Its total revenues witnessed a decline of 12% from 2019 to 2020. Additionally, the company faced challenges due to the postponed elective and semi-elective procedures, which typically utilize Medtronic's products.

Market Segmentation

The Global Artificial Disc Replacement Market can be broadly classified into the below-mentioned segments:

The global Artificial Disc Replacement market can be categorized into Material Type, Indication, Region. The Artificial Disc Replacement market can be categorized into Metal, Metal & Plastic based on Material Type. The Artificial Disc Replacement market can be categorized into Cervical Disc Replacement, Lumbar Disc Replacement based on Indication. The Artificial Disc Replacement market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Material Type

Metal & Plastic to Lead Maximum Market Share Due to Higher Operational Success Rates Along with The Advantages of Medical Plastic and Metal Hybrid Surface Over Traditional Metal-on-metal

In 2022, Metal & Plastic dominated the market. Most cervical total disc replacement implants, approved by the FDA in the U.S. today, incorporate iterations of metal alloy-based inferior and superior prosthetic endplates, which articulate with a central medical-grade plastic core. Moreover, the overall success rate of metal + plastic Artificial Disc Replacement procedures is high, fuelling market growth.

Based on Indication

Cervical Disc Replacement Segment Expects Dominion Owing to Its Minimally Invasive Nature of Therapy

The Cervical Disc Replacement segment is expected to account for a maximum revenue share in the market during the forecast period. A higher occurrence of cervical injuries and lifestyle and work-oriented skeletal disorders are some factors supporting diagnosing these conditions and undergoing spinal management. Moreover, market players are innovating implants for cervical-oriented vertebral procedures to cater to the more significant demand and foster segment growth.

Based on Region

Europe to Dominate Global Sales Owing to the Increasing Acceptance of Contemporary Medical Technologies

North American Artificial Disc Replacement dominated the market in 2022. It accounted for a revenue share of over 48% due to the presence of key players and technologically-equipped hospitals in the U.S. and Canada. Due to sedentary lifestyles and an older population, the region also has a large patient pool suffering from spinal disorders, such as degenerative disc disease, herniated discs, etc. Moreover, North America has a high adoption rate for technologically advanced medical devices and procedures. Additionally, favorable reimbursement policies and a well-established regulatory framework further contribute to the growth of the Artificial Disc Replacement market in the region.

The Artificial Disc Replacement industry in North America is rapidly gaining popularity. This is due to the investments by companies to expand their presence in the region and the increasing demand for minimally invasive procedures. Due to the underdeveloped healthcare sector in the Middle East and Africa, it is expected to account for the lowest market share.

Competitive Landscape

The Artificial Disc Replacement market is highly competitive, with several key players dominating the industry. Some major companies in the market include Medtronic, Orthofix Medical Inc., Globus Medical, Aesculap Inc., Zimmer Biomet, and NuVasive Inc. These companies are constantly engaged in strategies such as mergers, acquisitions, and product launches to maintain their market share and gain a competitive edge. For instance, in February 2021, NuVasive, Inc. acquired Simplify Medical, developer of the Simplify Cervical Artificial Disc, for cervical total disc replacement.

The key players in the global Artificial Disc Replacement market include - Medtronic PLC (Ireland), Orthofix Medical Inc. (U.S.), Globus Medical (U.S.), Aesculap Inc. (U.S.), NuVasive Inc. (U.S.), AxioMed LLC (U.S.), Zimmer Biomet (U.S.), SpineArt SA (Switzerland), Synergy Spine Solutions Inc. (U.S.), Centinel Spine (U.S.) among others.

Recent Market Developments

- In September 2022, NuVasive, Inc. introduced Reline Cervical, a new posterior cervical fusion (PCF) fixation system. This product aims to offer a less invasive spinal disc replacement procedure. The launch of Reline Cervical is part of an integrated solution that aims to provide compatibility and a comprehensive solution for patients. NuVasive, Inc. hopes to strengthen its position in the competitive artificial disc market by offering this innovative product.

- In July 2022, Medtronic recently received approval from the U.S. FDA for its UNiD Spine Analyzer. This advanced algorithm utilizes machine learning and Artificial Disc Replacement data to assist surgeons in planning lower lumbar spinal replacements and designing compensative mechanisms after six months of surgery. This development provides Medtronic with a notable competitive edge in the market as it allows for highly customized patient procedures.

Segmentation of the Global Artificial Disc Replacement Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Material Type

By Indication

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Artificial Disc Replacement in terms of revenue?

-

The global Artificial Disc Replacement valued at USD 0.6 Billion in 2022 and is expected to reach USD 1.3 Billion in 2030 growing at a CAGR of 12.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Medtronic PLC (Ireland), Orthofix Medical Inc. (U.S.), Globus Medical (U.S.), Aesculap Inc. (U.S.), NuVasive Inc. (U.S.), AxioMed LLC (U.S.), Zimmer Biomet (U.S.), SpineArt SA (Switzerland), Synergy Spine Solutions Inc. (U.S.), Centinel Spine (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 12.3% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Artificial Disc Replacement include

- Increasing number of spinal surgeries

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Artificial Disc Replacement in 2022.

Vantage Market

Research | 12-Sep-2023

Vantage Market

Research | 12-Sep-2023