Antimicrobial Plastics Market

Antimicrobial Plastics Market - Global Industry Assessment & Forecast

Segments Covered

By Additive Inorganic, Organic

By Type Commodity Plastics, Engineering Plastics, High Performance Plastics

By Application Packaging, Medical & Healthcare, Automotive, Building & Construction, Consumer Goods, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 41.8 Billion | |

| USD 71.1 Billion | |

| 7.9% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

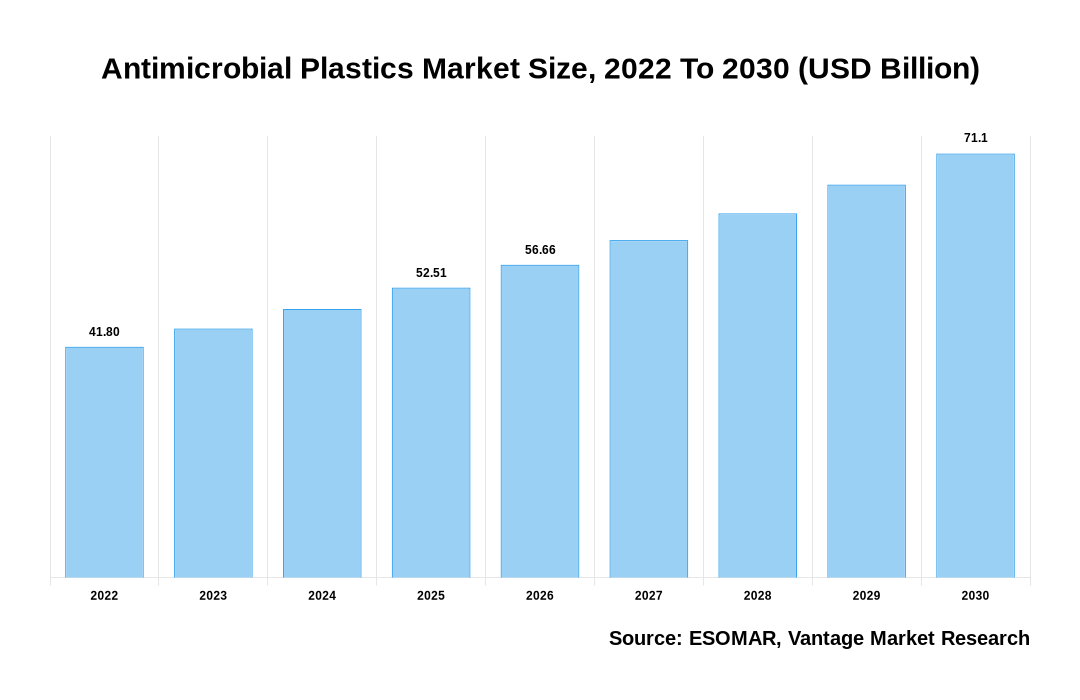

The global Antimicrobial Plastics Market is valued at USD 41.8 Billion in 2022 and is projected to reach a value of USD 71.1 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 7.9% between 2023 and 2030.

Premium Insights

According to the annual estimates provided by the World Health Organization (WHO), there are a global total of 300 to 500 million cases of malaria, 33 million cases of HIV/AIDS, 14 million individuals infected with tuberculosis, 333 million cases of STDs, and 3 to 5 million cases of cholera. Thus, providing safe water, sanitation, waste management, and hygienic conditions is crucial in preventing and safeguarding human health during infectious disease outbreaks, including those caused by coronavirus. Antimicrobial Plasticss have emerged as a popular choice in various industries due to their ability to reduce the growth and transmission of harmful microorganisms.

Antimicrobial Plastics Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Antimicrobial Plastics Market

- The intricate epidemiological landscape, healthcare-related infections (HAIs), microbial contamination, hospital-acquired infections, and infection vulnerabilities associated with medical and dental equipment all emphasize the importance of preventing microbial infections.

- Asia Pacific generated more than 42.9% of revenue share in 2022 and is expected to maintain the same during the forecast period.

- The Inorganic Additive segment accounted for the most significant market growth. It contributed over 62.8% of the total revenue share in 2022.

- Commodity Plastics segment revealed the most significant market growth, contributing more than 53.5% of the total revenue share in 2022.

- The Medical & Healthcare segment accounts for the most considerable revenue of 32.4% in 2022.

Economic Insights

Economic changes have also played a role in shaping the Antimicrobial Plastics market. Global supply chains have been interrupted with the worldwide epidemic, leading to an inadequate supply of ingredients, difficulties in production, and troubles with delivery. This has increased costs and longer lead times for Antimicrobial Plastics products. However, the market has also witnessed increased investments in research and development as companies look for innovative solutions to combat the spread of infections. In addition, the supply chain of Antimicrobial Plasticss involves several stages, including raw material procurement, manufacturing, distribution, and end-use. The procurement of raw materials, such as antimicrobial additives and plastic resins, can be influenced by global economic factors like availability, cost, and trade restrictions. The manufacturing process involves incorporating antimicrobial additives into plastic resins through various techniques like compounding or coating.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Increasing demand in the healthcare sector: Antimicrobial polymers are in greater demand as hospitals and clinics place more emphasis on infection prevention and control. These plastics are used in medical devices, hospital furniture, and equipment where the risk of infection transmission is high. For example, in hospitals, Antimicrobial Plasticss are extensively used in door handles, bed rails, IV poles, and other touchpoints to minimize the spread of infections.

- Rising awareness of hygiene in consumer products: Consumers are becoming more conscious about hygiene and are seeking products that offer antimicrobial protection. This trend can be seen in household appliances, food packaging, and personal care products. For example, kitchen appliances made from Antimicrobial Plasticss ensure the germ-free handling of food, maintaining a healthy environment in the kitchen.

- Growing adoption in the automotive industry: The automotive sector embraces Antimicrobial Plasticss for various interior applications. Antimicrobial Plasticss are employed in steering wheels, dashboard elements, armrests, and other areas that come into contact with passengers due to the growing emphasis on passenger safety and wellbeing. For example, car manufacturers are incorporating Antimicrobial Plasticss in air conditioning vents to inhibit the growth of bacteria and prevent unpleasant odors.

- Expansion in the construction sector: Because Antimicrobial Plasticss can stop the formation of mold, mildew, and other hazardous bacteria in building materials, the usage of them in the construction sector is on the rise. These plastics are utilized in damp environments like restrooms and kitchens. These plastics are used in areas prone to moisture, such as bathrooms and kitchens. For instance, Antimicrobial Plastics surfaces are used in wall claddings, flooring, and countertops in hospitals, hotels, and residential buildings to maintain hygienic environments.

- Technological advancements in antimicrobial agents: Continuous research and development efforts are being made to improve the effectiveness of antimicrobial agents used in plastics. Advances such as longer-lasting antimicrobial properties, eco-friendly agents, and enhanced performance drive market growth. For example, some companies are developing Antimicrobial Plasticss with active ingredients that can last longer, providing prolonged protection against microorganisms.

Market Segmentation

The Global Antimicrobial Plastics Market is segregated into the categories as mentioned below:

The global Antimicrobial Plastics market can be categorized into Additive, Type, Application, Region. The Antimicrobial Plastics market can be categorized into Inorganic, Organic based on Additive. The Antimicrobial Plastics market can be categorized into Commodity Plastics, Engineering Plastics, High Performance Plastics based on Type. The Antimicrobial Plastics market can be categorized into Packaging, Medical & Healthcare, Automotive, Building & Construction, Consumer Goods, Other Applications based on Application. The Antimicrobial Plastics market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Additive

The Inorganic Holds the largest share

The inorganic segment holds the majority of the market share in 2022. Inorganic materials like silver and copper have long been known for their antimicrobial properties. These metals have the ability to inhibit the growth of bacteria, viruses, fungi, and other harmful microorganisms. As a result, they are extensively used in various applications where hygiene and cleanliness are crucial, such as healthcare, food processing, packaging, and consumer goods. In addition, with growing concerns about healthcare-associated infections (HAIs) and the spread of antibiotic-resistant bacteria, there is a heightened focus on infection control measures in healthcare facilities. Inorganic Antimicrobial Plasticss play a crucial role in preventing the growth and transmission of harmful microorganisms in hospitals, clinics, and other healthcare settings. Additionally, stringent regulations and guidelines by regulatory bodies such as the U.S. FDA (Food and Drug Administration) and the CDC (Centers for Disease Control and Prevention) drive the adoption of Antimicrobial Plasticss in healthcare and medical device applications.

Based on Type

Commodity Plastics dominates the market

The commodity plastics segment accounted for the market's most considerable growth in 2022. Commodity plastics have good processing properties and can be easily modified to incorporate antimicrobial agents. Antimicrobial additives can be added to commodity plastics during manufacturing to impart antimicrobial properties to the final product. These additives can inhibit the growth and spread of various microorganisms, including bacteria, fungi, and viruses. As a result, Antimicrobial Plastics made from commodity plastics effectively reduces the risk of infection and transmission of diseases in various settings, such as healthcare facilities, food processing plants, and public spaces.

Based on Application

Medical & Healthcare mentioned the maximum market share

Medical and healthcare accounted for the most enormous market growth in 2022. Numerous factors, such as the rising need for infection control measures, the rise in infections linked to healthcare settings, and the desire for safer and more hygienic medical devices and equipment, can be contributed to this trend. Plastics that have been treated with antimicrobial compounds to prevent the reproduction of organisms such as fungi, viruses, and bacteria are known as Antimicrobial Plasticss. These antimicrobial agents can be incorporated into the plastic during manufacturing or applied as a coating or additive. By utilizing Antimicrobial Plasticss, healthcare facilities can reduce the risk of infection transmission and improve patient safety.

Based on Region

Asia Pacific led the market

Asia Pacific is accounted to lead the market in 2022. The healthcare and packaging sectors, especially in emerging markets like India, China, and Japan, are expected to witness a rising demand for Antimicrobial Plasticss. Furthermore, the expansion of insurance coverage in these countries, coupled with the growing incidence of chronic illnesses, is poised to emerge as a critical catalyst for government investments in healthcare infrastructure. Furthermore, the region is anticipated to experience the most rapid expansion within the global packaging sector, with countries like China and India at the forefront of market leadership. Key drivers of this growth in the region include the surge in e-commerce, online food deliveries, and ongoing innovation and advancements in the packaging industry.

Competitive Landscape

The market features diverse small- and medium-sized enterprises catering to global and local market needs. This market exhibits a characteristic pattern of forward integration, spanning from raw material production, through manufacturing, and finally distribution to various sectors and industries. This integration along the value chain ensures a continuous supply of raw materials and keeps manufacturing costs low. Additionally, a few businesses are investing in R&D projects to improve their product specifications and broaden their market reach, which is anticipated to increase product demand in the future. For example, in March 2022, Parx Materials introduced an innovative additive technology called Saniconcentrate. With the use of this technology, antimicrobial polymers that can thwart the growth of dangerous germs and viruses can be created.

The players in the global Antimicrobial Plastics market include BASF SE (Germany), Dow Inc. (U.S.), Clariant AG (Switzerland), Parx Materials N.V. (Netherlands), Ray Products Company Inc. (U.S.), COVESTRO AG (Germany), King Plastic Corporation (U.S.), Palram Industries Ltd. (India), SANITIZED AG (Switzerland), RTP Company (U.S.), Lonza Group AG (Switzerland), INEOS Styrolution Group GmbH (Germany), Milliken Chemicals (U.S.), BioCote Limited (UK), Microban International (U.S.) among others.

Recent Market Developments

- In May 2023, SANITIZED AG introduced Sanitized® BDC, a robust triple-action product with three active ingredients to safeguard aqueous systems like polymer dispersions and architectural paints. Sanitized® BDC ensures product sanitation and provides in-can preservation to maintain long-term stability.

- In May 2023, Palram collaborated with BioCote® to create an advanced antimicrobial wall cladding system featuring built-in antimicrobial protection for enhanced performance.

- In January 2022, BASF partnered with Permionics Membranes, based in Vadodara, India, to expand the application of BASF's Ultrason® E (PESU: polyethersulfone) into coated fabrics. These fabrics are utilized as particulate and bacterial filters for face masks, marking the first usage of Ultrason® E in this context.

Segmentation of the Global Antimicrobial Plastics Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Additive

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Antimicrobial Plastics in terms of revenue?

-

The global Antimicrobial Plastics valued at USD 41.8 Billion in 2022 and is expected to reach USD 71.1 Billion in 2030 growing at a CAGR of 7.9%.

Which are the prominent players in the market?

-

The prominent players in the market are BASF SE (Germany), Dow Inc. (U.S.), Clariant AG (Switzerland), Parx Materials N.V. (Netherlands), Ray Products Company Inc. (U.S.), COVESTRO AG (Germany), King Plastic Corporation (U.S.), Palram Industries Ltd. (India), SANITIZED AG (Switzerland), RTP Company (U.S.), Lonza Group AG (Switzerland), INEOS Styrolution Group GmbH (Germany), Milliken Chemicals (U.S.), BioCote Limited (UK), Microban International (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.9% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Antimicrobial Plastics include

- Growing awareness pertaining to antimicrobial plastics

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Antimicrobial Plastics in 2022.

Vantage Market

Research | 06-Oct-2023

Vantage Market

Research | 06-Oct-2023