Amines Market

Amines Market - Global Industry Assessment & Forecast

Segments Covered

By Products Ethanolamine, Fatty Amines, Alkylamines, Other Products

By Applications Crop Protection, Surfactants, Water Treatment, Personal Care, Gas Treatment, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 15.66 Billion | |

| USD 22.09 Billion | |

| 4.40% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

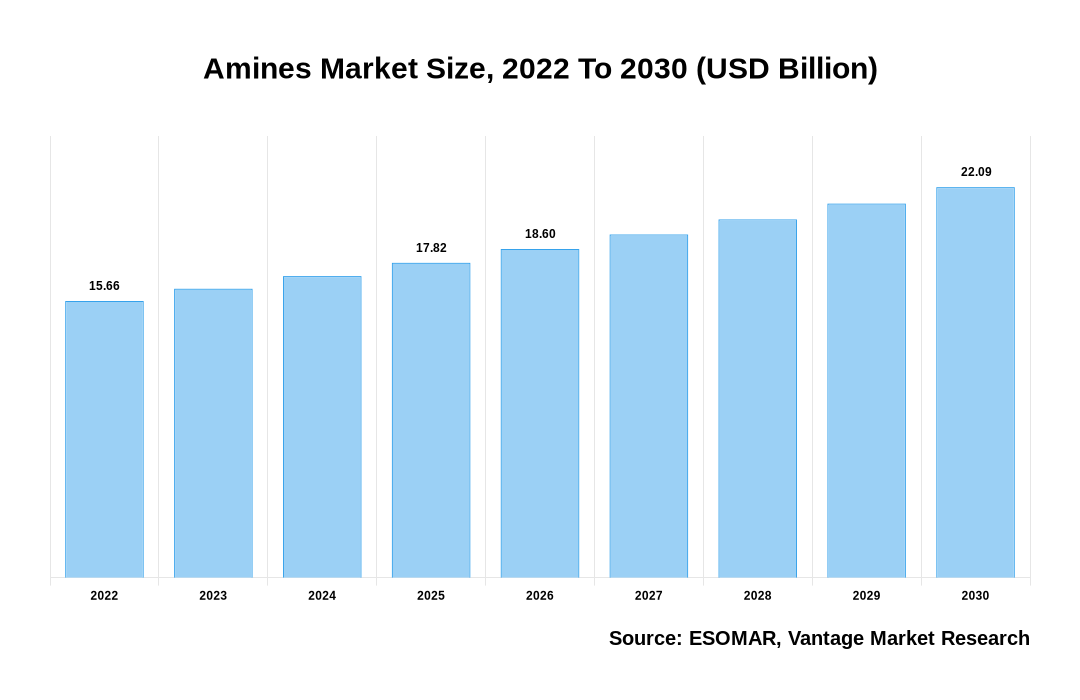

The Global Amines Market is valued at USD 15.66 Billion in 2022 and is projected to reach a value of USD 22.09 Billion by 2030 at a CAGR of 4.40% over the forecast period.

Premium Insights

One of the main reasons for the market’s growth is that Amines are used in many fields. For example, these methods are used to make the chemicals that protect crops used in the agricultural sector. Personal care products are becoming more popular all over the world because of things like rising incomes, better living conditions, and the rise of social media. The global sales of personal care products are expected to reach $1 trillion by the decade’s end. Plastics, emulsifiers, chelating agents, corrosion inhibitors, and powerful detergents are all made using Amines. This, combined with booming industries like construction, energy, and manufacturing, is helping the market expand. The rise of chronic diseases like diabetes, high blood pressure, and high cholesterol is also making the pharmaceutical industry more interested in Amines. According to the American Heart Association, more than 26 million adults in the United States have hypertension, one of the leading causes of death. The prevalence of hypertension varies depending on where you live, but it's estimated that about 30 percent of adults have hypertension. By the end of 2022, there will be an estimated 29.2 million cases of diabetes in the United States, a 7% increase from the 26.8 million cases in 2021. They are also gaining popularity in the automobile industry as solvents for producing paint and coatings. In addition, rising expenditures on research and development (R&D) to enhance their qualities and broaden their applications are expected to drive the expansion of the market.

The growth in the Amines market is also supported by government initiatives such as R&D funding for new Amines production and expansions of capacity in existing plants. The National Clean Energy Program (NCEP) is an important initiative of the Indian Government that focuses on renewable energy sources such as solar and wind power. It will promote the use of these sources of energy by developing government policies and investing in infrastructure. Asia-Pacific Partnership for Clean Technologies (APPCT) is a joint partnership between governments from 6 countries in the APAC region - Australia, China, India, Japan, South Korea, and Taiwan - to promote clean technologies. This initiative will focus on promoting innovative technologies such as renewable energy and low-emission vehicles. The US government has launched several initiatives to promote R&D in the Amines sector, which is anticipated to boost growth in this sector. For instance, the National Institute of Standards and Technology (NIST) has initiated a program called “Amines for Advanced Materials'' which aims at developing novel amino acid materials with enhanced performance characteristics for use in electronics and renewable energy applications. Another initiative by NIST is the “Amines Research Centers Program'' which provides financial assistance for research projects in this area.

Amines Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Amines Market

Moreover, the US Department of Energy (DOE) has sanctioned several grants under its “Advanced Research Projects Agency–Energy” (ARPA-E) program focusing on research related to oligomers and polymers derived from amino acids. In 2021, many new products were scheduled to hit the market, including amino benzothiazole (ABT), 2-amino-1,3-propanediol (2APD), and 4-aminopyridine (4AP). These products are expected to provide significant growth opportunities for the Amines market. Some restraints on the market include the presence of new product launches by major players that are restraining demand, lack of clarity on regulatory framework relating to Amines, and an increase in health concerns related to their usage. However, these restraints are expected to be overcome by 2024 due to growing investments by key players and the adoption of newer technologies. The lack of Government intervention and clarity on labeling requirements is also impacting the growth of the amino acid market. The growing awareness about environmental issues is also influencing buyers to look for greener alternatives to chemicals. This restraint would eventually lead to an increased demand for natural Amines from end users such as energy and chemical companies.

Technology and Innovation

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Consumers in the amine market are looking for new and innovative technology to improve their quality of life. Players are developing new products equipped with translational medicine capabilities to meet this need. Additionally, they are also focusing on developing innovative technologies that can improve the overall efficiency of the process. Molecular recognition and targeting technologies are changing how Amines are marketed. These technologies allow companies to identify specific molecules or targets and selectively deliver the desired product to the desired location. This can improve drug efficacy or reduce side effects by ensuring that the right dose is delivered to the right place at the right time. Molecular recognition and targeting technologies can be used in various applications, including drug delivery, diagnostics, and manufacturing processes. For example, molecular recognition technology can identify specific proteins or DNA sequences in a sample and then target drugs or other molecules specifically toward these targets. This can help improve drug efficacy or reduce side effects by ensuring that the right amount of medication is delivered where it is needed most. One of the main applications of deep learning in amine marketing is understanding how customers interact with brands and products. Companies can develop personalized customer experiences and create more effective marketing campaigns by understanding this behavior.

Top Market Trends

- The growing awareness of the health benefits associated with consuming fruits and vegetables

- The increasing popularity of plant-based diets

- The increased consumption of premium-quality foods

- The preference for natural ingredients and foods

- The trend toward healthier eating options

- Translational Medicine Solutions: Players develop translational medicine solutions to improve patient outcomes. These solutions include precision medicine and next-generation sequencing. They are also developing automated drug discovery tools to identify new therapeutic targets faster.

- Innovative Technologies: Players are focusing on developing innovative technologies that can improve the overall efficiency of the process. This includes things like advanced analytics and artificial intelligence. They are also developing blockchain technology solutions that streamline transactions and reduce costs.

- The growing interest in Slow Food movements

- The demand for sustainable agriculture practices

- Increasing preference for organic produce

- Increased focus on food security concerns

- Growing concern over the impact of food production on the environment

Market Segmentation

The global Amines Market is segmented based on Products, Applications, and Region. Based on the Product, the global Amines market is segmented into Ethanolamine, Fatty Amines, AlkylAmines, and Other Products. Furthermore, based on the Applications, the market is segmented into Crop Protection, Surfactants, Water Treatment, Personal Care, Gas Treatment, and Other Applications. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Products

Ethanolamine is projected to be the leading product segment in revenue during the forecast period. This is due to its increasing demand as a chemical intermediate in producing fuels and other chemicals. The Fatty Amines segment is expected to grow slower during the forecast period than other segments. This is because this type of amine has limited applications in industrial settings. Alkyl-Amines are also projected to grow at a high rate during the forecast period, primarily owing to their increasing demand for use as chemicals in various industrial applications. In 2022, the use of Amines in adhesives and sealants was high compared to the recent past. This is because the global market for adhesives and sealants is snowballing. The increase in the demand for adhesives and sealants is due to the increasing number of construction projects, growth in manufacturing industries, and increased demand from the transportation and furniture sectors.

Based on Applications

The Crop Protection segment is expected to be the fastest-growing application segment, with a CAGR of 9.4% during the forecast period. This is because of the increasing demand for pesticides and herbicides, which control plant pests and weeds. The Surfactants segment is expected to dominate the market with a CAGR of over 7% between 2021 and 2028. This is primarily due to the growing demand for oil-and gas-based chemicals, which are major users of surfactants. The Water Treatment segment is also expected to grow at a significant rate during this period. This is primarily due to the rising awareness about water pollution caused by various industrial processes, which is fuelling the need for effective water treatment solutions. The Personal Care segment is expected to grow at a slower rate owing to the saturation of existing players in this space. The Gas Treatment segment is expected to grow at a CAGR of 6.5% between 2021 and 2028, owing to the increasing awareness about the benefits of gas treatment in solving various environmental issues.

Based on Region

The growth of the Amines market segment based on the region from 2021 to 2028 is expected to be highest in North America followed by Europe and Asia Pacific. Latin America is expected to grow at a slower pace than the other regions during this period. The growth of the Amines market in North America is expected to be driven by increasing demand from the automotive sector. The increase in automobile production is expected to lead to an increase in the demand for Amines across various industries. Furthermore, increasing investment in R&D activities by major players is also contributing to the growth of the Amines market in North America. The market in Europe is expected to grow at a faster pace than the market in Asia Pacific owing to higher investments in R&D activities by major players. The Latin American region is expected to grow at a slower pace due to limited investments and stringent regulations imposed by governments on chemicals and chemical products. The Middle East & Africa region is also expected to witness modest growth during the forecast period.

Competitive Landscape

The key players in the Global Amines market include- Arkema SA (France), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), SABIC (Saudi Arab), The Dow Chemical Company (US), Huntsman Corporation (US), Mitsubishi Gas Chemical Company (Japan), Taminco Corporation (US), Celanese Corporation (US), Solvay S.A. (Belgium), INEOS Group (UK), Lanxess Corporation (Germany), Lyondell Basell Industries Holdings BV (US) and others.

Recent Developments

- Jiangsu P& Chemical Co. Ltd., China's largest producer of Amines, acquired Switzerland-based Syngenta AG’s synthetic Amines business.

- National Ammonia Company (NAC) signs an agreement with Mitsui Chemicals Europe Ltd.—a subsidiary of Mitsui Chemicals Corporation— to jointly develop ammonia plant technologies in Europe.

- The UK government pledges £455 million ($623 million) over five years for research and development into new industrial applications for ammonia and other nitrogen-containing substances.

- DuPont announces plans to build a new ethylene glycol plant using waste ammonium nitrate from coal-fired power plants as a feedstock.

- Bayer AG announced that it had launched a business unit focused on Amines. The focus of this unit will be on developing and marketing new molecules and technologies in this area. This move by Bayer AG aims to widen its presence in the Amines market and expand its customer base.

- Basf launched its new product line, Basf Amines 2020, which includes 11 new molecules for manufacturing various products, including plastics and coatings. The company also revealed plans to invest up to €1 billion in its research and development activities over the next five years.

- Ineos Chemical Corporation announced that it has successfully developed a novel C8 alkylation catalyst using peroxides promoted by nitrogenase enzymes from photosynthetic bacteria. The catalyst is expected to be commercialized in 2021. In addition, Ineos is developing a new way of producing propylene oxide from ethylene gas using carbon dioxide and water with lower emissions levels than traditional methods. The company expects the technology to be commercially available by 2023.

Segmentation of the Global Amines Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Products

By Applications

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 09-Feb-2023

Vantage Market

Research | 09-Feb-2023

FAQ

Frequently Asked Question

What is the global demand for Amines in terms of revenue?

-

The global Amines valued at USD 15.66 Billion in 2022 and is expected to reach USD 22.09 Billion in 2030 growing at a CAGR of 4.40%.

Which are the prominent players in the market?

-

The prominent players in the market are Arkema SA (France), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), SABIC (Saudi Arab), The Dow Chemical Company (US), Huntsman Corporation (US), Mitsubishi Gas Chemical Company (Japan), Taminco Corporation (US), Celanese Corporation (US), Solvay S.A. (Belgium), INEOS Group (UK), Lanxess Corporation (Germany), Lyondell Basell Industries Holdings BV (US).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.40% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Amines include

- Increasing Surfactant Demand

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Amines in 2022.