Aluminum Market

Aluminum Market - Global Industry Assessment & Forecast

Segments Covered

By Series Series 1, Series 2, Series 3, Series 4, Series 5, Series 6, Series 7, Series 8

By Types Primary, Secondary

By Processing Methods Flat Rolled, Castings, Extrusions, Forgings, Pigments & Powder, Rod & Bar

By End Use Industries Transport, Building & Construction, Electrical Engineering, Consumer Goods, Foil & Packaging, Machinery & Equipment, Other End Uses

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 175.85 Billion | |

| USD 265.82 Billion | |

| 5.30% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Premium Insights

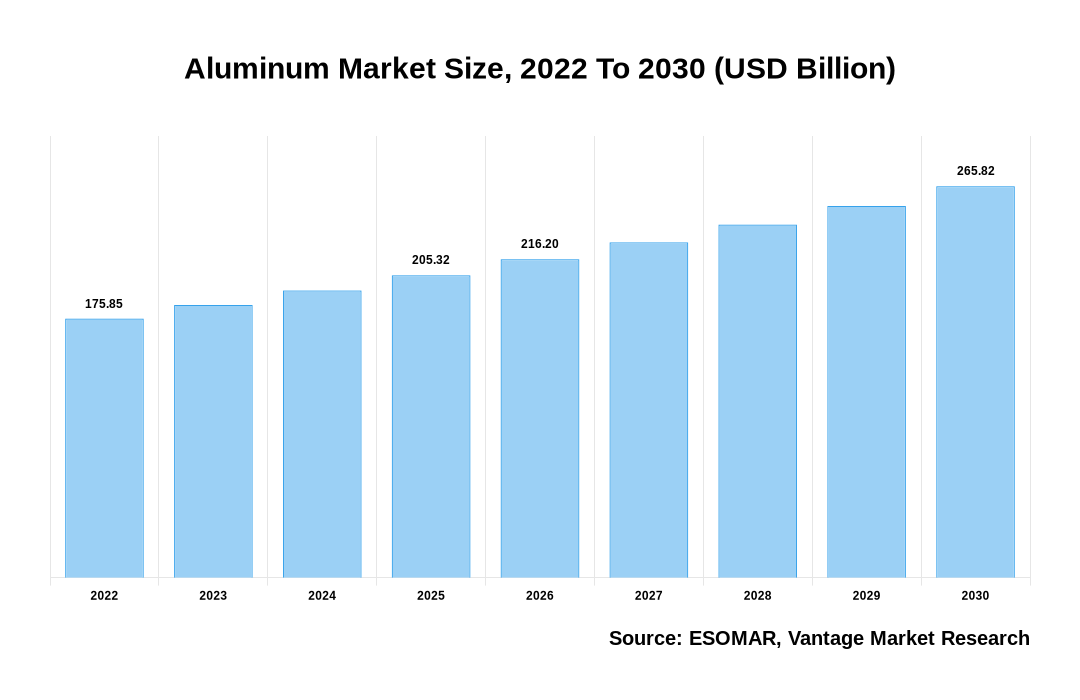

The Global Aluminum Market was valued at USD 175.85 Billion in 2022 and is projected to reach a value of USD 265.82 Billion by 2030. The Global Market is anticipated to grow to exhibit a CAGR (Compound Annual Growth Rate) of 5.30% over the forecast period.

A few key drivers exist for the Aluminum Market. Firstly, global economic growth is expected to remain strong in the coming years. This will lead to increased demand for Aluminum from many industries, including construction, transportation, and packaging. Additionally, new technologies are emerging that require Aluminum as a key raw material. These include electric vehicles, solar panels, and wind turbines. Furthermore, Aluminum producers are investing in new capacity and expanding existing mines and smelters to meet future demand. Lastly, environmental regulations are becoming more stringent, leading to higher demand for Aluminum as it is a recyclable metal.

Aluminum Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Aluminum Market

The Aluminum Market is expected to grow in the forecast period as global economic growth increases the demanding metal from industry sectors such as construction and transportation. In the construction sector, Aluminum is used extensively in commercial and residential applications. It is popular due to its strength, durability, and low maintenance costs. Aluminum windows, doors, curtain walls, and cladding are all in high demand as architects seek to create more energy-efficient buildings. The transportation sector is another key driver of demand for Aluminum. The lightweight metal is used extensively in the automotive industry, where it helps reduce fuel consumption and emissions. Aluminum is also being used increasingly in the production of electric vehicles (EVs), which are growing in popularity due to their environmental credentials. As the global economy continues to grow, demand for Aluminum from industry sectors such as transportation is increasing. This is because Aluminum is a versatile metal that is used in a wide range of industries and applications. For example, Aluminum is used in constructing aircraft and automobiles. It is also used in the manufacturing of electrical equipment and machinery. In addition, Aluminum is widely used in packaging, food and beverage cans, foil, and containers. This is also due to the growing popularity and the need for lighter materials to increase fuel efficiency. Additionally, the rise in infrastructure spending is also driving demand for Aluminum as it is used heavily in industries such as these.

In recent years, there has been a renewed interest in using Aluminum as an electrical conductor. This is due to the metal's low density, making it ideal for electrical wiring applications. Additionally, Aluminum's high conductivity and low resistance make it an attractive choice for electrical engineers. Several factors drive the increased interest in Aluminum as an electrical conductor. The increasing demand for energy-efficient products and components is among the most important. Aluminum is well-suited for this application due to its high conductivity, which allows it to transmit electricity with minimal loss. Additionally, Aluminum's light weight makes it easier to work with than other metals such as copper, making it an ideal choice for use in products that need to be lightweight and portable. Another factor driving the increased interest in Aluminum is its environmental friendliness. Unlike some other metals, Aluminum is not toxic and can be recycled without losing its properties. This makes it an attractive choice for green technologies such as solar panels and wind turbines. The increased interest in Aluminum as an electrical conductor is driven by several factors, including the need for more energy-efficient products, the increasing demand for renewable energy technologies, and the metal's environmental friendliness.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

However, the Global Aluminum Market is facing several challenges restraining its growth. These challenges include:

- The high cost of alumina and electricity: Alumina, the main raw material used in producing Aluminum, has increased by more than 50% over the past year, while the cost of electricity—another critical input—has also risen. This has put pressure on Aluminum producers’ margins, and some have been forced to cut production or close facilities altogether. The high cost of production is a major challenge for the Aluminum industry. Aluminum is produced using smelting, an energy-intensive process. The high energy cost is a major factor driving up the cost of Aluminum production. In addition, the alumina used to produce Aluminum is also becoming more expensive. The two major factors affecting the price of alumina are transportation costs and Chinese tariffs.

- The US-China trade war: The ongoing trade war between the United States and China has hurt the Global Aluminum Market. Chinese Aluminum exports to the US have declined sharply since the tariffs, leading to overcapacity in the Chinese Aluminum industry and lower prices globally.

- Sagging demand from key end markets: Demand for Aluminum from key end markets such as construction and automotive has been sluggish amid slow economic growth in recent years. This has weighed on the Aluminum prices and producers’ profitability.

- Volatile prices are another challenge facing the Aluminum Market. Aluminum prices have been highly volatile recently, driven by shifting global demand and supply dynamics. The sharp increase in Aluminum price in 2021 was followed by a sharp decrease a few years ago. This volatility makes it difficult for companies to plan and invest in new capacity expansion projects.

- Environmental concerns are another challenge facing the Aluminum industry. Aluminum production results in emissions of greenhouse gases and other pollutants. There is growing pressure on the industry to reduce these emissions to address climate change concerns.

Top Market Trends

1. Lightweight yet strong materials are in high demand across various industries, from automotive to aerospace. Aluminum meets this need perfectly and is therefore seeing increasing use in various applications. The metal is also highly recyclable, making it a more sustainable choice than many other materials.

2. As sustainability becomes an increasingly important consideration in construction, Aluminum is becoming more popular as a building material. Its low carbon footprint and recyclability make it an attractive option for eco-conscious builders. Additionally, its strength and durability mean that it can be used for many construction projects, from office buildings to bridges.

3. Increasing demand from the automotive industry: The automotive industry is one of the biggest consumers of Aluminum. This is because Aluminum is lightweight yet strong, making it ideal for cars and other vehicles. As the demand for more fuel-efficient and environmentally friendly vehicles increases, the demand for Aluminum increases.

- The growing use of Aluminum in construction: Aluminum is also gaining popularity in the construction industry due to its durability and energy-saving properties. It is often used in external cladding, window frames, and doors.

- Replacement of steel with Aluminum: In many industries, steel is being replaced by Aluminum due to its superior properties. This is particularly true in transportation, where weight reduction is key to improving fuel efficiency.

- Expansion of end-use applications: Due to its many benefits, Aluminum is used in an increasingly diverse range of applications, including packaging, electronics, consumer goods, and more.

- Innovation in production methods: With new technologies always emerging, there are always ways to improve the production process of Aluminum products. This can lead to lower costs and higher-quality products.

- A shift in production to low-cost countries. In recent years, there has been a shift in global production of Aluminum away from high-cost countries like Australia and the United States to lower-cost countries like China and Russia. This is largely due to these countries' lower labor and electricity costs.

Market Segmentation

The Aluminum Market is segmented based on Series, Types, Processing Methods, End Use Industries, and Region. Based on the Series, the market is segmented into Series 1, Series 2, Series 3, Series 4, Series 5, Series 6, Series 7, and Series 8. Furthermore, based on the Types, the market is further divided into Primary and Secondary. In addition, based on the Processing Methods, the market is further segregated into Flat Rolled, Castings, Extrusions, Forgings, Pigments & Powder, and Rod & Bar. Additionally, based on the End-Use Industries, the market is further segmented into Transport, Building & Construction, Electrical Engineering, Consumer Goods, Foil & Packaging, Machinery & Equipment, and Other End Uses.

Based on Series

Series 1 Aluminum alloys have become the dominant type in the global market in recent years. This is largely due to their superior strength and weight characteristics, which make them ideal for various applications. There are several reasons why Series 1 alloys have become so popular. Firstly, they are much lighter than other types of Aluminum, making them easier to work with and transport. Secondly, they are extremely strong and durable, which can be used in high-stress situations. Finally, series 1 alloys are also highly corrosion-resistant, making them ideal for harsh environments. Due to their many advantages, Series 1 alloys are now used in various industries, including construction, automotive, and aerospace. They are so widely used that they now account for over 60% of all Aluminum produced globally. In the last few decades, however, newer Aluminum alloys have been developed that offer even better performance in certain applications. For example, Series 2 alloys are specifically designed for use in the aerospace industry due to their high strength-to-weight ratio. Series 7 alloys are used in the automotive industry because of their improved weldability. And Series 8 alloys are used in the electrical and electronics industries because of their excellent conductivity. Despite these advances, Series 1 alloys still dominate the worldwide Aluminum Market. This is due to their continued popularity in several key markets, such as building and construction, packaging, and transportation. In addition, Series 1 alloys are produced by many manufacturers around the world, which helps to keep costs down.

Based on Type

As the name suggests, Primary Aluminum is made directly from alumina. It accounts for the largest market share of 54.6% in 2021. The production of Primary Aluminum is a two-stage process. First, alumina is extracted from bauxite ore and then converted into Aluminum metal via the Hall-Héroult process. Secondary Aluminum is made from recycled scrap Aluminum. It accounts for a market share of 45.4% in 2021. The production of Secondary Aluminum is a three-stage process. First, scrapped Aluminum is collected and sorted. Second, the scrapped Aluminum is melted and cast into ingots. Third, the ingots are rolled into sheets or extruded into shapes. The growth of Primary Aluminum is also because Primary Aluminum is produced from bauxite ore, which is widely available and has a lower production cost than Secondary or recycled Aluminum. However, the demand for Secondary and recycled Aluminum is growing at a faster rate than Primary Aluminum due to increasing environmental concerns about the impact of bauxite mining on ecosystems. In addition, Secondary or recycled Aluminum have superior environmental credentials regarding greenhouse gas emissions and energy consumption during production. As a result, while the Primary Aluminum segment is expected to remain the largest market share over the forecast period, it will lose ground to the Secondary or recycled segments.

Based on the Processing Method

The Extrusion sector is one of the most important processing methods for Aluminum and is anticipated to grow significantly in the coming years. Several factors are driving this growth, including the increasing demand for Aluminum products in various industries, the developing of new and improved extrusion technologies, and expanding existing extrusion capacity. As the demand for Aluminum products continue to grow, the Extrusion sector is expected to play an increasingly important role in meeting this demand. In particular, the production of Extrusions is expected to grow faster than other types of Aluminum processing, such as rolled products or castings. This is due to the many advantages Extrusion provides, including its flexibility, efficiency, and cost-effectiveness. New and improved Extrusion technologies are also playing a role in driving growth in the sector. These technologies allow for better control over the extrusion process, resulting in improved product quality and increased efficiency. In addition, they enable the production of new types of extrusions that were not previously possible. Finally, the expansion of existing extrusion capacity is also contributing to the sector's growth. Several new facilities have been built recently, and many existing facilities are expanding their capacities. This allows manufacturers to meet rising demand and stay ahead of the competition.

Based on End-Use Industry

The Transport sector is the largest consumer of Aluminum, accounting for around 30% of global demand in 2021. This is largely due to the growing popularity of lightweight vehicles, which helps to improve fuel efficiency. The sector is expected to grow steadily in the coming years, reaching a market share of 33% by 2028. Aluminum is widely used in automobiles due to its properties such as high strength-to-weight ratio and corrosion resistance. The Automotive industry is expected to proliferate in the coming years, driving the demand for Aluminum.

The Foil & Packaging industry is another major consumer of Aluminum. Aluminum cans are widely used for food & beverage packaging due to their superior properties, such as recyclability and durability. The growing demand for canned food and beverages is expected to drive the demand for Aluminum cans in the coming years. The Construction industry is another major end-user of Aluminum products. Aluminum windows, doors, and other building products are increasingly used in commercial and residential construction due to their energy efficiency and aesthetic appeal. The growing construction activity worldwide is expected to drive the demand for Aluminum products in the coming years.

Based on Region

The Asia-Pacific is predicted to have the fastest expanding market for Aluminum due to the increasing demand from End-Use Industries such as Automotive & Construction, according to our latest research report on the Aluminum. The Asia-Pacific Aluminum Market is forecast to grow at a CAGR of 5.4% from 2023 to 2030. The market in this region is expected to be driven by the increasing demand from End-Use Industries such as Automotive & Construction. In addition, the growing population and rising income levels are also fuelling the demand for Aluminum products in the region. China is the largest market for Aluminum in Asia-Pacific and is expected to continue its dominance during the forecast period. The country is a major producer, and consumer of Aluminum and has invested heavily in developing its domestic industry. The Chinese government’s plan to increase investment in infrastructure projects is also expected to drive the country’s demand for Aluminum. India is another major market for Aluminum in Asia-Pacific and is expected to witness significant growth during the forecast period. The growing Construction industry in India is one of the key factors driving the demand for Aluminum products in the country. In addition, the government’s initiative to promote energy efficiency is projected to boost the use of Aluminum in various applications such as doors, windows, curtain walls, and roofs. Japan is another important market for Aluminum products in Asia-Pacific and is expected to grow at a moderate pace during the forecast period.

In North America, the market is expanding due to stricter regulations on vehicle emissions. Due to the large level of demand that they produce, the Automotive and Transportation industries currently hold the majority of the market share in North America. A significant element driving the market expansion in this region is that electric car manufacturers are using this material to make their vehicles lighter. The European market is expanding due to stricter regulations on vehicle emissions and robust demand from end-use industries such as solar cells and packaging. The rise in demand among end-users for construction materials, consumer durables, and equipment can be ascribed to the expansion in the Middle East and Africa. Initiatives are also aiding the expansion of the market in these emerging countries in the construction industry and investments in infrastructure.

Competitive Landscape

The key players in the Global Aluminum Market include- Alcoa Corporation (US), Aluminum Corporation of China Limited (CHALCO) (China), Century Aluminum Company (US), China Hongqiao Group Limited (China), China Power Investment Corp. (China), China Zhongwang Holdings Limited (China), Dubai Aluminum Company Limited (UAE), East Hope Group (China), Emirates Global Aluminium (UAE), H.P. (Australia), Hindalco Industries Ltd. (India), Kaiser Aluminium (US), Norsk Hydro A.S.A. (Norway), Novelis (US), Rio Tinto Ltd. (UK), United Company RUSAL PLC (Russia), Vedanta Aluminium Limited (India), Xinfa Group Co. Ltd. (China) and others.

Recent Market Developments

● In the month of November, the company Saturnose announced plans to produce a rechargeable Aluminum solid-state battery after the results of scientific testing of their Enhanced Modified Aluminum Ion (Ea2I) battery technology was made public. When it appears the following year, it will likely be the first commercial for Aluminum-ion solid-state batteries, paving the way for a slow but steady shift away from the potentially dangerous rechargeable battery technology.

● As part of the most recent advancements in COVID's external inactive, the Centre for Biological Technology at the University of Queensland (CBT-QUT) has wet-etched nanoparticles effectively with a thickness of 21-25 nm onto a plane of Aluminum 6063 alloys in the month of December 2020. This showed that COVID-19 could remain latent on highly effective antiviral nanostructured surfaces for up to six hours. Public areas treated with Cicada's Antimicrobial Nanoparticles Solutions for COVID-Free Surface have shown tremendous promise in preventing the spread of COVID-19. These treatments would be an excellent place to begin researching for the next outbreak.

● An announcement from UC RUSAL in July 2020 stated that the Krasnoyarsk Aluminum Refinery (KrAZ) had transitioned to EcoSoderberg technologies. This renovation set the company back a cool $74 million. To implement the new EcoSoderberg technique, at least 1954 cells with the ability to reduce were needed. The method was developed at UC RUSAL's Technology and Engineering Center.

● The global supplier of rolled Aluminum products, Aleris Corporation, was bought by Novelis, a subsidiary of Hindalco Industries Ltd. Novelis' market standing has been bolstered thanks to the acquisition, which gave the company access to casting, recycling, rolling, and finishing facilities that complemented its existing portfolio. The organisation will be able to satisfy customer demand with this move better.

● In November 2021, Rio Tinto invested $1 million in its AP60 smelter in the Saguenay-Lac-Saint-Jean region of Quebec to enhance the number of smelting cells there and thus the quantity of low-carbon Aluminum it produces in Canada. With this investment, primary Aluminum smelter output can rise from 86,500 mt per year by roughly 45% or 26,500 mt. According to Rio Tinto, strong demand from the energy revolution and decarbonization would increase the Global Aluminum Market at an annual compound growth rate of 3.3% over the next ten years.

● Novelis, a part of Hindalco Industries Limited, acquired Aleris Corporation in April 2020, making Novelis the world's largest provider of rolled Aluminum products. Novelis's casting, rolling, recycling, and finishing resources are all mutually supportive of one another, and this synergy has helped the company rise to the top of its industry. This move will help the company better meet the needs of its demanding clientele.

Segmentation of the Global Aluminum Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Series

By Types

By Processing Methods

By End Use Industries

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 28-Dec-2022

Vantage Market

Research | 28-Dec-2022

FAQ

Frequently Asked Question

What is the global demand for Aluminum in terms of revenue?

-

The global Aluminum valued at USD 175.85 Billion in 2022 and is expected to reach USD 265.82 Billion in 2030 growing at a CAGR of 5.30%.

Which are the prominent players in the market?

-

The prominent players in the market are Alcoa Corporation (US), Aluminum Corporation of China Limited (CHALCO) (China), Century Aluminum Company (US), China Hongqiao Group Limited (China), China Power Investment Corp. (China), China Zhongwang Holdings Limited (China), Dubai Aluminum Company Limited (UAE), East Hope Group (China), Emirates Global Aluminium (UAE), H.P. (Australia), Hindalco Industries Ltd. (India), Kaiser Aluminium (US), Norsk Hydro A.S.A. (Norway), Novelis (US), Rio Tinto Ltd. (UK), United Company RUSAL PLC (Russia), Vedanta Aluminium Limited (India), Xinfa Group Co. Ltd. (China).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.30% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Aluminum include

- Rising Incorporation of Aluminium in the Automotive & Transportation Industry is a Current Trend

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Aluminum in 2022.