Alternative Lending Platform Market

Alternative Lending Platform Market - Global Industry Assessment & Forecast

Segments Covered

By Deployment Cloud, On-premise

By End Use Credit Unions, Peer-to-Peer Lending, Insurance Companies, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 567.51 Billion | |

| USD 832.10 Billion | |

| 4.90% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

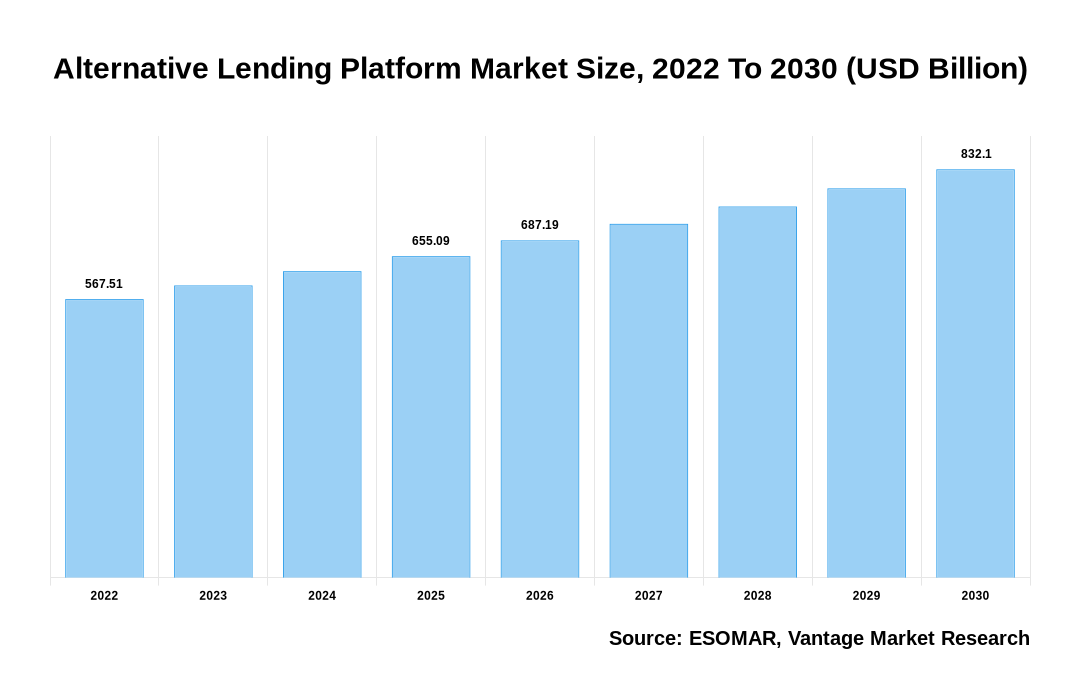

The Global Alternative Lending Platform Market was valued at USD 567.51 Billion in the year 2022 and is forecast to reach a value of USD 832.10 Billion by the year 2030. The Global Market is anticipated to grow to exhibit a Compound Annual Growth Rate (CAGR) of 4.90% over the forecast period.

Alternative Lending Platform Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Alternative Lending Platform Market

Alternative lending describes the broad range of loan choices that customers and company owners have in addition to typical bank loans. In other words, it refers to accepting loans from financial entities that are not banks or other non-banking organizations. Since traditional banks have been unable to finance blue-collar workers, freelancers, or gig workers due to their bad credit histories, alternative lending has developed significantly over the past few years. Nevertheless, a sizable portion of the populace in developing nations still obtains loans via archaic methods. For example, loans are frequently obtained from pawn shops where customers deposit valuables. In addition, people borrow money from friends and relatives in different situations.

The epidemic severely impacted small and medium-sized enterprises worldwide, which gave alternative finance, often known as alternative lending, a boost. The shutdown forced numerous businesses to close. Many smaller companies filed for bankruptcy, and many business owners lacked the funding to reopen their operations after removing the lockdown. These small business owners frequently lacked the credit history necessary to qualify for a loan, and those with a history of bankruptcy would have trouble obtaining any funding from a conventional bank. However, as a helpful asset class, alternative lending has grown. Retail and institutional investors can choose it because it is the least volatile alternative. These investments are simple and provide respectable profits for a limited time. The market for alternative financing is constantly evolving, and financial authorities are working to find ways to keep it under control so that it can expand securely.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Market Segmentation:

The Alternative Lending Platform Market is segmented on the basis of Deployment and End-Use. Based on Deployment, the market is segmented as Cloud and On-premise. Based on End Use, the market is segmented as Credit Unions, Peer-to-Peer Lending, Insurance Companies, and Others.

Based on End Use:

On the basis of End Use, Peer-to-Peer lending is one of the most well-known types of alternative lending; peer-to-peer loans connect a borrower, an investor, and a partner bank via an internet platform. P2P networks can connect borrowers and lenders at reasonable interest rates by utilizing criteria like credit ratings and social media activity. In addition, P2P lending systems enable transactions without holding the loans, allowing them to operate at a profit. Customers who refinance current debt at the lowest feasible rate find this quality especially appealing.

Asia Pacific is Projected to Grow at the Fastest CAGR during the Forecast Period

Asia Pacific is accounted to grow at the fastest CAGR during the forecast period. According to regional analysis, the Asia Pacific accounted for a sizeable portion of market revenue. China was a significant market contributor and previously held the largest share. The primary driver of the market in Asia Pacific's high revenue generation is the rise in digitization activities among financial organizations and the expansion of government programs for alternative financing in developing nations like China and India. Additionally, the existence of several small and medium-sized businesses also helps the Asia Pacific market flourish. Existing banks face a severe threat from nonbanks and alternative lending companies moving into the banking sector. However, the capacity of alternative lenders to use technology to offer practical and efficient loan services to underserved market participants allows them to enter the market and find success. However, the market was dominated by North America, which would also see the most significant CAGR in the future. According to the Global Entrepreneurship Monitor, most businesses in the United States are startups. This demonstrates the enormous potential for crowd lending in this area. Additionally, there has already been more cooperation between banks and marketplace lenders in the American market.

Competitive Landscape:

The key players in the Global Alternative Lending Platform market include- LendingClub Corporation, Prosper Marketplace Inc., Funding Circle Holdings PLC, On Deck Capital Inc., OurCrowd Management Limited, Social Finance Inc., GoFundMe Inc., LendingTree LLC, CreditEase Corporation, Kickstarter PBC, and others.

Segmentation of the Global Alternative Lending Platform Market:

Parameter

Details

Segments Covered

By Deployment

By End Use

By Region

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Vantage Market

Research | 12-Jul-2022

Vantage Market

Research | 12-Jul-2022

FAQ

Frequently Asked Question

What is the global demand for Alternative Lending Platform in terms of revenue?

-

The global Alternative Lending Platform valued at USD 567.51 Billion in 2022 and is expected to reach USD 832.10 Billion in 2030 growing at a CAGR of 4.90%.

Which are the prominent players in the market?

-

The prominent players in the market are LendingClub Corporation, Prosper Marketplace Inc., Funding Circle Holdings PLC, On Deck Capital Inc., OurCrowd Management Limited, Social Finance Inc., GoFundMe Inc., LendingTree LLC, CreditEase Corporation, Kickstarter PBC.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.90% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Alternative Lending Platform include

- Rising adoption of digital channels to improve the customer experience

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Alternative Lending Platform in 2022.