Alternative Fuels Market

Alternative Fuels Market - Global Industry Assessment & Forecast

Segments Covered

By Fuel Type CNG, Hydrogen, Electric, Other Fuel Types

By Vehicle Type Passenger Cars, Commercial Vehicle

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 412.4 Billion | |

| USD 1,342.3 Billion | |

| 15.9% | |

| Europe | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

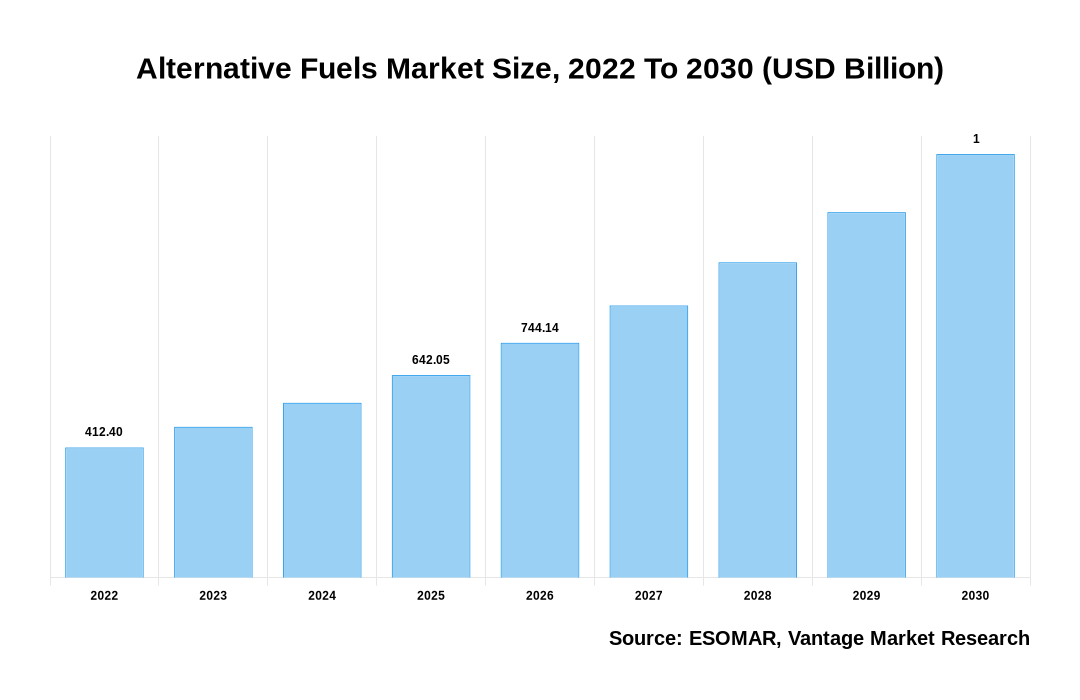

The global Alternative Fuels Market was valued at USD 412.4 Billion in 2022 and is projected to reach a value of USD 1,342.3 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 15.9% between 2023 and 2030.

Premium Insights

Alternative Fuels are derived from non-petroleum sources. Some are derived from renewable sources, while most are produced domestically, reducing our reliance on imported oil. Typically, they emit less pollution than petroleum and diesel. The transition of automakers from conventional vehicle production to emission-free vehicle production to capitalize on early revenue growth opportunities by providing future clean mobility solutions is expected to generate lucrative growth opportunities for the Alternative Fuels vehicles market. For example, Hyundai Motor Group announced a USD 5.54 billion investment to build an Integrated Electric Vehicle and Battery Manufacturing Facility at Bryan County, Georgia, United States of America on May 2022.

Alternative Fuels Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Alternative Fuels Market

In addition, the increasing demand for emission-free vehicles motivates automakers to accelerate and expand their Alternative Fuels vehicle (AFV) production capacities. VinFast, a Vietnamese manufacturer of electric vehicles, announced in March 2022 that it would invest USD 6.5 billion to set up a production facility in North Carolina, USA, with an annual production capacity of 150000 vehicles by 2024. Rising pollution levels, global warming, and deteriorating urban air quality have become a global concern. As a result, governments around the globe are implementing stringent regulations to reduce carbon emissions from automobiles. Government agencies enacted various emission standards for manufacturers to limit pollutants from automobile exhaust emissions. The level of CO permitted by the EPA is 3.4g mmol in light duty vehicles, with NOX being 0.4 g mmol. A vehicle emission programme for California, including requirements for manufacturers to produce and deliver zero emissions vehicles, has been launched by the Air Resources Board. The current regulations on ZEV require a significant yearly increase in the production and sale of battery electric cars, fuel cells, or plugin hybrids.

Key Highlights:

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

- Asia Pacific region accounted highest revenue share of around 43% in 2022.

- Europe is expected to witness the fastest CAGR between 2023 and 2030.

- By fuel type, the electric vehicles segment contributed 44% of the market share in 2022.

- By vehicle, the passenger cars segment has accounted 81% of the market share in 2022.

In addition, the European Union (EU) has also implemented several emission standards for automobile emission control. For example, in September 2015, the EU implemented Euro VI for light-duty and heavy-duty vehicles to reduce hazardous pollutants, such as NOx, produced by automotive exhaust. All automobile manufacturers must comply with Euro VI emission standards to sell a vehicle in Europe. In addition, nations such as the United States, Japan, India, and others are implementing emission control policies. In addition, governments undertake numerous initiatives to eliminate vehicles propelled by fossil fuels and attain clean mobility. These regulations are anticipated to increase the global demand for Alternative Fuels and renewable fuel vehicles.

Economic Insights

The European Commission's "Alternative Fuel Infrastructure Facility" has been formally launched, which is expected to increase adoption of electric mobility in Europe. Funds of USD 1.5 billion are used to build infrastructure with zero emissions, such as rapid charging and hydrogen filling stations. By 2030, the fund will help Europe make progress towards its 3.5 million and 1 million charging points targets. Between 2030 and 2035, EU countries have declared that they will not sell new ICE cars. With a view to reducing charging times and becoming 100% ecodrive zone by 2025, the Norwegian Government provides benefits such as not having road charges, no import duty for buyers of electric cars or heavy investment in improving infrastructure for charging stations and technology. It is expected that in the following years, these government incentives and active developments on the markets will continue to bring more Alternative Fuel Vehicle sales around the world.

Top Market Trends

- Rising Prices of Conventional Fuel: Global decline in oil reserves, increase in fossil fuel prices, increase in clean mobility solutions, stringent government emission control norms, and growth in supportive government policies to promote Alternative Fuels vehicle adoption are factors driving the market growth. Several countries throughout the world are seeing the price of fossil fuels climb. For example, in 2022, Europe saw a surge in gas prices due to various causes, such as limited Russian gas supplies, low storage levels, adverse weather conditions, and carbon pricing. As fossil fuel prices rise, more people will opt for alternative-fuel vehicles as a future transportation solution. Furthermore, cars powered by fossil fuels release toxic gases and contribute to higher pollution levels. Alternative Fuels cars, conversely, do not release CO2 or hazardous pollutants, making them an effective transportation choice with minimal running costs. As a result, rising fossil fuel prices will likely lead to increased adoption of Alternative Fuels and hybrid vehicles throughout the projection period.

- Rising Adoption of Clean Mobility: Climate change is causing an increase in the use of clean transportation solutions worldwide. The continued use of fossil fuels in vehicles is a key contributor to climate change. Vehicles that operate on Alternative Fuels such as natural gas, electricity, biofuel, bio-diesel, fuel cell, liquid nitrogen, and dimethyl ether emit less carbon. Increasing consumer environmental concerns, the implementation of tough emission rules, and the development of sophisticated cars that support Alternative Fuels are projected to drive the adoption of Alternative Fuels and hybrid vehicle markets throughout the forecast period.

Market Segmentation

The global Alternative Fuels market can be categorized on the following: Fuel Type, Vehicle Type, and Region. Based on Fuel Type, the market can be categorized into CNG, Hydrogen, Electric, and Other Fuel Types. Additionally, based on Vehicle Type, the market can be split into Passenger Cars and Commercial Vehicle. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Fuel Type

Electric Vehicles to Integrate Alternative Fuels Rapidly Owing to the Rising Adoption of BEVs

The battery-electric vehicle segment holds the largest market share. It is anticipated to maintain its dominance in the future due to the increasing adoption of battery electric vehicles for carbon footprint reduction. OEMs are implementing electrification by transitioning from conventional to electric automobile production to meet the demand for emission-free automobiles. Volkswagen, one of the foremost German manufacturers, announced in March 2022 that 70% of its European sales by 2030 would be EVs. Additionally, by that time, half of the company's sales in the United States and China were generated by electric vehicles. Other premium brands, including Ford, Lincoln, and others, have also committed to converting their vehicle production volume to EVs by 2030. Additionally, almost all premium manufacturers invest in electrification to remain competitive. This factor is anticipated to increase BEV demand.

Based on Vehicle Type

Passenger Vehicles to Dominate Global Market Due to Rising Penetration of Alternative Fuels

The passenger vehicles segment holds the largest market share in 2022 and is projected to continue to dominate the market throughout the forecast period. Passenger cars include SUVs, hatchbacks, sedans, and electric vehicles (battery electric vehicles (BEV), multi-utility vehicles (MUV), and hybrid electric vehicles (HEV)). During the forecast period, the increasing penetration of Alternative Fuels commercial vehicles in industrial sectors such as logistics and transportation is anticipated to generate new market growth opportunities for the commercial vehicle segment. In addition, logistics and transportation companies invest in vehicles powered by Alternative Fuels to attain an emission-free fleet as a future transportation solution. Due to their internet connectivity and cloud services, these high-tech automobiles also facilitate efficient fleet management.

Based on Region

Asia Pacific to Soar in Sales Owing to Rising Development of Low-Cost and Fuel-Effective Automobiles

The Asia Pacific region comprises South Korea, Japan, India, and China. In addition, an increasing number of regulatory policies and the adoption of cleaner fuels are the primary growth drivers for the region over the forecast period. In addition, this region provides lucrative opportunities for the development of low-cost, fuel-efficient automobiles and the expansion of Alternative Fuels stations and public charging infrastructure. The rising prevalence of renewable energy usage in countries such as India and China are anticipated to act as a growth driver for the Asia-Pacific Alternative Fuels market. Moreover, the governments of numerous Asia-Pacific nations are promoting the use of Alternative Fuels on a large scale. This factor may contribute significantly to the Alternative Fuels market’s expansion.

On the other hand, Europe is anticipated to be the region with the highest growth rate. This is due to the government's increasing technological advancement and positive initiatives, such as its investment in electric buses for public transportation. In addition, prominent participants in the market for Alternative Fuels vehicles are employing strategic partnerships and acquisitions to support the demand for Alternative Fuels vehicles. In June 2020, Ford and Volkswagen AG signed an agreement to expand their global alliance and meet the evolving needs of their consumers in Europe and other regions by offering complementary strengths in commercial & electric vehicles and midsize pickup trucks.

Competitive Landscape

The market for Alternative Fuels vehicles is extremely competitive and fragmented, with major participants including Honda Motor Co., Ltd., Toyota Motor Corporation, Nissan Motor Corporation, Daimler AG, Tesla, BYD Company Ltd., and Ford Motor Company, among others. Intensifying industry competition to satisfy emission-free automobile requirements and increasing automakers' investment in AFVs like electric and natural gas vehicles are propelling the market. Moreover, the number of manufacturers committing to zero-emission vehicles is rising rapidly.

The key players in the global Alternative Fuels market include - Ford Motor Company (U.S.), Toyota Motor Corporation (Japan), Nissan Motor Corporation (Japan), Honda Motor Company (Japan), BYD Auto Co. Ltd. (China), Daimler AG (Germany), Tesla Inc. (U.S.), Bayerische Motoren Werke AG (Germany), Audi AG (Germany), Volkswagen AG (Germany), Hyundai Motor Company (South Korea), Mitsubishi Motors Corporation (Japan), Suzuki Motor Corporation (Japan), General Motors (U.S.), Zero Motorcycles Inc. (U.S.), Tata Motors Limited (India) among others.

Recent Market Developments

- June 2022: Jaguar Land Rover will Create a Prototype of Hydrogen-Powered Defender Fuel Cell Vehicles. Jaguar Land Rover Automotive PLC announced the development of a Defender fuel cell prototype powered by hydrogen. In 2022 the company began testing fuel cell electric vehicles (FCEV). The initiative is part of the company's objective to accomplish zero tailpipe emissions by 2036 and zero carbon emissions throughout the supply chain, operations, products, and services by 2039.

- September 2022: Volvo Cars, which is wholly owned by the Zhejiang Geely group, announced its new full size electric SUV EX90 to replace their flagship XC90. In November 2022, the EX90 is announced.

- June 2022: Introduction of the prototype of the Jaguar Land Rover's hydrogen powered Defender Cell Vehicle. In 2021 the first tests have been initiated on Alternative Fuel and Hybrid Vehicles. By 2036 and product services by 2039, the company's objective is to achieve carbon emissions from vehicles.

Segmentation of the Global Alternative Fuels Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Fuel Type

By Vehicle Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Alternative Fuels in terms of revenue?

-

The global Alternative Fuels valued at USD 412.4 Billion in 2022 and is expected to reach USD 1,342.3 Billion in 2030 growing at a CAGR of 15.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Ford Motor Company (U.S.), Toyota Motor Corporation (Japan), Nissan Motor Corporation (Japan), Honda Motor Company (Japan), BYD Auto Co. Ltd. (China), Daimler AG (Germany), Tesla Inc. (U.S.), Bayerische Motoren Werke AG (Germany), Audi AG (Germany), Volkswagen AG (Germany), Hyundai Motor Company (South Korea), Mitsubishi Motors Corporation (Japan), Suzuki Motor Corporation (Japan), General Motors (U.S.), Zero Motorcycles Inc. (U.S.), Tata Motors Limited (India).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 15.9% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Alternative Fuels include

- Increasing Fossil Fuel Prices and Heavy Dependence on Foreign Countries for Crude Oil is Driving Market Growth

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Alternative Fuels in 2022.

Vantage Market

Research | 12-Jul-2023

Vantage Market

Research | 12-Jul-2023