Alpha Olefin Market

Alpha Olefin Market - Global Industry Assessment & Forecast

Segments Covered

By Products 1-Octene, 1-Hexene, 1-Butene, Other Products

By Applications Synthetic Lubricants, Detergent Alcohol, Polyethylene, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 4.3 Billion | |

| USD 6.9 Billion | |

| 7.20% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Premium Insights

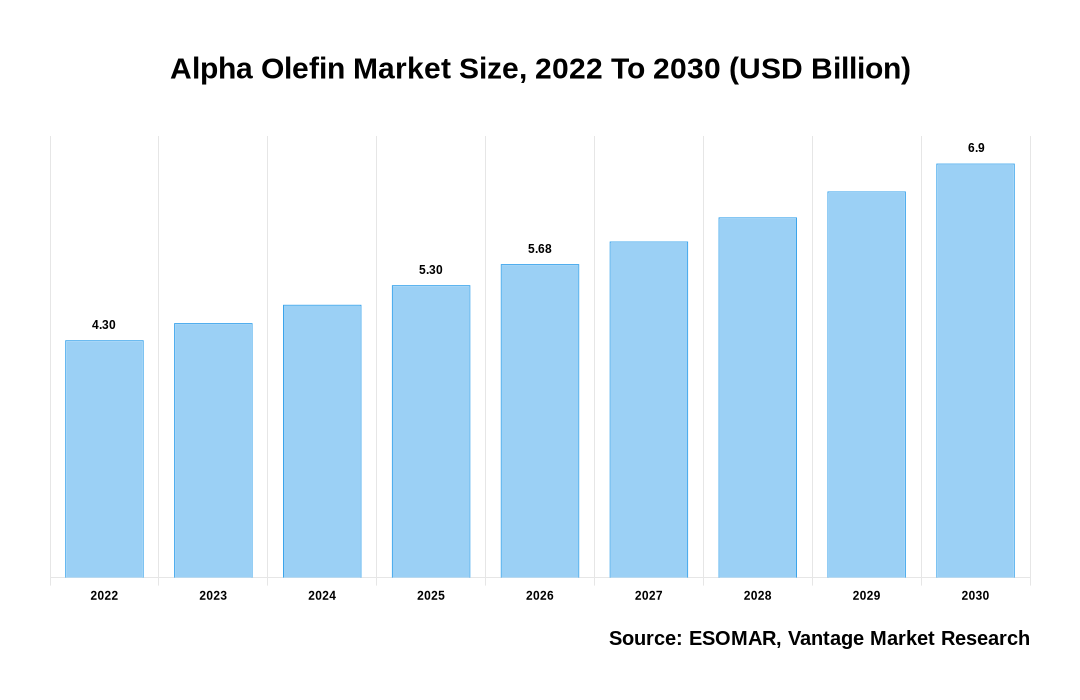

The global Alpha Olefin Market is valued at USD 4.3 Billion in 2022 and is projected to reach a value of USD 6.9 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 7.20% over the forecast period.

Within organic chemistry, alpha-olefins (or α-olefins) are a family of organic compounds, which are alkenes with a chemical formulation of CxH2x. They are often distinguished by having a double bond at the primary or alpha position. The location of a double bond enhances the reactivity of the compound and makes them useful for several applications. The global Alpha Olefin market is expected to be driven by significant drivers, including its usage in various applications, such as packaging, industrial processes, and consumer goods, combined with rising investment in various cracker joint venture projects. Additionally, the abundance availability of low-cost ethane from reserves of shale gas combined with rising supply levels of raw materials will further add to sustainable market growth.

Prominent manufacturers such as INEOS, SASOL, and CPChem are expanding their capacity to reduce the demand/supply cycle. Alpha Olefin are produced by ethylene, naphtha, butane, and natural gas. The oligomerization of ethylene is the most common process used for manufacturing Alpha Olefin, whereas ethylene is mainly obtained from natural gas. The recent discovery of shale gas within several countries has led to an expansion within the olefin industry as they are extremely rich in olefin content. The abundance of cheap natural-gas-based feedstock that comes from a global highly productive shale is expected to increase the footprint of the global Alpha Olefin market during the forecast period.

Rising consumption of Alpha Olefin is increasing across the globe owing to rising applications in various end-use industries. Major businesses are ready to invest in creating and studying Alpha Olefin. However, the market is expected to contradict growth during the forecast period owing to the rising price of raw materials. Additionally, this leads to increased manufacturing prices. Additionally, a shifting preference of manufacturers towards advanced technologies will cause constraints for the global Alpha Olefin market to grow.

Alpha Olefin Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Alpha Olefin Market

Economic Insights

Regarding its influence on the economy, the current conflict between Russia and Ukraine is anticipated to worsen during the projected period. A slowdown in global economic growth is anticipated due to the enormous and historic shocks brought on by Russia's assault against Ukraine. The annual World Economic League Table published by a British firm predicts that in 2022, the world economy will reach $100 trillion. However, because policymakers are anticipated to continue wrangling over price increases, this economic growth is predicted to stagnate in 2023.

Top Market Trends

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

1. Rising Industry Collaboration within Prominent Players: The dominant players are increasing heavily within their R&D departments to manage their supply chains and improve their manufacturing facilities effectively. Industry leaders are incorporating strategies such as mergers & acquisitions, collaborations, and refurbishing existing technologies. On February 2022, Axens and Univation Technologies agreed to increase capital and operational efficiency to increase production of their on-purpose linear Alpha Olefin. These products, including butene-1 and hexene-1, are used for producing polyethylene resins using the UNIPOL PE process.

2. Expanding Packaging Industry to Propel Market Growth: Rising utilization of Alpha Olefin within the packaging industry is expected to widen the market's footprint during the forecast period. According to the Packaging Industry Association of India (PAI), the Indian packaging market was valued at nearly 50.2 billion in 2019 and will grow with a CAGR of 26%. Additionally, studies have indicated that the packaging industry in China will grow with a CAGR of 5.3%.

3. Extending Applications: Alpha Olefin are utilized in synthetic lubricants and the paper and pulp industry. Rising demand for various plastics, including polypropylene and polyethylene, is further expected to increase the footprint of Alpha Olefin during the forecast period. The rising number of automobiles and increased utilization of Alpha Olefin will further contribute toward sustainable market growth.

4. PAO-based Synthetic Lubricants: PAOs have gained speedy acceptance as high-performance lubricant as they possess highly desirable characteristics such as viscosity index, thermal stability, oxidative stability, and low toxicity. PAOs offer the advantage of technical performance but also maintain the environment's quality in various sensitive applications. Studies have indicated that PAO-based synthetic lubricants have a higher superior rate in offshore drilling applications that address environmental concerns. Additionally, PAOs are biodegradable and can be used as a substitute for vegetable-oils. These factors are expected to increase the widen the market's scope.

5. Rising Surfactants Applications: Surfactants are used within a wide range of cleaning products, and one of the usual groups is anionic surfactants. They are highly utilized due to their foaming properties. A wide range of anionic surfactants are used within detergents. However, the most commonly utilized are the salts of dodecylbenzene sulfonic acid and ethoxylated sodium lauryl sulfate.

Market Segmentation

The global Alpha Olefin market can be categorized on the following: Product, Application, and Regions. Based on product, the market can be categorized into 1-octene, 1-hexene, 1-butene, and others. By application, the market can be segmented across synthetic lubricants, detergent alcohol, polyethylene, and others. Likewise, based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product

1-Hexane to Dominate Market Sales Owing to Rising Utilization as a Common Monomer

1-hexane is expected to dominate the largest market share in revenue and share. Factors such as rising utilization of 1-hexane as a common monomer for production of high-density polyethylene (HDPE) and linear low-density polyethylene (LLDPE) polymers are expected to increase the footprint of the segmental growth. Additionally, rising demand for polyethylene in terms of expanding the automotive and consumer goods market within emerging economies is expected to add to the utilization of Alpha Olefin. Furthermore, they are heavily integrated as an additive in synthetic lubricants. These factors will add to sustainable market growth. Demand for 1-dodecane is expected to grow with the fastest growing CAGR during the forecast period owing to the rising production of detergent-based alcohols.

Based on Applications

Polyethylene to Account for Largest Market Share While Synthetic Lubricants to Grow with Fastest CAGR

Polyethylene will dominate the global Alpha Olefin market during the forecast period. A budding construction sector is expected to contribute the largest share to the polyethylene segment. Polyethylene is also utilized within the packaging sector and for prototype development on Computer Numerical Control (CNC) machines and 3D printers. HDPE polyethylene offers easy processing at a comparative cost and is a good barrier to absorbing moisture. These factors are expected to contribute to segmental growth during the forecast period. Synthetic lubricants are expected to grow with the fastest growing CAGR during the forecast period owing to the rising implementation of regulations regarding pollution control.

Based on Region

Asia Pacific to Fuel Sales at a Larger Capacity Owing to Rising Environmental Concerns

The global Alpha Olefin market is expected to be dominated by the region of Asia Pacific due to rising demand from emerging economies, including China, India, Japan, South Korea, and other Southeast Asian Nations. Additionally, China is the largest producer of lubricants, oil field chemicals, and plasticizers manufactured using Alpha Olefin. Rising investments within the pulp and paper industry and rising consumption of soap and detergent-based products will add to the expanding market's scope. Increasing investments in manufacturing polyethylene, including LDPE and HDPE, within India and China will further boost the growth of the alpha-olefin market in the Asia Pacific.

North America will grow with the fastest growing CAGR during the forecast period owing to an extensive industrial consumer base and several manufacturing enterprises. Additionally, rising developments within petrochemicals and oil & gas infrastructure will further increase the market's footprint in the region.

Competitive Landscape

The global Alpha Olefin market is expected to be dominated by a few players. These players focus on capturing the maximum market share by integrating strategies, including expansion and collaborations with like-minded players. Additionally, heavy investments are being made towards research and development to produce a better product quality and increase their product portfolios.

The key players in the global Alpha Olefin market include - Chevron Phillips Chemical Company LLC (U.S.), Exxon Mobil Corporation (U.S.), Evonik Industries AG (Germany), Idemitsu Kosan Co. Ltd (Japan), INEOS (U.K.), LANXESS (Germany), Qatar Chemical Company Ltd (Qatar), SABIC (Saudi Arabia) among others.

Recent Market Developments:

· June 2019: INEOS Oligomers announced an MoU with Saudi Aramco and Total France for building three new plants as part of the Jubail 2 complex in Saudi Arabia. These plants are expected to build 425,000 tons acrylonitrile plants and 400,000-ton Linear Alpha Olefin (LAO) plants.

· May 2019: Exxon Mobil Corporation announced they plan to expand their Vistamaxx production in their Texas facility and enter the linear Alpha Olefin market. This expansion is expected to allow Exxon Mobile to enter the linear Alpha Olefin market, which is used for producing detergents and synthetic lubricants.

· January 2019: Shell announced that they began production of the alpha-olefins unit at their Geismar, Louisiana Unit in the United States. The plant is expected to offer a 425,000-ton-per-year capacity that will bring Geismar's total production to more than 1.3 million tons per annum.

Segmentation of the Global Alpha Olefin Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Products

By Applications

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 16-Mar-2023

Vantage Market

Research | 16-Mar-2023

FAQ

Frequently Asked Question

What is the global demand for Alpha Olefin in terms of revenue?

-

The global Alpha Olefin valued at USD 4.3 Billion in 2022 and is expected to reach USD 6.9 Billion in 2030 growing at a CAGR of 7.20%.

Which are the prominent players in the market?

-

The prominent players in the market are Chevron Phillips Chemical Company LLC (U.S.), Exxon Mobil Corporation (U.S.), Evonik Industries AG (Germany), Idemitsu Kosan Co. Ltd (Japan), INEOS (U.K.), LANXESS (Germany), Qatar Chemical Company Ltd (Qatar), SABIC (Saudi Arabia).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.20% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Alpha Olefin include

- Growing Demand from the Paper and Pulp Industries

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Alpha Olefin in 2022.