Air Purification System Market

Air Purification System Market - Global Industry Assessment & Forecast

Segments Covered

By Product Dust Collectors, Fume & Smoke Collectors, Vehicle Exhaust, Mist Eliminators, Fire/Emergency Exhaust, Others (Air Cleaners, industrial UV systems and commercial kitchen ventilation Systems)

By Technology HEPA, Electrostatic Precipitator, Activated Carbon, Ionic Filters, Others(Ultraviolet light air filters and ozone Generators)

By End-Use Automotive, Construction, Healthcare & Medical, Energy & Utilities, Manufacturing, Others (Residential,education,aviation,and hospitality Sectors)

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 28.9 Billion | |

| USD 68.71 Billion | |

| 10.1% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

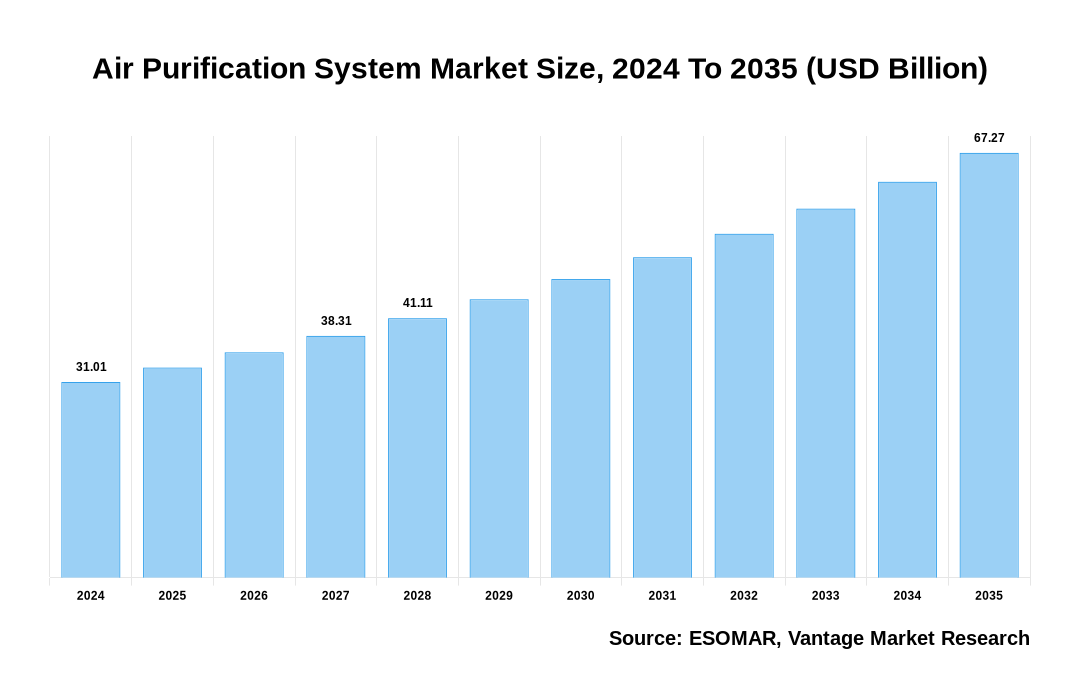

The global Air Purification System Market is valued at USD 28.9 Billion in 2023 and is projected to reach a value of USD 68.71 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 10.1% between 2024 and 2032.

Key highlights of Air Purification System Market

- In 2023, Asia Pacific exhibited its market prowess, achieving the highest revenue share of over 42.2%

- The North America region is poised for remarkable growth, displaying a market share in 2023

- HEPA segment dominates the market with 39.5% of market share in 2023

- The Healthcare & medical segment will continue to assert its dominance by end use, capturing the largest market share in 2023

- However, the high cost of products and maintenance remains a potential constraint on widespread adoption, even as shifting lifestyle preferences and increasing health concerns drive the industry

Air Purification System Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Air Purification System Market

Air Purification System Market: Regional Overview

Asia Pacific Dominated Sales with a 42.2% share in 2023. The Air Purification System market in Asia Pacific has the largest market share driven by the growing demand for these solutions due to the region's fast urbanization, industrialization, and increasing awareness of environmental and health concerns are likely driving the demand for these systems. The presence of air pollution in densely populated cities may also be contributing to the adoption of air purification systems for residential and commercial purposes. Government initiatives, standards, and regulations aimed at improving air quality may also be fostering the growth of the air purification market in Asia Pacific.

U.S. Air Purification System Market Overview

The U.S. Air Purification System market, valued at USD 4.47 Billion in 2023 to USD 7.85 Billion in 2032 is anticipated to grow at a CAGR of 6.45% from 2024 to 2032. The U.S. Air Purification System market is witnessing a transformative period marked by a shift towards healthier living environments and heightened concerns about air quality. For instance, according to the "State of the Air" 2023 report, although there has been progress in reducing air pollution, approximately 119.6 million Americans, or nearly 36% of the population, reside in areas with unsatisfactory levels of ozone or particle pollution. With consumers prioritizing clean and purified air, the market presents a dynamic arena for manufacturers and innovators to meet the evolving expectations and capitalize on the growing market potential in the United States.

The global Air Purification System market can be categorized as Product, Technology, End-Use and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Technology

By End-Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Air Purification System Market: Technology Overview

In 2023, the HEPA segment dominated the market with 39.5% market share. The {Keyword}} market, segmented by technology, includes HEPA, Electrostatic precipitator, Activated carbon, Ionic filters, Others (ultraviolet light air filters and ozone generators). HEPA dominated the Air Purification System market, holding the largest share due to its excellent filtration capabilities. These filters can effectively trap particles as small as 0.3 micrometers, including allergens, dust, and contaminants in the air. The wide adoption of HEPA technology highlights its proven effectiveness in creating clean and healthy indoor air environments. Consumers, businesses, and healthcare facilities prioritize air purification systems with HEPA filters, as they are known to improve overall air quality. The continued dominance of HEPA technology in the market shows its enduring appeal and reliability in meeting strict air purification standards, especially in light of concerns about respiratory health, allergies, and airborne pathogens.

Air Purification System Market: End-Use Overview

In 2023, the Healthcare & medical segment accounted for significant market share. End use segment is divided into Automotive, Construction, Healthcare & medical, Energy & utilities, Manufacturing, Others (residential, education, aviation, and hospitality sectors). Air purification systems are essential in hospitals, clinics, and other healthcare facilities as they help reduce the risk of airborne contaminants like bacteria and viruses. The demand for advanced air purification solutions in healthcare is driven by strict regulations, infection control measures, and a strong commitment to creating sterile environments. As the importance of indoor air quality continues to grow, the healthcare and medical sector's adoption of comprehensive air purification technologies demonstrates their dedication to ensuring optimal conditions for patient care and health outcomes.

Key Trends

- There is a noteworthy trend of increasing recognition regarding the significance of indoor air quality and its impact on health. In response to global health concerns such as the COVID-19 pandemic, both consumers and businesses are actively seeking to minimize indoor pollutants and allergens by investing in air purification systems.

- Consumers are increasingly prioritizing air purifiers with efficient filtration systems that can capture various particles such as allergens, bacteria, and viruses, making High-Efficiency Particulate Air (HEPA) filters and other advanced filtration technologies the main target of attention.

- The popularity of portable and personal air purification devices has increased. These small units are ideal for people seeking solutions that can be conveniently transported between rooms or while traveling, allowing them to customize their air quality control.

- There is an increasing trend of incorporating air purification technology into HVAC systems, which facilitates centralized management of air quality in large spaces and commercial buildings.

Premium Insights

The Air Purification System industry is expected to grow due to factors such as increased disposable income, rising standards of living, and a growing health consciousness. The anticipation is that the market will be notably impacted by a surge in airborne diseases and escalating air pollution levels. For instance, according to the State of the Air 2022 assessment, a significant portion of the population, more than 40%, resides in areas with failing grades for harmful levels of particle pollution or ozone. This increase is expected to raise public awareness about poor air quality and result in a higher demand for air purifiers. Initiatives such as the “Guide to Air Cleaners in the Home” by the U.S. Environmental Protection Agency and recommendations from the World Health Organization shape consumer choices in the air purification market and align with global efforts to combat declining indoor air quality.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Surge in industrial and urban activities has led to increased air pollution, resulting in a gradual deterioration of air quality globally

The global market for Air Purification System is experiencing robust growth due to the escalating impact of industrialization and urbanization on air quality. This decline has severe health implications, including asthma, cardiovascular risks, chronic headaches, and eye irritation, as highlighted by the World Health Organization (WHO), which attributes 2.4 million annual deaths to air pollution. Particularly alarming is the UNICEF statistic that around 50% of pediatric pneumonia deaths are linked to air pollution, underscoring the urgent need for air purifiers to mitigate health risks for vulnerable populations, especially children.

Growing adoption of air purifiers in various commercial sectors

Air purifiers are witnessing growing adoption in various commercial sectors, including hotels, airports, movie theaters, hospitals, and shopping complexes. The increasing awareness of the detrimental effects of poor indoor air quality on health has fueled the deployment of air purification systems in these settings. Concerns about the health and well-being of occupants in schools, commercial buildings, and hospitals have driven the uptick in air purifier usage, given the recognized impact of indoor air pollution on respiratory and cardiovascular diseases. The demand is further amplified by the escalating emissions of CO2 and smoke from industries and automobiles, posing serious health risks such as asthma, cancer, and respiratory diseases. Additionally, the use of coal as a fuel source and in thermal power generation in emerging countries exacerbates air quality issues, reinforcing the imperative for effective air purification systems.

Competitive Landscape

The Air Purification System market is highly competitive, Key players form partnerships, acquire other companies, and make technological advancements. The market is filled with advanced products that include HEPA filters, UV-C disinfection, and smart connectivity options. Startups often bring fresh ideas and solutions to address specific needs in the market. Established players rely on their strong brand reputation and wide distribution networks to capture a large market share. It is increasingly important for companies to focus on sustainable and eco-friendly solutions.

The key players in the global Air Purification System market include - Honeywell International, Inc., IQAir, Koninklijke Philips N.V, Unilever PLC, Sharp Electronics Corporation, Samsung Electronics Co., Ltd., LG Electronics, Panasonic Corporation, Whirlpool Corporation, Dyson, Carrier among others.

Recent Market Developments

- In November 2022, Atem X, the smart slim bionic air purifier launched by IQAir, aims to bring together four seemingly opposing qualities: robust air purification, whisper-quiet functioning, efficient energy usage, and an elegant, slender design.

- In June 2023, Standard Plumbing Heating Controls (SPHC), an independent Automated Logic Dealer based in Washington, has announced that it has entered into an agreement to be acquired by Automated Logic Corporation, which is a part of Carrier. SPHC specializes in offering HVAC and building automation services to a wide range of establishments, such as schools, colleges, universities, commercial buildings, and healthcare facilities.

- In November 2022, To meet the demands of HVAC design engineers, Carrier has launched an updated edition of its Hourly Analysis Program (HAP) software for peak load and energy modeling. This latest version has significantly reduced the time needed to create building models, from several days to just a few hours. By utilizing the U.S. DOE’s EnergyPlus calculation engine, the software provides advanced system simulation abilities, while integrating the ASHRAE Heat Balance load calculation method for enhanced accuracy in reflecting building physics.

FAQ

Frequently Asked Question

What is the global demand for Air Purification System in terms of revenue?

-

The global Air Purification System valued at USD 28.9 Billion in 2023 and is expected to reach USD 68.71 Billion in 2032 growing at a CAGR of 10.1%.

Which are the prominent players in the market?

-

The prominent players in the market are Honeywell International, Inc., IQAir, Koninklijke Philips N.V, Unilever PLC, Sharp Electronics Corporation, Samsung Electronics Co., Ltd., LG Electronics, Panasonic Corporation, Whirlpool Corporation, Dyson, Carrier.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 10.1% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Air Purification System include

- Surge in industrial and urban activities has led to increased air pollution, resulting in a gradual deterioration of air quality globally

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Air Purification System in 2023.