AI Training Dataset Market

AI Training Dataset Market - Global Industry Assessment & Forecast

Segments Covered

By Type Text, Audio, Image/Video

By Vertical IT, Government, Automotive, Healthcare, Retail & E-commerce, BFSI, Other Verticals

By Region North America , Europe, Asia Pacific, Latin America, Middle-East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 2.23 Billion | |

| USD 11.24 Billion | |

| 19.69% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

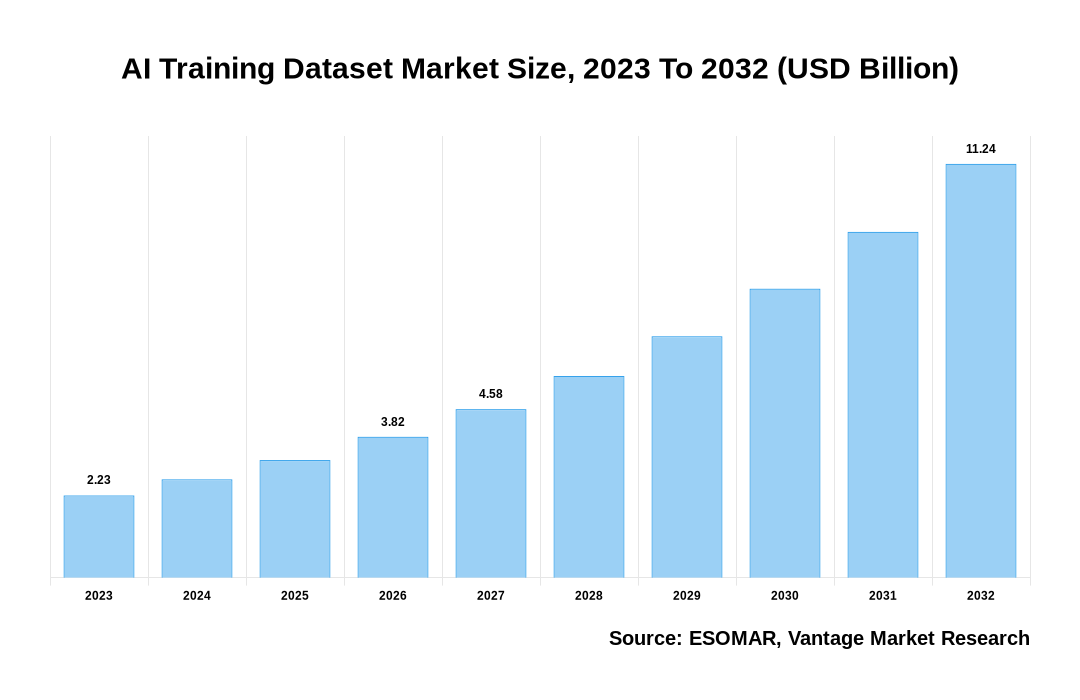

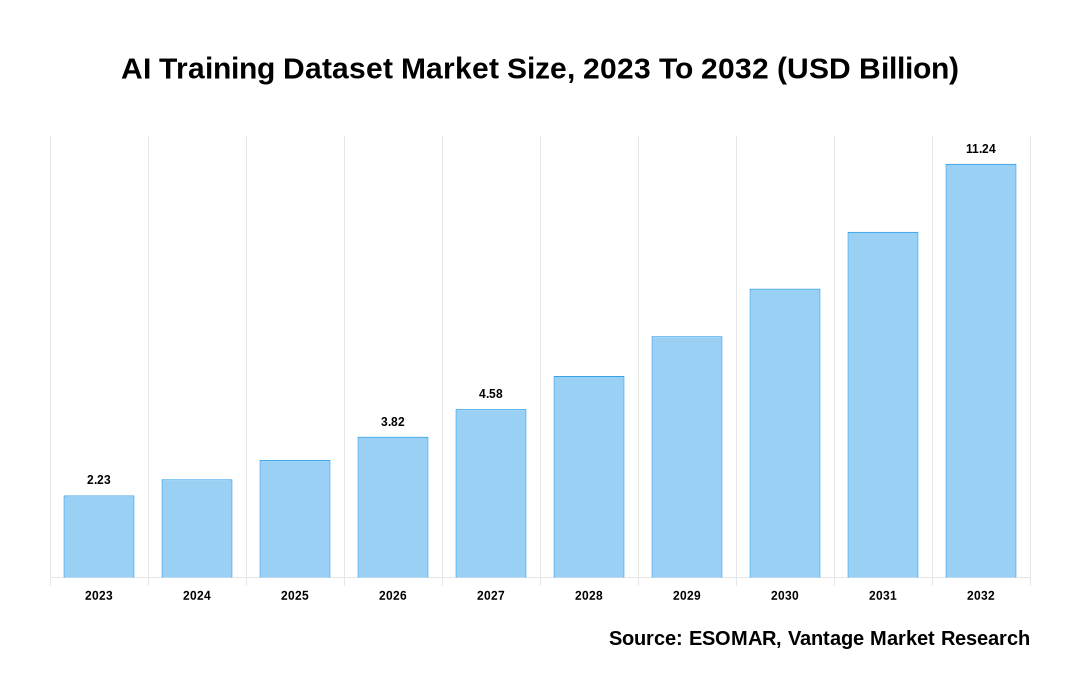

The global AI Training Dataset Market is valued at USD 2.23 Billion in 2023 and is projected to reach a value of USD 11.24 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 19.69% between 2024 and 2032.

Key Highlights of AI Training Dataset Market

- By the segmentation of the Type, the Text segment dominated the global market with 33.1% of market revenue in 2023,

- By the Vertical segmentation, the IT segment captured the highest market share of 36.1% in 2023,

- The US AI Training Dataset market, with a valuation of USD 643.38 Million in 2023, is projected to increase to USD 2,755.38 Million by 2032,

- The AI Training Dataset Market is experiencing robust growth driven by the growing demand and adaption for AI-driven solutions across industries. Additionally, the expanding scope of AI applications across diverse sectors further fuels market expansion, driving the continuous evolution of AI Training Dataset offerings,

- By Region, the North American region dominated the market in 2023, gaining the major market share above 41.1%,

- The Asia Pacific region market is expected to grow significantly from 2024 to 2032.

AI Training Dataset Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about AI Training Dataset Market

AI Training Dataset Market: Regional Overview

In 2023, the North America AI Training Dataset captured 41.1% of the revenue share. Vendors in this region are strategically releasing new datasets to accelerate the adoption of AI technology across various sectors. These datasets include sensor data collected from camera sensors and LiDAR for diverse driving conditions like cyclists, pedestrians, and signage. Such initiatives are driving market growth by catering to evolving industry needs. The presence of established technological firms in the North America, particularly in the U.S. and Canada, further strengthens the market landscape. These firms leverage advanced AI Training Datasets to enhance operations across healthcare, finance, cybersecurity, and eCommerce sectors, enabling tasks like predictive analytics and fraud detection.

U.S. AI Training Dataset Market Overview

The AI Training Dataset market in the U.S., with a valuation of USD 643.38 Million in 2023, is projected to reach around USD 2,755.38 Million by 2032. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 17.54 % from 2024 to 2032. Advancements in image and language-generative AI models are reshaping industries, focusing on improving customer service through language processing skills and large language models (LLMs) like ChatGPT. These innovations drive growth in the U.S. AI Training Dataset market, alongside deep learning models and AI hardware developments. Concerns over data privacy and algorithmic bias are prompting lawmakers to enhance regulations, emphasizing transparency, fairness, and accountability in AI decision-making. Regulators may mandate assessments of AI's societal impact and require firms to scrutinize how algorithms make decisions, ensuring responsible integration of AI technologies into products and processes.

The global AI Training Dataset market can be categorized as Type, Vertical, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Vertical

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

AI Training Dataset Market: Type Overview

In 2023, the global AI Training Dataset market saw significant growth, particularly in the Text segment, which held a 33.1% share. The Type segment is called Text, Audio, and Image/Video. Widespread use of text datasets in the IT sector, powering automation processes like speech recognition, text classification, and caption generation, is fuelling the text segment growth. Text classification, a key component, involves categorizing text efficiently using machine learning, boosting speed and efficacy. Audio datasets, including music and speech, also saw increased availability, enhancing productivity by enabling tasks like dictating documents. However, acquiring audio-based AI Training Datasets can be costly, depending on the dataset size, posing a potential challenge for market players.

AI Training Dataset Market: Vertical Overview

In 2023, the global AI Training Dataset market saw significant growth, especially driven by the IT segment, which claimed a substantial 36.1% share. The vertical segment is categorized into IT, Government, Automotive, Healthcare, Retail & E-commerce, BFSI, and Others. Technology companies leverage machine learning to enhance user experiences and develop innovative products, relying heavily on high-quality training data to optimize algorithms continuously. This trend extends across various solutions like computer vision, crowdsourcing, data analytics, and virtual assistants. Moreover, AI's integration into healthcare creates vast opportunities, including virtual assistants, lifestyle management, diagnostics, and wearable technology. Notably, advancements in voice-activated symptom checkers and workflow optimization further underscore AI's impact in healthcare. The synergy between information technology and healthcare drives substantial advancements and market expansion in the AI Training Dataset sector.

Key Trends

- Incorporating multiple data types, such as text, images, and audio, into AI training enhances model versatility and effectiveness in real-world scenarios.

- The exponential rise of AI and Machine Learning is driven by big data necessitates recording, storing, and analyzing vast amounts of data.

- 52% of companies fast-tracked AI adoption post-pandemic, and 86% declared AI a mainstream technology in 2023, focusing on remote work optimization and enhancing computational models.

- There is increasing reliance on synthetic data for training models, particularly for privacy protection and maintaining data quality, with an expected shift to 60% synthetic data usage by 2024.

Premium Insights

As the demand for AI applications continues to surge, the need for top-tier training data escalates proportionately. This trend spells an opportunity for companies specializing in training data services. AI applications often necessitate diverse data types, from speech to image data, offering specialized data providers a chance to cater to specific needs. Furthermore, annotated data is increasingly in demand for effective AI model training, opening doors for businesses offering annotation services. Quality assurance is paramount in ensuring AI model accuracy and reliability, presenting an opportunity for companies adept at guaranteeing data quality through meticulous quality assurance services. Additionally, with different industries requiring bespoke datasets for their AI applications, companies with access to industry-specific datasets can capitalize by providing tailored data solutions to specific verticals, further enriching the AI AI Training Dataset landscape.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The significance of AI across industries like manufacturing, IT, BFSI, retail, and healthcare is growing rapidly, driving demand for specialized training data. This trend creates opportunities for new entrants. AI's integration with big data enables the extraction of complex insights, emphasizing the need for mining meaningful patterns from vast datasets. As AI applications diversify, the need for high-quality training data increases. Competition intensifies as new players enter the market, pushing established companies to expand their offerings.

Automation through machine learning streamlines dataset creation, while data privacy and security concerns become paramount. Diverse datasets are crucial for accurate AI representation, yet the shortage of such data persists. However, the high cost of dataset creation and the challenge of finding skilled personnel hinder market growth. Legal and ethical considerations also impact dataset availability, highlighting the need for compliance with regulations and ethical standards.

Competitive Landscape

In the competitive landscape of the AI AI Training Dataset, industry players are engaged in strategic moves like mergers, collaborations, and acquisitions. Key participants are also prioritizing the launch of new datasets. Amidst this dynamic environment, leading companies emerge as visionary innovators, adeptly navigating the complexities of machine learning and data training to drive substantial growth. These market leaders respond quickly to evolving business needs, showcasing unwavering dedication to excellence and innovation. Their commitment serves as a catalyst propelling the industry forward into new territories.

Recent Market Developments

- In April 2024, Google invested USD 1 billion to expand data centers and integrate AI training into the company's existing data centers in Virginia, two in Loudoun County and one in Prince William County, and USD 75 million in workforce development programs.

- In May 2024, Satellogic unveils an expansive high-resolution image dataset for AI training. This dataset comprises approximately 3 million unique location images, doubling to 6 million with revisits, and is designed to enhance the training of AI foundation models.

- In April 2023, Google introduced the Google Al Video Captions (GVI-Captions) dataset, a significant addition to its AI training resources. This dataset is a comprehensive collection of YouTube videos, each with automatic captions generated by Google Al. Its primary purpose is to aid in training AI models for video caption generation, a feature that could potentially enhance the accessibility and user experience of online videos.

- In January 2023, Microsoft reportedly contemplated an investment of USD 10 billion in ChatGPT. The text-based generative AI is a natural language processing model, and the American giant expects it can provide more advanced search capabilities.

Vantage Market

Research | 21-May-2024

Vantage Market

Research | 21-May-2024

FAQ

Frequently Asked Question

What is the global demand for AI Training Dataset in terms of revenue?

-

The global AI Training Dataset valued at USD 2.23 Billion in 2023 and is expected to reach USD 11.24 Billion in 2032 growing at a CAGR of 19.69%.

Which are the prominent players in the market?

-

The prominent players in the market are Google LLC (U.S.), Appen Limited (U.S.), Cogito Tech LLC (U.S.), Lionbridge Technologies Inc. (U.S.), Amazon Web Services Inc. (U.S.), Microsoft Corporation (U.S.), Scale AI Inc. (U.S.), Samasource Inc. (U.S.), Alegion (Ireland), Deep Vision Data (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 19.69% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the AI Training Dataset include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the AI Training Dataset in 2023.