Acetone Market

Acetone Market - Global Industry Assessment & Forecast

Segments Covered

By Application Solvents, Methyl Methacrylate, Bisphenol A, Other Applications

By Grade Technical Grade, Specialty Grade

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 5.3 Billion | |

| USD 9 Billion | |

| 7.9% | |

| Europe | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

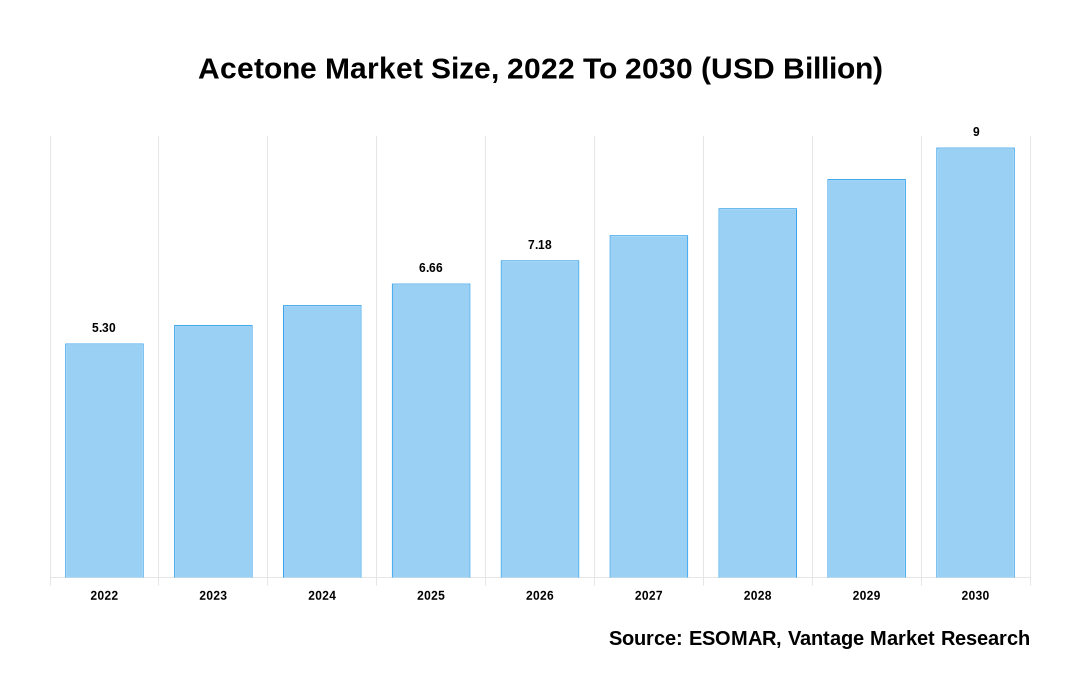

The global Acetone Market is valued at USD 5.3 Billion in 2022 and is projected to reach a value of USD 9 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 7.9% between 2023 and 2030.

Premium Insights

According to global trade, the countries with the highest volumes of Acetone consumption are Italy (115K tonnes), the UK (107K tonnes), and Germany (81K tonnes), with a combined 49% share of total consumption. The highest levels of Acetone per capita consumption were registered in the Netherlands (4.67 kg per person), followed by Italy (1.93 kg per person), the UK (1.59 kg per person), and France (1.17 kg per person). In comparison, the world average per capita consumption of Acetone was estimated at 1.20 kg per person. Similarly, production of Acetone in the U.S. increased from 1.37 million short tons in 2016 to 1.40 million short tons in 2017. Thus, increasing use of Acetone is accelerating the market growth in the coming years.

Acetone Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Acetone Market

Furthermore, as per the White House Briefing, in the United States, 1 in 5 miles of highways and major roads, and 45,000 bridges, are in poor condition. United states congress has passed legislation to reauthorize surface transportation programs for five years and invest USD 110 billion in additional funding to repair roads and bridges and support major, transformational projects. In the Union budget 2022-23, the Indian government has also allocated INR 1.34 lakh crore for the National Highway Authority of India (NHAI), registering an increase of 133% compared to the previous year. In 2022, the number of road bridges in China amounted to 961 thousand, an increase of 48,300 over the previous year. Thus growing road infrastructure in various countries will increase the consumption of Methyl Methacrylate (MMA), thereby propelling the overall industry growth.

Moreover, the widespread use as a solvent in various industries is accelerating the growth of the market. Acetone is a highly effective solvent for a wide range of substances, including oils, greases, resins, and plastics. It is commonly used in the production of paints, varnishes, adhesives, and coatings. Additionally, it is used as a cleaning agent for machinery and equipment. For instance, the annual demand for solvents in the U.S. is about 12 billion pounds, valued at about $5 billion.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Key Highlights

- Asia Pacific dominated the market with the highest revenue share of 43.1% in 2022.

- Europe is expected to witness the largest growth of the market during the forecast period.

- On the Application, the solvents application segment dominated the market and contributed more than 36.1% of the total revenue share in 2022.

- On the basis of Grade, the technical grade mentioned the largest market growth and contributed more than 61.4% of the total revenue share in 2022.

Economic Insights

Economic changes such as fluctuations in the GDP growth rates, inflation, and currency exchange rates can impact the demand and pricing of Acetone. Acetone is used in various industries such as chemicals, pharmaceuticals, and paints & coatings. Changes in the economic conditions of these industries can affect the demand for Acetone. For example, during an economic recession, the demand for products that use Acetone may decrease, leading to a decline in the Acetone market. The global supply chain also plays a crucial role in the Acetone market. Acetone is produced through the processing of propylene, which is a byproduct of the refining of crude oil or natural gas. Therefore, any disruptions in the supply of raw materials can impact the production and availability of Acetone. Supply chain disruptions can be caused by factors such as natural disasters, geopolitical tensions, or changes in trade policies.

Top Market Trends

- Rising Demand for Acetone in the Pharmaceutical Sector: Acetone serves as an essential intermediate in the synthesis of numerous pharmaceutical compounds. It is widely used as a solvent during drug formulation and active pharmaceutical ingredient (API) production. The increasing prevalence of chronic diseases, population growth, and expanding healthcare infrastructure globally have driven the demand for pharmaceutical products. Consequently, the demand for Acetone in the pharmaceutical industry is expected to witness substantial growth in the upcoming years, thereby supporting the overall expansion of the Acetone industry.

- Increasing Demand from Personal Care Industry: Acetone is commonly used as a nail polish remover due to its excellent solvent properties. The popularity of nail polish and nail care products has increased in recent years, driven by emerging fashion trends and increasing disposable incomes. As a result, the demand for Acetone-based nail polish removers has witnessed a significant upsurge. Additionally, Acetone is used in the production of other personal care products such as lotions, creams, and cosmetics. The ever-increasing consumer demand for beauty and personal care products further fuels the demand for Acetone.

Market Segmentation

The global Acetone market can be categorized as Application, Grade, and Region. Based on Application, the market is categorized into Solvents, Bisphenol A, Methyl Methacrylate, and Other Applications. Furthermore, based on Grade, the market is fragmented into Technical and Specialty. Finally, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Application

Solvents to Express Maximum Market Share Due to Increasing Demand for Chemicals and Pharmaceuticals

In 2022, solvents dominated the market due to the increasing demand for chemicals and pharmaceuticals. The escalating demand for specialty chemicals, pharmaceuticals, and other chemical intermediates has significantly fueled the demand for Acetone solvents. In addition, the stringent environmental regulations aimed at reducing volatile organic compound (VOC) emissions have further stimulated the demand for Acetone solvents.

Based on Grade

Technical Grade to Lead the Market Owing to the Increasing Demand from Various End-Use Industries

In 2022, the technical grade segment mentioned significant growth of the market owing to the increasing demand from various end-use industries such as chemicals, plastics, paints and coatings, adhesives, and others. These industries require Acetone as a solvent, a cleaning agent, or a raw material for the production of their products. With the growth of these industries, the demand for technical grade Acetone has also seen a substantial increase.

Based on Region

Asia Pacific to Dominate Global Sales Owing to the Surge in Demand for Chemicals

The Asia Pacific region is known for its rapidly expanding economies, population growth, and increasing industrialization. These factors have resulted in a surge in demand for chemicals, including Acetone. Acetone finds applications in various industries such as pharmaceuticals, cosmetics, paints and coatings, adhesives, and plastics. As these industries flourish, the Acetone market experiences steady growth. In addition, The region's favorable manufacturing capabilities and facilities have provided a solid foundation for the growth of the Acetone industry. Technological advancements, efficient production processes, and proximity to raw material sources allow for cost-effective production.

Competitive Landscape

Acetone players actively explore new market opportunities and expand their customer base. They establish strategic partnerships with distributors, retailers, and end-users to enhance market reach and penetration. This involves analyzing market trends, consumer preferences, and competitor activities to identify potential growth areas. Effective marketing and distribution strategies employed by Acetone players contribute to market expansion and overall industry growth. For instance, Honeywell announced that Lotte GS Chemical Corp. would employ Honeywell UOP Q-Max, Phenol 3G, and Evonik MSHP technologies to manufacture over 565,000 metric tons of phenol and Acetone per year at its petrochemicals facility in Yeosu, Korea. In addition to basic engineering design services, essential equipment, catalysts and adsorbents, and technical services, UOP is offering a license for the technology.

The key players in the global Acetone market include - Altivia, BASF SE, Borealis AG, Cepsa, Formosa Chemicals & Fibre Corporation, Honeywell International Inc., INEOS Kumho P&B Chemicals Inc., LCY GROUP, Mitsui Chemicals Inc., Prasol Chemicals Pvt. Ltd., PTT Phenol Company Limited, Reliance Industries Limited, and Shell PLC. among others.

Recent Market Developments

- January 2023: Olythe will introduce a miniature gas sensor that can measure Acetone as a component of medical diagnostics. At SPIE Photonics West 2023, the company will unveil the sensor. Certain diseases and metabolic disorders could be detected and treated more effectively with this technology.

- July 2022: LG Chem announced that it would export 1,200 tons of Acetone and 4,000 tons of phenol. According to the company, this is South Korea's largest shipment of products with the ISCC PLUS certification.

- July 2022: LG Chem Ltd. began exporting its first batch of bio-balanced phenol and Acetone. An ISCC PLUS-certified product makes use of renewable bio-feedstocks such as biomass and waste cooking oil from renewable sources. This is the largest quantity of ISCC PLUS certified product South Korea has ever exported, with 4,000 tons of phenol and 1,200 tons of Acetone.

- March 2021: Honeywell announced that Lotte GS Chemical Corp. would use Honeywell UOP Q-Max, Phenol 3G, and Evonik MSHP technologies to produce more than 565,000 metric tons per annum of phenol and Acetone at its petrochemical facility in Yeosu, South Korea.

Segmentation of the Global Acetone Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Application

By Grade

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Acetone in terms of revenue?

-

The global Acetone valued at USD 5.3 Billion in 2022 and is expected to reach USD 9 Billion in 2030 growing at a CAGR of 7.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Altivia, BASF SE, Borealis AG, Cepsa, Formosa Chemicals & Fibre Corporation, Honeywell International Inc., INEOS Kumho P&B Chemicals Inc., LCY GROUP, Mitsui Chemicals Inc., Prasol Chemicals Pvt. Ltd., PTT Phenol Company Limited, Reliance Industries Limited, and Shell PLC..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.9% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Acetone include

- Growing Demand For Acetone In Cosmetics And Personal Care Products

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Acetone in 2022.

Vantage Market

Research | 13-Jul-2023

Vantage Market

Research | 13-Jul-2023