Yoga Clothing Market

Yoga Clothing Market - Global Industry Assessment & Forecast

Segments Covered

By Type Top Wear, Bottom Wear

By End-User Men, Women

By Distribution Channel Supermarkets/Hypermarkets, Specialty Stores, E-Commerce, Other Channels

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 26.52 Billion | |

| USD 54.55 Billion | |

| 8.35% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

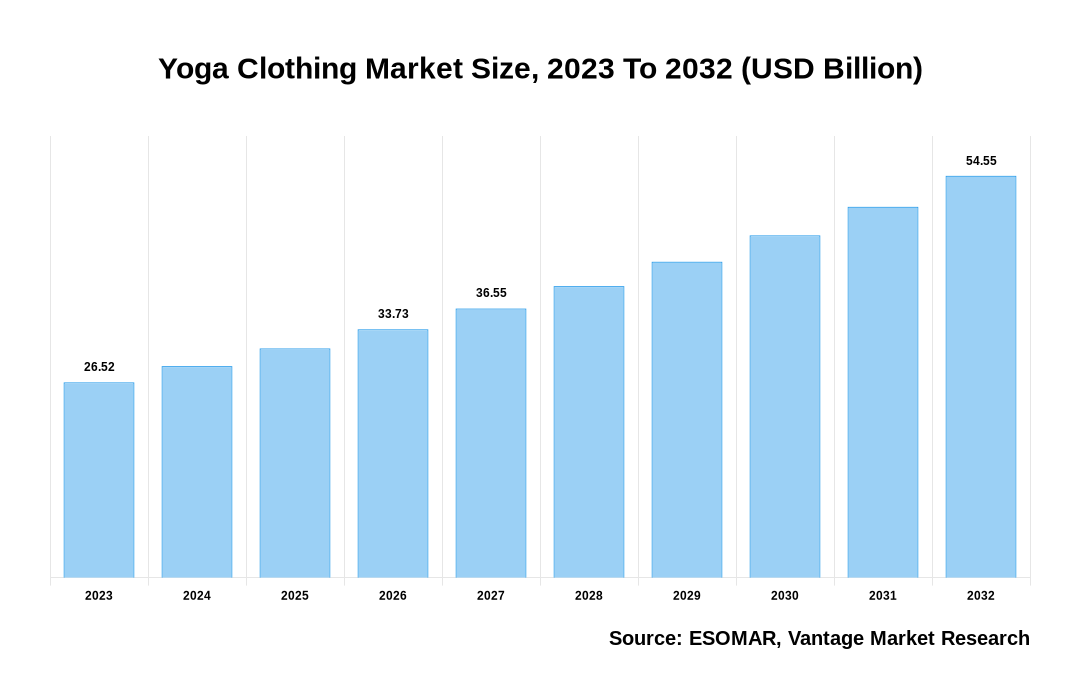

The global Yoga Clothing Market is valued at USD 26.52 Billion in 2023 and is projected to reach a value of USD 54.55 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 8.35% between 2024 and 2032.

Key highlights of Yoga Clothing Market

- North America dominated the market in 2023, obtaining the largest revenue share of 35.5%,

- In 2023, the Asia Pacific region had a substantial market share and will witness remarkable growth during the forecast period,

- The bottom wear segment dominated the Yoga Clothing market with the largest market share of 54.5% in 2023,

- The Women segment continued to assert its dominance by the End-Users segmentation, capturing the largest market share of 62.2% in 2023,

- Specialty Stores dominated the market with a significant market share of 61.9% in 2023,

- The surge in demand caused by a growing emphasis on holistic wellness driving consumers to seek yoga apparel that not only prioritizes comfort and functionality but also aligns with sustainability and ethical production practices.

Yoga Clothing Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Yoga Clothing Market

Yoga Clothing Market: Regional Overview

North America Dominated Sales with a 35.5% share in 2023. Over 33% of Americans believe they are very likely to try yoga. Although women make up 70% of yoga practitioners, the number of male practitioners in the United States doubled over the years. The American College of Physicians states that yoga is a viable first-line treatment for persistent low back pain. Numerous yoga pants manufacturers in the United States intend to open stores in Canada and Mexico. For instance, Lululemon is renowned as Canada's pioneering professional sports brand, recognized for its high-quality sportswear tailored for yoga and fitness enthusiasts across North America. Initially specializing in yoga apparel, the brand has firmly established itself in the women's sports market. With an impressive awareness rate ranging from 80% to 85% in Canada and approximately 45% to 50% in the U.S. market, Lululemon has become synonymous with premium activewear, symbolizing both style and performance for its loyal customer base.

U.S. Yoga Clothing Market Overview

The US Yoga Clothing market, valued at USD 5.8 Billion in 2023 to USD 10.13 Billion in 2032, is anticipated to grow at a CAGR of 6.4% from 2024 to 2032. With the growing popularity of yoga and other wellness activities, there is an increasing need for elegant yet comfortable sportswear. For instance, based on a survey in 2023, approximately 36 million practitioners and a growing number of enthusiasts in the U.S. The data reveals a significant participation of women compared to men in yoga activities. Moreover, consumers in the U.S. are consistently investing in yoga-related expenditures, including classes, apparel, and accessories like mats and gear. Notably, the demographic of yoga practitioners extends beyond adults to children.

The global Yoga Clothing market can be categorized as Type, End-user, Distribution Channels, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By End-User

By Distribution Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Yoga Clothing Market: Type Overview

In 2023, the Bottom Wear segment dominated the market with the largest market share, accounting for 54.5% of the overall market. The Yoga Clothing market, segmented by the type, includes Top Wear and bottom Wear. This enduring popularity of leggings, yoga pants, and similar apparel among consumers engaged in yoga and other fitness activities drives the Yoga Clothing market growth. Comfort, flexibility, and style are essential in activewear, as these garments are favored during yoga sessions and seamlessly transition into everyday attire. For instance, Spanx expanded its activewear product line, including track trousers, yoga pants, tennis skirts, and more with pockets. Focusing on performance-driven designs and fashion-forward aesthetics, the Bottom Wear segment continues to drive innovation and growth in the Yoga Clothing market.

Yoga Clothing Market: End-user Overview

In 2023, the women end users generated 62.2% of the revenue. The End-user segment is divided into Men and Women. The preference for yoga apparel among women reflects a growing emphasis on health, wellness, and self-care, with activewear serving as functional gear and fashion statement. For instance, as per a survey in 2023, approximately 45% of women in India are yoga practitioners. As a result of this demand, brands have increased their market share in Yoga Clothing by offering a large option in sizes and designs that are specially tailored to satisfy the needs and tastes of women.

Yoga Clothing Market: Distribution Channel Overview

The Specialty Stores segment had a significant market share of 61.9% in 2023. The Distribution Channel segment is bifurcated into Supermarkets/Hypermarkets, Specialty Stores, E-Commerce, and Other Channels. Specialty stores offer a curated selection of yoga apparel, providing consumers access to high-quality products, expert advice, and a personalized shopping experience. Their prominence in the market reflects a growing demand for niche retailers prioritizing expertise and authenticity. As the popularity of yoga and activewear continues to soar, specialty stores are expected to remain integral distribution channels, serving as hubs for community engagement and brand loyalty within the Yoga Clothing market.

Key Trends

- Athleisure clothing has become increasingly popular due to the fusion of athletic and casual fashion. Yoga wear has evolved from being only workout gear to versatile apparel that can be worn for both daily activities and exercise.

- The market for Yoga Clothing is increasingly emphasizing diversity and inclusivity; companies are broadening their size ranges, including various models in their ads, and providing styles that accommodate multiple body types and ethnic backgrounds.

- The rise of social media and online shopping has altered the market for Yoga Clothing. Building a strong online presence and direct-to-consumer channels is a top priority for many brands to effectively connect and interact with their target audience.

Premium Insights

The increasing prevalence of obesity worldwide, as highlighted by the WHO, underscores the urgency of adopting healthier lifestyles. Obesity, linked to various health complications like cardiovascular diseases and diabetes, has driven a surge in fitness consciousness and the number of individuals practicing yoga, consequently boosting the demand for Yoga Clothing market. Advancements in fabric technology and design innovation further enhance the performance and aesthetics of yoga clothing, catering to evolving consumer preferences. The significance of yoga in promoting fitness and wellness is underscored by events like "International Yoga Day" on June 21st, which fosters global awareness of yoga's benefits, contributing to market growth.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Fitness apps have become increasingly popular tools for consumers seeking guidance and motivation for their workout routines, including yoga practices, increasing demand for yoga clothing

These apps often feature yoga workouts, tutorials, and challenges, encouraging users to engage in yoga and creating a demand for suitable yoga clothing. For instance, MyFitnessPal was the top-ranked fitness and sports mobile app worldwide in January 2024, bringing in over USD 12 million in in-app purchases. With a combined income of almost 5.68 million U.S. dollars from the Google Play and Apple App Store, Strava came in second. Moreover, when celebrities endorse or launch their yoga clothing lines, it generates excitement and interest among fans, increasing sales and visibility for these products. For instance, celebrity endorsement of yoga collections by Teresa Giudice and the adoption of fitness apps have spurred consumption rates.

Increasing health clubs and fitness centers worldwide provides convenient access to yoga classes and other wellness activities

As more individuals join these clubs, the demand for appropriate yoga attire correspondingly increases. Additionally, major clothing brands recognizing the growing popularity of yoga and the athleisure trend have started incorporating yoga-inspired collections into their offerings. This expansion of distribution channels and the availability of yoga clothing in well-established retail outlets contribute significantly to market growth.

The emergence of e-commerce has catalyzed significant shifts in consumer behavior and shopping preferences for yoga clothing

With the convenience and accessibility of online platforms, yoga clothing companies prioritize establishing digital stores, leveraging their websites and mobile applications, and targeted digital marketing initiatives to engage and capture the attention of their increasingly tech-adequate audience. However, amidst this digital disruption, the essence of brick-and-mortar stores remains indispensable. These physical outlets not only provide a tangible space for customers to experience products firsthand but also serve as vital hubs for community engagement and brand immersion, fostering a deeper connection between yoga enthusiasts and the brand's ethos.

Competitive Landscape

The competitive landscape of the Yoga Clothing market is highly competitive, characterized by several prominent players striving for market share and consumer attention. Established brands like Adidas AG, Nike, Inc., and Puma S.E. compete alongside specialized companies such as Manduka, Lululemon Athletica, and Aurorae Yoga, LLC, offering a diverse range of yoga apparel catering to various preferences and needs. Additionally, companies like Hugger Mugger, Prana, Asics Corporation, and Under Armour, Inc. contribute to the market's overall richness and diversity by bringing distinctive offerings to the competitive mix. With businesses continuously innovating to set themselves apart through design, material technology, sustainability initiatives, and marketing techniques, this dynamic environment is meant to draw the attention of the growing fashion-forward and health-conscious yoga community.

The key players in the global Yoga Clothing market include - ADIDAS AG (Germany), NIKE Inc. (U.S.), MANDUKA (U.S.), HUGGER MUGGER (U.S.), PRANA (U.S.), PUMA SE (Germany), ASICS Corporation (Japan), Under Armour Inc. (U.S.), Lululemon Athletica (Canada), Aurorae Yoga LLC (U.S.) among others.

Recent Market Developments

- In September 2022, Puma unveiled a line of yoga wear collections, including tights, tops, and jackets made from certified recycled cotton and polyester.

- In July 2022, Follett Higher Education, the largest campus shop in North America, announced that it would partner with Beyond Yoga to provide students and campus members with branded sportswear from well-known yoga gear companies.

- In July 2023, Canadian sportswear company Lululemon and Bolt Threads collaborated to develop eco-friendly yogawear items made of leather derived from mushrooms.

Vantage Market

Research | 21-Mar-2024

Vantage Market

Research | 21-Mar-2024

FAQ

Frequently Asked Question

What is the global demand for Yoga Clothing in terms of revenue?

-

The global Yoga Clothing valued at USD 26.52 Billion in 2023 and is expected to reach USD 54.55 Billion in 2032 growing at a CAGR of 8.35%.

Which are the prominent players in the market?

-

The prominent players in the market are ADIDAS AG (Germany), NIKE Inc. (U.S.), MANDUKA (U.S.), HUGGER MUGGER (U.S.), PRANA (U.S.), PUMA SE (Germany), ASICS Corporation (Japan), Under Armour Inc. (U.S.), Lululemon Athletica (Canada), Aurorae Yoga LLC (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 8.35% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Yoga Clothing include

- Fitness apps have become increasingly popular tools for consumers seeking guidance and motivation for their workout routines, including yoga practices, increasing demand for yoga clothing

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Yoga Clothing in 2023.