Esports Market

Esports Market - Global Industry Assessment & Forecast

Segments Covered

By Application Platform, Service

By Streaming Type On-Demand, Live

By Device Type Smart Phone, Smart TV, Desktop/ Laptop/ Tablets, Gaming Console

By Revenue Stream Media Rights, Game Publisher Fee, Sponsorship, Digital Advertisement, Tickets & Merchandise

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 1.7 Billion | |

| USD 11.94 Billion | |

| 27.6% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

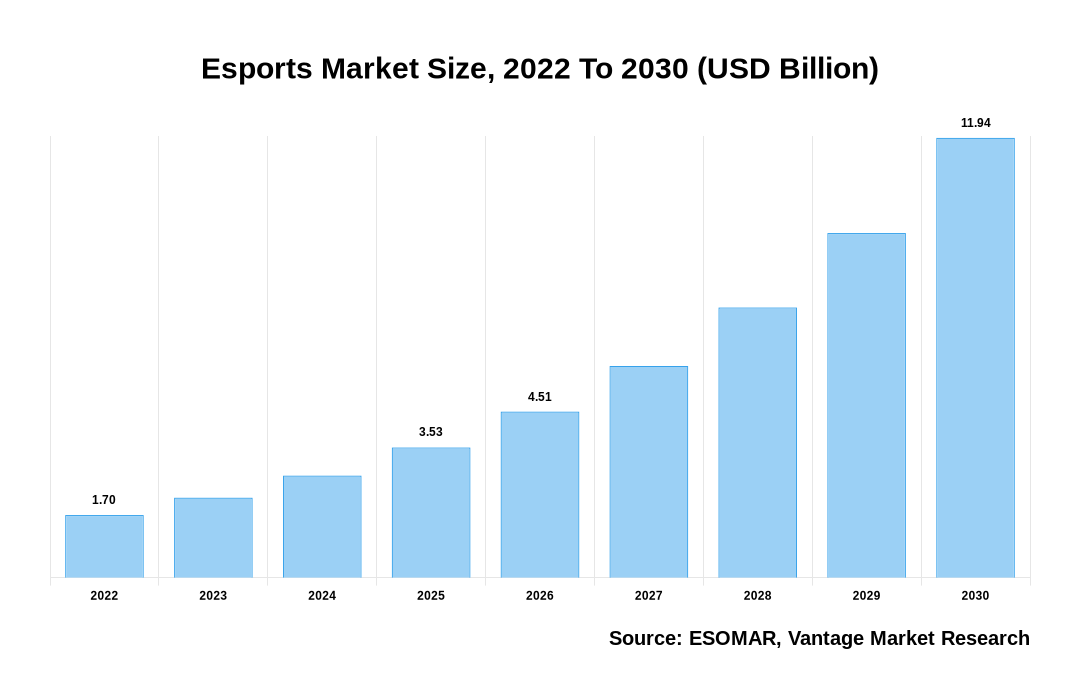

The global Esports Market is valued at USD 1.7 Billion in 2022 and is projected to reach a value of USD 11.94 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 27.6% between 2023 and 2030.

Premium Insights

The increased demand for competitive gaming around the world is fueling the Esports market's meteoric rise. Esports is demonstrating its longevity, with an expected 495 million viewers and a 15.7% revenue rise year over year, according to Newzoo. The availability of internet streaming services like Twitch and YouTube, which have made it simpler for fans to follow their favorite teams and players, is one of the main reasons for this rise. Furthermore, the sector has gained legitimacy and financial stability thanks to significant investments made by established sports leagues like the NBA and NFL. The COVID-19 pandemic contributed to the growth of Esports by providing a means of amusement during lockdowns. Furthermore, the development of regional and global leagues, such as the League of Legends World Championship, has established a vibrant ecosystem that draws spectators and advertisers, thereby reinforcing Esports' position as a significant force in the entertainment sector.

Esports Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Esports Market

- The increasing mainstream acceptance of Esports as a legitimate form of entertainment and competition is a key driver for the market's growth.

- Smartphones will continue to assert their dominance by device type, capturing the largest market share globally throughout the forecast period 2023 to 2030.

- In 2022, North America exhibited its market prowess, achieving the highest revenue share of over 45%.

- The Asia Pacific region is poised for remarkable growth, displaying a noteworthy Compound Annual Growth Rate (CAGR) between 2023 and 2030.

Top Market Trends

- Esports leagues are starting to imitate traditional sports models by taking a more localized approach. By forging local connections, this movement encourages greater fan involvement. The Overwatch League and the Call of Duty League, for example, have franchise systems that have allowed teams to represent particular locations, instilling a sense of community pride. Sponsors looking to engage with local audiences find this regionalization appealing as well, which encourages more investment in the Esports industry.

- There is a variety of game titles in the Esports sector. Though more recent titles like Valorant and Among Us have made their way into the competitive arena, classic giants like League of Legends and Counter-Strike continue to hold their positions. This movement not only makes Esports more appealing to a wider range of gamers but also gives publishers and game developers a way to make money off of their works by hosting leagues and tournaments for Esports, which promotes the industry's long-term growth.

Report Coverage & Deliverables

Get Access Now

Economic Insights

With COVID-19 having both positive and negative effects, the Esports market has shown resilience and adaptability, supported by economic insights. The pandemic's early disruption of live events and sponsorships resulted in a brief decline in revenue. But the move to online competitions and the spike in attendance during lockdowns quickly recovered. Esports Insider reported that in 2020, Esports generated $1.08 billion in global income, a YoY gain of 15.7%. Increased online interaction and advertising expenditure from non-endemic firms hoping to connect with the Esports audience drove this expansion. Furthermore, the pandemic demonstrated the industry's resilience to the disease as it persisted in growing despite physical constraints. The financial data highlights how flexible the sector is, with Esports developing as a profitable investment opportunity that draws in both new and experienced participants looking to capitalize on the sector's long-term growth potential.

Market Segmentation

The Global Esports Market is segregated into the segments as mentioned below:

The global Esports market can be categorized into Application, Streaming Type, Device Type, Revenue Stream, Region. The Esports market can be categorized into Platform, Service based on Application. The Esports market can be categorized into On-Demand, Live based on Streaming Type. The Esports market can be categorized into Smart Phone, Smart TV, Desktop/ Laptop/ Tablets, Gaming Console based on Device Type. The Esports market can be categorized into Media Rights, Game Publisher Fee, Sponsorship, Digital Advertisement, Tickets & Merchandise based on Revenue Stream. The Esports market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Application

Platforms to be Utilized at the Maximum Owing to Increasing Focus on Competitive Gaming

In 2022, platforms are utilized to their fullest extent in the Esports industry, and for good reason. Esports platforms function as the main support system for competitive gaming, offering online spaces for teams, players, and spectators to interact. These platforms perform a multitude of tasks, such as organizing competitions, broadcasting games, enabling player interaction, and providing resources for creating content. Major sites that draw millions of visitors every day include Twitch, YouTube Gaming, and Esports-specific sites like ESL Play. The reason for platforms' dominance is that they serve as the focal points for Esports engagement, making it possible to monetize content through sponsorships, adverts, and subscriptions. This strategy promotes the growth and sustainability of the sector. Although important, services frequently center around and enhance these platforms, making them less important in terms of market usage.

Based on the Streaming Type

Live Events to Account for a Majority of the Revenue Owing to Increasing Focus on Streaming Websites

In 2022, within the ever-changing Esports market, "live" material is the most popular offering. The live component is essential to the competitive gaming experience since it allows for real-time involvement and lets spectators see the action as it happens. Live streaming of Esports tournaments, matches, and events is common on websites like Twitch and YouTube Gaming. These events draw sizable audiences who want to feel the thrill of adrenaline, talk with their favorite streamers, and participate in live chat sessions. An essential component of the Esports experience is the real-time interaction between competitors, spectators, and the content. Even if on-demand material is useful for highlights and replays, live Esports broadcasts continue to be popular because they capture the spirit of competition and provide a sense of immediacy and community.

Based on Device Type

Smartphones will be Utilized at the Maximum to View Livestreams owing to Unmatched Accessibility.

In 2022, smartphones will be the most popular product in the Esports industry out of all the possibilities mentioned. The supremacy of smartphones can be ascribed to their unmatched accessibility and ease. Esports fans can track their preferred teams, players, and competitions in addition to participating in mobile gaming, which has grown to be a substantial part of the Esports industry. Through social media and gaming apps, smartphones can enable immediate connection and social interaction with other gamers. Because of their mobility, fans can easily access and participate in Esports content while on the go, cementing the smartphone's status as the go-to device for Esports consumption. Because of their widespread use and adaptability, smartphones are the preferred device for the majority of Esports fans, even though other gadgets such as smart TVs, PCs, laptops, tablets, and game consoles also have vital roles in the Esports ecosystem.

Based on the Revenue Stream

Sponsorship to Accommodate the Maximum Revenue Owing to Increased Financial Support

In 2022, sponsorship is the product that is used in the Esports industry the most frequently. The reason for this domination is the significant financial support and brand alliances that sponsors offer to Esports teams, organizations, and events. Esports has developed into a profitable channel for sponsors looking to connect with the younger, more tech-savvy consumer base. These collaborations go beyond simple advertising, as sponsors frequently work together to create content and use experiential marketing to integrate their companies into the Esports community further. Sponsorships provide the industry with much-needed funding for player salaries, prize pools from tournaments, and the general expansion of infrastructure. Media rights, game publisher fees, digital ads, and ticket sales all play a big part in the Esports industry, but sponsorship is the one that keeps it growing and thriving the most.

Based on Region

North American Esports Section to Dominate owing to Supportive Infrastructure.

In the Esports industry, North America is linked to the highest sales figures. Numerous elements contribute to this domination, such as a sizable and well-off gaming population, a strong competitive gaming infrastructure, and a history of early adoption and industry investment. Major events, Esports organizations, and a thriving streaming culture are all quite prevalent in North America. Moreover, the region generates a substantial amount of income via television deals and business sponsorships.

The Asia Pacific is witnessing a sharp expansion in the Esports industry. Massive player and fan bases, especially in South Korea and China, are the main drivers of this expansion. The proliferation of mobile Esports games and growing funding from both domestic and international organizations are driving this expansion. Furthermore, the region's expanding middle class and internet infrastructure are fostering an environment that is conducive to Esports' further growth.

Competitive Landscape

Key participants in the competitive Esports sector are well-known companies that manage famous game franchises and competitions, such as Tencent (China), Activision Blizzard (U.S.), and the ESL (Germany). When it comes to content distribution, streaming services like Twitch and YouTube Gaming continue to rule. The NBA and NFL, two established sports organizations, have entered the Esports market, escalating the level of competition. In addition, there is competition for market share from up-and-coming entrepreneurs in the Esports technology, content production, and Esports betting sectors. The sector's ongoing attractiveness and quick expansion are reflected in this varied ecosystem, which encourages competition and innovation across a wide range of players.

The key players in the global Esports market include - Gameloft SE (France), Kabam (Canada), Nintendo (Japan), Gfinity (UK), CJ Corporation (South Korea), FACEIT (UK), Activision Blizzard Inc. (U.S.), Modern Times Group (Sweden), NVIDIA Corporation (U.S.), Electronic Arts (U.S.) among others.

Recent Market Developments

- Syracuse University in the United States declared in March 2023 that it would introduce a new degree program devoted to electronic sports soon. The institution hopes to provide fresh expertise for forthcoming instruments and trends through this curriculum.

- International sportswear brand Nike debuted its first ad on an esports platform in October 2022

Segmentation of the Global Esports Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Application

By Streaming Type

By Device Type

By Revenue Stream

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Esports in terms of revenue?

-

The global Esports valued at USD 1.7 Billion in 2022 and is expected to reach USD 11.94 Billion in 2030 growing at a CAGR of 27.6%.

Which are the prominent players in the market?

-

The prominent players in the market are Gameloft SE (France), Kabam (Canada), Nintendo (Japan), Gfinity (UK), CJ Corporation (South Korea), FACEIT (UK), Activision Blizzard Inc. (U.S.), Modern Times Group (Sweden), NVIDIA Corporation (U.S.), Electronic Arts (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 27.6% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Esports include

- Rising Popularity of Video Games to Spur Market Growth

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Esports in 2022.

Vantage Market

Research | 08-Nov-2023

Vantage Market

Research | 08-Nov-2023