Construction Market

Construction Market - Global Industry Assessment & Forecast

Segments Covered

By Product Heavy and Civil Engineering, General Construction

By Sector Urban, Rural

By Construction Type New, Renovation

By End User Public, Private

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 12.3 Trillion | |

| USD 19.59 Trillion | |

| 5.3% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

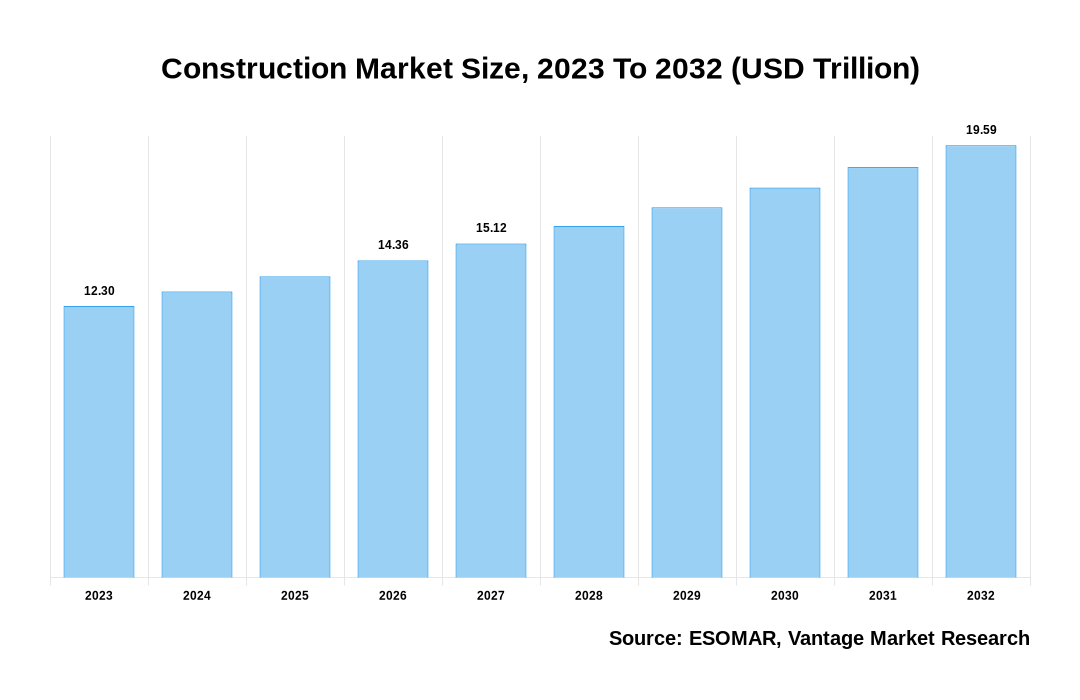

The global Construction Market is valued at USD 12.3 Trillion in 2023 and is projected to reach a value of USD 19.59 Trillion by 2032 at a CAGR (Compound Annual Growth Rate) of 5.3% between 2024 and 2032.

Key highlights of Construction Market

- Asia Pacific dominated the market in 2023, obtaining the largest revenue share of 47.2%

- The North America region will witness remarkable growth with a CAGR during the forecast period

- The General construction segment dominated the Construction market with the largest market share of 66.2% in 2023

- New Construction Type segment dominated the market with a significant market share in 2023

- Private end user dominated the market with largest market share of 75.2% in 2023

- Sustainability initiatives and regulations promoting green building practices stimulate the adoption of eco-friendly materials drives demand for Construction market

Construction Market Size, 2023 To 2032 (USD Trillion)

AI (GPT) is here !!! Ask questions about Construction Market

Construction Market: Regional Overview

Asia Pacific Dominated Sales with a 47.2% share in 2023. Asia Pacific dominated the Construction industry due to various factors, including fast urbanization, which increases demand for new infrastructure and residential and commercial developments, especially in nations like China and India where urban populations are growing. The growing middle class in the area is driving growth in the real estate industry by driving up demand for homes and commercial spaces with its growing purchasing power. In addition, governments in the Asia-Pacific region have been making significant investments in large-scale infrastructure projects in an effort to raise living standards, promote economic growth, and increase connectivity. For instance, in 2023, the Chinese government made significant investments in infrastructure projects, with an estimated total investment of USD 4.2 trillion for the 14th Five-Year Plan period (2023–2025), according to International Trade Administration (ITA). Furthermore, China's Belt and Road Initiative has accelerated regional growth by fostering domestic construction activity and providing opportunities for foreign investment and cooperation. The region is at the forefront of innovation, driving efficiency, lowering environmental impact, and fulfilling changing regulatory criteria.

India Construction Market Overview

The India Construction market, valued at USD 897.9 Billion in 2023 to USD 1405.5 Billion in 2032, is anticipated to grow at a CAGR of 5.1% from 2024 to 2032. Rapid urbanization, ambitious infrastructure projects, and evolving regulatory frameworks characterize India's Construction market. The country's need for residential, commercial, and industrial space is rising due to a growing population and rising urban migration. With initiatives like the Atmanirbhar Bharat (Self-Reliant India) campaign and the Smart Cities Mission, the Indian government has been actively promoting infrastructure development, opening up investment opportunities and fostering expansion in the Construction industry. In addition, the sector is changing due to technological and sustainable developments, as evidenced by the growing use of green building techniques and Building Information Modeling (BIM).

The global Construction market can be categorized as Product, Sector, Construction Type, End User, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Sector

By Construction Type

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Construction Market: Product Overview

In 2023, the General Construction segment dominated the market with the largest share of 66.2%. The Construction market, segmented by the Product, includes Heavy and Civil Engineering, Bridges, Roads, Railways, Airports, Others (Sewage, Under Bridges etc.), General Construction, Residential, Houses, Apartments, Others (Villas, Hostels etc.), Commercial, Hotels, Offices, Hospitals, Malls/Multiplexes, Educational Institutes, Others (Shops, Leisure Parks etc.), Industrial, Chemical & Pharmaceutical, Metal & Category Processing, Textiles, Oil & Gas, Others (Marine, Power etc.). General Construction typically encompasses a wide range of construction activities, including residential, commercial, industrial, and infrastructure projects. With such versatility, it caters to the needs of both individual consumers and large-scale enterprises, thereby capturing a significant portion of the market share. The need for housing increased as urbanization and population growth increased, sparking a wave of single-family homes and high-rise apartment complex construction. Furthermore, new housing trends, such as sustainable and smart buildings, propelled the Residential segment forward, driving investment in eco-friendly building materials, energy-efficient designs, and integrated smart technologies. Additionally, government initiatives promoting affordable housing and urban development further stimulated construction activity, fueling the market's expansion.

Construction Market: Construction Type Overview

In 2023, significant revenue was generated by Construction for new construction. The Construction Type segment is divided into New and Renovation. The surge in new construction activity was fueled by increasing demand for modern infrastructure, residential housing, commercial spaces, and industrial facilities. Moreover, advancements in construction technology, sustainable building practices, and innovative design concepts have further spurred investment in new construction projects. There is a rapid urbanization and infrastructure development initiatives have led to a surge in construction activities. Additionally, favorable government policies, such as incentives for real estate development and infrastructure spending, have provided further impetus to new construction projects.

Construction Market: End User Overview

In 2023, the Private segment dominated the market with the largest share of 75.2%. The Construction market, segmented by the End User, is bifurcated Public and Private. This segment encompasses a diverse range of private sector entities and individuals involved in construction activities, including real estate developers, private investors, homeowners, and small-to-medium-sized enterprises (SMEs). The dominance of the private segment reflects the significant role private investment plays in driving construction projects across residential, commercial, industrial, and infrastructure sectors. Factors such as favorable economic conditions, low-interest rates, and rising consumer confidence have spurred private sector participation in construction, leading to increased demand for new developments, renovations, and infrastructure upgrades.

Key Trends

- Growing environmental consciousness has raised demand for green building materials and sustainable building techniques. These include of using eco-friendly materials, integrating renewable energy sources, and creating energy-efficient designs.

- The use of digital technologies, such building information modeling (BIM), is a growing trend in Construction industry because these technologies improve project management, efficiency, and collaboration in the construction process. Drones, augmented reality, and virtual reality are additional tools used for project planning, safety, and monitoring.

- Prefabricated and modular construction methods can cut waste, costs, and construction time, they are becoming more and more common. Compared to traditional building, these techniques offer more scalability, flexibility, and quality control.

Premium Insights

The Construction market is being driven by urbanization and population growth further increase demand for residential, commercial, and infrastructure construction projects, particularly in emerging economies. For instance, according to the World Bank projects that by 2045, there will be 6 billion people living in urban regions worldwide, a 1.5-fold increase from the current estimate of over 50% of people living in urban areas. Government programs that promote the development of infrastructure, such as utilities and transportation networks, also encourage investment and building activity. Technological innovations that improve the efficiency, productivity, and cost-effectiveness of construction operations include digitalization, Building Information Modeling (BIM), and prefabrication techniques. In addition, low borrowing rates and stable economic conditions promote investment in building projects, and market expansion is facilitated by attempts to rehabilitate areas devastated by natural disasters and by renovating aging infrastructure.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The increasing population growth and urbanization in propelling the Construction market

There's a growing demand for a variety of construction projects as the world's population keeps growing, especially in urban areas. For instance, the United Nations (UN) report predicts the world's population will increase by 2 billion in next 30 years, from 8 billion in 2050 to 9.7 billion. Urbanization leads to new residential complexes, commercial buildings, industrial facilities, and infrastructure such as transportation networks, schools, and healthcare facilities. The influx of people into cities drives the need for housing, offices, retail spaces, and amenities, stimulating construction activity and investment. Emerging economies experiencing rapid urbanization and population growth are particularly significant contributors to the expansion of the Construction market.

This restraint underscores the challenges and intricacies inherent in construction projects that can impede market growth

Construction projects involve numerous stakeholders, intricate processes, and regulatory requirements. Compliance with building codes, zoning regulations, environmental standards, and safety protocols complicates construction projects. Additionally, logistical challenges such as material sourcing, transportation, and site access further complicate project execution. Moreover, unforeseen weather conditions, labor shortages, and supply chain disruptions can exacerbate these complexities, leading to delays, cost overruns, and project failures. Navigating these intricate challenges requires meticulous planning, expertise, and resources, posing obstacles to market expansion and profitability for construction firms.

The transformative potential of digital technologies, particularly Building Information Modeling (BIM), in revolutionizing the Construction industry

BIM is a process that involves producing digital representations of physical and functional properties of buildings and infrastructure, enabling stakeholders to collaboratively design, construct, and manage projects more efficiently. BIM facilitates improved communication, coordination, and decision-making throughout the project lifecycle, enhancing productivity, reducing errors, and minimizing rework. By embracing digitalization and adopting BIM technology, construction firms can streamline workflows, optimize resource allocation, and improve project outcomes. Moreover, integrating digital tools such as drones, sensors, and virtual reality (VR) further enhances project visualization, monitoring, and management, offering new opportunities for innovation and efficiency in the construction sector. Embracing these digital solutions enables construction companies to stay competitive, deliver higher-quality projects, and adapt to the evolving demands of the market.

Competitive Landscape

The competitive landscape of the Construction market is characterized by key companies, including China State Construction Engineering Corp. Ltd. (CSCEC), China Railway Group Ltd., Power Construction Corp., compete on the basis of project scale, technological innovation, and reputation for quality and reliability. In addition, new competitors have entered the market and conventional market dynamics have been upset by the introduction of innovative construction techniques like modular construction and sustainable building practices, which have created a dynamic and quickly changing competitive environment in the Construction industry.

The key players in the global Construction market include - Actividades de Construcción y Servicios, Bechtel, Bouygues, China Communications Construction Company, Larsen & Toubro, PowerChina, Skanska, STRABAG, TechnipFMC, Vinci. among others.

Recent Market Developments

- In February 2024, CSCEC and SK Ecoplant jointly financed USD 1.9 billion in a green hydrogen project in Egypt to spearhead a revolution in renewable energy. This joint venture aims to develop green ammonia, green hydrogen, and renewable energy projects in Egypt.

- In December 2023, the Cirata floating photovoltaic (PV) power generation project in Indonesia, located in the Cirata reservoir in the province of West Java, was completed by Power Construction Corporation of China (POWERCHINA). The floating solar power plant helps cut the annual usage of coal by 117,000 tons while producing 300,000MWh of clean energy.

- In September 2023, CEC increased the scope of its operations by building a 640 MW ammonia/methanol complex in Songyuan, Jilin province. This project aims to create green methanol and ammonia by using renewable energy sources like solar and wind power.

- In September 2023, Bouygues Construction invested in the reuse market when it established Cyneo, a new business devoted to reusing building materials. By boosting material reuse, the goal is to advance the circular economy in the building industry.

FAQ

Frequently Asked Question

What is the global demand for Construction in terms of revenue?

-

The global Construction valued at USD 12.3 Trillion in 2023 and is expected to reach USD 19.59 Trillion in 2032 growing at a CAGR of 5.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Actividades de Construcción y Servicios, Bechtel, Bouygues, China Communications Construction Company, Larsen & Toubro, PowerChina, Skanska, STRABAG, TechnipFMC, Vinci..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.3% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Construction include

- The increasing population growth and urbanization in propelling the {{Keyword}} market

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Construction in 2023.